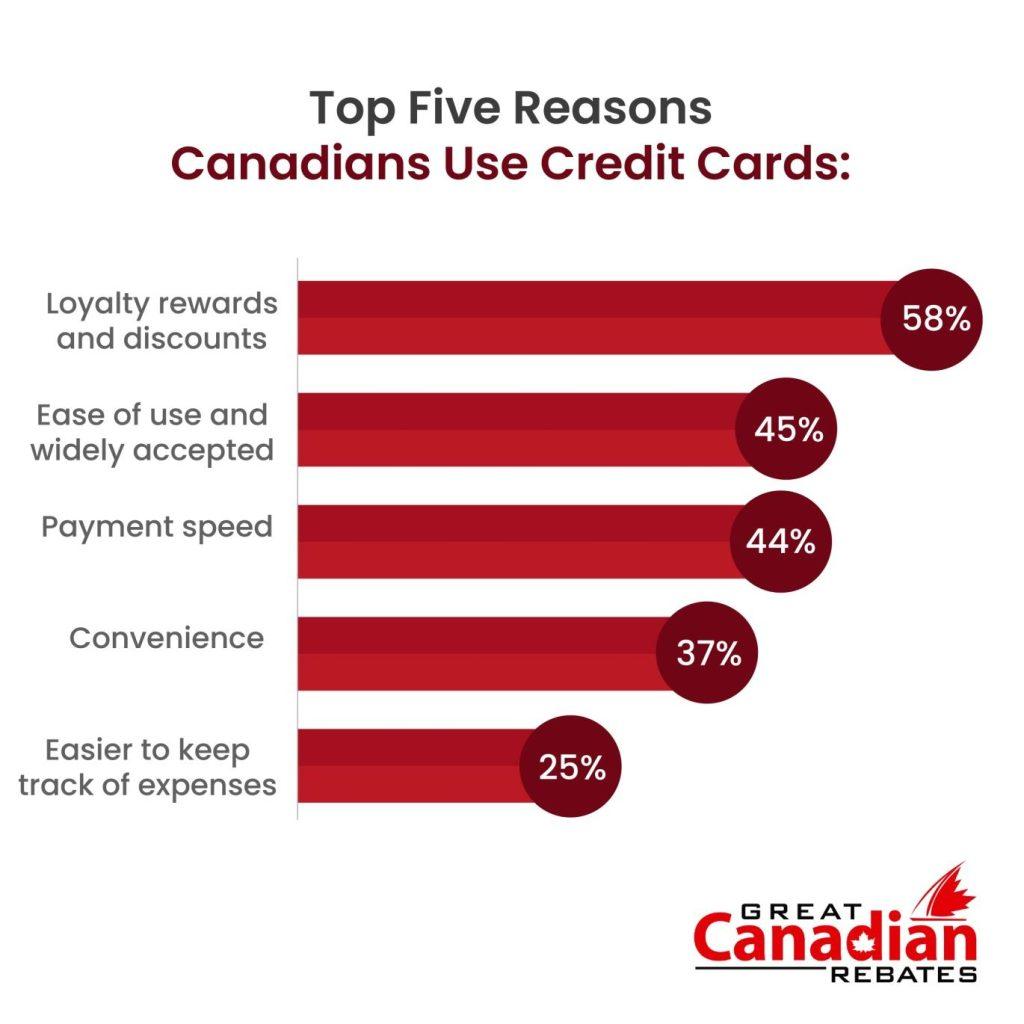

In today’s world, managing personal finances effectively means more than just keeping a budget; it’s about optimizing your spending, saving wherever possible, and reaping rewards that contribute to your long-term financial goals. One excellent way to do this is through credit card rewards programs. When paired with a trusted cash-back platform, like Great Canadian Rebates, these credit cards can help you maximize your rewards on everyday purchases.

Let’s delve into the exclusive Great Canadian Rebates credit card offers and how they can boost your savings potential.

What is Great Canadian Rebates?

Great Canadian Rebates (GCR) is a premier cashback platform that offers Canadians an easy and rewarding way to earn cashback on a variety of online purchases. Whether you’re shopping for electronics, groceries, or planning your next vacation, GCR provides you with opportunities to earn cashback for your purchases at thousands of online retailers

By partnering with top credit card providers in Canada, Great Canadian Rebates lets users earn cashback on everyday expenses, making it easier to build savings over time. The platform works seamlessly with various credit cards, enhancing the overall cashback experience.

The Benefits of Credit Cards Through Great Canadian Rebates

1. Rewards

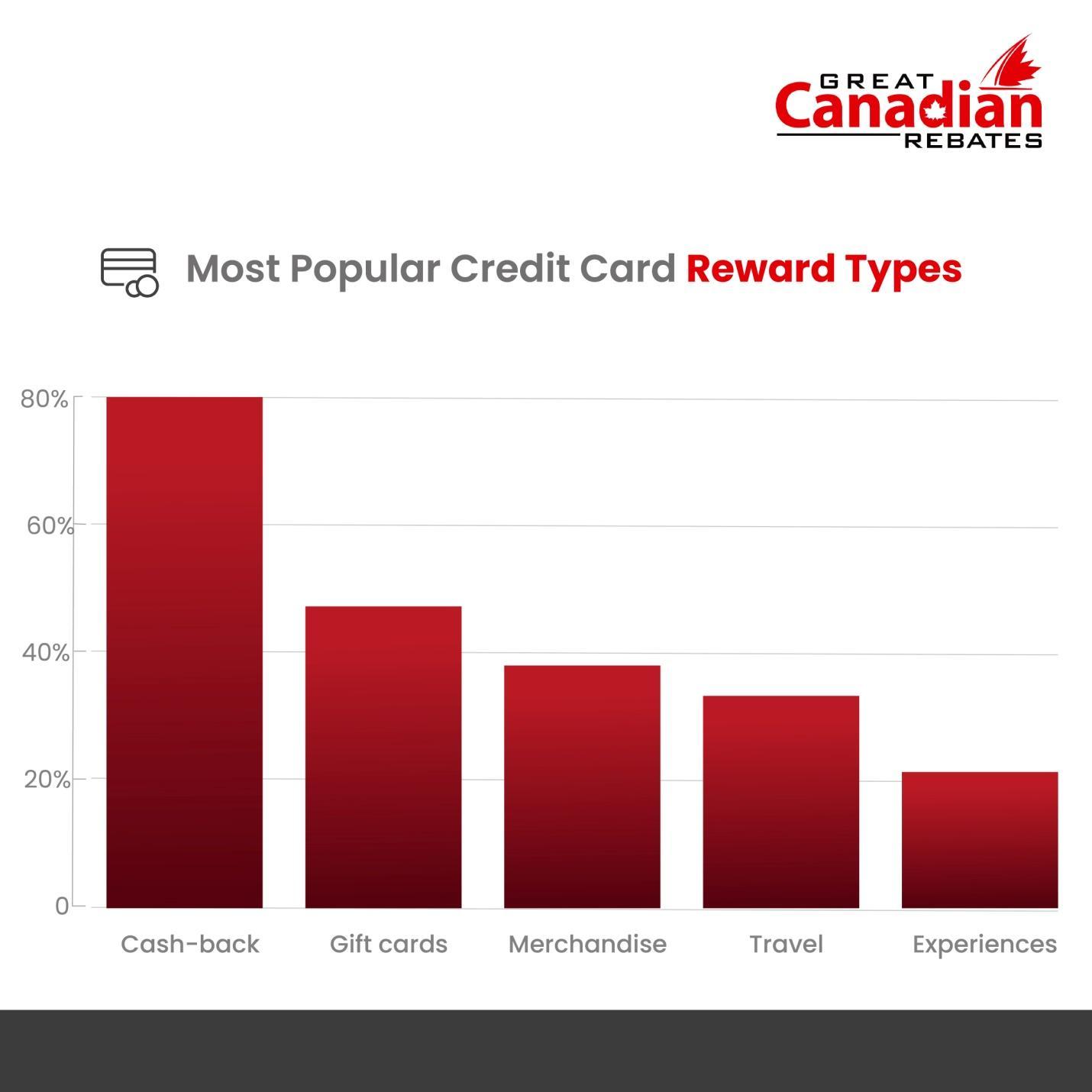

Great Canadian Rebates credit card offers are designed to maximize rewards through everyday spending. Whether it’s a card that offers points for every dollar spent or a cashback program, rewards are a powerful incentive. Users can redeem points for merchandise, travel, or statement credits, creating a flexible and rewarding experience.

Many cards come with bonus categories for specific purchases like groceries, gas, and dining, such as the Neo World Elite® Mastercard, allowing users to earn at accelerated rates for their regular spending.

2. CashBack

Cash back is one of the most sought-after benefits, especially for those who want immediate and tangible rewards for their spending. GCR credit card offers often feature generous cash back percentages across various categories such as groceries, gas, dining, and recurring bills. Some cards even allow users to earn a flat rate of cashback on all purchases, making it easy to earn rewards on every transaction.

3. Travel Benefits

For frequent travelers, Great Canadian Rebates provides a range of travel-related benefits. Many cards such as the Amex Aeroplan Business Reserve Card feature rewards points that can be redeemed for flights, hotel stays, car rentals, and more.

Additional perks such as priority boarding, travel insurance, and airport lounge access are also offered on some cards, elevating the travel experience. This makes GCR credit cards a valuable asset for travel enthusiasts looking to get the most out of their purchases.

4. Purchase Protection

Purchase protection is an essential feature for anyone who makes significant purchases. It safeguards items against theft, loss, or damage for a certain period after the purchase is made with a credit card such as the RBC® Avion Visa Infinite. This benefit ensures that if a newly bought product is damaged or stolen, you’re covered without having to rely solely on the retailer’s return policy.

5. Extended Warranty

An extended warranty can be an incredibly valuable feature for those who buy durable goods such as electronics or home appliances. Great Canadian Rebates credit card offers frequently include extended warranty coverage, which can lengthen the manufacturer’s warranty by a set period. This benefit helps reduce the financial burden of repairs or replacements once the original warranty expires.

6. Rental Car Insurance

If you rent a car, some GCR credit cards can offer rental car insurance that protects you in case of an accident or damage. This feature can save you from having to purchase expensive rental car insurance directly from the rental agency, which can be pricey. The credit card rental car insurance typically covers damage to the car, theft, and sometimes liability for injuries.

7. Cell Phone Protection

For those who rely heavily on their mobile phones, cell phone protection is a highly valuable benefit. Several Great Canadian Rebates credit card offers including the American Express® Business Gold Rewards Card include coverage for cell phones when the device is purchased or paid for with the card. This coverage generally includes damage or theft, which can be particularly useful if you rely on your phone for both personal and business needs.

8. Access to Special Events

A standout feature of certain GCR credit cards is access to exclusive events. This could range from early access to concert tickets, VIP experiences at sporting events, private screenings of films, or invitations to members-only events. For entertainment enthusiasts, these perks are an exciting bonus, providing unique opportunities to engage with brands and events in ways that go beyond the typical consumer experience.

Top Credit Cards in Canada

1. American Express SimplyCash™ Preferred Card

This card is a great option for anyone looking to earn cashback quickly. It offers 4% cashback on gas and groceries—two categories that most people spend heavily on. You also earn 2% cashback on all other purchases. This is ideal for those who want to make the most of their daily purchases, from filling up at the pump to shopping for essentials.

2. Tangerine Money-Back Credit Card

With this card, users can choose two categories to earn up to 2% cashback, making it a flexible option for individuals with specific spending patterns. It also provides 0.5% cashback on all other purchases. Great Canadian Rebates enhances the appeal of this card by providing access to exclusive benefits like MasterCard benefits when you apply via their portal, boosting the overall cashback potential.

3. Amex Gold Rewards Card

The Amex Gold Rewards Card offers 2 points for every $1 spent on travel, gas, groceries, and drugstore purchases, and 1 point for every dollar spent on other purchases. When paired with Great Canadian Rebates, this card enables a substantial welcome bonus upon approval. Plus, with travel perks such as access to airport lounges and an annual $100 CAD travel credit, this card is perfect for those who love to travel and earn rewards simultaneously.

4. SimplyCash Card from American Express

This cardoffers a 2% cash back on gas and groceries, and 1.25% cash back on all other eligible purchases, making it simple to earn cash back without having to keep track of categories. Plus, users can enjoy a generous welcome offer of $100 and additional perks like access to events and offers by Amex ExperiencesTM.

How to Maximize the Credit Card Benefits

1. Combine Credit Cards

The most effective way to boost your cashback potential is by using credit cards in conjunction with Great Canadian Rebates’ credit card offers. GCR’s platform partners with a wide range of retailers, offering exclusive cashback deals when you shop through their portal. Using your credit card to pay for these purchases means you earn cashback both from the card and the cashback program. This dual benefit can significantly increase the savings you accumulate.

2. Keep an Eye on Seasonal Promotions

Great Canadian Rebates frequently runs special promotions that give users the opportunity to earn even higher cashback rates for certain credit cards. These seasonal deals might include limited-time bonuses or special rates for specific categories such as travel or apparel. By subscribing to GCR’s newsletter or regularly checking the website, you can stay updated on these exclusive offers.

3. Review Your Spending Patterns

Not all credit cards are created equal. Some offer higher cashback on groceries, while others might be more rewarding for travel or gas purchases. Take the time to assess your spending habits and choose a Great Canadian Rebates credit card offer that aligns with your needs.

4. Use Your CashBack for Financial Goals

Once you’ve accumulated cashback, it’s important to use those rewards effectively. Consider applying your cashback toward financial goals like building an emergency fund, paying down credit card debt, or contributing to your retirement savings. Alternatively, you could reinvest your cashback into more purchases that earn additional rewards, enhancing your financial growth over time.

Enhance Your Financial Strategy with Great Canadian Rebates

When it comes to maximizing credit card benefits, Great Canadian Rebates credit card offers provide an outstanding opportunity to earn rewards, cash back rebates, and enjoy valuable perks.

Our online platform lets Members compare credit card options available in Canada and apply for the one that best suits their financial and lifestyle requirements. It’s free to join, and Members can also choose from over 700 well-known merchants and take advantage of great rebates, deals, and discounts. Visit the website today for more information.