Groceries are a significant part of everyone’s budget, and it’s only wise to make your spending work for you. In Canada, there are various credit cards that reward you for doing something you’re already doing—buying groceries!

Whether you’re looking for top-rated cash back credit cards or points that you can redeem for travel or other perks, choosing the right credit card can result in meaningful savings. In this blog, we’ll compare the best grocery rewards credit cards in Canada and provide tips for maximizing your rewards and cash back.

What to Look for in a Grocery Rewards Credit Card

Before diving into the best credit cards, it’s essential to understand what factors to consider when choosing a credit card for grocery shopping. Here are the main considerations:

1. Cash Back vs. Points

Some credit cards offer cash back on grocery purchases, while others reward you with points that can be redeemed for travel, gift cards, or merchandise. If you prefer instant savings, cash-back cards may be more suitable. However, if you travel often or enjoy the flexibility of rewards, a points-based card might be a better fit.

2. Bonus Categories

Many credit cards offer enhanced rewards on specific spending categories like groceries, dining, or gas. Some cards may offer a higher reward rate for grocery purchases, while others might include groceries in broader categories. Check whether your chosen card offers bonus categories on other types of spending you do frequently.

3. Annual Fees

Premium credit cards often come with higher annual fees but provide superior rewards and benefits. If you’re considering a premium card, calculate whether the rewards and benefits will offset the cost of the annual fee. For those who want to avoid annual fees, there are plenty of no-fee cards that still offer great rewards on groceries.

4. Acceptance and Restrictions

Some cards limit where you can earn bonus rewards. For example, grocery store warehouse clubs like Costco or Walmart may not be included in the bonus categories, even though they carry groceries. Be sure to read the fine print to ensure your favorite grocery stores are included in the bonus rewards structure.

5. Sign-Up Bonuses and Promotions

Many credit cards offer lucrative sign-up bonuses. These bonuses are often offered in the form of extra points or cash back after spending a certain amount within the first few months. Take advantage of these promotions to maximize your rewards early on.

Best Grocery Rewards Credit Cards in Canada

Now that you know what to look for, let’s dive into some of the best grocery rewards credit cards in Canada that offer the most generous rewards for your grocery spending.

1. Platinum Card® from American Express Canada

Points: Earn 3 Membership Rewards points per $1 spent on groceries

Bonus: Up to 60,000 Membership Rewards points

Annual Fee: $699

The Platinum Card® from American Express Canada is a premium offering that gives you access to travel rewards, grocery rewards, and more. While its annual fee may be steep, the benefits far outweigh the cost, especially if you’re someone who enjoys the finer things in life. You’ll earn 3 Membership Rewards points per $1 spent on groceries, which adds up quickly.

Why we love it:

In addition to the generous grocery rewards, the Platinum Card® offers elite travel benefits like airport lounge access, travel insurance, and exclusive offers for dining and shopping. If you’re looking for both grocery rewards and premium travel perks, this card is a top contender.

2. Marriott Bonvoy Credit Cards

Points: Earn up to 5 points per $1 spent at participating Marriott Bonvoy hotels and grocery purchases at grocery store partners

Bonus: 75,000 points for new cardholders

Annual Fee: $120

The Marriott Bonvoy Credit Cards provide excellent value for anyone who enjoys travel and hotel stays. You’ll earn up to 5 Marriott Bonvoy points per $1 spent at participating Marriott properties and select grocery stores. If you’re loyal to Marriott or travel often, the points you accumulate on your grocery purchases can be redeemed for free nights and other travel-related rewards.

Why we love it:

It’s a great choice if you’re someone who enjoys staying at Marriott hotels. The ability to earn points on grocery purchases, combined with travel rewards, makes this card a versatile option for frequent travelers.

3. Amex Business Platinum Card

Points: Earn 1.5 points per $1 spent on business-related purchases, including groceries

Bonus: 75,000 Membership Rewards points

Annual Fee: $499

The Amex Business Platinum Card is an excellent option for business owners, offering 1.5 Membership Rewards points per $1 spent on most purchases, including groceries. It’s designed for entrepreneurs who want to earn rewards on everyday expenses while enjoying business perks like extended warranties, travel insurance, and VIP access to events.

Why we love it:

If you run a business and frequently purchase groceries for office supplies or team events, this card rewards you with points on everyday purchases. Plus, the 75,000-point bonus is an enticing offer that can be used for travel or other rewards.

4. Wealthsimple Cash Card

Cash Back: 1% on all purchases, including groceries

Bonus: None

Annual Fee: $0

The Wealthsimple Cash Card is a no-fee, cash back card that provides 1% cash back on all purchases, including groceries. While it doesn’t have the same level of rewards as some premium cards, it’s a simple and effective way to earn cash back on your grocery spending without worrying about an annual fee.

Why we love it:

For those who don’t want to deal with annual fees or complicated reward systems, the Wealthsimple Cash Card is an easy option. The 1% cash back on all purchases makes it a good choice for those looking to earn rewards on groceries, dining, and other spending.

5. Amex Gold Credit Card

Points: Earn 2 Membership Rewards points per $1 spent on groceries

Bonus: 25,000 Membership Rewards points

Annual Fee: $250

The Amex Gold Credit Card is a great middle-ground option for grocery rewards. With 2 Membership Rewards points per $1 spent on groceries, it offers a solid rate of return without the high fees associated with premium cards like the Platinum Card®. The 25,000-point sign-up bonus is another perk that makes this card a strong contender.

Why we love it:

The Amex Gold Credit Card is perfect for those who want good grocery rewards and the flexibility to redeem points for travel, merchandise, and more. The relatively low annual fee compared to the Platinum Card® makes it an excellent choice for those seeking value without the hefty price tag.

Maximizing Savings on Grocery Purchases

To get the most out of your grocery rewards credit card, here are some tips to help you maximize your savings:

Use the Right Card for the Right Purchase

Stick to the card that offers the highest rewards rate for groceries. If you also spend a lot on dining, consider using a different card that offers bonus rewards in that category.

Sign-Up Bonuses

Many cards offer lucrative sign-up bonuses, so make sure to take advantage of them. Be mindful of any spending thresholds to ensure you qualify for the bonus.

Watch for Special Promotions

Keep an eye out for promotional offers that increase rewards in specific categories. For example, some credit cards offer extra points on groceries during certain periods.

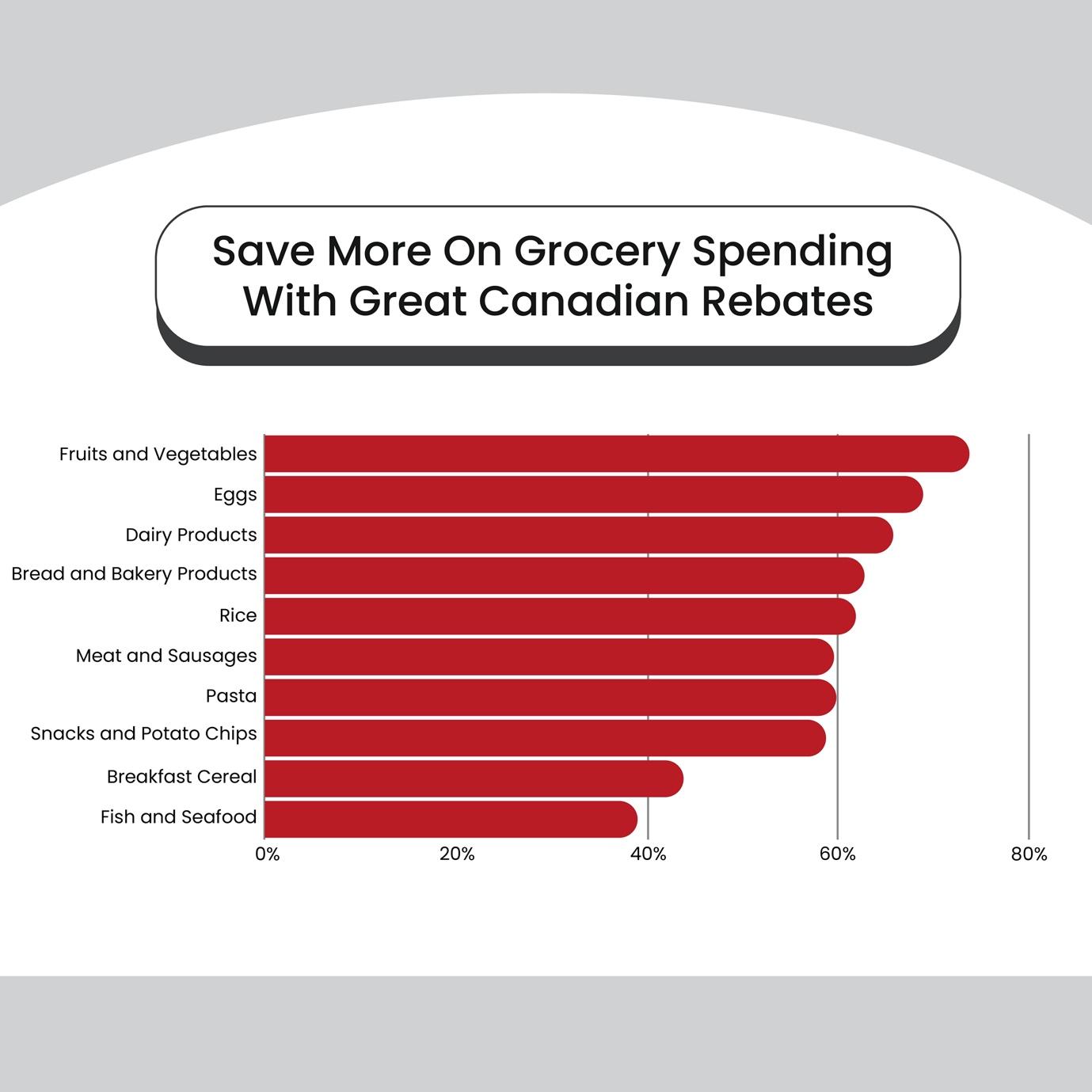

Use Great Canadian Rebates

When shopping online or through partner retailers, use Great Canadian Rebates to earn extra cash back on your purchases.

Why These Cards Stand Out for Grocery Shopping

When it comes to grocery rewards, the cards we’ve highlighted above offer the best value for Canadian shoppers. Each one brings unique benefits to the table, making them ideal for maximizing your grocery shopping rewards. From premium benefits to simple cash back, these cards cover a wide range of preferences.

The Platinum Card® from American Express Canada stands out not only for its grocery rewards but also for its exclusive travel perks, making it a top choice for those who value both everyday rewards and premium benefits.

The Marriott Bonvoy Credit Cards offer a fantastic way to earn points that can be redeemed for hotel stays or travel rewards, making them an excellent option for those who travel frequently. Plus, the grocery rewards come as a bonus to an already rewarding travel-focused card.

For business owners, the Amex Business Platinum Card is a solid pick. It allows you to earn points on your business-related expenses, including groceries and provides valuable business-oriented perks.

The Wealthsimple Cash Card is a no-fee option that offers a simple 1% cash back on all purchases, including groceries, making it a great choice for those looking for a straightforward way to earn rewards without the hassle of an annual fee.

Finally, the Amex Gold Credit Card provides excellent rewards on groceries and dining, making it a perfect balance between everyday rewards and travel flexibility.

Each of these cards provides valuable grocery rewards, and choosing the right one depends on your spending habits and goals.

Find the Best Credit Card Deals with Great Canadian Rebates

Choosing the right grocery rewards credit card can make a significant difference in your savings. To compare the best grocery rewards credit cards, visit Great Canadian Rebates. We offer the latest deals and promotions to help you maximize your rewards and cash back.