Managing a household budget comes with a long list of responsibilities. Between groceries, utilities, childcare, and insurance, it can feel like the expenses never stop. However, with the right credit card strategy, your family can make the most of every dollar spent. By optimizing family credit card rewards, you can earn cash back or points on essential expenses, giving your finances a well-deserved boost.

In this guide, we’ll explore effective strategies for using credit card rewards to reduce household costs and highlight family-friendly cards that can help you achieve your financial goals. Whether you’re aiming for cash back, travel rewards, or both, we’ve got you covered with tips on how to maximize your family credit card rewards.

1. Understanding Family Credit Card Rewards

Before diving into strategies, it’s important to understand what family credit card rewards are and how they work. Simply put, credit card rewards are benefits you earn through your spending. These rewards come in the form of cash back, points, or miles and can be redeemed for a variety of rewards such as statement credits, travel, merchandise, or gift cards.

To maximize the potential of your rewards, it’s essential to understand the types of rewards available and how to earn them. Some cards offer flat-rate rewards (for example, 1.5% cash back on all purchases), while others provide higher rates on specific categories such as groceries, gas, or dining. Family expenses often fall into these categories, making it easy to earn rewards on daily purchases.

Top-rated cash back credit cards are ideal for families who want to save money and make everyday purchases work harder. With the right card, you can earn rewards on everything from utility bills to daycare expenses.

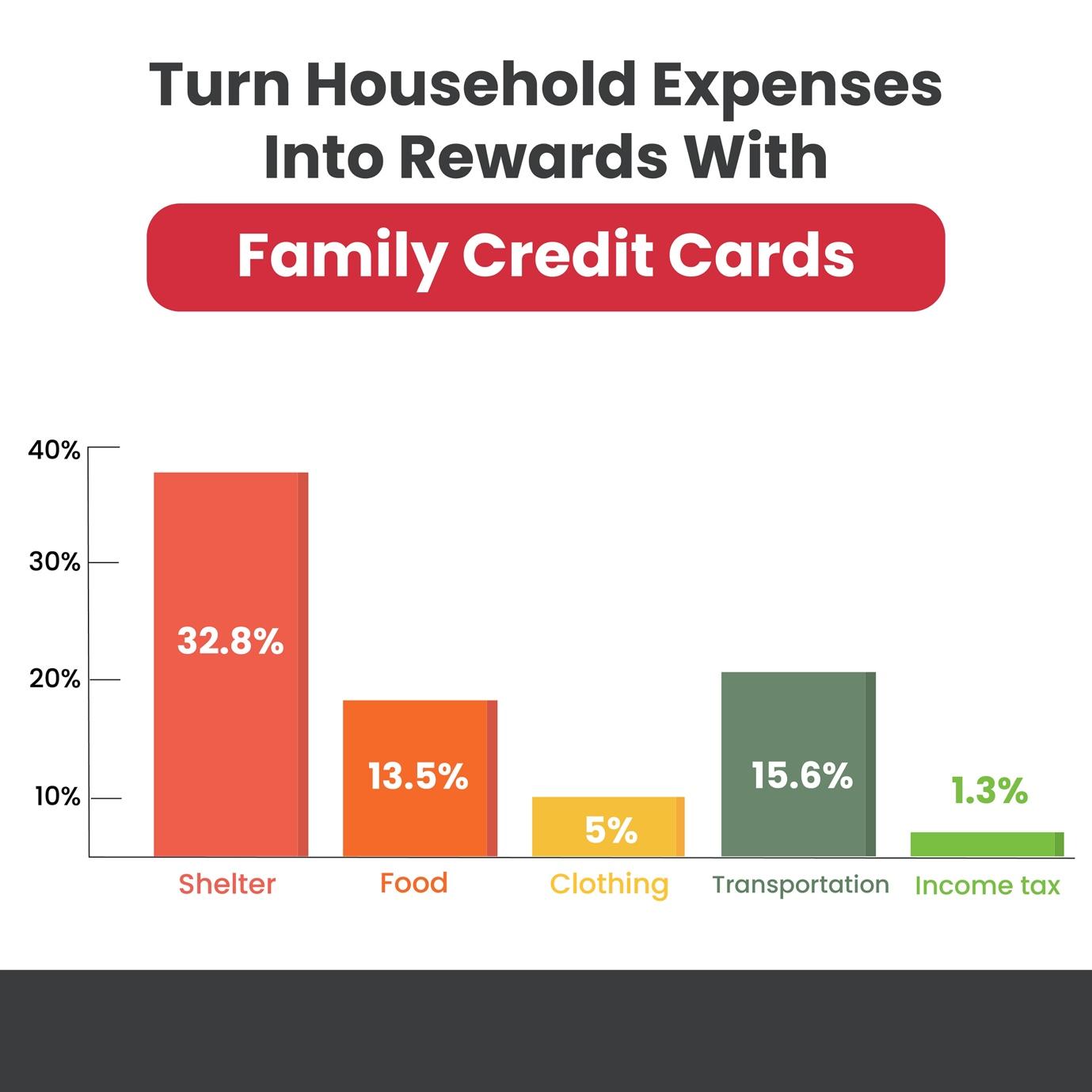

2. Identify Your Family’s Spending Habits

Before you start applying for credit cards, take a close look at your family’s spending habits. Where does most of your monthly budget go? Some common family expenses include:

- Groceries: Shopping for food is a major expense for most households.

- Utilities: Monthly bills for electricity, water, gas, and internet services.

- Childcare: Expenses for daycare, after-school programs, and babysitters.

- Insurance: Home, auto, and health insurance premiums.

- Transportation: Gas, public transit, and car maintenance.

By categorizing your spending, you can identify which cards offer the best rewards for your family’s needs. For instance, if groceries make up a significant portion of your expenses, choose a card that provides bonus points or cash back for grocery purchases. If childcare is a major recurring cost, look for a card that offers bonus rewards for recurring payments.

Bonus Tip: Use Credit Cards for Regular Payments

Many families pay for services like daycare, utilities, and insurance via monthly or annual payments. You can easily optimize your credit card rewards by using your card for these recurring expenses. Some credit cards offer bonus points for recurring charges, helping you earn even more without any additional effort.

3. Choose the Right Family-Friendly Credit Cards

Not all credit cards are created equal when it comes to family expenses. Here are some family credit card rewards options that offer excellent benefits for Canadian families:

- Platinum Card Amex Canada – A premium card that offers a suite of travel and dining perks, making it ideal for families who travel frequently. With a solid rewards structure and access to exclusive benefits, this card can help families accumulate valuable points that can be redeemed for travel or merchandise.

- Wealthsimple Cash Card – A great no-fee card for everyday purchases. With no annual fee and easy cash back rewards, it’s a straightforward option for families who want to earn cash back on all purchases, from groceries to entertainment.

- Marriott Bonvoy Credit Cards – Perfect for families who travel often. Marriott Bonvoy cards earn points that can be used for hotel stays, making it easier to plan family vacations. Additionally, these cards come with bonus points for everyday spending, especially in categories like dining and travel.

- Amex Gold Credit Card – Known for its high rewards rate on groceries, dining, and entertainment, the Amex Gold Credit Card is ideal for families who spend heavily in these categories. The card’s benefits make it easy to rack up points quickly.

- Amex Business Platinum Card – This card offers premium benefits and rewards that cater to families with side businesses. With its high points earning potential and travel perks, it’s a great choice for families who frequently purchase business-related items, as well as personal goods.

By selecting the right card for your spending habits, you can maximize rewards and reduce the cost of everyday purchases.

4. Automate Recurring Expenses for Earning Rewards

One of the most effective strategies for earning rewards is to automate your recurring family expenses. Many households have regular, monthly bills such as utilities, insurance premiums, phone plans, and childcare payments. These types of expenses can easily be paid using your credit card, allowing you to earn rewards automatically.

By setting up automated payments, you don’t have to worry about missing deadlines, and you’ll continue earning rewards on essential purchases. Additionally, many credit cards offer extra points or cash back for recurring payments, making this an excellent way to maximize rewards.

Common Recurring Expenses to Automate:

- Utilities: Gas, water, electricity, internet, and phone bills.

- Insurance: Health, home, and auto insurance premiums.

- Subscriptions: Streaming services, gym memberships, and digital services.

- Childcare: Daycare and after-school programs.

Make sure to track your spending carefully and ensure that you’re not spending more than necessary to earn rewards. Also, ensure that any recurring charges are set up as automatic payments to avoid missing out on rewards.

5. Use Supplementary Cards for Family Members

Many credit card issuers allow families to add supplementary cardholders to their account at no extra charge. By providing your spouse, children, or other family members with their own authorized cards, you can accumulate points even faster.

For example, if you give your teenager a supplementary card to buy groceries or gas, you can earn rewards for their purchases as well. Keep track of these purchases, especially if you’re managing a family budget, but this is an easy way to increase the number of points or cash back you earn on everyday purchases.

6. Redeem Your Rewards Wisely

Once you’ve earned enough rewards, the next step is figuring out the best way to redeem them. Many cards allow you to redeem points for:

- Statement Credits: Use points to offset your monthly bills or purchases.

- Travel: Use points for flights, hotel stays, or car rentals.

- Gift Cards: Choose from a variety of popular retailers, from grocery stores to restaurants.

- Merchandise: Redeem points for electronics, home appliances, or other items you might need for your family.

When redeeming rewards, be sure to consider your family’s needs and preferences. For instance, if you’re planning a vacation, using points for travel may provide the most value. On the other hand, if you prefer to lower your monthly expenses, using rewards for statement credits can help reduce your bills.

Some cards, such as the Amex Gold Credit Card and Platinum Card Amex Canada, offer enhanced redemption options for travel rewards, which can be ideal if you’re looking to plan a family vacation.

7. Take Advantage of Promotional Offers and Sign-Up Bonuses

Credit card issuers often offer attractive sign-up bonuses and promotional offers, especially for new cardholders. These bonuses can help you boost your reward balance right from the start.

For example, many cards provide a large sign-up bonus if you meet a certain spending threshold within the first few months. Cards like the Marriott Bonvoy Credit Cards and Amex Business Platinum Card often feature substantial bonuses that can be used for travel, hotel stays, or other family expenses.

Keep an eye out for seasonal promotions and limited-time offers as well. Credit card companies may run promotions where you can earn extra points or cash back for specific categories like dining, travel, or grocery shopping. By taking advantage of these promotions, you can quickly accumulate rewards.

8. Monitor Your Spending and Stay Within Budget

To ensure that you’re truly benefiting from credit card rewards, it’s important to monitor your spending. While credit cards can offer great perks, they can also encourage overspending if you’re not careful.

Be sure to:

- Pay off your balance in full each month to avoid interest charges.

- Set spending limits for family members with supplementary cards.

- Track rewards and expenditures to ensure you’re not overspending.

Need More Advice? Head Over to Our Website!

Optimizing family credit card rewards requires a strategic approach, but the rewards are well worth the effort. By identifying your family’s spending habits, choosing the right cards, and redeeming rewards wisely, you can save money, earn valuable benefits, and make the most of everyday expenses.

For Canadian families looking to maximize credit card cash back and rewards, we recommend checking out Great Canadian Rebates. Our platform offers an easy way to compare credit cards and find the best options to help you save on family expenses.