So, you’re a Canadian looking to maximize your credit card perks but torn between travel rewards and cash back options? Let’s break it down in a way that’s as smooth as your favorite playlist.

The Lowdown: Travel Rewards vs. Cash Back

Before diving into the nitty-gritty, let’s get a clear picture of what each card offers.

Travel Rewards Credit Cards: These cards let you earn points or miles for every dollar spent, which you can redeem for flights, hotel stays, and other travel-related expenses. They often come with perks like travel insurance, airport lounge access, and no foreign transaction fees.

Cash Back Credit Cards: Straightforward and simple, these cards give you a percentage of your spending back as cash. You can usually redeem this cash as a statement credit, direct deposit, or even gift cards.

The Perks: What’s in It for You?

Let’s break down the advantages of each to see which vibes with your lifestyle.

Travel Rewards Cards: The Jetsetter’s Dream

- High-Value Redemptions: When used wisely, points can offer more value than standard cash back. For instance, redeeming points for flights or hotel stays can yield higher returns per point.

- Exclusive Perks: Think complimentary checked bags, priority boarding, and access to swanky airport lounges. Some cards even offer comprehensive travel insurance and no foreign transaction fees, making your globetrotting hassle-free.

- Lucrative Welcome Bonuses: Many travel cards entice new users with hefty sign-up bonuses, giving your points balance a significant boost right off the bat.

Cash Back Cards: The Straight Shooter

- Simplicity and Flexibility: No need to navigate complex redemption systems. Your rewards come as cash, which you can use however you please.

- Lower or No Annual Fees: Many cash back cards come with low or no annual fees, making them cost-effective for everyday use.

- Consistent Rewards: Earn a steady percentage back on all purchases, with some cards offering higher rates for specific categories like groceries or gas.

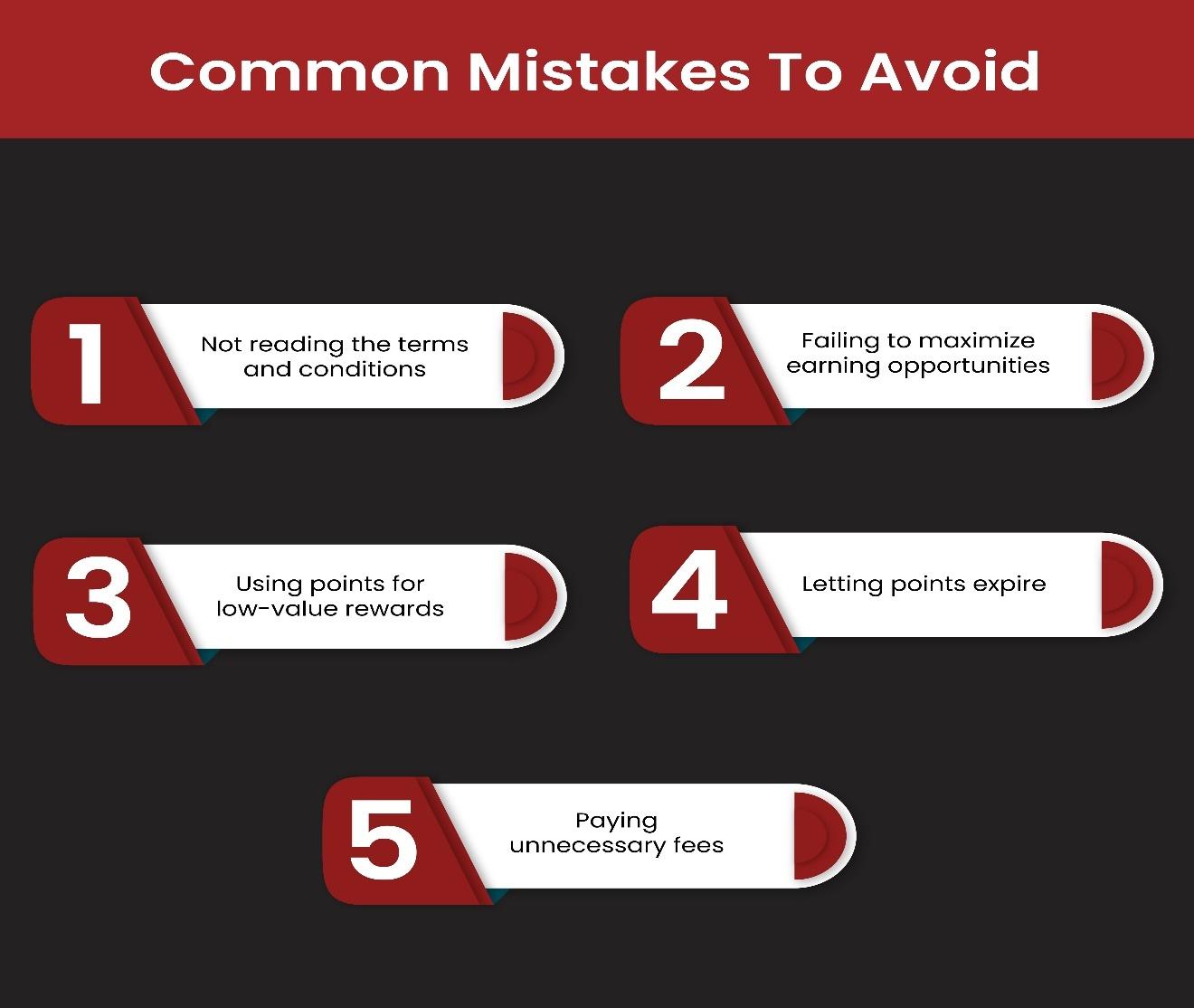

The Trade-Offs: Consider the Flip Side

No card is perfect. Here’s what to watch out for.

Travel Rewards Cards: The Fine Print

- Annual Fees: Premium perks often come with premium prices. Be prepared for higher annual fees, though the benefits can outweigh the costs if you maximize them.

- Redemption Restrictions: Points values can vary, and finding available flights or accommodations for redemption can sometimes be a hassle.

- Complexity: Understanding the ins and outs of point systems, transfer partners, and blackout dates requires a bit of homework.

Cash Back Cards: The Basics

- Fewer Perks: While straightforward, cash back cards often lack the bells and whistles of travel cards, such as travel insurance or lounge access.

- Lower Reward Potential: The earning potential might be less compared to travel cards, especially if you’re a frequent traveler who can leverage point multipliers and bonuses.

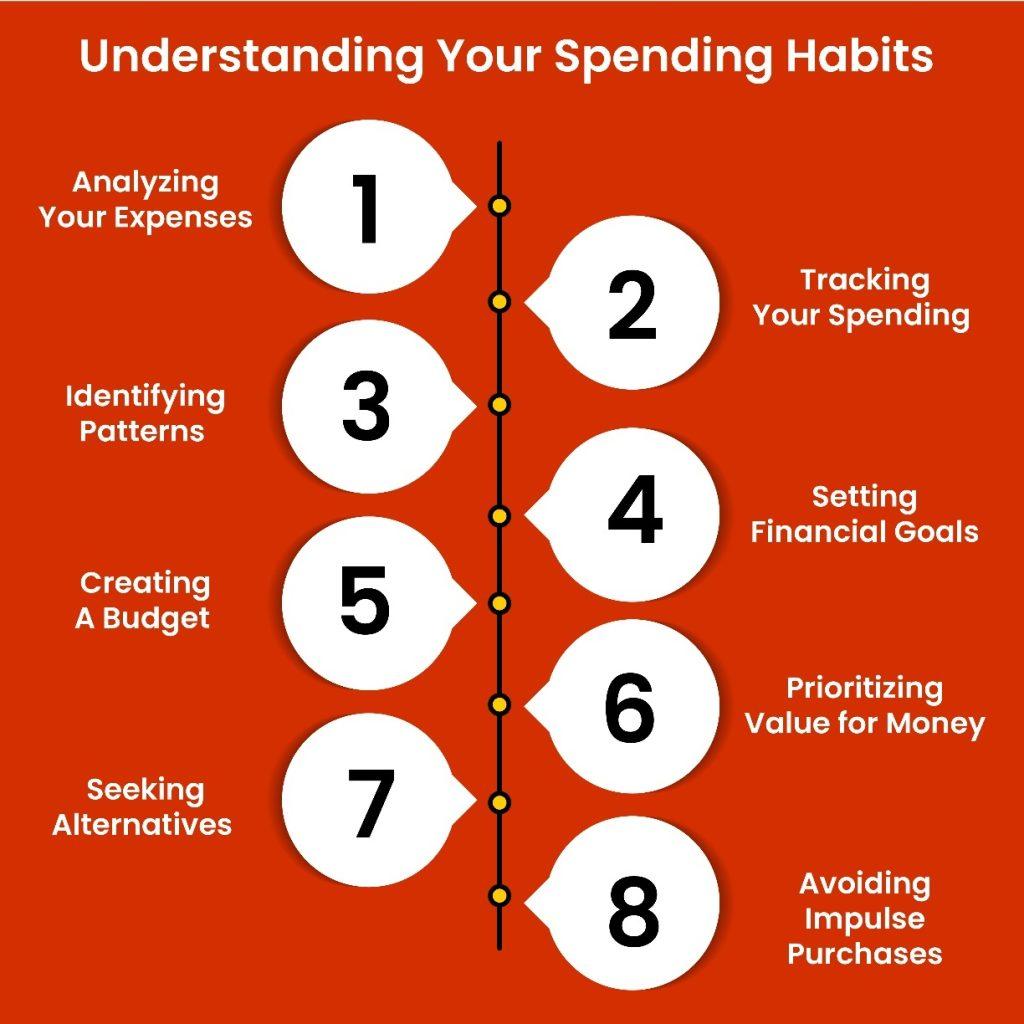

Decision-Making Framework: Find Your Perfect Match

Choosing the right card boils down to aligning it with your lifestyle and spending habits. Here’s a step-by-step guide to help you decide.

1. Assess Your Spending Habits

- Frequent Traveler? If you’re often jet-setting, a travel rewards card could offer significant value through points and travel perks.

- Homebody or Road Warrior? If most of your spending is on everyday items like groceries, gas, or dining out, a cash back card might be more beneficial.

2. Calculate Potential Rewards

- Break Down Your Expenses: Look at your monthly spending categories.

- Estimate Rewards: Use available calculators or the card’s reward structure to see how much you’d earn annually with each type of card.

3. Consider Annual Fees

- Weigh the Costs: Subtract the annual fee from your estimated rewards to see your net gain.

- Justify the Fee: Ensure that the card’s perks and rewards outweigh the cost of the annual fee.

4. Evaluate Redemption Options

- Flexibility: Cash back offers ultimate flexibility, while travel rewards can offer higher value but may come with restrictions.

- Ease of Use: Consider how straightforward it is to redeem your rewards.

5. Factor in Additional Benefits

- Perks: Travel cards often come with additional benefits like travel insurance, purchase protection, and concierge services.

- Foreign Transaction Fees: If you travel internationally, a card with no foreign transaction fees can save you money.

Top Canadian Credit Cards to Consider

Choosing the right credit card is a mix of science and strategy. You want to maximize rewards, minimize fees, and get the most value based on your spending habits. Whether you’re looking for top-rated cash back credit cards or travel rewards that fuel your next getaway, here are some of the best options available through Great Canadian Rebates.

Best Travel Rewards Credit Cards in Canada

If you’re all about jet-setting, flight upgrades, and exclusive perks, these travel rewards credit cards should be on your radar.

American Express Cobalt Card

Best for Foodies and Frequent Flyers

- Earn 5x points on dining, groceries, and food delivery (including Uber Eats and DoorDash).

- Earn 2x points on eligible travel and transit, making it a solid pick for commuters and frequent travelers.

- Earn 1x points on everything else.

- Flexible redemption options: Points can be used for flights, hotels, Airbnb stays, or transferred to airline partners for even better value.

- Exclusive perks: Access to Amex Offers, Front Of The Line event ticket presales, and more.

Why choose this card?

If you love dining out, travel frequently, and want flexible points that can be used for both daily expenses and big trips, this is one of the best cards on the market.

TD First Class Travel Visa Infinite Card

Best for Travel Bookings

- Earn up to 9x TD Points per $1 on travel booked through ExpediaForTD.com.

- Earn 3x TD Points on everyday purchases.

- Strong travel insurance package: Includes trip cancellation, medical, and lost baggage coverage.

- Annual fee rebate for the first year (if you meet the spending requirement).

Why choose this card?

If you frequently book flights and hotels through Expedia Canada, this card maximizes your rewards while offering premium travel protection.

Marriott Bonvoy American Express Card

Best for Hotel Lovers

- Earn 5x points at Marriott Bonvoy properties worldwide.

- Earn 2x points on gas, dining, and travel purchases.

- Annual Free Night Award (valued up to 35,000 points) after your first year.

- Elite Status Boost: Automatically qualify for Silver Elite Status and earn towards Gold Status faster.

Why choose this card?

Perfect for travelers who frequently stay at Marriott hotels and want perks like room upgrades, free nights, and late checkouts.

Rogers Red World Elite Mastercard

Best for No Foreign Transaction Fees

- Earn 1.5% unlimited cash back on all purchases.

- Earn 3% cash back on purchases in U.S. dollars, making it ideal for cross-border shopping and travel.

- No foreign transaction fees, saving you 2.5% on international purchases.

Why choose this card?

A great alternative to travel cards that charge foreign transaction fees. If you make purchases in U.S. dollars or travel internationally, this card can save you money while giving you solid rewards.

Best Cash Back Credit Cards in Canada

Prefer cold, hard cash instead of travel perks? These cash back credit cards give you simple and flexible rewards.

Tangerine Money-Back Credit Card

Best for Customizable Categories

- Earn 2% cash back on two spending categories of your choice (e.g., groceries, gas, restaurants, entertainment, recurring bills).

- Earn 0.5% cash back on all other purchases.

- No annual fee and automatic cash back deposits to your bank account.

- Upgrade to the Tangerine World Mastercard for additional perks like rental car insurance and mobile device coverage.

Why choose this card?

This is one of the best no-fee cash back cards with the flexibility to customize your bonus categories.

Simplii Financial Cash Back Visa Card

Best for Dining and Everyday Purchases

- Earn 4% cash back on restaurants, bars, and coffee shops.

- Earn 1.5% cash back on gas, groceries, and drugstore purchases.

- Earn 0.5% cash back on everything else.

- No annual fee and easy cash redemption.

Why choose this card?

Ideal for food lovers who spend a lot on dining and want high cash back rates without an annual fee.

TD Infinite Cash Back Visa Card

Best for Everyday Spending

- Earn up to 3% cash back on groceries, gas, and recurring bill payments.

- Earn 1% cash back on all other purchases.

- Strong insurance benefits: Includes purchase security, extended warranty, and mobile device protection.

Why choose this card?

A great all-rounder with strong rewards on everyday spending without complex redemption rules.

Wealthsimple Cash Card

Best for Instant Cash Back

- Earn 1% cash back on every purchase.

- Instant cash back deposits into your Wealthsimple account.

- No foreign transaction fees, making it a great option for international spending.

- Works like a prepaid card, meaning no credit check required.

Why choose this card?

If you want real-time cash back rewards and a simple, fee-free spending experience, this is a great option.

The Final Word: Aligning with Your Lifestyle

At the end of the day, the best card for you aligns with your spending habits, financial goals, and personal preferences. If you’re all about jet-setting and love the idea of turning everyday spending into free travel, a travel rewards credit card could be your best bet. On the other hand, if you prefer cold hard cash in your pocket, cash back credit cards offer no-fuss rewards that you can spend however you like.

For many people, a hybrid strategy works best—using a travel card for big purchases that maximize points and a cash back card for day-to-day spending. That way, you get the best of both worlds without leaving any rewards on the table.

Shop Smart, Earn More with Great Canadian Rebates

Looking for the top-rated cash back credit cards or a rewarding Scotiabank credit card? With Great Canadian Rebates, you can earn cash back rebates while scoring deals from top retailers like Expedia Canada, AliExpress Canada, and SportChek.