The Tangerine Cash Back Credit Card is a versatile credit card designed to help Canadians earn cash back on their everyday purchases. With no annual fee and customizable cash back categories, this card offers a flexible and rewarding way to save money.

One of the standout features of the Tangerine Cash Back Credit Card is its ability to tailor your rewards to your spending habits. Unlike other cash back cards that offer fixed rewards, the Tangerine Cash Back Credit Card allows you to choose the categories that best align with your spending patterns. This means you can earn higher cash back rates on the purchases you make most frequently.

This blog post aims to guide you in maximizing your Tangerine Cash Back Credit Card rewards. We’ll delve into the card’s features and benefits and provide tips on how to make the most of its customizable cash back program. By understanding the Tangerine Cash Back Credit Card and using it strategically, you can unlock its full potential and enjoy the financial rewards it offers.

Understanding the Tangerine Cash Back Credit Card

The Tangerine Cash Back Credit Card offers a straightforward rewards program that allows you to earn cash back on your everyday purchases. The card’s customizable cash back categories provide flexibility, allowing you to tailor your rewards to your spending habits.

To earn cash back with the Tangerine cash back card, simply use your card for your everyday purchases. The card will automatically track your spending and allocate cash back to the categories you’ve selected. You can choose up to three categories to earn cash back on, providing you with the flexibility to focus on the areas that align with your spending patterns.

The Tangerine Cash Back Credit Card offers a variety of cash back rates depending on the category you’ve selected. These rates can range from 2% to 4%, allowing you to earn higher rewards on the purchases that matter most to you.

When considering the Tangerine Cash Back Credit Card, it’s important to factor in the following:

- Annual fee: The Tangerine Cash Back Credit Card has no annual fee, making it an attractive option for those looking to avoid unnecessary costs.

- Interest rate: The card’s interest rate is competitive, but it’s important to pay your balance in full each month to avoid interest charges.

- Eligibility requirements: To be eligible for the Tangerine Cash Back Credit Card, you’ll need to meet certain criteria, such as having a good credit score.

By understanding these factors, you can determine if the Tangerine Cash Back Credit Card is the right choice for your needs and financial goals.

Key Features of the Tangerine Cash Back Credit Card

The Tangerine Cash Back Credit Card offers a comprehensive suite of features and benefits that make it a valuable credit card option for Canadian consumers. Here’s a closer look at some of its key features:

No Annual Fee

One of the most attractive features of the Tangerine cash back card is that it has no annual fee. This means you can enjoy the benefits of the card without incurring any additional costs. This is especially beneficial for those who want to avoid unnecessary expenses and maximize their rewards.

Customizable Cash Back Categories

The Tangerine Cash Back Credit Card offers a unique feature that allows you to customize your cash back categories. This means you can choose the categories that align with your spending habits and earn higher cash back rates on the purchases that matter most to you.

To customize your cash back categories, simply log in to your Tangerine online banking account. You can select up to three categories to earn cash back on. These categories include:

- Groceries

- Gas

- Restaurants

- Drugstores

- Home Improvement

- Travel

- Other

By selecting the categories that best reflect your spending patterns, you can maximize your cash back earnings and get the most out of your Tangerine Cash Back Credit Card.

Cash Back Rates

The cash back rates for the Tangerine Cash Back Credit Card vary depending on the category you’ve selected. The current cash back rates are as follows:

- Groceries, Gas, and Drugstores: 2% cash back

- Restaurants: 3% cash back

- Home Improvement and Travel: 4% cash back

- Other: 1% cash back

These rates are subject to change, so it’s always a good idea to check the Tangerine website for the most up-to-date information.

Other Benefits

In addition to customizable cash back categories, the Tangerine Cash Back Credit Card offers other benefits, including:

- Purchase Security: This coverage protects your eligible purchases against theft, loss, or damage.

- Extended Warranty: This feature doubles the manufacturer’s warranty for up to an additional year on eligible purchases.

- Travel Medical Insurance: This coverage provides medical insurance while travelling abroad.

- 24/7 Customer Support: Tangerine offers 24/7 customer support to assist you with any questions or issues.

These additional benefits can enhance the overall value of the Tangerine Cash Back Credit Card and provide added peace of mind.

Maximizing Your Tangerine Cash Back Credit Card Rewards

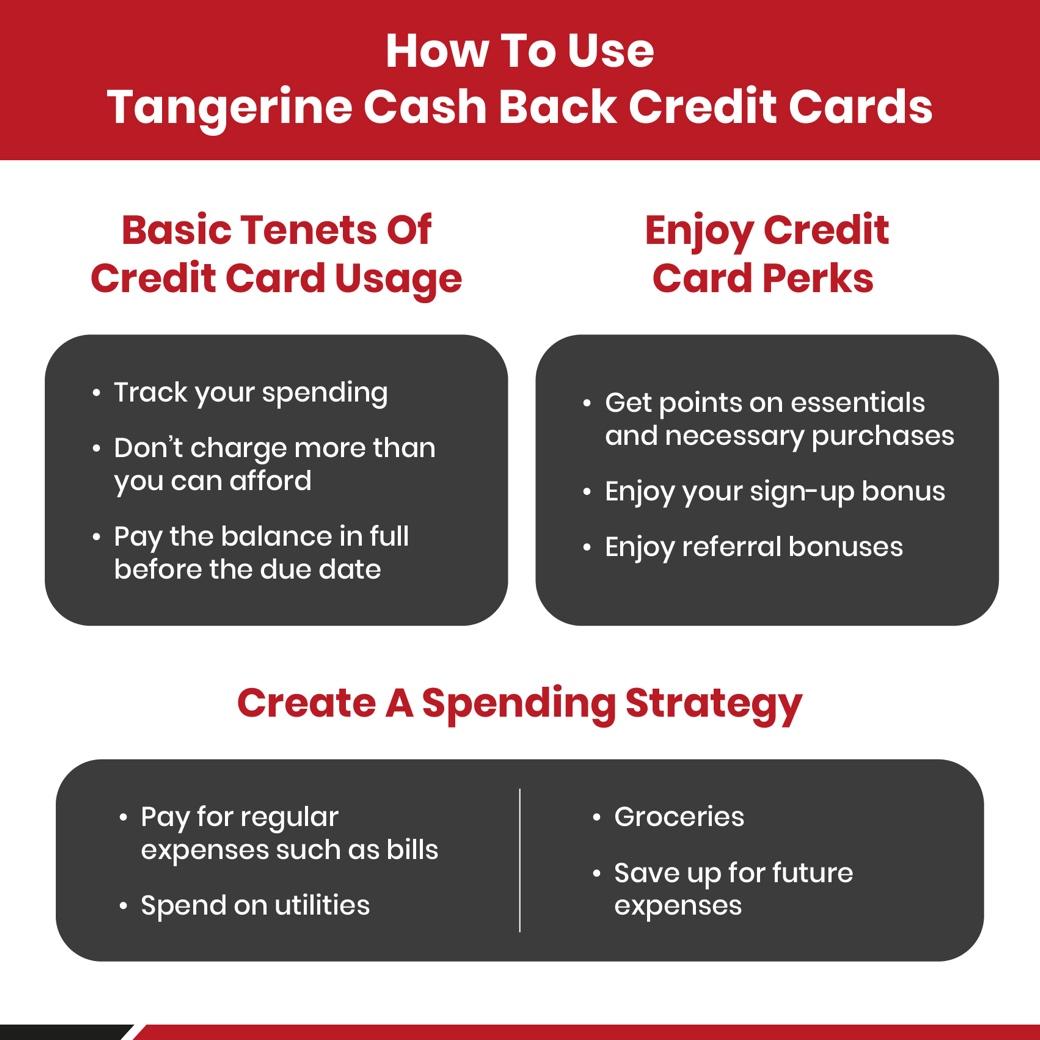

To get the most out of your Tangerine cash back card, it’s important to understand how to maximize your rewards. Here are some tips to help you make the most of your card:

Earning More Cash Back

- Choose your cash back categories wisely: Select the categories that align with your spending habits to earn the most cash back. Consider your regular purchases and choose the categories that will maximize your rewards.

- Pay your bills with your Tangerine Cash Back Credit Card: Many everyday expenses, such as utility bills, phone bills, and streaming services, can be paid using your credit card. This is a great way to earn cash back on your regular expenses.

- Shop at participating retailers: Some retailers offer bonus cash back or other promotions when you use your Tangerine cash back card. Keep an eye out for these opportunities to earn extra rewards.

- Consider using your card for travel expenses: While the Tangerine Cash Back Credit Card doesn’t offer specific travel rewards, you can still earn cash back on your travel expenses. Book flights, hotels, and car rentals with your card to accumulate cash back.

Redeeming Cash Back for Maximum Value

- Redeem your cash back regularly: Don’t let your cash back rewards accumulate. Redeem your cash back regularly to avoid missing out on potential benefits.

- Consider cash back options: The Tangerine Cash Back Credit Card offers various cash back options, such as cash deposits, statement credits, or gift cards. Choose the option that best suits your needs and preferences.

- Use cash back for everyday expenses: Redeeming your cash back for everyday expenses can help you save money on your regular purchases. Consider using cash back to pay for groceries, dining out, or utility bills.

- Take advantage of special offers: Keep an eye out for special offers and promotions that allow you to redeem your cash back for even greater value.

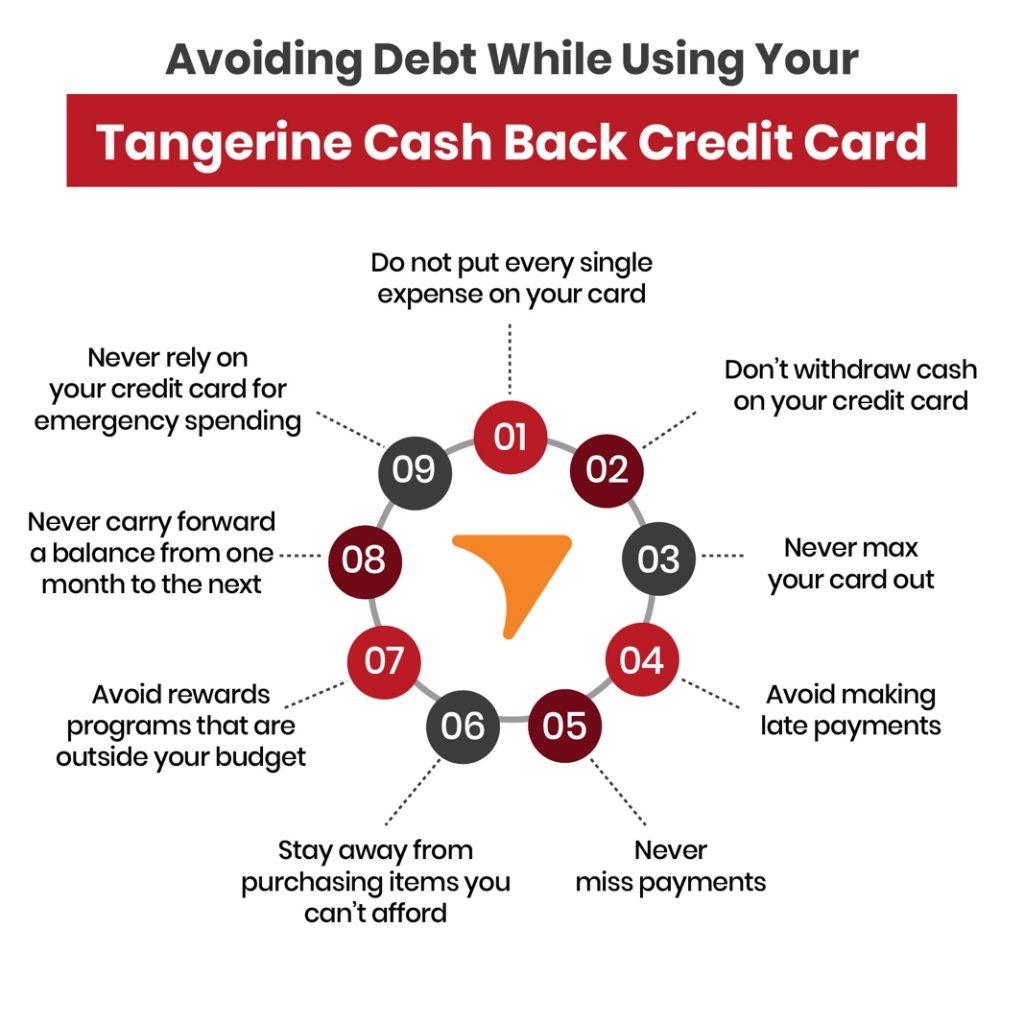

Using Your Tangerine Cash Back Credit Card Responsibly

- Pay your balance in full each month: One of the most important tips for using any credit card responsibly is to pay your balance in full each month. This will help you avoid interest charges and maximize the value of your rewards.

- Monitor your spending: Keep track of your spending to ensure you’re using your Tangerine Cash Back Credit Card responsibly. Avoid overspending and make sure you can comfortably afford your monthly payments.

- Take advantage of additional benefits: The Tangerine Cash Back Credit Card may offer additional benefits, such as purchase protection or extended warranty. Be sure to familiarize yourself with these benefits and take advantage of them when needed.

By following these tips, you can maximize the value of your Tangerine Cash Back Credit Card and enjoy the financial rewards it offers. Remember, responsible credit card usage is essential to ensure you’re getting the most out of your rewards.

Great Canadian Rebates is your one-stop shop for the best cash back credit cards in Canada. Our platform offers a variety of exciting deals and promotions that can help you save more money.

By joining Great Canadian Rebates, you can access exclusive offers and discounts, earn cash back on your purchases, and maximize your rewards with expert advice. Don’t miss out on these amazing opportunities. Sign up now and start earning more today!