For international students and travellers, having the right credit card can be a game-changer. It can help minimize foreign transaction fees, maximize rewards on international purchases, and offer travel-specific perks such as insurance and lounge access. In this guide, we’ll explore the key features to look for in a Canadian credit card, helping you make an informed decision for your study-abroad experience.

1. Understand Foreign Transaction Fees

When you’re studying abroad, your everyday transactions will often be in a foreign currency. Most Canadian credit cards charge a 2.5% foreign transaction fee on purchases made in non-Canadian dollars. This fee adds up quickly and can significantly inflate your expenses. To avoid this, it’s essential to look for cards that waive foreign transaction fees.

For instance, Scotiabank Passport Visa Infinite and Scotiabank Gold American Express are two popular travel cards in Canada that waive this 2.5% fee, making them ideal for students who spend a lot abroad. Both cards also offer extensive travel insurance packages and rewards tailored to international travellers.

2. Maximize Rewards on Travel-Related Spending

Credit cards with high reward rates on travel expenses are particularly valuable for students studying abroad. You’ll want to focus on cards that offer strong returns on categories such as dining, transportation, and accommodations.

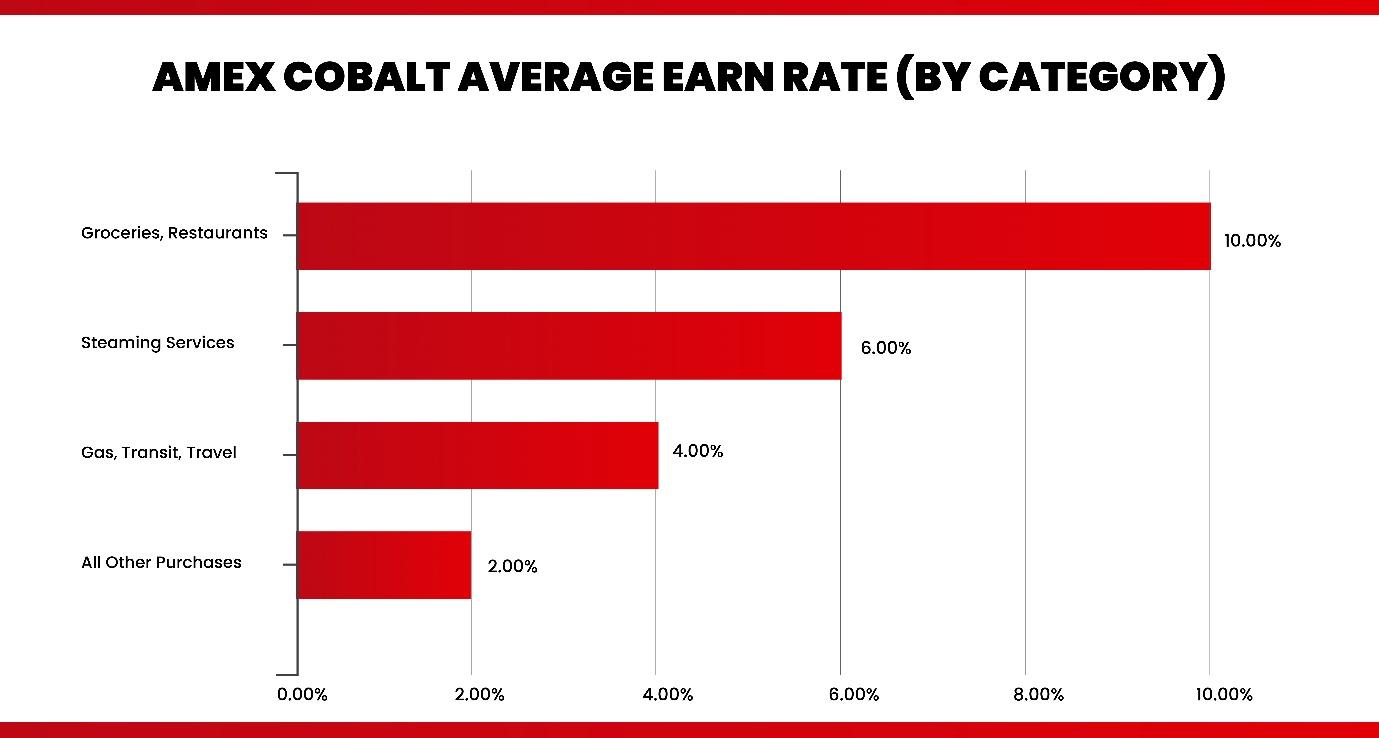

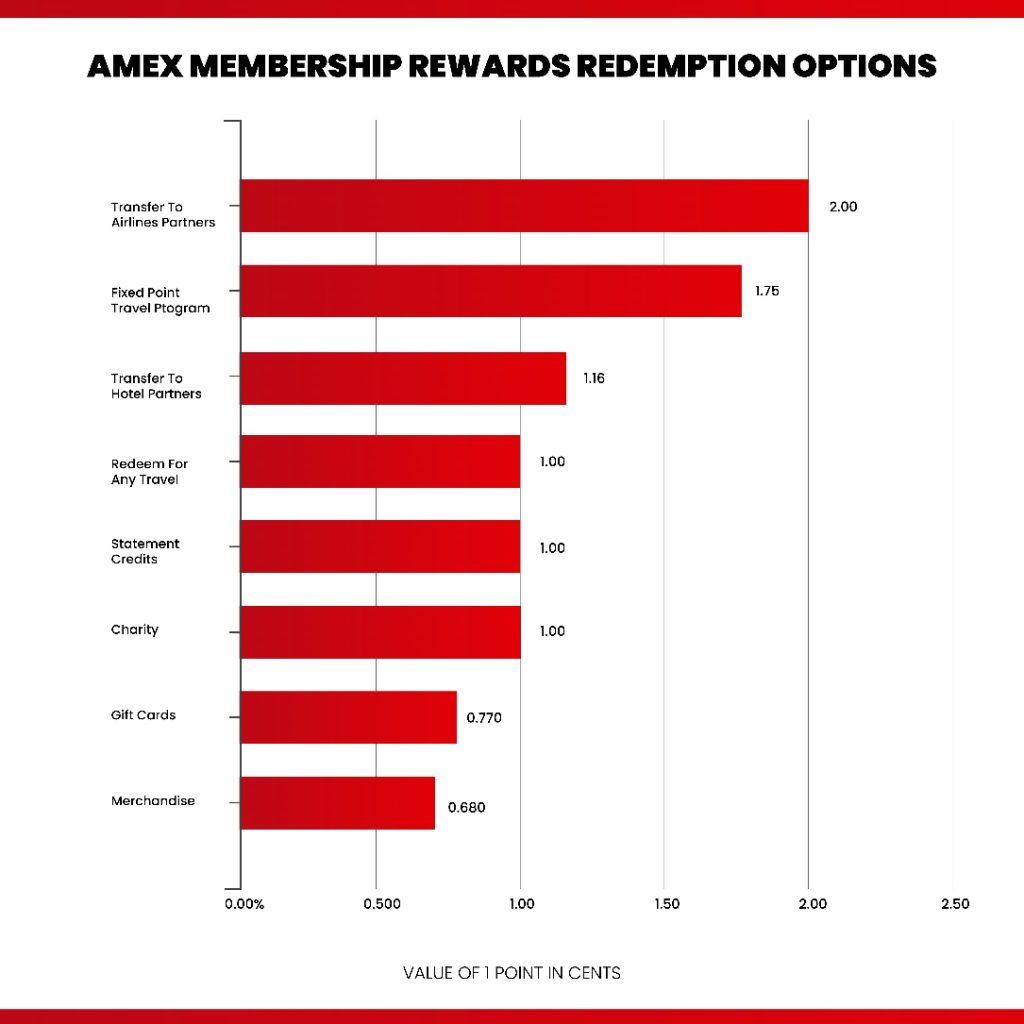

The American Express Cobalt card is widely recognized for its top-tier rewards system. It offers 5X points on eligible eats and drinks, including groceries and dining. Additionally, the card offers 2X points on eligible transit and gas purchases, making it perfect for international travel. This card is especially beneficial if you frequently dine out or use public transportation abroad.

The BMO Ascend World Elite Mastercard also stands out, offering up to 5X points on travel-related purchases and 3X points on dining, entertainment, and recurring bills. Such reward structures allow you to accumulate points faster, which you can redeem for flights, accommodations, or even statement credits.

3. Look for Comprehensive Travel Insurance

Travel insurance is a must when studying abroad. Many premium travel credit cards come with built-in travel insurance that covers medical emergencies, trip cancellations, lost baggage, and more.

The TD First Class Travel Visa Infinite is renowned for its comprehensive travel insurance. It covers medical emergencies up to $2 million, flight delays, trip cancellations, and lost baggage. Additionally, it offers 8X points on travel booked through Expedia for TD, making it a fantastic card for frequent travellers. Another strong contender is the Scotiabank Gold American Express, which includes similar comprehensive travel insurance benefits.

Having this coverage can save you the hassle and expense of purchasing standalone insurance, ensuring peace of mind while abroad.

4. Consider Lounge Access and Travel Perks

Long layovers are common for international students flying between home and school. If you frequently travel, a card that offers airport lounge access can enhance your experience, providing a comfortable place to relax during your layovers.

The Scotiabank Passport Visa Infinite offers six complimentary airport lounge visits annually through the Priority Pass program, which grants access to over 1,200 lounges worldwide. Similarly, the BMO Ascend World Elite Mastercard comes with four annual lounge passes through DragonPass, ensuring comfort during your travels.

In addition to lounge access, many travel credit cards offer perks like concierge services, hotel discounts, and exclusive experiences. The American Express Platinum Card, for instance, is a premium card offering luxury travel perks such as access to the Amex Fine Hotels & Resorts program, which includes complimentary benefits like room upgrades and daily breakfast.

5. Evaluate Annual Fees

While premium travel cards offer excellent rewards and perks, they often come with hefty annual fees. However, for students who frequently travel abroad, the rewards and benefits typically outweigh the cost.

For instance, the Scotiabank Passport Visa Infinite charges an annual fee of $150, but the first year is waived, and its foreign transaction fee waiver and lounge access can easily make up for the fee. The American Express Cobalt has a more affordable annual fee of $155.88 and offers top-tier rewards, making it a great value for students who spend a lot on dining and transit.

If you’re on a tight budget, the Tangerine World Mastercard is a no-fee card that offers unlimited cash-back rewards and 0.5%-10% cash back on eligible purchases, though it lacks travel-specific perks like insurance or foreign fee waivers.

6. Check for Eligibility and Credit Score Requirements

Before applying for a credit card, it’s essential to check the eligibility requirements, such as the minimum credit score and income. Many premium travel cards require a credit score of 660 or higher, along with a minimum income of $60,000 for individuals or $100,000 for households. For students who may not meet these requirements, cards like the Tangerine World Mastercard or Simplii Cash Back Visa are more accessible, with lower income and credit score thresholds.

Choosing the right credit card as an international student or traveller in Canada involves weighing the benefits of rewards, foreign transaction fee waivers, travel insurance, and other perks. For students who prioritize travel and dining, the American Express Cobalt is a solid option due to its high rewards rate in those categories. Meanwhile, the Scotiabank Passport Visa Infinite is ideal for those who want to avoid foreign transaction fees and enjoy lounge access. Carefully consider your spending habits and travel needs to pick a card that aligns with your lifestyle and maximizes value during your study-abroad journey.

Earn Cash Back Rebates Now!

Become a member of Great Canadian Rebates and unlock cash back rewards on your purchases. Whether you’re using an American Express Cobalt or a Scotiabank Passport Visa Infinite, enjoy additional savings.

Don’t forget to check out online coupons for even more discounts!