Travel credit cards offer a great opportunity to earn rewards on everyday purchases that can be redeemed for flights, hotel stays, and other travel-related expenses. However, selecting the right travel credit card can be challenging, especially for first-time users. This guide will help new users navigate through the numerous options in Canada by focusing on key factors that should align with their travel habits and financial situation.

1. Determine Your Travel Preferences

Before diving into specific features, it’s essential to evaluate your travel habits. Are you loyal to a specific airline or hotel chain? Do you frequently travel internationally, or are your trips primarily within Canada? Understanding your needs helps narrow down the type of rewards program that best suits your travel style.

Airline Rewards Cards

If you are a frequent flyer with a particular airline, such as Air Canada, look into co-branded cards like the TD Aeroplan Visa Infinite. These cards offer valuable perks like priority boarding, free checked bags, and higher points on airline-related purchases.

General Travel Cards

If you’re not loyal to a particular airline or hotel, consider general travel cards like the Scotiabank Passport Visa Infinite, which allows you to redeem points on any travel expense. This card is particularly attractive because it doesn’t charge foreign transaction fees, making it ideal for international travellers.

2. Consider the Sign-Up Bonus

One of the most lucrative aspects of travel credit cards is the sign-up bonus, which can offer significant rewards for new users. These bonuses can range from a few hundred to over a thousand dollars in travel credits, depending on the card.

For instance, the American Express Cobalt Card offers up to 15,000 points in the first year, depending on your spending habits, which could be worth up to $660 towards travel. The Scotiabank Passport Visa Infinite offers 30,000 Scene+ points as a welcome bonus, which equates to around $300 in travel.Keep in mind that these bonuses often require you to spend a certain amount within the first few months, so choose a card whose spending requirements align with your budget.

3. Evaluate the Annual Fees

Most travel credit cards come with an annual fee, which can vary widely from around $100 to $600 or more. However, the perks offered often offset the cost of the fee.

For budget-conscious travellers, no-fee options like the American Express Green Card are worth considering. Although it may lack some of the premium benefits, it still offers valuable rewards.

For those willing to pay a higher fee for premium perks, the American Express Platinum Card offers extensive travel benefits such as access to airport lounges, hotel upgrades, and concierge service, though it comes with an annual fee of $699.

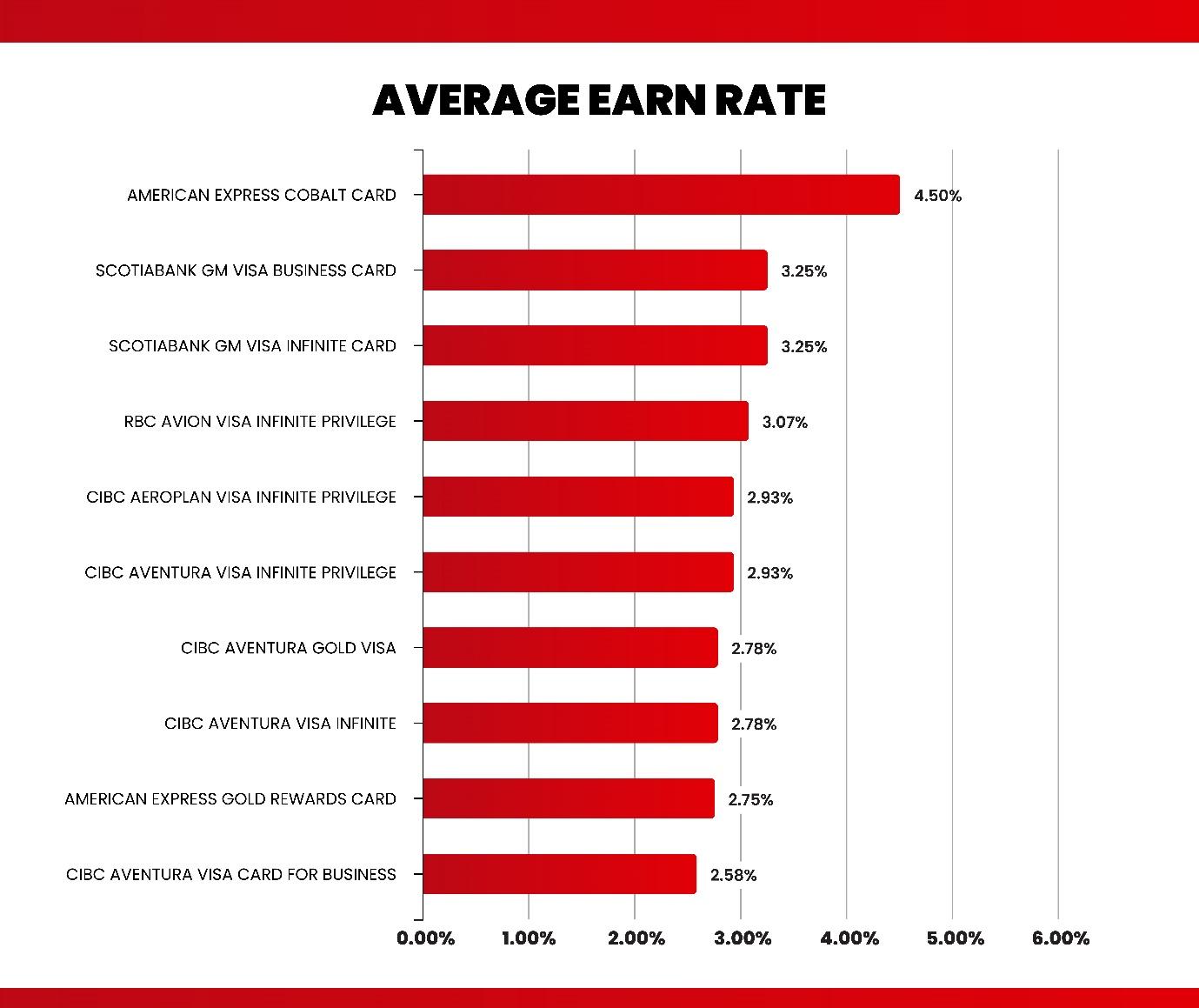

4. Analyze the Earn Rates and Reward Flexibility

The earn rate—how many points or miles you accumulate per dollar spent—can vary significantly between cards and categories. Some cards offer accelerated earn rates in categories like dining, groceries, and travel.

For example, the American Express Cobalt Card offers 5 points per dollar spent on dining and groceries, making it an excellent choice for foodies. On the other hand, if you spend more on travel expenses, the TD Aeroplan Visa Infinite or RBC Avion Visa Infinite may be more beneficial due to their higher earn rates on travel-related purchases.

It’s also crucial to check the flexibility of rewards. Cards like the Scotiabank Passport Visa Infinite allow you to redeem points for various travel-related expenses, from flights to hotel stays, while others, like the Marriott Bonvoy American Express, focus more on hotel stays.

5. Look for Travel Insurance and Other Perks

Many travel credit cards offer valuable perks beyond points, such as travel insurance, airport lounge access, and no foreign transaction fees. These perks can save you significant money and add convenience to your trips.

Travel Insurance

Cards like the Scotiabank Gold American Express provide comprehensive travel insurance, including emergency medical coverage, trip cancellation, and flight delay insurance, which is particularly beneficial for frequent travellers.

No Foreign Transaction Fees

If you frequently travel abroad, consider a card that doesn’t charge foreign transaction fees, such as the Scotiabank Passport Visa Infinite, saving you 2.5% on every foreign purchase.

6. Assess the Minimum Income Requirement and Credit Score

Most premium travel credit cards in Canada come with a minimum income requirement, which can range from $60,000 to $100,000 for household income. Additionally, these cards typically require a good to excellent credit score (around 700 or higher).

For instance, the TD Aeroplan Visa Infinite has a personal income requirement of $60,000, while the RBC Avion Visa Infinite has similar requirements. Make sure to check the eligibility criteria before applying to avoid any unnecessary hits to your credit score.

7. Choose a Card That Aligns With Your Budget

Ultimately, the best travel credit card is one that aligns with your travel habits, spending patterns, and financial goals. First-time users should weigh the benefits against the costs, ensuring the card offers value for their specific needs.

If you’re new to travel rewards, start with a low-fee or no-fee card like the Tangerine World Mastercard, which offers flexible redemption options and cash-back rewards on various spending categories. As you gain experience, you can graduate to more premium cards that offer greater rewards and travel perks.

Earn Cash Back with Great Canadian Rebates

Earn Cash Back Rebates and save on hundreds of merchants when you join Great Canadian Rebates. Whether you’re using the American Express Cobalt, Scotiabank Passport Visa Infinite, or the TD Cash Back Visa, start shopping and saving today with exclusive online coupons!