Tax time can be a stressful period, but maximizing credit card tax deductions in Canada can significantly reduce your tax bill. One tool that can simplify this process is a credit card. By understanding the types of deductions available and how credit cards can help, you can optimize your tax return.

A credit card tax deduction in Canada reduces your taxable income, lowering the amount of tax you owe. This differs from a tax credit, which directly reduces the amount of tax you pay. Common deductions for individuals include medical expenses, charitable donations, and employment expenses. Businesses can claim deductions for operating costs like rent, utilities, and advertising, and in fact, the Government of Canada paid out around $37.3 billion in refunds between January 2022 and February 2023 at around $2093 per head.

Accurate record-keeping is essential. Receipts, invoices, and bank statements are crucial for substantiating claims. This is where credit cards and cash back shopping sites shine. Every purchase made is digitally recorded, providing a detailed transaction history. This can simplify the process of tracking eligible expenses. Moreover, some credit cards, like the American Express Cobalt, offer cash back shopping sites like Walmart Canada Cash Back, allowing you to earn rewards while making purchases. While these rewards might not be directly tax-deductible, they can offset the cost of everyday expenses, effectively increasing your disposable income.

Understanding Tax Deductions

To maximize your tax refund or minimize your tax bill, understanding credit card tax deductions is crucial. A deduction is an amount subtracted from your total income, thereby reducing the amount of income subject to taxation. This can lead to significant savings.

It’s important to differentiate between deductions and tax credits. While both reduce your tax burden, deductions decrease your taxable income, while credits directly reduce the amount of tax you owe. For instance, a charitable donation is often a tax credit, while business expenses are typically deductions.

Common tax deductions for individuals include medical expenses, employment expenses, and carrying charges on investments. Businesses can claim deductions for a wide range of expenses, such as rent, utilities, salaries, and office supplies.

The cornerstone of claiming any deduction is proper documentation. Receipts, invoices, and bank statements are essential to substantiate your claims.

Credit Cards and Tax Deductions

Credit cards can be powerful tools for both individuals and businesses when it comes to tax time. One of the most significant advantages lies in their ability to simplify expense tracking. Detailed transaction records are automatically generated with each purchase, making it easier to categorize expenses for tax purposes. For businesses, this can be a time-saver, as manually recording every expenditure can be tedious and prone to errors.

For business owners, credit card tax deductions in Canada offer additional benefits. Many business expenses, from travel and accommodations to office supplies and advertising, can be deducted. Using a credit card for these purchases provides a clear record of expenses and simplifies the process of claiming deductions. Additionally, some business credit cards offer rewards programs, which can provide additional value and potentially offset business costs.

While credit cards offer numerous advantages, it’s essential to be aware of potential drawbacks. For instance, credit card interest is generally not tax-deductible, and carrying a balance can negate any potential tax savings. Moreover, it’s crucial to maintain detailed records, even with digital statements and all credit card rebates. Categorizing expenses and keeping supporting documentation are essential for successful tax filings.

By understanding how to effectively use credit card tax deductions in Canada and maintain proper records, taxpayers can optimize their deductions and potentially reduce their tax liability.

Business Expenses and Credit Cards

For businesses, credit cards and credit card rebates can be indispensable tools for managing and tracking expenses. Many business costs are tax-deductible, and using a credit card to pay for these expenses can simplify the process of claiming credit card tax deductions in Canada.

Eligible business expenses are those incurred to generate income. This includes a wide range of costs, from operational expenses to travel and entertainment. Common examples include:

- Travel expenses: airfare, hotel accommodations, rental cars, and public transportation costs directly related to business activities.

- Meals and entertainment: costs associated with client meetings or business-related events.

- Office supplies: stationery, computer equipment, software, and other items used for business operations.

- Advertising and marketing: costs incurred to promote products or services.

- Rent and utilities: for business premises.

- Salaries and wages: paid to employees.

Tracking business expenses for credit card tax deductions is highly beneficial. Each transaction is recorded, providing a detailed record of the date, amount, and vendor. This information is invaluable when preparing tax returns. It’s essential to keep the credit card statement organized and categorize expenses for easy reference.

However, meticulous record-keeping is crucial. While credit cards offer a convenient way to track expenses, additional documentation might be necessary for certain deductions. For instance, for travel expenses, you might need to retain receipts for meals, tolls, and parking. It’s advisable to maintain a separate business expense log to supplement credit card statements.

Personal Expenses and Credit Cards

While primarily focused on business expenses, credit cards can also be helpful in tracking certain personal expenses that might be tax-deductible. These expenses often vary based on individual circumstances.

Some common personal expenses that might be counted toward credit card tax deductions include:

- Medical expenses: out-of-pocket costs for medical treatments, prescriptions, and dental care.

- Childcare expenses: costs incurred for childcare services to enable the taxpayer to work or attend school.

- Education expenses: tuition fees, textbooks, and other costs related to post-secondary education.

Using a credit card to pay for these expenses can simplify the process of tracking eligible costs. By categorizing expenses, you can easily identify potential deductions when preparing your tax return.

It’s important to note that there are limitations and restrictions on personal expense deductions. Not all medical or childcare expenses are deductible. Moreover, the eligibility for education-related deductions depends on specific circumstances. Tax laws can be complex, and it’s advisable to consult with a tax professional to determine which expenses qualify for deductions.

Remember, while credit cards can be a valuable tool, accurate record-keeping is essential for maximizing tax deductions.

Maximizing Tax Deductions with Credit Cards

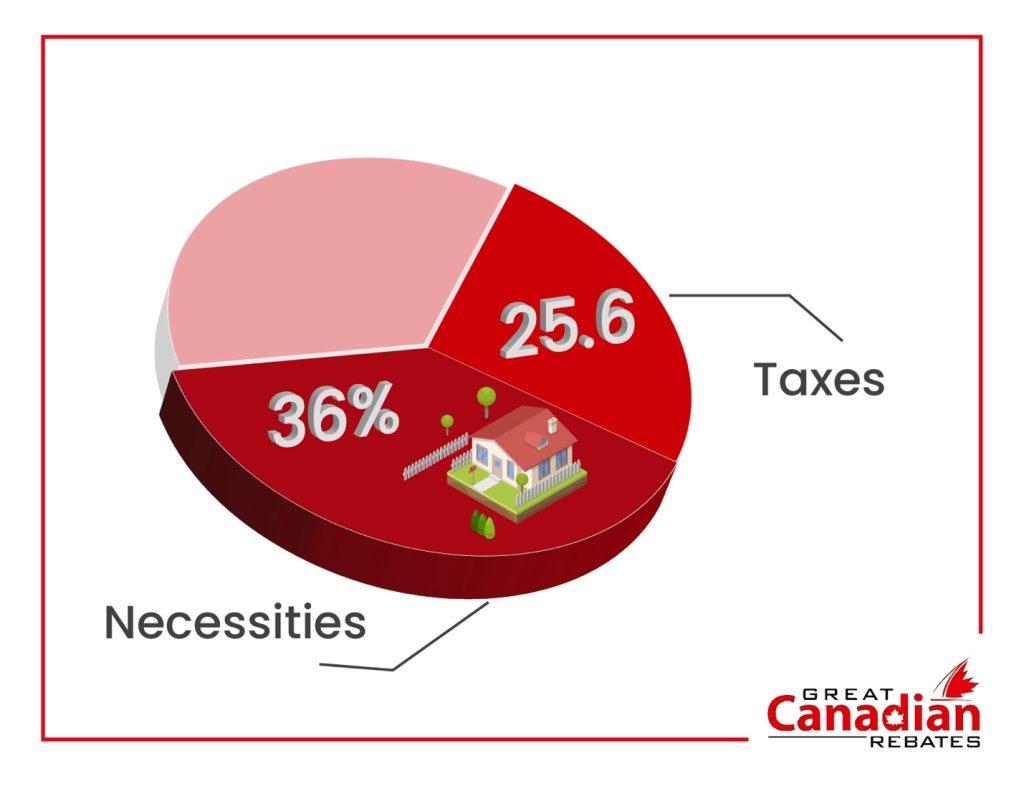

To fully leverage the benefits of credit card tax deductions, effective organization is crucial, especially since you’re paying around 25.6% in taxes on average. Start by categorizing your credit card statements. Create separate files or folders for business and personal expenses. Within these categories, further classify transactions by type, such as travel, meals, office supplies, or medical expenses. This detailed categorization will streamline the process of identifying potential deductions.

Many credit cards offer rewards programs and cash back. While these rewards might not be directly tax-deductible, they can indirectly contribute to tax savings. For businesses, rewards can be used to offset operational costs, such as travel expenses or office supplies. This effectively reduces your overall business expenses, which can indirectly impact your taxable income.

Accurate expense categorization is paramount. Misclassifying expenses can lead to audits or penalties. Ensure that every transaction is allocated to the correct category. For business expenses, clearly differentiate between personal and business-related purchases. Use descriptive notes or labels to clarify the purpose of each transaction.

Common mistakes taxpayers make include:

- Failing to keep supporting documentation.

- Incorrectly categorizing expenses.

- Ignoring small expenses.

- Not taking advantage of credit card rewards.

By following these guidelines and maintaining meticulous records, you can maximize your tax deductions and optimize your financial position.

Conclusion

Effectively utilizing credit card tax deductions can significantly enhance your ability to maximize tax deductions. By meticulously tracking expenses, categorizing transactions, and taking advantage of available deductions, you can optimize your tax return. Remember, accurate record-keeping is paramount. Consider using accounting software or apps to streamline the process.

While credit cards offer numerous benefits, it’s essential to use them responsibly. Avoid carrying balances to prevent incurring interest charges. Regularly review your credit card statements to ensure accuracy and identify potential deductions.

By combining strategic credit card usage with sound financial management, you can optimize your tax position and achieve long-term financial well-being.

Great Canadian Rebates can further enhance your savings journey. By taking advantage of cash-back offers on credit cards for everyday purchases, you can increase your disposable income. These savings can be allocated towards paying off credit card balances, building an emergency fund, or investing for the future. Visit Great Canadian Rebates today and start maximizing your savings potential with the best credit card rebates.

Remember, every dollar saved is a dollar closer to your financial goals.