A borrower can obtain a set amount of money from a lender when they have a line of credit. This form of credit arrangement is a versatile form of financing that can be used for different objectives, such as meeting short-term cash flow demands or providing coverage for unforeseen expenses.

Understanding a Line of Credit

A traditional loan is not comparable to a line of credit in important respects. In contrast to a loan, which gives the borrower access to a fixed sum of money that must be repaid over a fixed period, a line of credit gives the borrower more leeway in how they spend the money. When a borrower takes out a line of credit, the lender gives them access to a pool of funds from which they can take money out as needed. The borrower is only needed to make payments on the borrowed amount.

You have the option of securing or not securing a line of credit. While applying for a secured line of credit, the borrower must provide collateral in real estate or other assets to secure the loan. This offers the lender some degree of protection if the borrower cannot repay the loan.

Line of Credit Variants

There are numerous variants of lines of credit, each with its characteristics and advantages. They are as follows:

1. Personal Line of Credit

A personal line of credit is an unsecured loan often used to pay for personal needs like renovation or unforeseen medical bills. The borrower’s creditworthiness and previous financial history determine the maximum amount to be borrowed.

2. Business Lines of Credit

One form of financing tailored to the needs of businesses is known as a business line of credit. It can be used to fulfill short-term cash flow needs, such as paying wages or acquiring inventories. The borrower’s company credit score and financial history are considered when determining the amount of money that can be borrowed.

3. Home Equity Line of Credit

A Home Equity Line of Credit (HELOC) is a secured line of credit backed by the borrower’s home. The home’s worth and the amount of equity the borrower has been considered to determine the maximum amount that can be borrowed against it. HELOCs are a popular financial tool for financing home improvements and other major purchases.

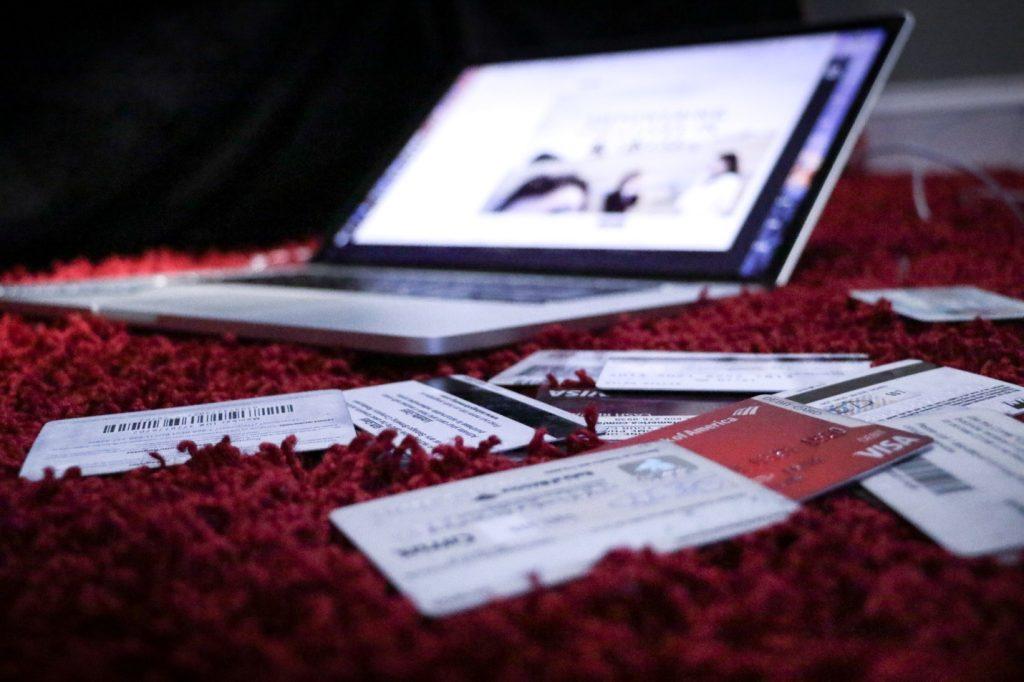

4. Credit Cards

Credit cards are a form of unsecured line of credit that may be used to make purchases or withdraw cash from an ATM. Credit cards can make cash-back for shopping online or withdraw cash. They have interest rates greater than other kinds of lines of credit. They may also have additional expenses, such as annual fees or penalties for transferring balances.

5. Invoice Financing

Invoice financing is a business line of credit that addresses cash flow gaps produced by unpaid invoices. The value of the borrower’s unpaid invoices determines the amount of cash advance provided by the lender; the borrower is responsible for repaying the loan after the invoices have been paid.

6. Merchant Cash Advance

A merchant cash advance is a business line of credit to address short-term cash flow needs. The lender makes a cash advance available based on the borrower’s future credit card sales. The borrower repays the loan by setting aside a proportion of their daily credit card proceeds.

Advantages of a Line of Credit

Using a line of credit comes with various advantages. Some of them are as follows:

1. Flexibility

Flexibility is one of the primary advantages. A line of credit, as opposed to a standard loan, allows the borrower to take out only the amount of money they require at any time. This can be very helpful for businesses whose cash flow requirements are bound to fluctuate. In addition, lines of credit typically feature lower interest rates than those associated with credit cards and other forms of short-term financing, making them a more cost-effective choice.

2. Increased Credit Score

Having a line of credit can assist the borrower in raising their credit score. Their ability to create a positive credit history and improve their credit usage ratio can be helped by the responsible use of a line of credit. Borrowers can establish their creditworthiness to lenders and boost their chances of being authorized for other loans if they make their payments on time.

3. Control

Lines of credit also provide an increased level of control over cash usage. A traditional loan is one in which the funds are given to the borrower all at once for a certain purpose. In contrast, a line of credit allows the borrower to access funds as required and to use those funds for any reason they see fit. This can be especially helpful for companies that need to cover unforeseen expenses or seize new opportunities when they present themselves.

Risks Involved in Using a Line of Credit

Using a line of credit comes with a certain amount of risk exposure. They are as follows:

1. Money Wastage

One of the primary dangers is a waste of money. Due to the flexibility that a line of credit provides, borrowers are tempted to borrow more money than is required or to spend the money on things that are not necessary. In the long run, this can result in larger debt levels and instability in the financial system.

2. Increased Interest Rates

The interest rate on a line of credit can change depending on the circumstances of the market, as opposed to a conventional loan, in which the interest rate remains the same throughout the payback duration. Because of this, it may be impossible to estimate the total amount of interest by the end.

3. Hefty Fees

Certain lines of credit might come with quite hefty fees and interest rates. When taking out a loan, borrowers should research the terms and conditions of their line of credit to ensure they have a complete understanding of all of the fees and costs involved.

Borrowers considering using a line of credit should carefully assess the benefits and risks of this form of financing before making their decision. They need to examine their financial circumstances and ensure they are in a position to make payments on time and refrain from overspending.

Borrowers should research to find the best rates and terms for lines of credit if they decide this is the best option for them. Before making a final choice, they should compare the loan offers and review each loan’s terms and conditions.

Final Word

A line of credit can be a helpful tool for managing short-term cash flow demands or unforeseen spending. It is an open-ended form of credit. Before taking out a loan, borrowers should exercise caution in using finance and consider the advantages and disadvantages. They can attain their financial goals and improve their overall financial stability with the help of a line of credit if they plan their borrowing responsibly. Approach Great Canadian Rebates to learn more about it.