For Canadians who love to explore the world, finding the perfect travel credit card is essential to making the most out of every journey. The Scotiabank Passport Visa Infinite stands out as a top contender among Canada’s top-rated cash back credit cards and travel credit cards. With its impressive suite of benefits, no foreign transaction fees, and premium travel rewards, it’s a card designed for the modern traveller.

In this comprehensive guide, we’ll delve into everything that makes the Scotiabank Passport Visa Infinite the ultimate companion for Canadian globetrotters. From its unique perks to its broad Canadian acceptability, you’ll discover why this card deserves a place in your wallet. We’ll also highlight how Scotiabank credit cards differ from other providers and how you can take full advantage of credit card rebates through platforms like Great Canadian Rebates.

Why the Scotiabank Passport Visa Infinite Stands Out

The Scotiabank Passport Visa Infinite card is not your average cash back credit card. It is specifically designed for Canadians who travel frequently, whether for business or leisure, and want to save on fees, earn travel rewards, and access exclusive perks.

Here’s why this card is a must-have for travellers:

No Foreign Transaction Fees

One of the card’s biggest selling points is that it charges no foreign transaction fees on purchases made abroad. This is a rare and invaluable feature among Canadian credit cards, as most cards charge a 2.5% fee on international transactions. Whether you’re paying for a hotel stay in Paris or grabbing coffee in Tokyo, the Scotiabank Passport Visa Infinite ensures you’re not paying extra on currency conversions.

Comprehensive Travel Insurance Coverage

The card offers extensive travel insurance coverage, which is a huge benefit for those who frequently travel. The coverage includes:

- Emergency medical insurance for trips up to 25 days.

- Trip interruption, cancellation, and delay insurance.

- Lost or delayed baggage insurance.

- Travel accident insurance.

This protection gives travellers peace of mind, knowing that unexpected events won’t leave them out of pocket.

Priority Pass Airport Lounge Access

Cardholders receive a Priority Pass membership, which includes six complimentary airport lounge visits per year. These lounges offer a quiet and luxurious space to relax before flights, complete with food, drinks, and other amenities. For frequent flyers, this perk alone can significantly enhance your travel experience.

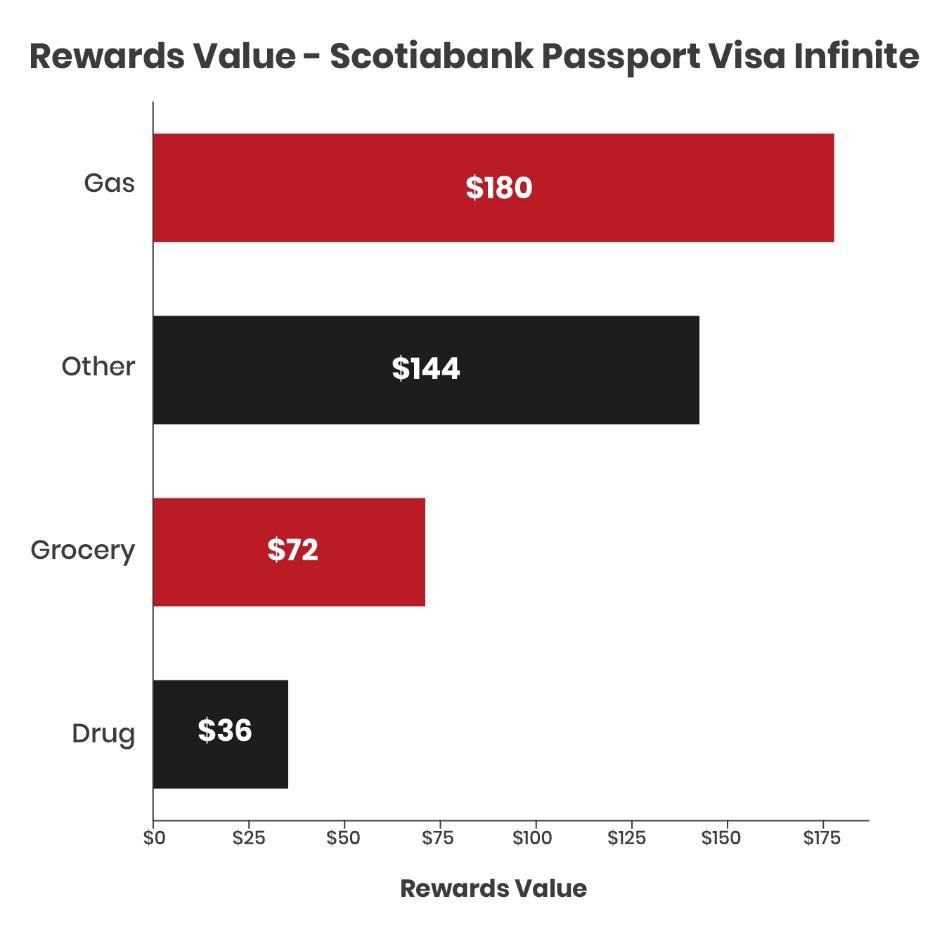

Strong Earning Potential on Travel Purchases

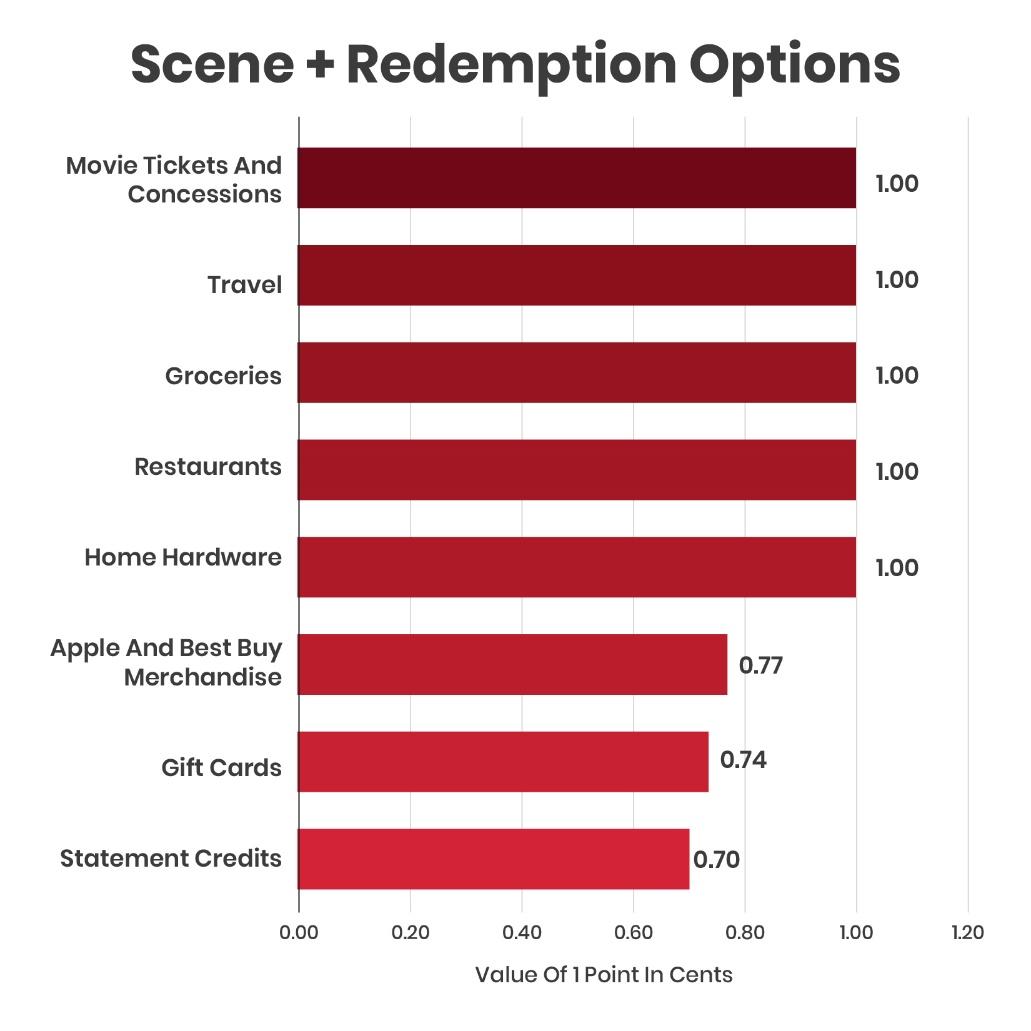

With this card, you’ll earn 2 Scene+ points for every $1 spent on eligible grocery stores, dining, entertainment, and transit, which includes public transport and rideshare services. Additionally, cardholders earn 1 Scene+ point for every $1 spent on all other purchases. Scene+ points can be redeemed for travel, giving you the flexibility to book flights, hotels, car rentals, and vacation packages.

The value of Scene+ points is often maximized when redeemed for travel, offering excellent rewards for those who enjoy planning getaways. Whether you’re flying across Canada or booking international trips, this card helps you accumulate points faster.

Welcome Bonus

The Scotiabank Passport Visa Infinite also comes with a generous welcome bonus for new applicants. Currently, cardholders can earn up to 40,000 Scene+ points in their first year, provided they meet certain spending criteria. These points can be redeemed for up to $400 in travel, giving your travel plans a significant boost right from the start.

How Scotiabank Credit Cards Differ from Other Providers

Scotiabank sets itself apart from other Canadian credit card providers with its unique approach to customer service, rewards, and travel perks. Here’s why Scotiabank credit cards shine in comparison to competitors:

No Foreign Transaction Fees

As mentioned earlier, one of the biggest differentiators is Scotiabank’s no foreign transaction fee feature, which is extremely rare among Canadian credit cards. Many of its competitors continue to charge these fees, putting Scotiabank at the forefront for Canadian travellers.

Scene+ Rewards Program

The Scene+ program is an exclusive offering from Scotiabank, merging two popular loyalty programs—Scene and Scotia Rewards—into one comprehensive rewards system. Scene+ points are flexible and can be redeemed for travel, gift cards, entertainment, and merchandise. The program is especially appealing to those who want versatility in how they use their points, making it a standout option compared to other rewards programs.

Premium Concierge Services

With the Scotiabank Passport Visa Infinite, cardholders can enjoy 24/7 access to Visa Infinite’s concierge services. Whether you need help booking a table at a popular restaurant or securing tickets for a sold-out event, the concierge service provides personal assistance whenever you need it.

Canadian Acceptability and Global Reach

As one of Canada’s leading banks, Scotiabank credit cards are widely accepted throughout the country. However, their global reach, backed by Visa, ensures that you can use the card in millions of locations worldwide. Whether you’re shopping at a local store in Vancouver or dining at a café in Europe, you can trust that your Scotiabank Passport Visa Infinite will be accepted.

Scotiabank Passport Visa Infinite vs. Other Travel Credit Cards

While there are many travel credit cards available in Canada, the Scotiabank Passport Visa Infinite stands out for its comprehensive benefits and travel-friendly features. Let’s compare it to other popular cards:

TD First Class Travel Visa Infinite

While the TD First Class Travel card offers competitive travel rewards and points redemption through Expedia for TD, it does charge foreign transaction fees, which can add up for frequent international travellers. Scotiabank’s no-foreign-fee policy offers more savings for those making frequent foreign purchases.

RBC Avion Visa Infinite

The RBC Avion Visa Infinite is another popular choice for travellers, offering strong reward points and travel insurance. However, like TD’s card, it also charges foreign transaction fees, making the Scotiabank Passport Visa Infinite the better option for Canadians who frequently shop abroad.

American Express Gold Rewards Card

The Amex Gold Rewards card offers excellent earning potential on travel and grocery purchases, along with a flexible points system. However, Amex’s limited acceptance in Canada and abroad means it’s not as universally applicable as the Scotiabank Passport Visa Infinite, which is a Visa card accepted at a wider range of merchants globally.

How to Maximize Credit Card Rebates with the Scotiabank Passport Visa Infinite

If you’re looking to get the most out of your Scotiabank Passport Visa Infinite, it’s worth exploring credit card rebates and cash back opportunities through platforms like Great Canadian Rebates.

Great Canadian Rebates allows you to earn cash back on your purchases from a wide range of retailers and services. By using their platform in conjunction with your Scotiabank card, you can increase your savings on everything from travel to everyday purchases. Here’s how to maximize your rewards:

1. Sign Up for a Great Canadian Rebates Account

To start earning credit card rebates, you’ll need to sign up for a free account on the Great Canadian Rebates website. Once you’ve registered, you can browse thousands of retailers that offer cash back.

2. Link Your Scotiabank Passport Visa Infinite

Use your Scotiabank Passport Visa Infinite to make purchases through the Great Canadian Rebates platform. Each time you make a qualifying purchase, you’ll receive a percentage of your money back as a rebate.

3. Combine Your Scene+ Points with Rebates

Since you’re earning Scene+ points on every purchase made with your Scotiabank Passport Visa Infinite, you’re essentially double-dipping on rewards. This combination of points and rebates allows you to save even more.

Travel Credit Cards and the Importance of No Foreign Transaction Fees

When it comes to travel credit cards, one of the most important features to look for is the absence of foreign transaction fees. While many credit cards charge a 2.5% fee on foreign transactions, the Scotiabank Passport Visa Infinite eliminates this fee, making it a top choice for Canadians who frequently travel abroad.

Without this fee, you can save a significant amount of money on purchases made in other currencies. Whether you’re shopping in Europe, paying for a meal in Asia, or booking a hotel in the U.S., you can use your card without worrying about costly exchange rate fees. This is particularly useful for those who travel often or make regular international purchases.

Other Travel Perks of the Scotiabank Passport Visa Infinite

In addition to no foreign transaction fees, the Scotiabank Passport Visa Infinite offers several other perks that make it an ideal choice for travellers. These include:

Visa Infinite Luxury Hotel Collection

When you book through the Visa Infinite Luxury Hotel Collection, you’ll gain access to exclusive perks at participating properties. These benefits include room upgrades, free breakfast for two, early check-in and late check-out, and complimentary Wi-Fi.

Car Rental Discounts

The card offers savings on car rentals from Avis and Budget, which is a great perk for those who frequently rent vehicles while travelling.

Travel Assistance Services

Whether you need medical assistance while travelling or help with lost luggage, Scotiabank Passport Visa Infinite provides 24/7 travel assistance services, ensuring you’re never alone.

Why Credit Cards?

Credit cards offer a range of benefits to Canadians, making them a valuable financial tool when used responsibly. From convenience to rewards programs, credit cards have transformed how Canadians manage their daily spending, travel, and larger purchases.

One of the primary advantages of credit cards is their convenience. Canadians can use credit cards almost everywhere, from online shopping to everyday purchases like groceries, fuel, and dining out. They provide a secure and easy way to make payments without needing to carry large amounts of cash. In addition, credit cards often come with fraud protection, which safeguards cardholders from unauthorized transactions and ensures peace of mind while shopping.

Another significant benefit for Canadians is the ability to build a credit history. Responsible use of a credit card, such as paying off the balance on time and keeping credit utilization low, helps establish a solid credit score. A good credit score is crucial for obtaining loans, mortgages, and even better interest rates on future credit products, enabling Canadians to access financial opportunities more quickly.

Credit cards also offer rewards programs that allow cardholders to earn points, miles, or cash back on their purchases. Many Canadians benefit from top-rated cash back credit cards that provide a percentage of their spending back in cash, helping to save money on everyday purchases. Others prefer travel credit cards that accumulate points or miles toward flights, hotels, and other travel-related expenses. By leveraging these rewards, Canadians can maximize the value of their spending and reduce costs, whether they’re at home or abroad.

In addition, many credit cards provide purchase protection and extended warranties, which can be particularly helpful for larger purchases like electronics or appliances. These features ensure that consumers are covered if their item is damaged or defective, offering additional value beyond the initial purchase.

Finally, credit cards can also be a tool for budgeting and managing expenses. By tracking purchases through monthly statements, Canadians can monitor their spending habits and set financial goals. The added flexibility of credit cards, such as the ability to pay off purchases over time, can help Canadians manage unexpected expenses. However, it’s crucial to avoid carrying high-interest debt.

Overall, credit cards are a powerful financial tool for Canadians. With proper management, they offer convenience, rewards, protection, and an effective way to build credit while maximizing the value of everyday and travel-related spending.

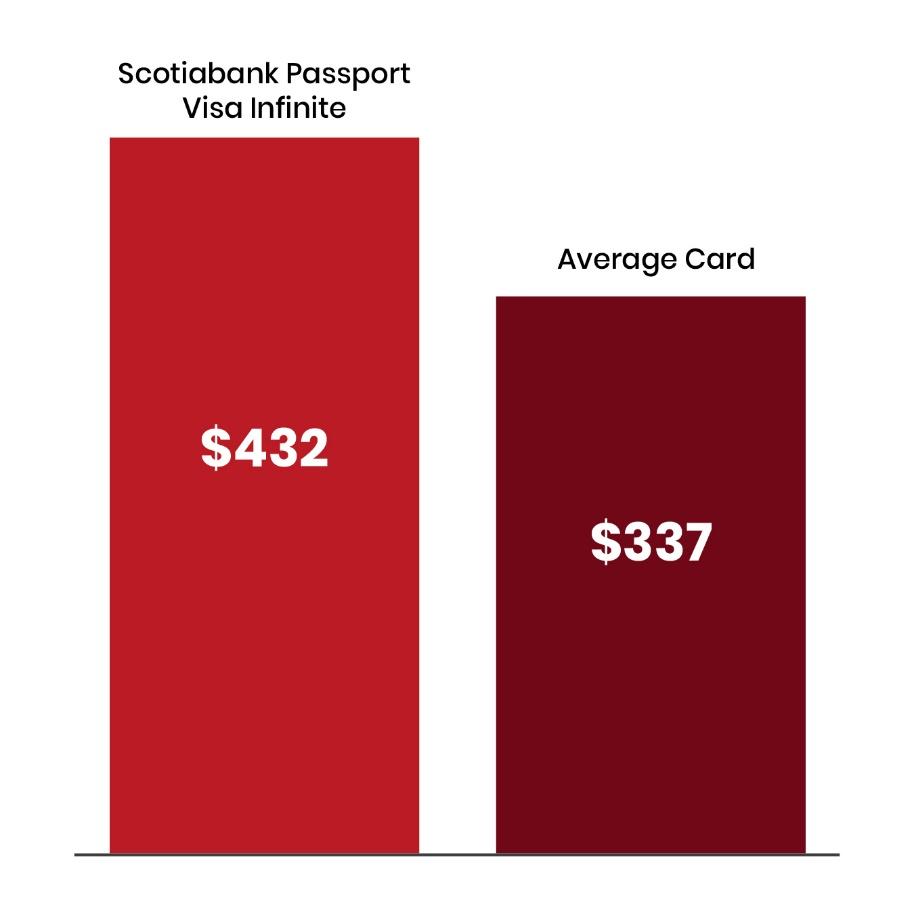

Conclusion: Why the Scotiabank Passport Visa Infinite is the Best Choice for Canadian Travelers

For Canadians who want a travel credit card that offers exceptional value, the Scotiabank Passport Visa Infinite is hard to beat. With no foreign transaction fees, comprehensive travel insurance, Priority Pass lounge access, and a generous rewards program, this card is designed to help you make the most of your travels while saving money and earning valuable points.

Additionally, with credit card rebates from platforms like Great Canadian Rebates, you can further enhance your savings on everyday purchases and travel bookings. If you’re looking for a card that delivers on all fronts—rewards, protection, and convenience—the Scotiabank Passport Visa Infinite is truly a traveller’s best friend.

If you plan to apply for a cash back rewards credit card, head to Great Canadian Rebates. Their online platform will allow you to compare the best cash back credit cards and others, which will help you choose the one that fits the bill. You can earn a solid credit card rebate when you sign up for the credit card through our platform.

Visit their website for more information.