The RBC Avion Visa Infinite is one of Canada’s top travel rewards credit cards, designed specifically to provide flexibility, value, and convenience to frequent travellers. With RBC Avion Visa rewards, you can turn everyday spending into flights, hotel stays, and even unique experiences—all while enjoying exclusive travel perks.

This card is worth exploring for Canadians who want to maximize their travel potential without the hassle of blackout dates, limited seat availability, or complicated redemption processes.

In this article, we’ll explore the RBC Avion Visa Infinite, detailing the card’s travel benefits, rewards structure, and additional perks, which make it ideal for jet-setters and occasional travellers alike. We’ll also explain how to boost your rewards with Great Canadian Rebates.

Why the RBC Avion Visa Infinite Is Popular Among Canadian Travellers

The RBC Avion Visa Infinite stands out for several reasons: it provides flexibility in travel redemption, generous point-earning opportunities, and valuable travel insurance. Whether you’re an avid traveller or someone who flies just a few times a year, the Avion Visa Infinite makes it easy to earn rewards and enjoy premium perks on the road.

Key Benefits of the RBC Avion Visa Infinite

Flexible Point Redemption with RBC Avion Visa Rewards

With RBC Avion Visa rewards, you can redeem points without the typical restrictions that can make travel redemption frustrating. There are no blackout dates, which means you’re free to book flights during peak seasons. Also, you’re not limited to specific airlines—you have the flexibility to fly with almost any airline worldwide.

You can redeem your points for a range of travel options, including:

- Flights

- Hotels

- Car rentals

- Vacation packages

This flexibility in point redemption gives Avion Visa Infinite users more control over their travel experiences, making it a go-to card for many Canadians. And with no seat restrictions on flights, you can book your ideal trip without having to search for available seats in limited point redemption categories.

Earn Points on Everyday Purchases

Earning RBC Avion Visa rewards is simple. Here’s how the points structure works:

- 1 point for every dollar you spend on everyday purchases.

- 1.25 points for every dollar you spend on travel-related purchases booked through RBC Rewards.

This earning potential allows you to rack up points quickly, especially if you’re using the card for both day-to-day expenses and travel purchases. And unlike some other top-rated cash back credit cards, these points aren’t limited by annual earning caps, meaning your rewards continue to accumulate without interruption.

Welcome Bonus for New Cardholders

New Avion Visa Infinite cardholders often have access to a welcome bonus. This initial bonus can give your points balance a substantial boost, which you can then use towards your next trip. Check Great Canadian Rebates for potential offers on the Avion Visa Infinite, as they often have additional promotions and rebates for new applicants.

Comprehensive Travel Insurance Coverage

The RBC Avion Visa Infinite includes a comprehensive travel insurance package, making it a standout card for those who want to feel secure on the go. Here’s what the insurance coverage includes:

- Out-of-Province/Country Emergency Medical Insurance: Coverage for up to $1 million for medical emergencies.

- Flight Delay and Trip Interruption Insurance: Receive compensation for trip delays or interruptions due to unexpected events.

- Auto Rental Collision/Loss Damage Insurance: Coverage for rental vehicles in case of damage or theft.

- Lost or Stolen Baggage Insurance: This policy helps cover the costs of replacing personal items if luggage is lost or stolen.

Having these types of coverage in place allows you to travel with peace of mind, knowing that you’re covered if any unexpected issues arise. This insurance is precious for Canadians who travel frequently or take family vacations, as it can help offset costs associated with unforeseen travel disruptions.

Access to Exclusive Visa Infinite Perks

Visa Infinite cardholders gain access to exclusive benefits that can elevate their travel experience. Some of the perks include:

- Visa Infinite Luxury Hotel Collection: Access premium benefits, like room upgrades, free breakfast, and late checkout, when booking at participating hotels.

- Visa Infinite Dining Series: Enjoy exclusive dining events hosted by top chefs across Canada.

- Visa Infinite Concierge Service: Whether you need help booking reservations, planning travel itineraries, or arranging special events, the concierge service can assist with the details.

These perks enhance the Avion Visa Infinite’s appeal, providing a level of service that adds value beyond rewards alone.

Boost Your Points with Great Canadian Rebates

Using Great Canadian Rebates in conjunction with your RBC Avion Visa Infinite card can maximize your rewards even further. Great Canadian Rebates offers cash back on purchases made at a wide range of online retailers, allowing you to earn both credit card rewards and cash back on the same transaction.

Here’s how it works:

- Sign up for an account on Great Canadian Rebates.

- Visit the How It Works page to understand how to earn cash back.

- Shop at participating stores through the Great Canadian Rebates platform to earn cash back.

- Use your RBC Avion Visa Infinite to complete your purchases, earning both cash back and Avion points.

For frequent online shoppers, this approach offers a great way to double up on rewards and save more on everyday expenses.

How to Redeem RBC Avion Visa Rewards Points

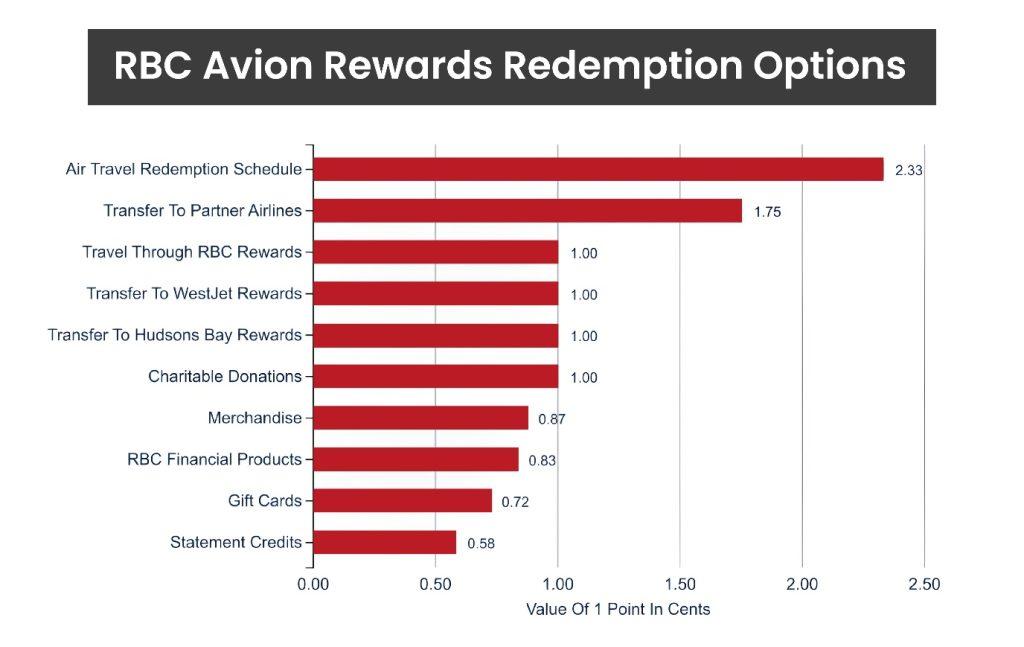

Redeeming points with the RBC Avion Visa rewards system is straightforward and highly flexible. Here’s a look at some of the most popular redemption options for cardholders:

1. Flights

RBC Avion cardholders can redeem points for flights with almost any airline, which is a huge benefit for those who want flexibility in travel. Unlike other cash back credit cards that may limit how you can redeem rewards, RBC’s travel program lets you book flights through RBC Rewards or transfer points to other loyalty programs like British Airways Avios, providing even more flexibility.

2. Hotel Stays and Vacation Packages

RBC Rewards points can be redeemed for hotel bookings and vacation packages through RBC’s travel portal, making it easy to plan a complete trip without the need for cash outlays. This option is perfect for those who want to use points not just for flights but for the full travel experience.

3. Statement Credits and Merchandise

For those who prefer to keep things simple, RBC Rewards points can also be redeemed for statement credits, which function similarly to cash back. This option allows you to apply points directly to your credit card balance, effectively turning your rewards into a cash back credit card feature.

Frequently Asked Questions

1. What is the redemption value for RBC Avion points on flights?

The value can vary depending on the route. Still, generally, points are worth approximately 1.2 to 1.5 cents per point for flights within Canada and the U.S., depending on the time of year and availability.

2. Can I transfer my Avion points to other loyalty programs?

Yes, RBC allows point transfers to several frequent flyer programs, including British Airways Avios and WestJet Rewards. This is a valuable feature for travellers who prefer flexibility in their travel plans.

3. How does Great Canadian Rebates work with the RBC Avion Visa Infinite card?

By signing up on Great Canadian Rebates and shopping through their links, you can earn cash back at participating retailers. When you pay with your RBC Avion Visa Infinite card, you’ll also earn RBC Avion Visa rewards on top of the cash back, maximizing your savings.

Who Should Consider the RBC Avion Visa Infinite?

The RBC Avion Visa Infinite is ideal for Canadians who value flexible, easy-to-use travel rewards without the restrictions often found with other programs. Here are some of the types of travellers who would benefit most from this card:

- Frequent Flyers: If you fly regularly, the Avion Visa Infinite offers points on all purchases and a flexible travel rewards program without blackout dates.

- Luxury Travellers: This card offers premium benefits that enhance travel experiences, including access to the Visa Infinite Luxury Hotel Collection and Visa Infinite Concierge Service.

- Budget-Conscious Travellers: With Great Canadian Rebates, you can stretch your money further by earning cash back on top of your credit card rewards.

Where To Apply For The Best Canadian Credit Cards?

Great Canadian Rebates is an online platform that lets Members compare credit card options available in Canada and apply for the one that best suits their financial and lifestyle requirements. It’s free to join, and Members can also choose from over 700 well-known merchants and take advantage of great rebates, deals, and discounts.

Visit the website today for more information.