Credit cards are an integral part of modern financial management, offering convenience and flexibility. However, many Canadians find themselves burdened with unnecessary interest charges, often due to a lack of understanding regarding credit card grace periods in Canada. This seemingly simple concept can be the difference between using your credit card wisely and accumulating costly debt. This comprehensive guide aims to demystify credit card grace periods in Canada, explaining statement cycles and providing practical strategies to avoid paying more than necessary.

Understanding the Credit Card Grace Period

The credit card grace period in Canada is a crucial aspect of credit card usage. It’s the window of time between the end of your billing cycle and the payment due date, during which you can pay off your balance without incurring interest charges.

- Definition:

- The grace period is the period during which you can pay off your balance without being charged interest.

- It is a feature offered by most credit card issuers in Canada.

- Duration:

- The duration of the grace period varies, typically ranging from 21 to 30 days.

- It is important to check with your credit card issuer for the exact length of your grace period. This will also help you avoid overdraft or being penalized and allow you to manage multiple cards at the same time.

- Conditions:

- The grace period applies only if you pay your statement balance in full by the due date.

- If you carry a balance, interest charges will accrue from the date of purchase.

The Statement Cycle: A Key Component

To fully understand the grace period, it’s essential to comprehend the statement cycle. The statement cycle is the period for which your credit card transactions are recorded and summarized in a monthly statement.

- Definition:

- The statement cycle is the billing period, typically one month, for which your credit card transactions are recorded.

- It ends on the statement closing date.

- Statement Closing Date:

- The statement closing date is the end of the statement cycle.

- Transactions made after this date will appear on the next statement.

- Payment Due Date:

- The payment due date is the date by which you must pay your statement balance to avoid interest charges.

- It is typically 21 to 30 days after the statement closing date.

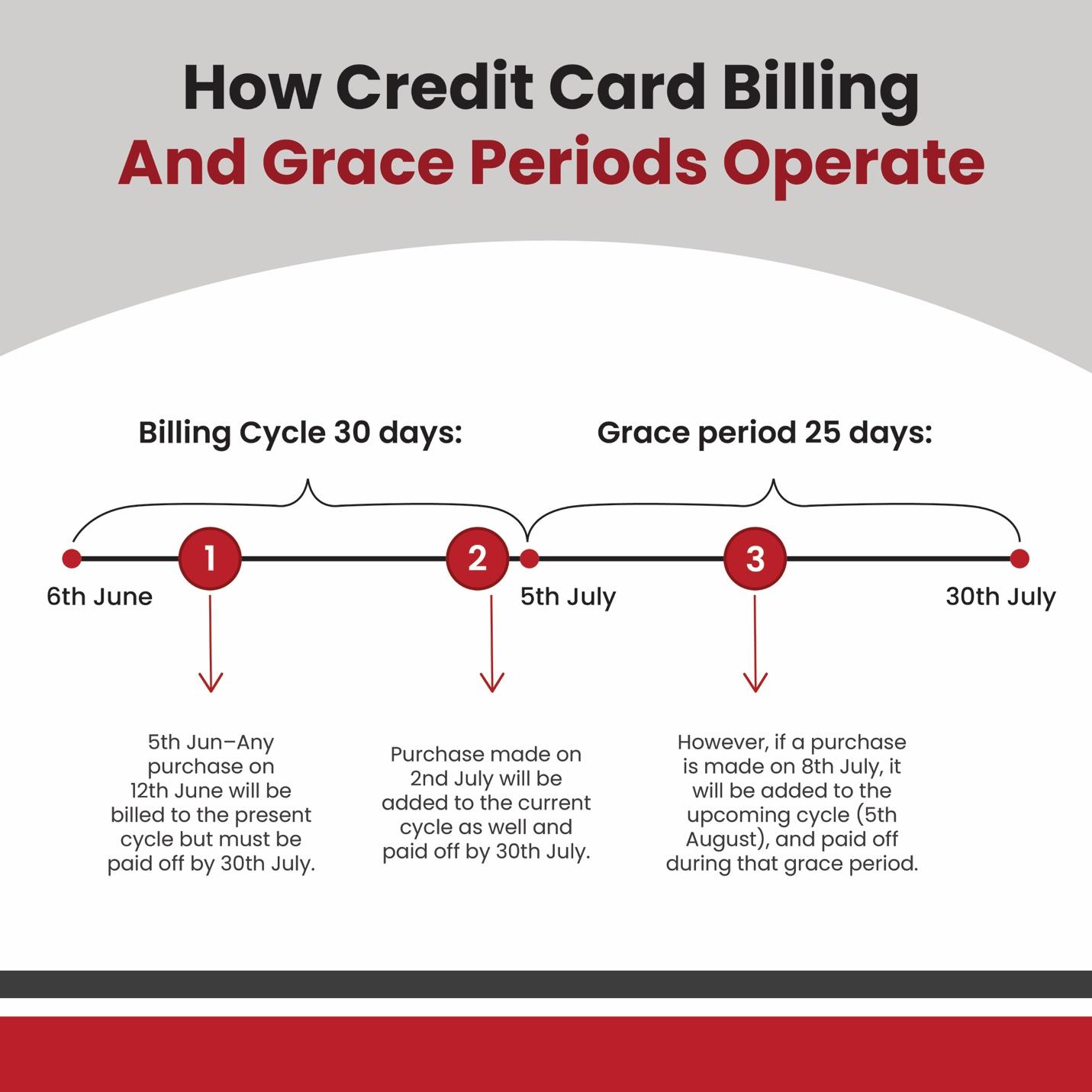

How Grace Periods and Statement Cycles Interact

The grace period and statement cycle are closely intertwined. Understanding their interaction is crucial for avoiding interest charges.

- Purchases Within the Statement Cycle:

- Purchases made within the statement cycle are included in the monthly statement.

- You have until the payment due date to pay off these purchases without incurring interest.

- Carrying a Balance:

- If you carry a balance from a previous statement cycle, you will not have a grace period on new purchases.

- Interest charges will accrue from the date of purchase.

- Minimum Payments:

- Making only the minimum payment will not prevent interest charges.

- You must pay the entire statement balance to avoid interest.

Strategies to Avoid Paying Interest

Avoiding interest charges is essential for responsible credit card management. Here are some effective strategies.

- Pay Your Balance in Full:

- The most effective way to avoid interest charges is to pay your statement balance in full by the due date.

- This ensures you take full advantage of the grace period.

- Set Up Automatic Payments:

- Set up automatic payments to ensure you never miss a payment due date.

- This can help you avoid late fees and interest charges.

- Monitor Your Statement Cycle:

- Keep track of your statement cycle and payment due dates.

- This helps you plan your payments and avoid surprises.

- Avoid Cash Advances:

- Cash advances typically do not have a grace period.

- Interest charges accrue from the date of the cash advance.

- Use Credit Cards Responsibly:

- Use credit cards for purchases you can afford to pay off within the grace period.

- Avoid overspending and accumulating debt.

The Impact of Interest Charges

Understanding the impact of interest charges can motivate you to avoid them.

- Compounding Interest:

- Credit card interest compounds daily or monthly, meaning you pay interest on interest.

- This can quickly escalate your debt.

- High APRs:

- Credit card APRs are typically much higher than other forms of borrowing.

- This makes credit card debt expensive.

- Negative Impact on Credit Score:

- Carrying a high balance and making late payments can negatively impact your credit score.

- This can affect your ability to obtain loans and credit in the future.

Choosing the Best Credit Cards in Canada

Selecting the right credit card can help you maximize the benefits of the grace period and avoid unnecessary interest charges.

- Low APR Cards:

- If you anticipate carrying a balance, choose a credit card with a low APR.

- This can help minimize interest charges.

- Cash Back Cards:

- Cash back cards offer rewards on your purchases, which can help offset interest charges.

- Many of the best credit cards in Canada offer cash back.

- Travel Rewards Cards:

- Travel rewards cards offer points or miles that can be redeemed for travel expenses.

- Many of the best travel cards have good grace periods.

- Cards with Long Grace Periods:

- Look for cards with longer grace periods to give you more time to pay your balance.

- This is an important factor to consider.

- Comparing Credit Card Offers:

- Before applying for a credit card, compare credit card offers from different issuers.

- Pay attention to the APR, grace period, and other terms and conditions.

How to Calculate Interest Charges

Understanding how interest charges are calculated can help you avoid them.

- Average Daily Balance Method:

- Most credit card issuers use the average daily balance method to calculate interest charges.

- This method calculates the average daily balance for each day in the statement cycle.

- Daily Periodic Rate:

- The daily periodic rate is the annual percentage rate (APR) divided by 365.

- This rate is applied to the average daily balance.

- Interest Calculation:

- Interest charges are calculated by multiplying the daily periodic rate by the average daily balance and the number of days in the statement cycle.

Grace Periods and Balance Transfers

Balance transfers can be a useful tool, but it’s essential to understand how grace periods apply.

- Balance Transfer Fees:

- Balance transfers often come with fees, typically a percentage of the transferred amount.

- Factor these fees into your decision.

- Promotional APRs:

- Some cards offer promotional APRs for balance transfers.

- Be aware of the standard APR that will apply after the promotional period ends.

- Grace Period on New Purchases:

- If you have a balance transfer, you may not have a grace period on new purchases.

- Interest charges may accrue from the date of purchase.

Grace Periods and Cash Advances

Cash advances are another area where grace periods typically do not apply.

- High APRs:

- Cash advances usually come with higher APRs than regular purchases.

- Avoid cash advances whenever possible.

- Immediate Interest Charges:

- Interest charges on cash advances accrue from the date of the transaction.

- There is no grace period.

- Cash Advance Fees:

- Cash advances also come with fees, which can be a fixed amount or a percentage of the advance.

Understanding credit card grace periods in Canada is essential for responsible credit card management. By paying your balance in full, monitoring your statement cycle, and avoiding cash advances, you can avoid unnecessary interest charges. Choosing the best credit cards in Canada with favourable terms and comparing credit card offers can further enhance your financial well-being.

Maximize your financial savings with Great Canadian Rebates! Explore our exclusive credit card offers and find the perfect card with favourable grace periods and rewards. Start saving today by signing up for our rebate programs.