The MBNA Smart Cash Platinum Plus Mastercard is one of the most straightforward and accessible cash back credit cards available to Canadians. With its no annual fee structure, the card is designed for individuals who want to earn cash back on everyday purchases without the need for complex rewards systems or high annual fees.

Whether you’re filling up your car at the gas station or shopping for groceries, this card offers tangible value on frequent, necessary expenses. Let’s dive into what makes the MBNA Smart Cash Platinum Plus Mastercard stand out, how it compares to other cash back cards, and the broader impact of credit card usage in Canada.

Features of the MBNA Smart Cash Platinum Plus Mastercard

- No Annual Fee: One of the most appealing aspects of the MBNA Smart Cash Platinum Plus Mastercard is that it comes with no annual fee. This means you won’t need to worry about paying extra costs to hold the card, allowing you to enjoy the full benefits of your cash back without it being reduced by yearly charges. For many Canadians, avoiding fees is a top priority, and this card is a great option for those who want to maximize their rewards without additional expenses.

- 5% Cash Back on Gas and Groceries (First 6 Months): In the first six months of holding the card, cardholders earn an impressive 5% cash back on eligible gas and grocery purchases. Given that these two categories are frequent expenses for most people, this is a quick way to accumulate cash back. However, this elevated cash back rate applies until your monthly purchases in these categories reach $500. After that, the rate returns to the standard 2%.

- 2% Cash Back on Gas and Groceries (After 6 Months): After the introductory period ends, the MBNA Smart Cash Platinum Plus Mastercard continues to offer 2% cash back on gas and grocery purchases, up to $500 per month. While some other cash back cards offer higher ongoing rewards, this rate remains competitive for a card with no annual fee. This ongoing reward structure makes it a solid long-term option for frequent gas station visits and grocery runs.

- 0.5% Cash Back on All Other Purchases: For all other eligible purchases that don’t fall into the gas or grocery categories, cardholders earn 0.5% cash back. While this rate may seem modest, it ensures you’re still getting some reward for all other transactions, no matter where you shop.

- Standard Interest Rates: The card features a standard interest rate of 19.99% on purchases, 22.99% on balance transfers, and 24.99% on cash advances. Users should be aware of these rates and avoid carrying a balance, as interest can quickly negate the benefits of cash back rewards.

- Balance Transfers and Access Cheques: In addition to earning cash back on everyday purchases, the MBNA Smart Cash Platinum Plus Mastercard offers balance transfer options and access cheques. These features are helpful for those looking to consolidate debt or access quick funds in an emergency. However, it’s important to manage these features responsibly due to the higher interest rates on these transactions.

Maximizing Your MBNA Smart Cash Platinum Plus Mastercard

To take full advantage of the MBNA Smart Cash Platinum Plus Mastercard, consider the following tips:

- Focus on Gas and Groceries: Given that the highest cash back rates are earned in gas and grocery purchases, it’s a good idea to use the card specifically for these categories. If you’re regularly spending on groceries and filling up your vehicle, you can easily hit the $500 cap for 5% or 2% cash back in these categories each month. For the first six months, make sure to maximize your purchases in these areas to get the full benefit of the 5% cash back.

- Avoid Carrying a Balance: The standard interest rates on the card can be high if you carry a balance from month to month. To truly benefit from the rewards, always aim to pay off your balance in full each billing cycle. By avoiding interest charges, you’ll ensure that your cash back rewards remain intact and don’t get eaten up by fees.

- Monitor Your Monthly Spending: Since the 5% and 2% cash back rates on gas and groceries are capped at $500 per month, it’s important to track your spending. Once you hit that cap, you’ll earn 0.5% cash back on any additional purchases in those categories. By keeping an eye on your spending, you can plan to maximize your rewards without exceeding the cap unnecessarily.

How the MBNA Smart Cash Platinum Plus Mastercard Stacks Up Against Other Cash Back Cards

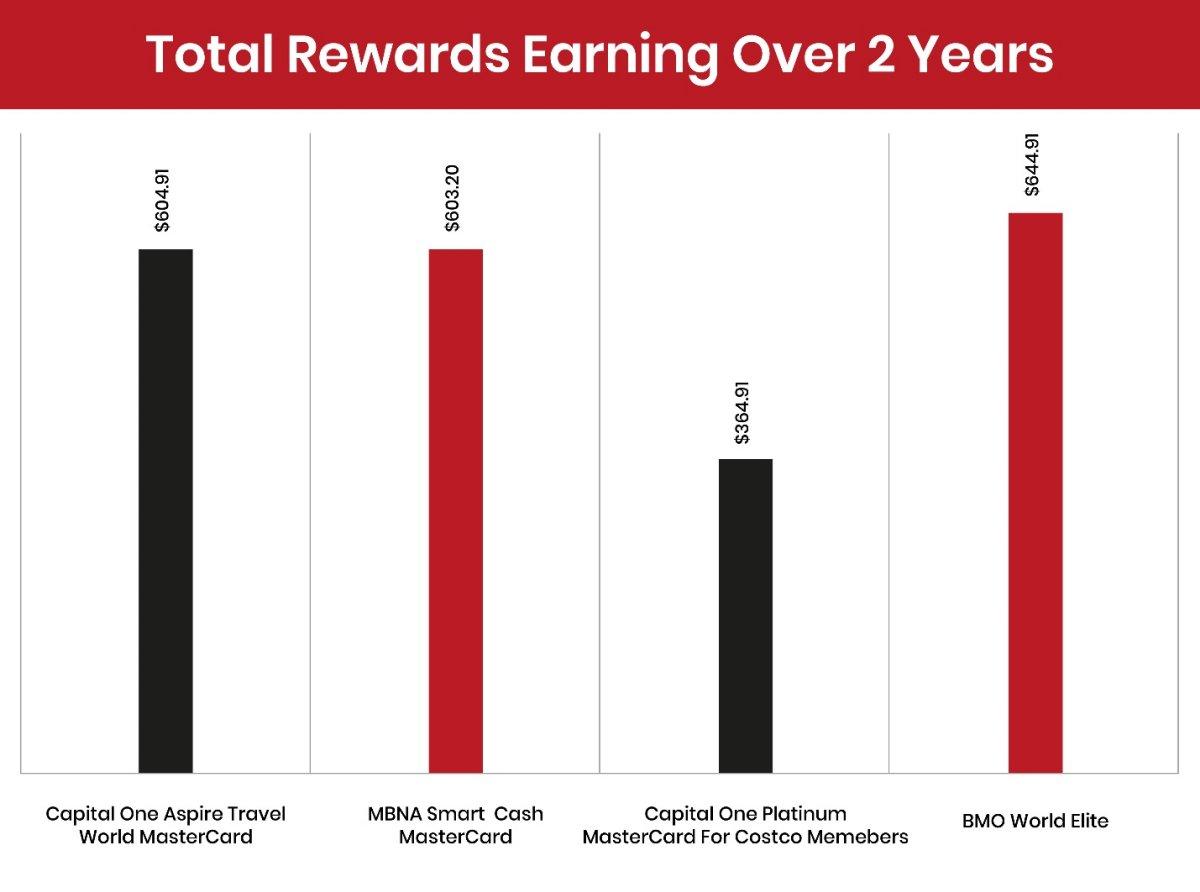

When compared to other popular cash back credit cards in Canada, the MBNA Smart Cash Platinum Plus Mastercard shines in several areas, particularly for those looking for a no-fee option. Here’s how it compares to a few other notable cards:

- Tangerine Money-Back Credit Card:Similar to the MBNA card, the Tangerine Money-Back Credit Card offers 2% cash back in up to three categories of your choice, including groceries and gas, and 0.5% on all other purchases. It also has no annual fee and offers more flexibility in choosing your reward categories. However, the Tangerine Money-Back Credit Card doesn’t offer a 5% introductory rate like the MBNA Smart Cash card.

- CIBC Dividend Visa Infinite: The CIBC Dividend Visa Infinite offers 4% cash back on groceries,2% on gas, transportation, and dining, and 1% on all other purchases. It also comes with a $120 annual fee, but the first year is often waived as a promotion. Compared to the MBNA Smart Cash Platinum Plus Mastercard, this card offers higher ongoing rewards in specific categories. Still, it charges an annual fee, making the MBNA card more attractive for those who want a no-fee option with more straightforward benefits.

- Rogers World Elite Mastercard: The Rogers World Elite Mastercard offers 1.5% cash back on all purchases and 3% cash back on eligible purchases made in U.S. dollars. While this card doesn’t limit rewards to specific categories, making it appealing for general spending, it requires a minimum income (either $80,000 for individuals or $150,000 for households) to qualify. The MBNA Smart Cash Platinum Plus Mastercard is more accessible to a broader range of Canadians, especially those without high incomes.

- Scotia Momentum Visa Infinite: The Scotia Momentum Visa Infinite offers 4% cash back on groceries and recurring bills, 2% on gas and daily transit, and 1% on all other purchases. This card is ideal for those who spend heavily on groceries and bills, but like the CIBC Dividend Visa Infinite, it comes with an annual fee ($120, often waived for the first year). For those who want higher rewards and don’t mind the annual fee, this could be a better option, but for those looking for no annual fee, the MBNA Smart Cash Platinum Plus Mastercard is still a strong contender.

The Impacts of Credit Cards in Canada

Credit cards have become an essential financial tool for Canadians, offering convenience, security, and rewards on everyday purchases. However, their impact goes beyond just cash back or travel points. Here are a few ways credit cards influence spending habits and financial health in Canada:

- Building Credit Using a credit card responsibly can help individuals build and maintain a strong credit score. A high credit score is essential when applying for loans, mortgages, and even renting an apartment. By paying off your credit card balance in full each month, you demonstrate your ability to manage debt, which can lead to better credit opportunities in the future.

- Spending Flexibility Credit cards provide Canadians with spending flexibility, allowing them to make large purchases and pay them off over time. While this can be helpful in emergencies, it’s crucial to avoid carrying a balance and incurring high interest charges. Many Canadians use credit cards for budgeting purposes, taking advantage of rewards programs while carefully tracking their expenses.

- Rewards and Benefits Credit cards like the MBNA Smart Cash Platinum Plus Mastercard offer tangible rewards in the form of cash back, travel points, or other perks. These rewards can help offset everyday costs, making them a popular choice for Canadians who want to make their money go further. However, it’s essential to choose a card that aligns with your spending habits to maximize the benefits.

- Security and Fraud Protection Credit cards come with built-in security features, including fraud protection and zero liability for unauthorized charges. This makes them a safer option compared to carrying cash or using debit cards, which may not offer the same level of protection. For Canadians who travel or shop online frequently, credit cards provide peace of mind that their transactions are secure.

Is the MBNA Smart Cash Platinum Plus Mastercard Right for You?

The MBNA Smart Cash Platinum Plus Mastercard is an excellent option for Canadians looking for a simple, no-fee cash back card. With its generous 5% cash back on gas and groceries in the first six months and 2% after that, it’s perfect for those who spend heavily in these categories. While the 0.5% cash back on all other purchases is relatively modest, it still offers some reward for general spending.

If you’re looking for a card with no annual fee, straightforward rewards, and a focus on everyday purchases like gas and groceries, the MBNA Smart Cash Platinum Plus Mastercard could be a great fit. As always, it’s important to use the card responsibly by paying off your balance in full each month and avoiding unnecessary fees.

Where Should You Apply?

If you plan to apply for a cash back rewards credit card, head to Great Canadian Rebates. Our online platform will allow you to compare the best cashback credit cards and others, which will help you choose the one that fits the bill. You can earn a solid credit card rebate when you sign up for the credit card through our platform.

Visit our website for more information.