Disputing a credit card charge in Canada might seem daunting, but understanding the process can empower you to protect your financial interests. Whether you’ve encountered an unauthorized transaction or a billing error, it’s crucial to act promptly and follow the right steps to resolve the issue. This guide will walk you through the dispute resolution process, highlight your rights, and offer tips on effectively managing disputes.

Understanding Credit Card Charges and Your Rights

Before diving into the dispute process, it’s essential to understand your rights as a credit cardholder in Canada. The Consumer Protection Act and Financial Consumer Agency of Canada (FCAC) guidelines provide robust protection for consumers.

These regulations ensure that credit card issuers address billing errors, unauthorized charges, and disputes fairly and promptly. As a credit cardholder in Canada, it’s crucial to familiarize yourself with the key rights and protections in place to safeguard your interests.

First, under the Consumer Protection Act, credit card users have the right to dispute unauthorized charges and billing errors. If you identify any unauthorized transactions on your credit card statement or notice inaccuracies in the billing, you have the right to report and dispute these issues. The credit card issuer is mandated to thoroughly investigate your claims and address any errors in a timely manner.

Additionally, the Financial Consumer Agency of Canada (FCAC) provides guidelines that outline the procedures credit card issuers must follow when handling disputes. These guidelines ensure that credit card companies address disputes fairly and promptly. When initiating a dispute process, it’s important to adhere to the specific guidelines outlined by the FCAC to ensure that your rights are protected throughout the process.

It’s also important to note that as a credit cardholder in Canada, you have the right to seek recourse if you encounter unfair treatment or if the credit card issuer does not adequately address your concerns. The regulatory framework in Canada is designed to provide avenues for consumers to escalate their concerns and seek redress in the event of disputes or grievances related to credit card transactions.

Types of Disputable Credit Card Charges

Understanding the types of disputable credit card charges is essential for effectively managing your credit card account and protecting yourself from potential financial losses. In Canada, credit cardholders have the right to dispute various types of charges that appear on their statements. Here are the main categories of disputable credit card charges:

Unauthorized Transactions

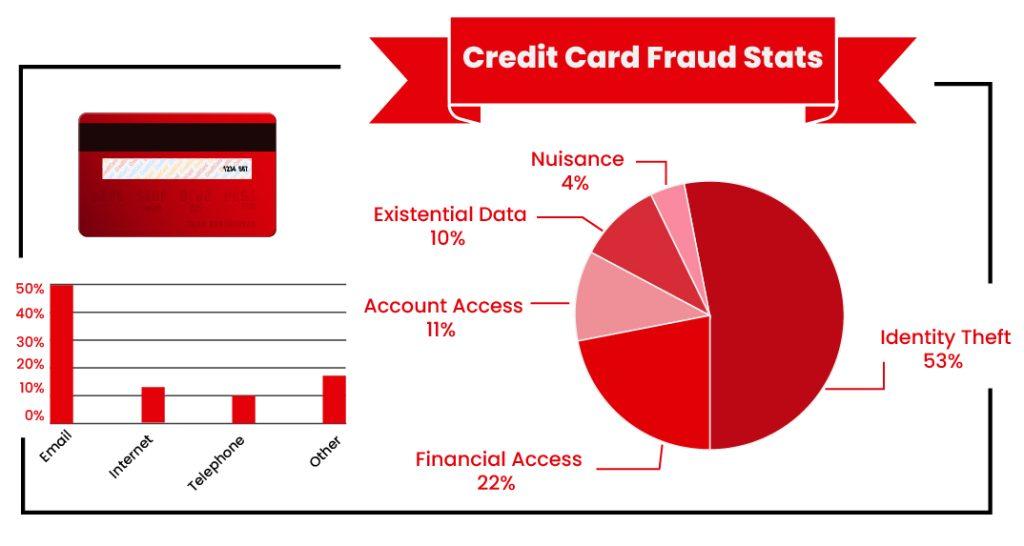

Unauthorized transactions are charges made without your consent. These charges are often a result of fraud or identity theft. Fraudulent activities can occur when someone gains access to your credit card information and uses it to make purchases without your knowledge. Common scenarios include:

- Stolen Card Information: Your card details are stolen through methods like skimming devices, data breaches, or phishing scams.

- Lost or Stolen Card: Your physical credit card may be lost or stolen, and someone may use it to make unauthorized purchases.

- Online Fraud: Your card information is used for online transactions without your authorization.

To protect yourself from unauthorized transactions, it’s crucial to regularly monitor your credit card statements and report any suspicious activity to your card issuer immediately. Credit card companies are generally responsive to such issues and will work with you to resolve them quickly.

Billing Errors

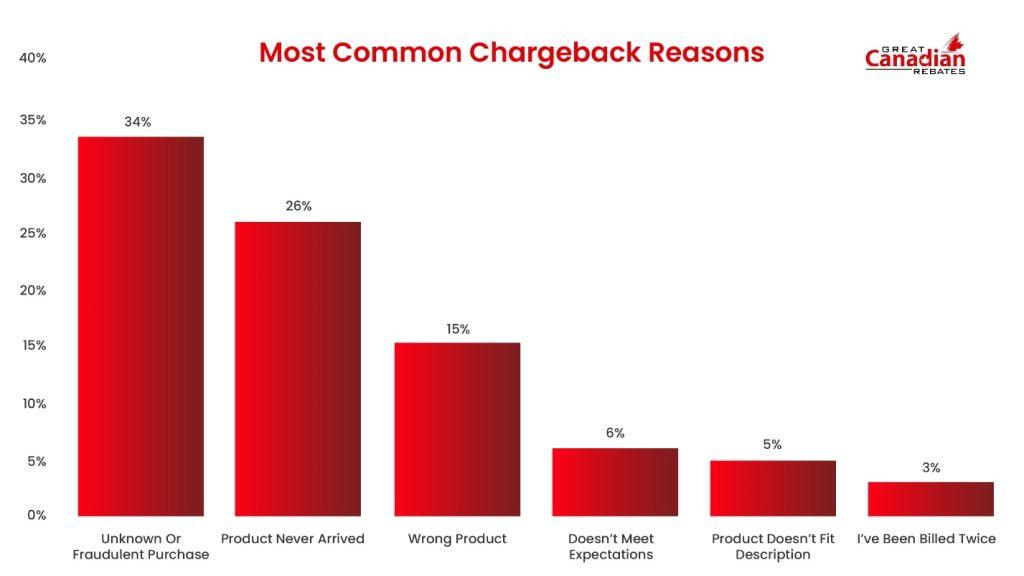

Billing errors are another common type of disputable charge. These errors can occur due to various reasons and may include:

- Incorrect Amounts: You are charged an amount that is different from what you agreed upon during the purchase.

- Duplicate Charges: You are charged multiple times for the same transaction.

- Unprocessed Returns: You return an item, but the refund is not reflected on your credit card statement.

- Incorrect Merchant Details: The charge appears with incorrect merchant information, causing confusion.

Billing errors can be accidental but can still cause significant inconvenience and financial strain. When you identify a billing error, it’s best to first contact the merchant to correct the issue. If the merchant is unresponsive or unable to resolve the error, proceed with filing a dispute with your credit card issuer.

Quality of Goods/Services

Disputes related to the quality of goods or services occur when the product or service you receive does not meet the promised standards or your expectations. These disputes can arise in situations such as:

- Defective Products: The item you purchased is faulty or does not work as advertised.

- Service Not Rendered: You pay for a service that is not provided, such as a hotel booking that was not honoured.

- Significantly Not As Described: The product or service is vastly different from what was advertised or agreed upon.

When faced with quality-related disputes, it’s essential to gather evidence, such as photos of defective products or correspondence with the merchant, to support your claim. Start by addressing the issue directly with the merchant. If the merchant fails to resolve the problem, escalate the matter to your credit card issuer.

Additional Types of Disputable Charges

While unauthorized transactions, billing errors, and quality disputes are the most common, other types of disputable charges may include:

- Subscription Cancellations: Charges continue to appear even after you’ve cancelled a subscription service.

- Hidden Fees: Unexpected fees that were not disclosed at the time of purchase.

- Incorrect Currency Conversion: Charges that reflect an incorrect currency conversion rate, leading to higher costs.

Step-by-Step Guide to Disputing a Credit Card Charge

1. Review Your Statement Carefully

Regularly reviewing your credit card statements is the first line of defence against unauthorized or incorrect charges. Look for unfamiliar transactions, wrong amounts, or charges for items you did not receive.

2. Gather Evidence

Before contacting your credit card issuer, gather all relevant evidence to support your dispute. This might include:

- Receipts and invoices

- Emails or correspondence with the merchant

- Screenshots of online transactions

- Any other documentation proving the charge is incorrect or unauthorized

3. Contact the Merchant

In many cases, contacting the merchant directly can resolve the issue quickly. Explain the problem and provide your evidence. Merchants are often willing to correct billing errors or address unauthorized charges to maintain customer satisfaction.

4. Notify Your Credit Card Issuer

If the merchant cannot resolve the issue, the next step is to contact your credit card issuer. You can do this via phone, email, or the issuer’s online portal. When you contact them, be sure to:

- Clearly explain the dispute and provide relevant details (e.g., transaction date, amount, and merchant name)

- Attach or reference any evidence you’ve gathered

- Request a confirmation of your dispute submission

5. Submit a Written Dispute

For formal documentation, it’s advisable to submit a written dispute. Most credit card issuers have specific forms for this purpose, which you can find on their website or request via customer service. Your submission should include all relevant details and evidence.

6. Monitor Your Account

While your dispute is being reviewed, keep a close eye on your account. Credit card issuers are required to acknowledge your dispute within 30 days and resolve it within two billing cycles (but no longer than 90 days).

7. Follow Up

If you do not receive a timely response or resolution, follow up with your credit card issuer. Keep records of all your communications, including dates, times, and the names of the representatives you speak with.

Tips for Effective Dispute Management

Disputing a credit card charge can be a complex process, but effective management can make it more straightforward and increase the likelihood of a favourable outcome. Here are detailed tips to help you handle credit card disputes efficiently:

Be Prompt

Time is critical when disputing credit card charges. Most credit card issuers have a specific window during which disputes must be filed, often within 60 days of the statement date on which the charge appears. The sooner you act, the better your chances of resolving the dispute quickly and effectively. Prompt action also helps prevent further unauthorized charges if the dispute is related to fraud. If you delay, you risk losing the right to dispute the charge, which could result in financial loss. Additionally, acting promptly shows the issuer that you are diligent and serious about resolving the issue.

Stay Organized

Organization is critical to managing a credit card dispute efficiently. Start by creating a dedicated file—either physical or digital—for all documents related to the dispute. This should include:

- Credit Card Statements: Highlight the disputed charge on your statement for easy reference.

- Receipts and Invoices: Collect all receipts and invoices that pertain to the disputed transaction.

- Correspondence: Save all emails, letters, and notes from phone calls with both the merchant and your credit card issuer. Include dates, times, and the names of the representatives you spoke with.

- Dispute Forms: Keep copies of any forms or written disputes you submit to your credit card issuer.

Having all this information readily accessible can be crucial if you need to escalate the dispute or if there are questions about your claim. A well-organized file makes it easier to track the progress of your dispute and provides a clear record of your actions.

Know Your Rights

Familiarizing yourself with your rights as a credit cardholder in Canada is essential. The Financial Consumer Agency of Canada (FCAC) provides guidelines and resources to help consumers understand their rights and responsibilities. According to the FCAC, you have the right to dispute unauthorized or incorrect charges and expect a timely response from your credit card issuer. Understanding these rights can empower you to advocate for yourself more effectively.

Additional Tips for Managing Disputes

- Document Everything: Keep detailed notes of every interaction you have regarding the dispute, including phone calls, emails, and letters. Note the date, time, and the names of anyone you speak with.

- Follow-up: Don’t hesitate to follow up if you haven’t received a response within the expected timeframe. Persistence can sometimes be the key to resolving your issue.

- Escalate When Necessary: If your dispute isn’t resolved to your satisfaction, don’t be afraid to escalate it. Most credit card issuers have a formal escalation process, which may include speaking with a supervisor or filing a complaint with the issuer’s ombudsman.

By following these tips, you can manage credit card disputes more effectively, protecting yourself from financial loss and ensuring your rights are upheld. Being proactive, organized, and knowledgeable about your rights are essential steps in navigating the dispute process successfully.

Benefits of Credit Card Dispute Protection

Credit card dispute mechanisms offer an additional layer of security, ensuring that cardholders are not held financially responsible for unauthorized or incorrect charges. This protection is vital in an age where identity theft and fraudulent activities are on the rise. By being able to dispute these charges, you can prevent financial loss and safeguard your personal information.

Dispute protections safeguard your finances by allowing you to contest charges that you did not authorize or that were processed incorrectly. This means that if you encounter any billing errors or if your card is used fraudulently, you can initiate a dispute process to rectify these issues. This protection ensures that you are not unfairly burdened by expenses that are not your responsibility, helping maintain your financial health.

Knowing that you can dispute charges and have them investigated provides peace of mind, allowing you to use your credit card with confidence. This assurance means you can make purchases, both online and offline, without the constant worry of potential errors or fraud. If an issue arises, you can rely on the dispute process to address and resolve the problem, ensuring that your finances remain secure and stress-free.

Conclusion: Taking Control of Your Credit Card Disputes

Disputing a credit card charge in Canada doesn’t have to be overwhelming. By understanding your rights and following a structured process, you can effectively manage disputes and protect your financial interests. Regularly reviewing your statements, acting promptly, and staying organized is vital to resolving issues efficiently.

Beyond dispute protection, leveraging the various benefits and rewards offered by Canadian credit cards can significantly enhance your financial strategy. From cash back and travel rewards to rebates and exclusive perks, choosing the right credit card can offer substantial value.

Search For the Best Cash Back Card for Online Shopping

If you’re looking for cards that offer fantastic cash back or credit card rebates, you’ve come to the right place! Great Canadian Rebates is an online platform that lets Members compare credit card options available in Canada and apply for the one that best suits their financial and lifestyle requirements.

It’s free to join, and Members can also choose from over 700 well-known merchants and enjoy great rebates, deals, and discounts. Visit the website today for more information.