The allure of exploring new destinations and creating unforgettable memories is a universal dream. For many Canadians, credit card rewards offer a tantalizing pathway to unlocking these experiences. However, the choice between earning credit card points or airline miles can be perplexing. This guide will demystify the differences between these reward currencies, helping you make an informed decision that aligns with your travel goals and spending habits.

According to recent news, Canadians are increasingly turning to credit card rewards to offset travel expenses. This growing trend underscores the importance of understanding the nuances between points and miles to maximize your travel savings.

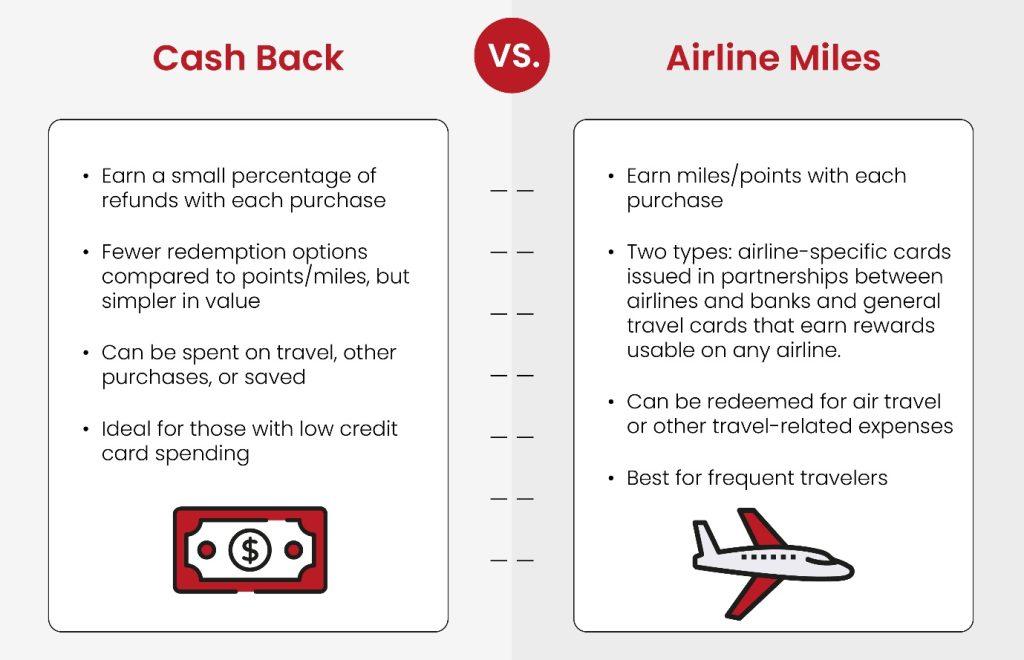

However, the question remains: Are credit card points or airline miles the better option for maximizing your travel savings?

Understanding Credit Card Points

Credit card points offer a versatile approach to accumulating rewards. These points can be earned on various purchases and redeemed for a wide range of options, including travel, merchandise, gift cards, or even statement credits. The flexibility of points makes them appealing to a broad spectrum of consumers.

While the concept of earning points on everyday spending might seem straightforward, there are nuances and complexities that can significantly impact the value you derive from your rewards.

How Credit Card Points Work

Credit card points are earned based on your spending activity. Typically, you earn a specific number of points for every dollar spent, with some cards offering bonus points for specific categories like dining, travel, or groceries. The accumulation of points is straightforward; however, the true value lies in how you redeem them.

The Value Proposition of Credit Card Points

The value of your credit card points is not fixed; it fluctuates based on how you redeem them.

Direct Redemption

Most credit card issuers allow you to redeem points for merchandise, gift cards, or statement credits. However, the value you receive for your points is often less than optimal. For instance, redeeming points for a $100 gift card might require more than $100 worth of points, diminishing their value.

Travel Rewards

Many credit card issuers partner with airlines and hotels, allowing you to transfer your points to their loyalty programs. This can significantly boost the value of your points, especially when redeeming for premium travel experiences like business class flights or luxury hotel stays.

Point Charts and Award Availability

The value of your points can also be influenced by the availability of reward options. Some travel rewards programs have dynamic pricing, meaning the number of points required for a specific flight or hotel stay can fluctuate based on demand.

Maximizing the Value of Your Credit Card Points

To make the most of your credit card points, consider the following strategies:

Understand Point Valuation

Calculate the value of your points based on different redemption options. Compare the cash value of the reward to the number of points required. This will help you identify the best redemption opportunities.

Transfer Bonus

Some credit card issuers offer bonus points when transferring your points to airline or hotel partners. Take advantage of these opportunities to increase the value of your rewards.

Flexible Redemption Options

Choose a credit card that offers multiple redemption options, allowing you to adapt to changing circumstances and maximize the value of your points.

Strategic Spending

Focus your spending on categories that earn higher rewards to accelerate your point accumulation.

Welcome Bonuses

Take advantage of credit card welcome bonuses to quickly boost your points balance. Be mindful of the spending requirements to qualify for the bonus.

The Allure of Airline Miles

Airline miles are specifically designed for frequent flyers, offering a direct path to unlocking travel-related rewards. By concentrating on a single airline or airline alliance, you can accumulate miles efficiently and potentially unlock premium benefits.

Key benefits of airline miles:

Dedicated to Travel

Airline miles are specifically tailored to travel enthusiasts, providing a clear pathway to flight rewards.

Upgrade and Lounge Access

Accumulating a significant number of airline miles can unlock premium cabin upgrades, priority boarding, and access to exclusive airport lounges.

Partnerships and Alliances

Many airlines participate in airline alliances, expanding your redemption options and potentially offering more travel choices.

Status Benefits

Earning a high status level with an airline can provide additional perks like free checked bags, priority customer service, and bonus miles.

Credit Card Points vs. Airline Miles: Which is Right for You?

The decision between credit card points and airline miles hinges on your travel habits, spending patterns, and desired redemption outcomes. Consider the following factors:

Travel Frequency and Loyalty

If you frequently fly with a specific airline, accumulating airline miles might be advantageous. However, if your travel plans are diverse, credit card points offer greater flexibility.

Redemption Preferences

Evaluate your desired rewards. Do you prioritize travel, merchandise, or cash back? Credit card points typically offer a wider range of options, while airline miles are focused on travel-related benefits.

Value of Rewards

Compare the value of points and miles based on your desired redemptions. Consider redemption rates, blackout dates, and any fees associated with using your rewards.

Credit Card Fees

Some credit cards with lucrative rewards programs come with annual fees. Weigh the benefits of the rewards against the cost of the annual fee to determine if the card is a good fit for your financial situation.

Flexibility

Consider how flexible you want your rewards to be. Credit card points offer more flexibility in terms of redemption options, while airline miles are more specific to travel.

Maximizing Your Rewards Potential

To truly optimize your rewards earning, consider a hybrid approach that combines the best of both worlds: credit card points and airline miles. Here’s how:

Dual-Card Strategy

Consider having both a points-earning card and an airline-focused card. Use the points card for everyday purchases and the airline card for travel-related expenses.

Transferring Points

If your credit card allows, transfer your accumulated points to airline miles for specific travel redemptions. This strategy provides flexibility and maximizes your rewards potential.

Strategic Spending

Prioritize spending on categories that earn higher rewards, such as dining, groceries, or travel, to accelerate your points or miles accumulation.

Shopping Portals

Utilize online shopping portals to earn additional points or miles on your purchases. Many portals offer bonus rewards for shopping at specific retailers.

Welcome Bonuses

Take advantage of credit card welcome bonuses to kickstart your rewards balance. Look for cards with generous welcome offers and ensure you meet the minimum spending requirements to claim the bonus.

Consider Co-Branded Cards

Some airlines offer co-branded credit cards with enhanced earning potential on flights and other travel-related purchases. If you’re loyal to a particular airline, a co-branded card can be a valuable addition to your rewards strategy.

Pay Your Balance in Full

Avoid interest charges to fully benefit from your rewards. Consistent on-time payments not only help you maintain a good credit score but also ensure that your rewards aren’t eroded by interest costs.

Understanding the Fine Print

While credit card rewards can be a fantastic way to save money and enhance your travel experiences, it’s essential to understand the terms and conditions associated with your rewards program. Pay attention to the following:

Expiration Dates

Some rewards programs have expiration dates, so it’s important to use your points or miles before they expire.

Blackout Dates

Be aware of blackout dates when redeeming airline miles, as these can limit your travel options during peak periods.

Fees and Surcharges

Some rewards programs may charge fees for certain redemptions or impose surcharges on award tickets.

Minimum Redemption Requirements

You may need to accumulate a specific number of points or miles before you can redeem them for rewards.

Great Canadian Rebates: Your Guide to Rewards Optimization

Great Canadian Rebates can be a valuable resource for comparing credit card rewards programs and finding the besttravel rewards orcash back credit card to suit your needs. Their platform provides detailed information on various credit cards, allowing you to compare points, miles, and other benefits side-by-side. By utilizing Great Canadian Rebates, you can make informed decisions and maximize your rewards potential.

Don’t let travel expenses drain your wallet! Leverage the power of credit card rewards to explore the world while saving money. Visit Great Canadian Rebates today to find the perfect credit card to fuel your adventures.