Managing your credit card payments effectively can significantly impact your financial health. Knowing the optimal time to pay your credit card bill helps you avoid interest charges, improve your credit score, and make the most of grace periods and rewards. This guide explores strategies for payment timing, focusing on popular cards like the American Express Cobalt.

Understanding Credit Card Payment Cycles

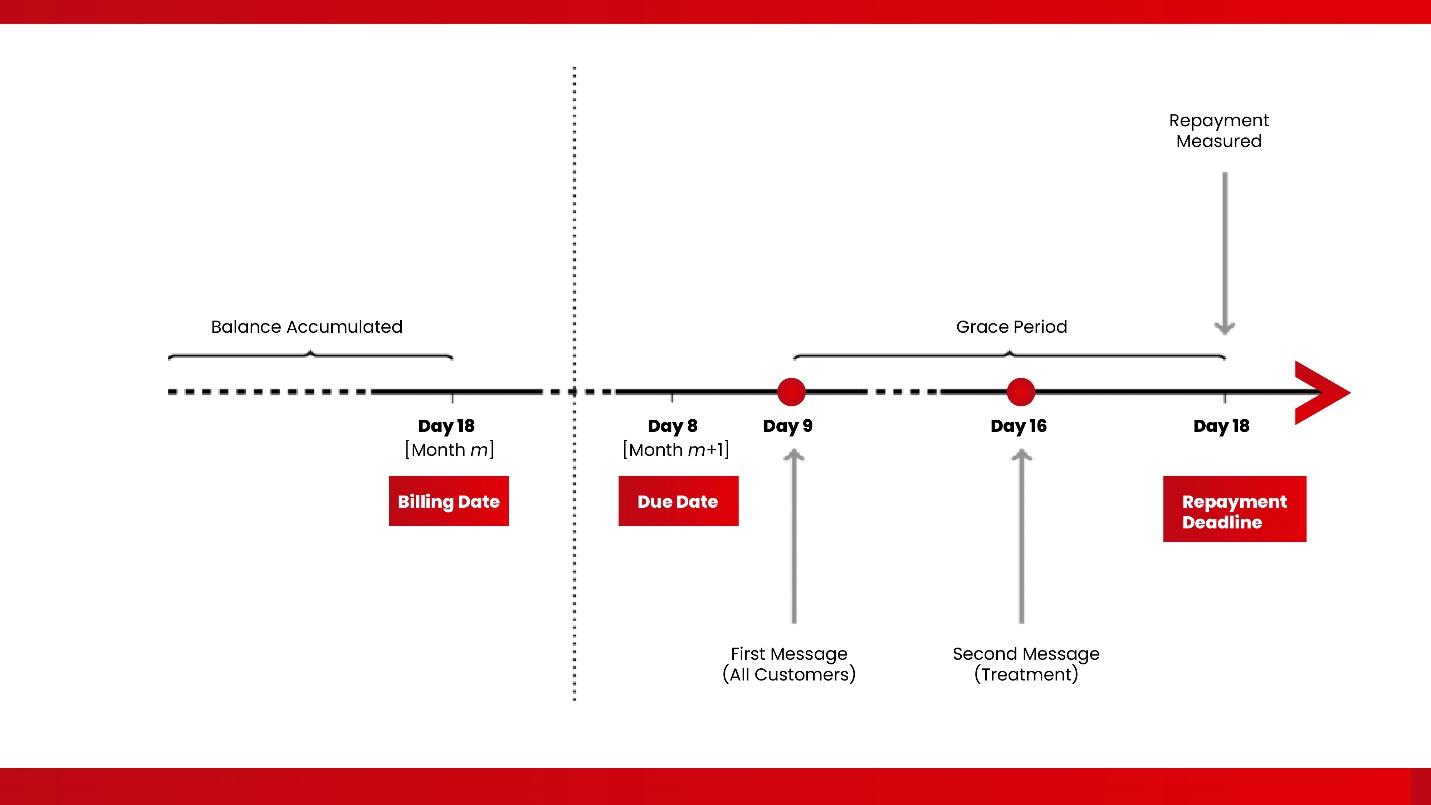

Credit card billing cycles typically last about a month. At the end of each cycle, you receive a statement detailing your transactions, minimum payment due, and the payment due date. To maximize the benefits of your credit card, it’s crucial to understand key dates:

- Statement Closing Date: The end of your billing cycle, when your credit card issuer calculates your balance and generates your statement.

- Payment Due Date: The date by which you must make at least the minimum payment to avoid late fees and potential damage to your credit score.

- Grace Period: The time between the end of your billing cycle and the payment due date during which you can pay off your balance without incurring interest.

Strategies for Payment Timing

1. Pay Before the Statement Closing Date

One effective strategy is to pay down your balance before the statement closing date. This reduces the reported balance on your statement, which can positively impact your credit score. For example, if you’re using the American Express Cobalt Card, making a payment before the statement closing date will lower the amount reported to credit bureaus and help improve your credit utilization ratio.

2. Pay in Full by the Due Date

To avoid paying interest, always aim to pay your full balance by the due date. This strategy is particularly useful for high-reward cards. By paying in full, you ensure that you take advantage of the grace period and enjoy the benefits of rewards and cash back without accruing interest charges.

3. Utilize Automatic Payments

Setting up automatic payments for at least the minimum amount due can help you avoid late fees and ensure that you never miss a payment. Many top-rated cash back credit cards, such as the TD Cash BackVisa, offer features that allow you to automate payments easily. This can be especially useful if you have multiple cards or want to simplify your payment process.

4. Make Multiple Payments

For those who want to keep their credit utilization low and improve their credit score, making multiple payments throughout the month can be beneficial. For instance, if you regularly use a MBNA Rewards card, you might consider making small payments every week or bi-weekly. This approach keeps your balance lower and can help in maintaining a low credit utilization ratio.

5. Align Payments with Your Pay Schedule

If you receive multiple paychecks each month, you might align your credit card payments with your pay schedule. For example, if you use a Simplii Cash Back Visa or Tangerine Cash Back Credit Card, you can schedule payments to coincide with your paydays. This ensures that you have sufficient funds available and can avoid overspending.

Avoiding Common Payment Mistakes

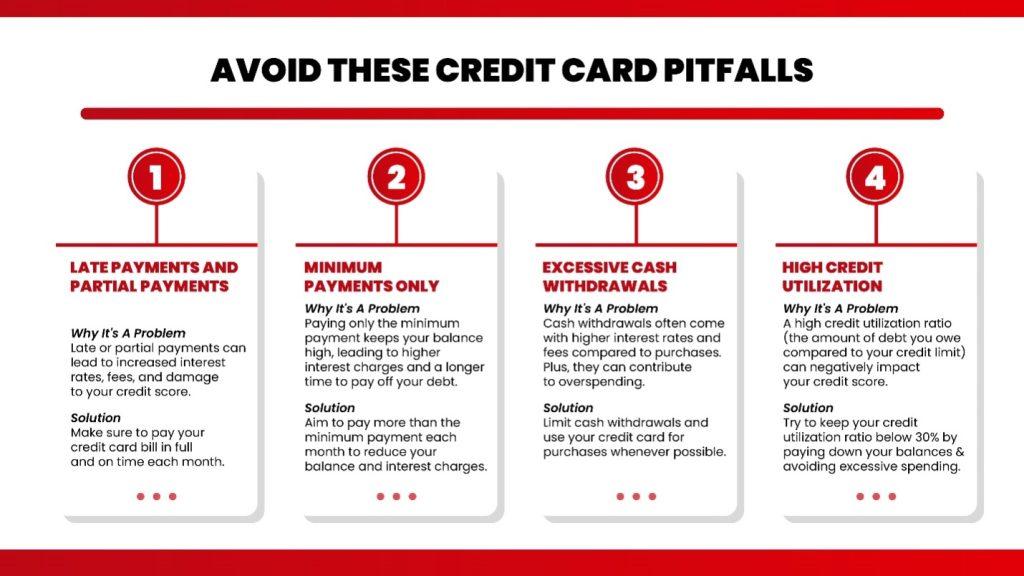

To maximize the benefits of your credit card, avoid these common payment mistakes:

- Only Making Minimum Payments: Paying only the minimum amount due can lead to accumulating interest and prolonging debt. Always aim to pay off the full balance.

- Missing the Payment Due Date: Late payments can result in fees and negatively affect your credit score. Set reminders or automate payments to stay on track.

- Ignoring the Grace Period: Not utilizing the grace period can lead to unnecessary interest charges. Aim to pay your balance in full before the grace period ends.

Conclusion

Understanding when to pay your credit card bill can significantly impact your financial health and card benefits. By paying before the statement closing date, making full payments by the due date, utilizing automatic payments, and aligning payments with your pay schedule, you can avoid interest charges, improve your credit score, and maximize rewards. Whether you’re using the American Express CobaltCard, or the TD Cash Back Visa, applying these strategies will help you make the most of your credit card benefits and maintain a healthy financial profile.

Optimize Your Credit Card Benefits Today!

Become a member of Great Canadian Rebates and master the art of payment timing to boost your rewards and avoid interest charges. Whether you’re using the American Express Cobalt Card or some other option, paying at the right time can enhance your financial health. Start implementing these strategies and make the most of your credit card rewards. Explore online deals and coupons for extra savings!