In recent years, Canadians have embraced cash back shopping as a smart and rewarding way to manage their expenses. From everyday essentials to luxury purchases, cash back shopping in Canada has proven to be a versatile and financially savvy choice. Online cash back platforms have revolutionized how Canadians save, offering unmatched convenience, value, and accessibility.

Let’s explore the top reasons why cash back shopping is so popular, supported by user testimonials and survey data.

1. Instant Gratification with Tangible Rewards

Unlike other loyalty programs that require users to accumulate points over long periods, cash back shopping provides immediate benefits. With every purchase, shoppers see real savings credited to their accounts.

A recent RBC poll indicates that one-third (33%) of Canadian credit cardholders prefer cash back incentives over other types of rewards.

Additionally, the Canadian cash back programs market is projected to experience significant growth, with spending expected to surge by 14.9% annually. This trend reflects a growing preference among Canadians for straightforward and immediate rewards in their shopping experiences.

2. Wide Range of Participating Retailers

Cash back platforms partner with hundreds of retailers, catering to various shopping needs. Whether you’re buying groceries, clothing, electronics, or booking travel, there’s a cash back deal for almost everything.

Top Cash Back Retailers in Canada:

- Canadian Tire: Earn up to 1% cash back on selected items from tools and automotive supplies to home goods and sporting equipment.

- SportChek: Earn 1.25% cash back rebate on high-quality products for fitness enthusiasts and casual shoppers alike.

- Best Buy Canada: Get 3% cash back on major appliances, smart home, vacuums, floor care, health and fitness, 2.25% cash back on a wide range of items, and 2% cash back on refurbished items and outlet centre.

This extensive network of partnerships makes cash back shopping in Canada an attractive choice for diverse consumer needs.

3. Flexibility to Stack Savings

One of the lesser-known cash back shopping benefits is the ability to stack savings. Shoppers can combine cash back offers with retailer promotions, sales, and even loyalty rewards programs.

Example:

During Black Friday, a cash back platform user purchased a laptop at Best Buy using a cash back credit card and the Great Canadian Rebates (GCR) platform. By combining the store’s discount, cash back offer, and credit card rewards, they saved over $150 on the purchase.

Pro Tip: Look for seasonal sales and exclusive promotions on GCR to maximize your savings.

4. Perfect for Everyday Shopping

Cash back shopping isn’t just for big-ticket items; it’s also ideal for everyday purchases. Canadians love using cash back for essentials like groceries, gas, and dining.

Popular Everyday Categories on GCR:

- Groceries: Earn cash back at stores like Instacart and Well.ca.

- Dining Out: Simplii Financial™ Cash Back Visa* Card users earn 4% cash back on restaurant, bar and coffee shop purchases.

- Gas: Cards like the TD Cash Back Visa Infinite* Card offer 3% cash back on gas purchases.

User Testimonial:

“Using cash back for groceries and gas has become a no-brainer. It’s money I would spend anyway, so getting some of it back feels great,” says Jordan M., a GCR user from Vancouver.

5. Boosts Financial Discipline

Cash back shopping in Canada encourages smarter spending habits. By focusing on purchases that offer rewards, Canadians can make more informed financial decisions.

Pro Tip: Set a monthly budget and prioritize purchases through cash back platforms like GCR to maximize savings while staying on track financially.

6. Easy to Use and Accessible

Platforms like GCR simplify the cash back process, making it accessible to everyone. The steps are straightforward:

- Sign up for free on GCR’s website.

- Browse cash back offers by category or retailer.

- Shop through the platform to earn cash back rewards credited to your account.

User Testimonial:

“I love how easy it is to find cash back deals on GCR. The website is user-friendly, and I never miss a chance to save,” says Sarah P., a student from Montreal.

7. Encourages Big-Ticket Purchases

For many Canadians, cash back shopping serves as an incentive for larger purchases. Whether upgrading appliances or booking a vacation, the cash back earned can offset the cost significantly.

Top Categories for Big-Ticket Savings:

- Travel: Earn cash back on bookings with Expedia Canada, Priceline Canada, and more.

- Electronics: Save on premium gadgets at retailers like Staples Canada and Best Buy Canada.

User Testimonial:

“I planned a trip to Europe and booked through GCR. The cash back I earned covered my travel insurance costs, which was a pleasant surprise,” shares Kevin R., a frequent traveler from Calgary.

8. Cash Back Credit Cards Enhance Rewards

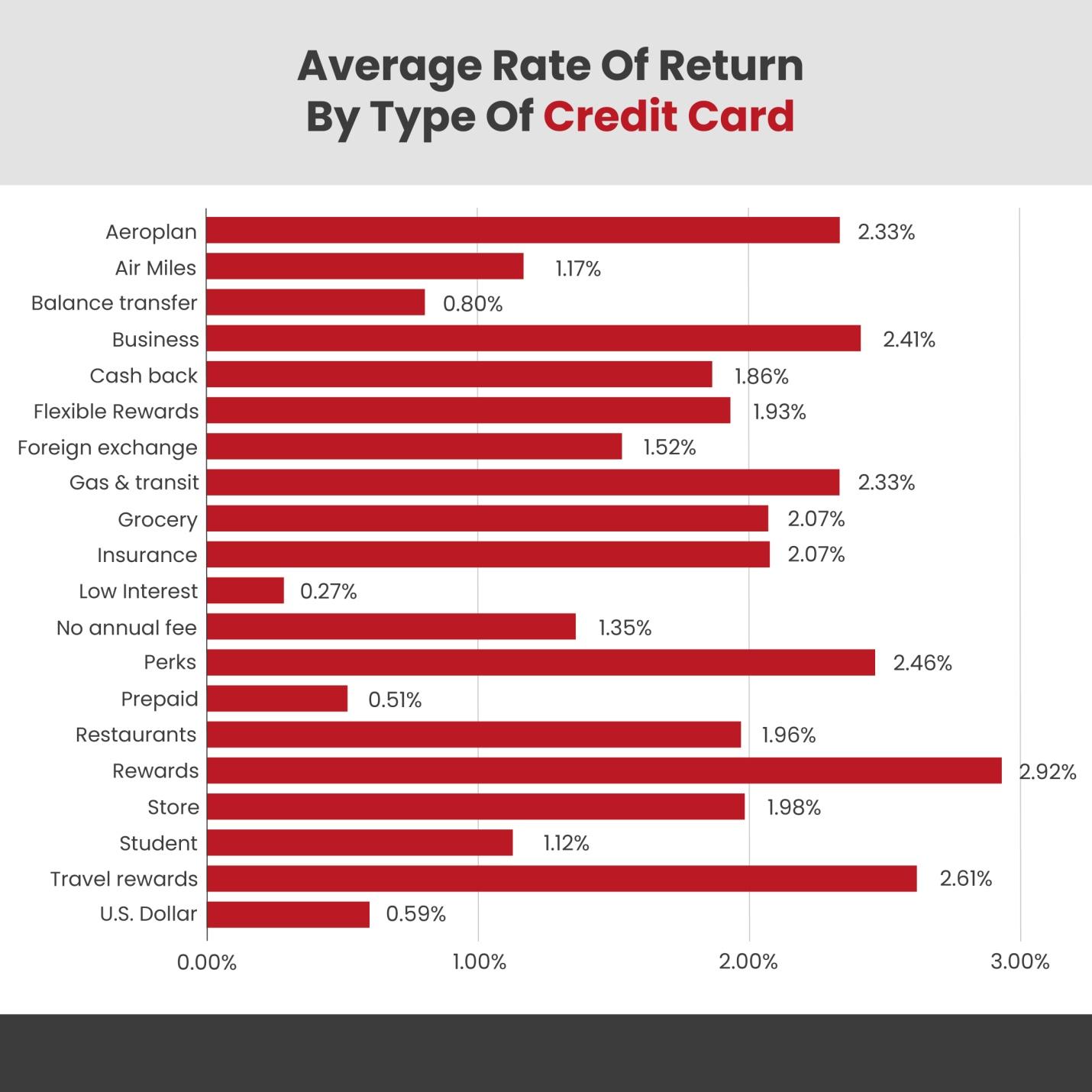

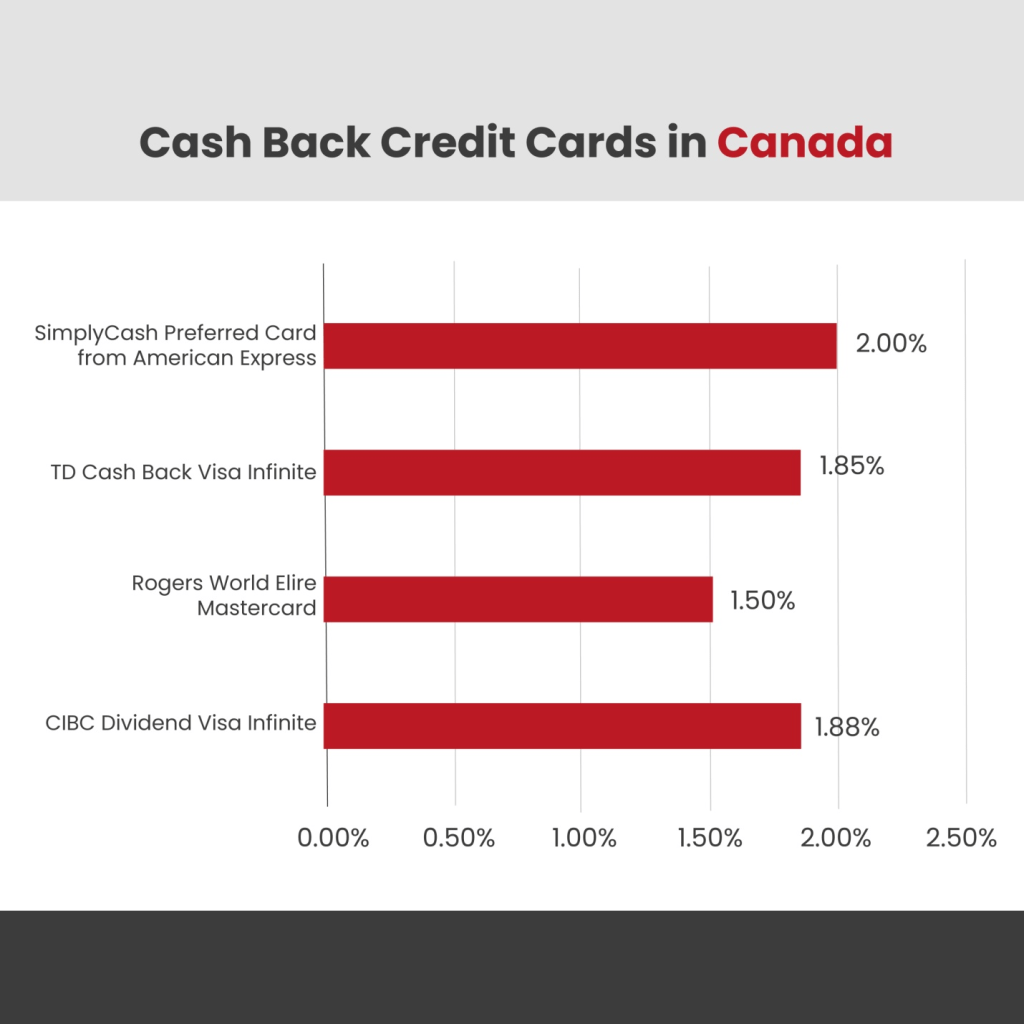

Pairing cash back platforms with top-rated cash back credit cards in Canada amplifies savings. These cards offer category-specific rewards, ensuring every purchase contributes to your savings goals.

Top Cash Back Credit Cards in Canada:

- Tangerine Money-Back Credit Card: Earn up to 2% cash back on two categories of your choice, and 0.5% on all other purchases.

- Simplii Financial™ Cash Back Visa Card*: Get 4% cash back on restaurant, coffee, and bar (up to $5,000 per year), 1.5% cash back on gas, groceries, drugstore (up to $15,000 per year, and 0.5% cash back on all other purchases.

- TD Cash Back Visa Infinite Card*: Enjoy 3% cash back on groceries, gas, and bill payments, and 1% cash back on all other purchases.

Pro Tip: Choose a cash back credit card that aligns with your spending habits to maximize rewards.

9. No Restrictions or Expiry Dates

Unlike traditional loyalty programs, cash back rewards often come with fewer restrictions. They don’t expire as long as your account is active and in good standing.

Example:

GCR users can accumulate rewards at their own pace and redeem them whenever they choose, offering unparalleled flexibility.

Survey Insight:

83% of Canadians use credit cards because of the rewards that come with it.

10. Encourages Sustainable Shopping

Many cash back platforms partner with eco-friendly brands, encouraging sustainable shopping practices. Cash back shopping in Canada can earn rewards while making environmentally conscious choices.

Eco-Friendly Retailers on GCR:

- Well.ca: Offers 1.25% cash back on organic and eco-friendly products.

- Ecobee: Earn 5% cash back rewards on sustainable smart home technology.

User Testimonial:

“It feels great to support green brands and get rewarded for it. Cash back shopping aligns with my values,” says Emily T., an environmentalist from Ottawa.

11. Ideal for Referral Bonuses

Canadians also appreciate the opportunity to earn additional rewards through referral programs. Many cash back platforms offer bonuses when users invite friends or family to join the platform.

Pro Tip: Share your referral link during special promotions to earn higher bonuses and maximize your rewards.

12. Trusted by Canadians Nationwide

Platforms like GCR have built a reputation for reliability, transparency, and excellent customer service. With a large user base across Canada, GCR continues to be a preferred choice for cash back shopping.

User Testimonial:

“I’ve been using GCR for years and have never been disappointed. It’s a reliable way to save on everything I buy,” says Tom L., a loyal user from Edmonton.

Maximizing Cash Back Shopping in Canada

To fully enjoy the benefits of cash back shopping, consider these strategies:

- Stay Informed: Subscribe to newsletters for updates on new deals.

- Plan Purchases: Time your shopping around sales events.

- Combine Rewards: Use cash back credit cards alongside cash back platforms for maximum savings.

- Leverage Tools: Use GCR’s browser extension to ensure you never miss a deal.

Partner With Great Canadian Rebates for Savings

When it comes to cash back shopping in Canada, Great Canadian Rebates is a leader. With an extensive network of top cash back retailers, GCR ensures users get the best deals on every purchase.

Our online platform lets Members compare top credit card options available in Canada and apply for the one that best suits their financial and lifestyle requirements. It’s free to join, and Members can also choose from over 700 well-known merchants and take advantage of great rebates, deals, and discounts. Visit the website today for more information.