Few tools are as valuable as a travel credit card when it comes to enhancing your travel experiences. For Canadians, the Marriott Bonvoy Credit Cards in Canada lineup offers exceptional rewards, exclusive travel perks, and elite status benefits tailored for frequent travellers. Whether you’re a loyal Marriott Bonvoy member or enjoy luxury travel, these cards provide an easy way to elevate your trips while earning valuable hotel rewards.

This guide delves into why exclusive travel credit cards are a must-have and compares the best Marriott Bonvoy credit card options available to Canadians. We’ll also explore how Great Canadian Rebates can help you maximize your savings with credit card rebates.

Why Choose a Marriott Bonvoy Credit Card?

Marriott Bonvoy is one of the world’s leading hotel loyalty programs, offering access to over 8,000 properties across 139 countries and territories. By using a Marriott Bonvoy Credit Card, you can earn points for free hotel stays, exclusive benefits like late checkout, room upgrades, and even airline rewards.

For Canadians, these cards are more than just a payment tool—they’re a gateway to enriching travel experiences. Coupled with Great Canadian Rebates, they also offer additional savings and cash back opportunities, making them even more rewarding.

Top Marriott Bonvoy Credit Cards in Canada

Marriott Bonvoy® American Express® Card

The Marriott Bonvoy® American Express® Card is a standout option for Canadian travellers who frequently stay at Marriott properties.

Key Features:

- Welcome Bonus: Earn 50,000 Marriott Bonvoy points when you charge $1,500 to your card in the first three months.

- Rewards Rate: Earn 5 points per $1 spent at Marriott properties and 2 points per $1 on other eligible purchases.

- Annual Fee: $120.

- Annual Free Night Award: Enjoy a free night every year after your card anniversary, redeemable at hotels costing up to 35,000 points.

- Elite Status: Automatically receive Silver Elite Status, offering late checkout and other perks.

Best For:

This card is ideal for Canadians who regularly stay at Marriott hotels and want to maximize their rewards and enjoy elite benefits.

Marriott Bonvoy® Business American Express® Card

For business owners or professionals with significant travel expenses, the Marriott Bonvoy® Business American Express® Card offers tailored rewards and benefits.

Key Features:

- Welcome Bonus: Earn 70,000 Marriott Bonvoy points when you spend $3,000 in the first three months.

- Rewards Rate: Earn 5 points per $1 spent at Marriott properties, 3 points on gas, dining, and travel, and 2 points on all other purchases.

- Annual Fee: $150.

- Annual Free Night Award: Receive a free night certificate each year, redeemable for stays up to 35,000 points.

- Elite Status: Includes automatic Silver Elite Status, with the option to achieve Gold Elite Status by spending $30,000 annually.

Best For:

This card is perfect for Canadian entrepreneurs who want to turn their business expenses into valuable travel rewards.

How Marriott Bonvoy Credit Cards Benefit Frequent Travellers

Marriott Bonvoy credit cards are designed to offer more than just a payment method—they provide a gateway to enhanced travel experiences and significant savings. For frequent travellers, these cards unlock a variety of benefits that make every trip smoother, more rewarding, and more enjoyable. Here’s a detailed look at how these cards can transform your travel routine.

Earn Free Nights Faster

One of the most compelling features of Marriott Bonvoy credit cards is their ability to help you earn free nights quickly. Every dollar you spend on your card earns points that can be redeemed for stays at thousands of Marriott properties worldwide.

Whether you’re planning a weekend getaway to a cozy Marriott Courtyard or an extended vacation at a luxurious Ritz-Carlton, these points make it easier to stretch your travel budget. For instance, if your annual spending aligns with bonus categories like Marriott stays, dining, or travel, you’ll amass points at an accelerated rate.

These cards also come with welcome bonuses that significantly boost your points balance from the outset. For example, the Marriott Bonvoy® American Express® Card offers a welcome bonus of up to 50,000 points when you meet the minimum spending requirement within the first three months. That’s enough for a free night at many high-tier Marriott properties or multiple nights at mid-range hotels.

Strategically, using your Marriott Bonvoy card for everyday purchases ensures that no dollar goes unaccounted for in your pursuit of free stays. Additionally, combining these rewards with promotions on platforms like Great Canadian Rebates amplifies your ability to earn points faster.

Elite Status Perks

Elite status within the Marriott Bonvoy program unlocks exclusive benefits that enhance every stay. With Marriott Bonvoy credit cards, cardholders receive automatic Silver Elite Status, which includes:

- Priority late checkout, allowing you to linger a little longer after your stay.

- Bonus points on stays, accelerating your rewards.

- Dedicated reservation lines for quicker and more personalized service.

For travellers who frequently stay at Marriott properties, the perks don’t stop at Silver. By spending a designated amount annually, you can achieve Gold Elite Status, unlocking even more benefits such as:

- Room upgrades, subject to availability, for a more luxurious experience.

- Welcome gifts at check-in to make your stay feel special.

- Enhanced earnings on stays, with even more points awarded per dollar spent.

Elite status isn’t just about the tangible perks—it’s about the elevated experience. From the moment you step into a Marriott property, your elite designation ensures a smoother, more enjoyable stay.

Comprehensive Travel Insurance

When travelling, peace of mind is priceless. Marriott Bonvoy credit cards include a suite of travel insurance benefits that protect a variety of scenarios:

- Trip Cancellation and Interruption Insurance: This policy covers you if you need to cancel or cut your trip short due to unforeseen circumstances, such as illness or emergencies.

- Car Rental Theft and Damage Insurance: Protects you from financial loss when renting a car, eliminating the need to purchase expensive coverage from rental agencies.

- Travel Accident Insurance: Offers compensation in the event of accidental injury or loss of life while travelling.

- Lost or Delayed Baggage Coverage: Ensures you’re reimbursed for essentials if your baggage is lost or delayed.

These benefits not only save you money but also provide invaluable reassurance, allowing you to focus on enjoying your trip without worrying about unexpected expenses.

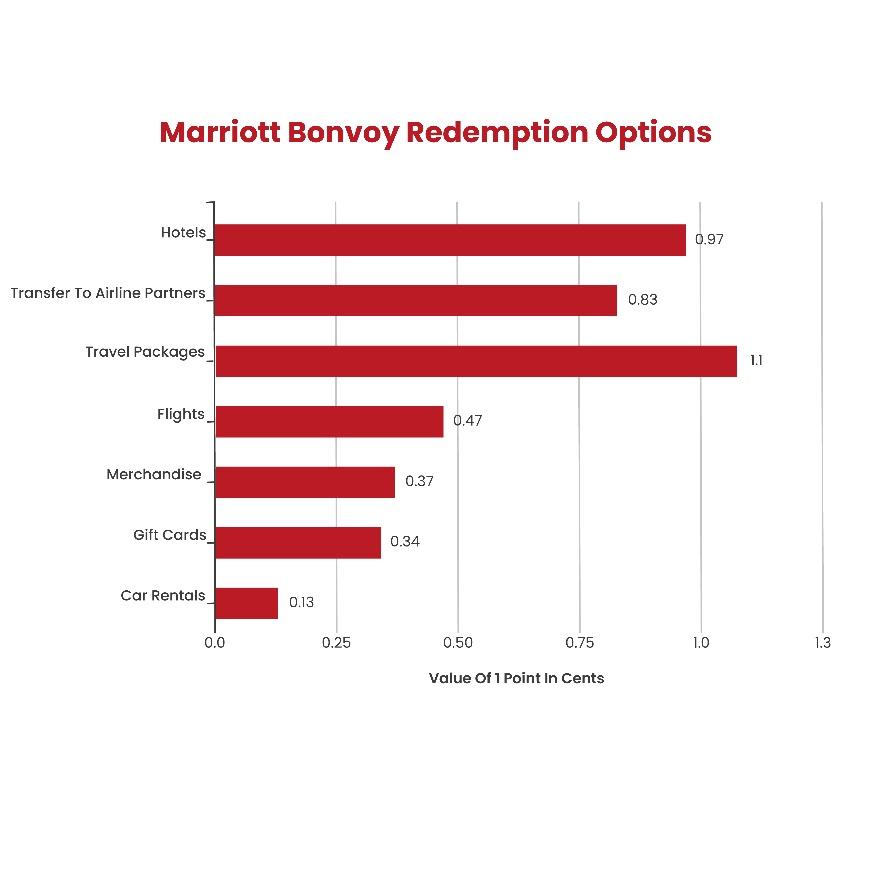

Flexible Redemption Options

Flexibility is a hallmark of the Marriott Bonvoy program. Points earned with Marriott Bonvoy credit cards can be redeemed in numerous ways to suit your travel preferences:

- Hotel Stays: Redeem points for free or discounted stays at Marriott’s vast portfolio of over 8,000 properties, ranging from budget-friendly hotels to ultra-luxury resorts.

- Flights and Car Rentals: Convert points into airline miles or use them to book car rentals, expanding your travel options.

- Exclusive Experiences: Marriott Bonvoy Moments allows you to use points for curated experiences, such as concert tickets, culinary events, or once-in-a-lifetime adventures.

The program also features PointSavers, which lets you book stays at select properties for fewer points, increasing the value of your rewards. Additionally, points can be transferred to over 40 airline partners, offering even more ways to enhance your travel.

For Canadians, the ability to redeem points across various categories makes these cards a versatile addition to any wallet. The flexibility ensures that you can adapt your rewards strategy to fit your travel plans, whether it’s a spontaneous weekend trip or a meticulously planned international adventure.

Annual Free Night Awards

Both the Marriott Bonvoy® American Express® Card and the Marriott Bonvoy® Business American Express® Card include an annual free night certificate. This award can be redeemed at properties requiring up to 35,000 points, which often covers stays at upscale hotels.

This single benefit often justifies the card’s annual fee. For example, a free night at a hotel that typically costs $300 per night is already worth more than the $120-$150 fee associated with these cards. It’s an excellent way to enjoy a luxury experience without dipping into your travel budget.

Travel Partnerships for Enhanced Rewards

Marriott Bonvoy has partnerships with airlines, rental car companies, and other travel providers, allowing you to earn and redeem points seamlessly across platforms. For example, the ability to convert Marriott points into airline miles at favourable rates can lead to significant savings on flights.Additionally, cardholders can enjoy perks like discounted rates on car rentals or bonus points for dining at partner restaurants, further enhancing the card’s value.

Simplified Account Management

Managing your Marriott Bonvoy credit card is straightforward, with intuitive tools for tracking points, redeeming rewards, and monitoring expenses. The Marriott Bonvoy app integrates seamlessly with your card account, providing real-time updates on your points balance, upcoming stays, and exclusive offers.For frequent travellers, this ease of use ensures that you spend less time managing logistics and more time enjoying the rewards.

Maximizing Savings with Great Canadian Rebates

By applying for your Marriott Bonvoy Credit Card Canada through Great Canadian Rebates, you can unlock even more savings:

- Exclusive Rebates: Earn a one-time credit card rebate when you apply for your card through the Great Canadian Rebates website.

- Additional Cash Back: Use your Marriott Bonvoy card for purchases at participating retailers on Great Canadian Rebates to stack your savings with cash back and points.

- Simplified Process: Learn how to apply and earn rebates easily by visiting the How It Works page.

Tips for Choosing the Right Card

- Assess Your Spending Habits: Determine whether you spend more on Marriott stays, dining, or everyday expenses to select the card with the best rewards rate for your lifestyle.

- Consider Annual Fees: The value of free night certificates and rewards points can often outweigh the annual fee if you use your card strategically.

- Plan Your Redemptions: Use Marriott Bonvoy’s point calculator to maximize the value of your rewards by booking stays during peak or special promotions.

- Combine with Great Canadian Rebates: Boost your rewards potential by combining the perks of your Marriott Bonvoy card with cash back offers on the Great Canadian Rebates platform.

Frequently Asked Questions

1. Are Marriott Bonvoy Credit Cards worth it for Canadians?

Yes, they offer significant value for frequent travellers, especially those loyal to Marriott properties. With welcome bonuses, free night awards, and elite status, they can save you hundreds annually.

2. How do I earn the most Marriott Bonvoy points?

To earn the most points, focus your spending on Marriott stays and other high-reward categories like dining or travel, and use Great Canadian Rebates for additional savings.

3. Can I upgrade my Silver Elite Status?

Yes, by spending a specified amount annually on your Marriott Bonvoy card, you can upgrade to Gold Elite Status for enhanced perks.

Final Thoughts

The Marriott Bonvoy Credit Cards Canada are a top choice for frequent travellers looking to enhance their journeys with valuable rewards, exclusive perks, and financial peace of mind. From earning free nights faster to enjoying elite status benefits, these cards cater to a variety of travel needs.

By applying through Great Canadian Rebates, you can further maximize your savings, combining the benefits of cash back and rewards points. Whether you’re a casual traveller or a road warrior, Marriott Bonvoy credit cards offer unparalleled value and flexibility, making them a must-have for your wallet.

Where To Apply For The Best Canadian Credit Cards?

Great Canadian Rebates is an online platform that lets Members compare credit card options available in Canada and apply for the one that best suits their financial and lifestyle requirements. It’s free to join, and Members can also choose from over 700 well-known merchants and take advantage of great rebates, deals, and discounts.

Visit the website today for more information.