Loyalty programs can be a powerful tool for saving money, earning rewards, and elevating travel experiences, but not all hotel loyalty programs are created equal. Before committing to a particular program, it’s essential to ask critical hotel loyalty program questions to ensure that you’re getting the best value for your travel needs.

Whether you’re a frequent traveller or someone who enjoys the occasional getaway, understanding the ins and outs of loyalty programs can help you maximize your benefits. In this guide, we’ll explore key questions to consider before joining a hotel loyalty program and highlight travel credit cards in Canada, such as the Marriott Bonvoy® American Express®* Card, TD Platinum Travel Visa Card, TD First Class Travel Visa Infinite Card, and the American Express® Aeroplan®* Card.

How Flexible Is the Program?

When it comes to hotel loyalty programs, flexibility is crucial. You want to ensure that the program allows you to use your points or rewards in various locations and under different conditions. Some programs restrict the use of points to specific hotels or brands within their network, while others offer more freedom, allowing you to use points across a wide range of properties globally.

For instance, Marriott Bonvoy is known for its extensive reach, with over 7,000 properties worldwide. This flexibility makes it a great option for travellers who frequent different destinations and don’t want to be tied down to a single hotel brand. On the other hand, some smaller loyalty programs may offer excellent rewards but limit you to a handful of hotels or regions.

Key Question: Can I use my points or rewards at various hotels and in different locations, or am I restricted to a specific brand or region?

What Is the Earning Potential?

One of the most essential questions about the hotel loyalty program is how quickly and easily you can earn points. Some programs offer a higher rate of earning points per dollar spent, while others may require more spending to accumulate significant rewards. Additionally, it’s worth considering whether the program offers points for other travel-related expenses, such as dining, car rentals, or activities.

Programs like Marriott Bonvoy® American Express® Card* and TD First Class Travel Visa Infinite Card allow cardholders to earn extra points on everyday purchases, making it easier to accumulate rewards for your next trip. If you frequently use travel credit cards, choosing one that complements your hotel loyalty program can significantly increase your points earnings.

Key Question: How quickly can I earn points through regular hotel stays and other travel-related expenses?

How Valuable Are the Rewards?

It’s not just about how quickly you can earn points; it’s also about what those points are worth. Different loyalty programs offer varying redemption values, meaning that 10,000 points in one program might be worth a free night at a luxurious hotel. In contrast, the same number of points in another program might only get you a basic room. Before joining a loyalty program, research the average redemption value of points and how that compares to the cost of stays.

For example, some programs may offer better value when redeeming points for off-peak travel dates or promotions. Others, like American Express® Aeroplan® Card*, offer a broader range of redemption options, including flights and travel experiences, which can be especially useful if you’re looking for more than just hotel stays.

Key Question: What is the redemption value of points, and how far will my points go toward future hotel stays?

Are There Any Blackout Dates or Restrictions?

Blackout dates and restrictions can be a significant hindrance when trying to redeem your points. Some hotel loyalty programs limit the availability of points redemption during peak travel times, such as holidays or popular vacation seasons. If you’re someone who likes to travel during these times, it’s essential to find a program that offers more flexible redemption options without too many blackout dates.

Marriott Bonvoy, for example, has limited blackout dates, providing more opportunities for travellers to redeem points year-round. Be sure to ask about any restrictions or limitations on when and where you can use your points before committing to a program.

Key Question: Are there any blackout dates or restrictions on redeeming points, particularly during peak travel seasons?

Are There Status Tiers or Elite Benefits?

Many hotel loyalty programs offer elite status tiers that unlock additional benefits as you progress. These benefits can include complimentary room upgrades, early check-in, late check-out, and access to exclusive lounges. If you’re a frequent traveller, the opportunity to reach elite status can significantly enhance your travel experience.

Programs like Marriott Bonvoy® American Express® Card* and TD Platinum Travel Visa Card offer elite status perks, which can make your stays more comfortable and enjoyable. Some credit cards even fast-track your journey to elite status, allowing you to enjoy benefits sooner.

Key Question: Does the loyalty program offer elite status tiers, and what benefits can I unlock at each level?

How Does the Program Handle Expiring Points?

It’s important to know whether your points will expire if they’re not used within a certain time frame. Some hotel loyalty programs have strict expiration policies, which can result in losing points if you don’t use them within a specific period. On the other hand, some programs extend the life of your points as long as you make regular transactions or stay at the hotel periodically.

Before joining a loyalty program, it’s essential to understand the expiration policy to avoid losing valuable rewards. Programs like Marriott Bonvoy offer a generous points expiration policy, with points expiring after 24 months of inactivity, giving you ample time to redeem them.

Key Question: Do the points expire, and how can I keep them active to avoid losing them?

How Can I Combine Points With Other Rewards?

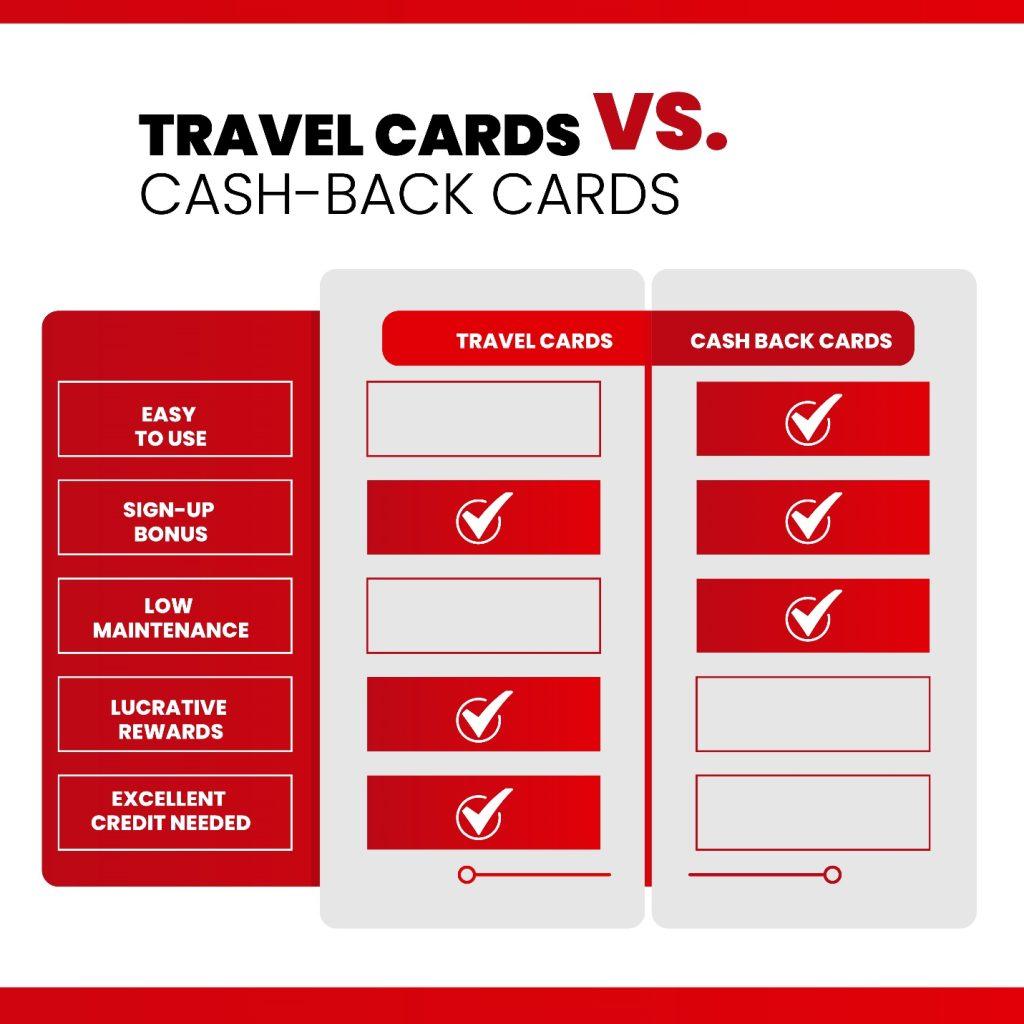

Many savvy travellers use a combination of top-rated cash back credit cards and hotel loyalty programs to maximize their benefits. For instance, some credit cards allow you to transfer points or combine them with airline miles or other rewards programs. This flexibility can be a significant advantage, especially if you want to pool rewards for a big trip.

Credit cards like the TD First Class Travel Visa Infinite Card allow you to earn points that can be used for a variety of travel expenses, not just hotels. If you’re looking for versatility, make sure your hotel loyalty program allows for combining or transferring points with other reward systems.

Key Question: Can I combine my hotel loyalty points with airline miles or other rewards to maximize my travel benefits?

Are There Credit Card Partnerships That Complement the Program?

Many travel credit cards offer special partnerships with hotel loyalty programs, allowing you to earn points faster or enjoy additional perks during your stays. For instance, the Marriott Bonvoy® American Express® Card* is an excellent option for travellers who stay at Marriott hotels, as it offers bonus points for every dollar spent at their properties.

By using a credit card that complements your loyalty program, you can accelerate your points accumulation and take advantage of additional travel perks, such as free nights, upgrades, and even travel insurance.

Key Question: Are there credit card partnerships that allow me to earn points faster and enjoy extra benefits at partner hotels?

What Are the Redemption Options Beyond Hotel Stays?

While hotel loyalty programs often emphasize free nights, many offer diverse redemption options beyond just accommodations. These can include flights, car rentals, travel experiences, and even merchandise or gift cards. For those who value flexibility, a loyalty program that allows you to redeem points in multiple ways can be particularly appealing. For example, you can use points to upgrade flights, book car rentals, or even access exclusive experiences like guided tours or VIP event tickets.

Several credit cards, like the TD First Class Travel Visa Infinite Card and American Express® Aeroplan® Card, offer this type of flexibility, enabling cardholders to redeem points for a wide array of travel-related expenses. In addition to flights and hotel stays, cardholders can use points toward cruises, rental cars, and vacation packages. This variety of redemption options makes it easier to tailor rewards to your personal travel style and needs.

By choosing a program that goes beyond just hotel stays, you can maximize the value of your points, ensuring you get the most out of your loyalty membership or credit card rewards. Flexibility in redemption is critical to enhancing your travel experience.

Key Question: What other redemption options are available beyond hotel stays, such as flights or travel experiences?

Is There a Fee to Join the Program?

Most hotel loyalty programs are free to join, making it easy for travellers to start earning points and benefits without any upfront costs. However, some programs may have additional membership fees or require you to hold a specific credit card to unlock premium perks and access the best rewards. It’s important to review each program’s terms to understand if there are any fees associated with joining or maintaining your membership.

For example, programs like Marriott Bonvoy® offer enhanced benefits to members who hold the Marriott Bonvoy® American Express® Card*. Although this credit card comes with an annual fee, the exclusive perks, such as bonus points, free night stays, and elite status upgrades, can far outweigh the cost. For frequent travellers, these benefits can significantly enhance the loyalty program’s overall value.

Before committing, ask yourself: Are there any fees to join the loyalty program, or is holding a specific credit card required to access the best rewards? Carefully weigh the advantages against any associated costs to ensure the program aligns with your travel habits and provides a worthwhile return on investment.

Key Question: Are there any fees to join the loyalty program, or do I need a specific credit card to access the best rewards?

Best Travel Credit Cards in Canada for Hotel Loyalty Programs

When considering joining a hotel loyalty program, it’s also essential to evaluate travel credit cards that can enhance your membership. Below are some top-rated options in Canada:

- Marriott Bonvoy® American Express® Card*

This card offers accelerated points earning at Marriott properties and access to elite status benefits. It’s ideal for frequent Marriott guests who want to maximize their rewards. - TD Platinum Travel Visa Card

With generous points earned on travel-related expenses, this card is a solid choice for travellers looking to accumulate points for a variety of travel needs, including hotel stays. - TD First Class Travel Visa Infinite Card

Offering versatile redemption options, this card is perfect for travellers who want to use their points for more than just hotels, including flights and car rentals. - American Express® Aeroplan® Card*

For those who travel frequently with Air Canada, this card provides great flexibility by allowing points to be used for both flights and hotel stays. It’s a strong option for travellers who value versatility.

Conclusion

By asking the right hotel loyalty program questions, you can ensure that you’re choosing a program that aligns with your travel needs and preferences. Whether you’re focused on earning points quickly, enjoying elite status perks, or maximizing flexibility, the right program and credit card partnership can make all the difference in your travel experiences.

Be sure to evaluate the earning potential, redemption options, and any restrictions before committing, and pair your program with a travel credit card to maximize your loyalty rewards.

Where to Apply?

If you plan to apply for a cash back rewards credit card, head to Great Canadian Rebates. Their online platform will allow you to compare the best cashback credit cards and others, which will help you choose the one that fits the bill. You can earn a solid credit card rebate when you sign up for the credit card through our platform.

Visit their website for more information.