Hey there, fellow Canucks! If you’re looking to keep more loonies in your pocket while tackling everyday expenses like groceries, gas, and online shopping, you’ve come to the right place. Let’s dive into some slick strategies that can help you rake in the cash back and save big on your daily spending.

The Power of Cash Back Credit Cards

First things first, let’s talk about cash back credit cards. These nifty pieces of plastic reward you for making purchases by giving you a percentage of your spending back. It’s like getting a little thank-you note from your bank every time you swipe.

Top Cash Back Credit Cards in Canada

Here are some of the top-rated cash back credit cards that can help you maximize your savings:

- American Express Cobalt Card: This card offers 5% cash back on eligible eats and drinks in Canada (including groceries and dining) for the first $30,000 annually, and 1% thereafter. Plus, 2% back on travel and transit, and 1% on everything else.

- TD Cash Back Visa Infinite Card: Earn 3% cash back on eligible grocery and gas purchases, as well as on regularly recurring bill payments set up on your account. All other purchases earn 1% cash back.

- Tangerine Money-Back Credit Card: This card lets you earn 2% cash back in up to three categories of your choice (such as groceries, gas, or recurring bill payments) and 0.5% on all other purchases.

- SimplyCash Preferred Card from American Express: Offers 4% cash back on eligible gas and grocery purchases in Canada (up to $1,200 cash back annually), and 2% cash back on all other purchases.

When choosing a card, consider your spending habits and look for one that offers the highest rewards in the categories where you spend the most.

Leveraging Cash Back Rebate Platforms

Why stop at credit card rewards when you can double-dip with cash back rebate platforms? These online services partner with retailers to give you a portion of your purchase back when you shop through their links.

Popular Cash Back Platforms in Canada

- Great Canadian Rebates: Established in 2005, this platform offers cash back and coupons from over 900 well-known merchants. You can save at least 5% on average in cash back rebates, sales links, and coupons.

- Rakuten Canada: Formerly known as Ebates, Rakuten partners with over 750 stores, offering up to 30% cash back on purchases. They also provide in-store cash back options and feature a variety of deals and coupons.

- Paymi: This platform allows you to securely link your debit or credit cards for automatic cash back earnings at your favorite Canadian stores and restaurants.

To maximize your savings, always check these platforms before making a purchase to see if your retailer is partnered with them.

Combining Store Loyalty Programs

Many retailers offer loyalty programs that reward you with points or discounts on future purchases. By stacking these programs with your cash back credit card and rebate platforms, you can triple-dip on savings.

Examples of Store Loyalty Programs

- PC Optimum: Offered by Loblaws-owned stores (like Real Canadian Superstore and No Frills), this program lets you earn points on purchases, which can be redeemed for discounts on future shopping trips.

- Canadian Tire Triangle Rewards: Earn Canadian Tire Money on purchases at Canadian Tire, Sport Chek, and participating gas stations, which can be used towards future purchases.

Before shopping, ensure you’re enrolled in the store’s loyalty program and use your membership at checkout.

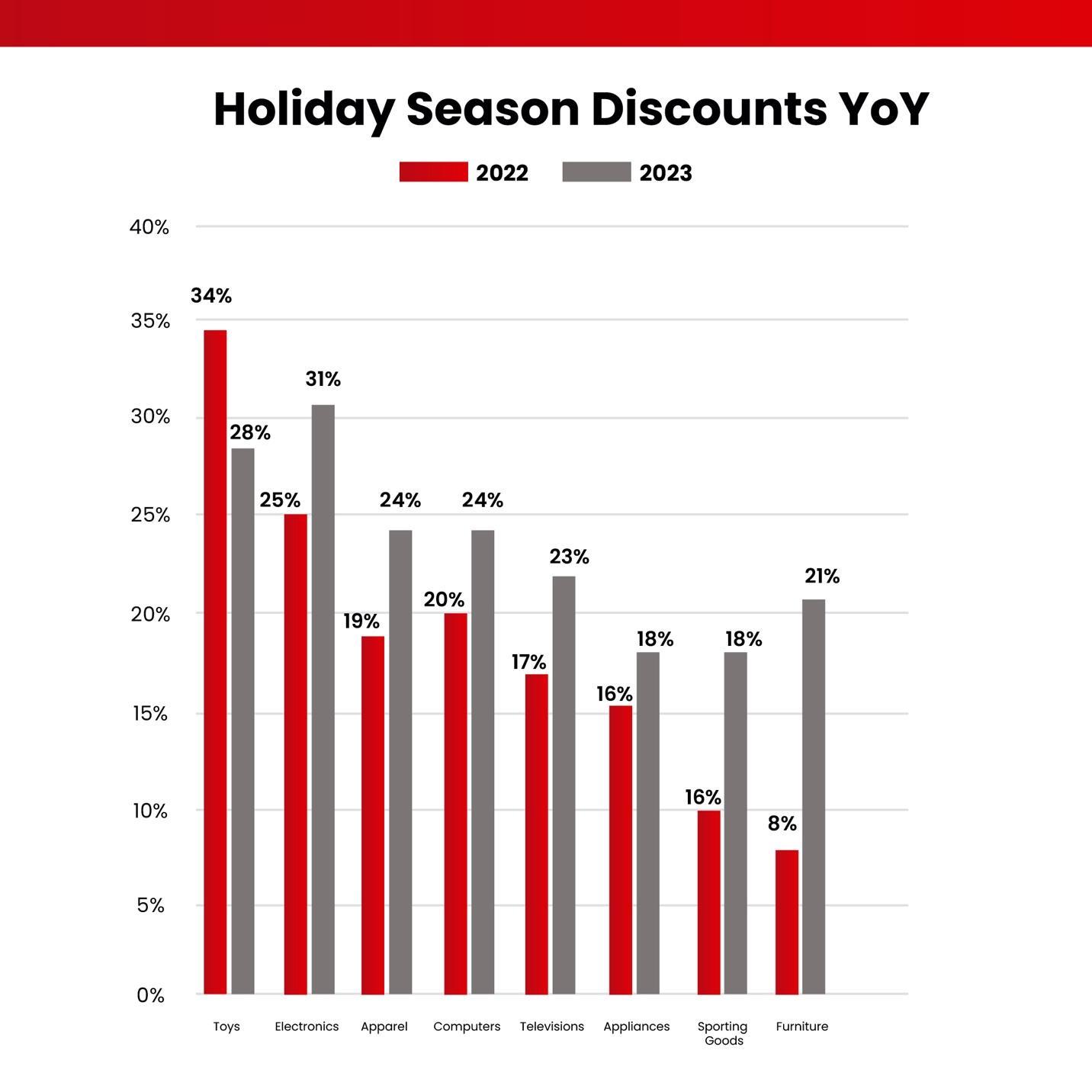

Timing Your Purchases with Seasonal Deals

Being strategic about when you make big purchases can lead to significant savings. Retailers often offer substantial discounts during certain times of the year.

Key Shopping Periods

- Black Friday and Cyber Monday: Held in late November, these events offer massive discounts across various product categories.

- Boxing Day: On December 26th, many retailers clear out inventory with deep discounts.

- Back-to-School Season: Late summer often brings sales on school supplies, electronics, and clothing.

Plan your major purchases around these periods to take advantage of the best deals.

Leveraging Credit Card Promotions

Credit card issuers frequently run promotions that offer bonus cash back or points for spending in specific categories or with certain retailers.

How to Stay Informed

- Email Notifications: Subscribe to your credit card issuer’s newsletters to receive updates on current promotions.

- Mobile Apps: Many banks have apps that notify you of ongoing offers and promotions.

- Online Account Portals: Regularly check your credit card’s online account portal for available offers.

By staying informed, you can take advantage of these promotions to maximize your cash back earnings.

Real-Life Strategies for Everyday Savings

Let’s put it all together with some actionable tips:

- Use the Right Card for the Right Purchase: For example, use your American Express Cobalt Card for dining and groceries to earn higher cash back rates.

- Shop Through Rebate Platforms: Before making an online purchase, check if the retailer is partnered with platforms like Great Canadian Rebates or Rakuten Canada to earn additional cash back.

- Enroll in Store Loyalty Programs: Always use your loyalty card at checkout to accumulate points or discounts.

- Plan Big Purchases Around Sales Events: Wait for major sales events like Black Friday to make significant purchases.

- Stay Updated on Credit Card Promotions: Regularly check for special offers from your credit card issuer to earn bonus cash back.

By implementing these strategies, you can maximize your savings and keep more money in your pocket.

More Cash Back Hacks: Even More Ways to Save Big in Canada!

You thought we were done? Nope! There are even more ways to squeeze extra savings out of your everyday spending. Let’s take a deeper dive into next-level hacks that can help you stack rewards and save more than the average shopper.

Hack #1: Use Multiple Credit Cards Strategically

Not all cash back cards are created equal. Instead of relying on just one, why not use multiple cards to maximize your rewards?

Here’s how it works:

- Groceries & Dining → American Express Cobalt Card (5% cash back on food & drinks)

- Gas & Recurring Bills → TD Cash Back Visa Infinite (3% cash back)

- Everything Else → Tangerine Cash Back Card (Choose two 2% categories + 0.5% on everything else)

By rotating between the right cards for the right purchases, you’re ensuring that you maximize your cash back across all spending categories.

Hack #2: Automate Your Savings with Recurring Bill Payments

Did you know you can earn cash back just by paying your bills? Many cash back credit cards offer rewards on recurring payments like:

- Cell phone plans

- Internet & cable bills

- Netflix, Disney+, Spotify subscriptions

- Utility bills (where credit cards are accepted)

Sign up for automatic payments on your cash back credit card, and you’ll effortlessly earn rewards every month.

Pro Tip: If your card doesn’t offer bonus cash back on bill payments, you can buy gift cards for your service provider from grocery stores that offer higher cash back rates!

Hack #3: Double-Dip with Cash Back Apps

There are apps that give you cash back on top of what you already earn with your credit card. Stack them for maximum savings.

Here are some of the best:

- Checkout 51 → Get cash back on groceries just by snapping your receipt!

- Caddle → Get paid for answering surveys, scanning receipts, and writing product reviews.

- Drop → Earn points on purchases at partnered retailers, which can be redeemed for gift cards.

Use these apps alongside your cash back credit card and rebate platforms like Great Canadian Rebates for triple-dip savings!

Hack #4: Buy Gift Cards for Extra Cash Back

Buying gift cards is one of the most overlooked hacks for earning bonus rewards.

How to Do It:

- Use a credit card that earns high cash back at grocery stores (like the American Express Cobalt Card).

- Buy gift cards for places where you frequently shop (Amazon, Walmart, Tim Hortons, Starbucks, Uber, etc.).

- Use the gift card instead of your credit card for purchases at those stores.

Example: If you buy a $500 gift card at a grocery store that earns 5% cash back, that’s $25 back instantly. You wouldn’t get that kind of return using your regular credit card at those retailers.

Hack #5: Make Your Big Purchases During Sign-Up Bonuses

Planning to buy a new laptop, TV, or furniture? Time your purchase with a new credit card sign-up bonus!

Many cards offer welcome bonuses where you can earn $200+ in cash back when you spend a certain amount within the first three months.

How to Take Advantage:

- Find a credit card with a high welcome offer.

- Plan your big-ticket purchase right after getting approved.

- Hit the spending requirement in one go, and score your bonus rewards!

��� Example: Say a card gives you 10% cash back up to $200 in your first 3 months. If you were already planning a $2,000 furniture purchase, this means you just earned $200 free!

Hack #6: Use Online Promo Codes and Coupons

Stacking coupon codes with cash back platforms is a super hack for online shopping. Before you buy anything, make sure to check:

- Great Canadian Rebates for cash back opportunities.

- Retailer’s website for exclusive promo codes.

- Third-party coupon sites like Reebee or Save.ca.

Hot Retailer-Specific Discounts:

- Staples Coupon Code Canada → Save on office supplies.

- SportChek Promo Code → Get deals on shoes, sportswear, and outdoor gear.

- Canadian Tire Coupons → Great for home improvement and auto supplies.

- Dell Canada Coupon Code → Save on laptops and accessories.

- Shein Coupon Code Canada → Fashion deals on a budget.

Using these codes alongside cash back platforms and the right credit card = stacked savings!

Hack #7: Buy in Bulk and Split the Cost

Warehouse clubs like Costco and Bulk Barn offer big savings when you buy in large quantities. But what if you don’t need 20 lbs of rice or a giant pack of toilet paper?

Here’s the trick:

- Team up with family or friends and split the cost.

- Use a cash back credit card to earn rewards on the total.

- Pay each other back via Wealthsimple Cash Card or Interac e-Transfer to make it seamless.

Now, you’re saving money, earning cash back, and not hoarding a lifetime supply of toothpaste.

Hack #8: Set Up Price Drop Alerts

Nothing’s worse than buying something and seeing the price drop the next day. Avoid this by using price tracking tools.

- Honey → Automaticallyapplies coupons at checkout and tracks price drops.

- CamelCamelCamel → Tracks Amazon price history and sends alerts.

- Reebee → Comparesweekly flyers from major Canadian retailers.

Many credit cards also offer price protection, meaning if the price drops within a certain time frame, you can request a refund for the difference.

Bonus Tip: If a store doesn’t offer price matching, return the item and rebuy it at the lower price!

Hack #9: Travel Smart & Stack Rewards

Cash back savings don’t stop at groceries and online shopping—you can also save on travel!

How to Save Big on Travel

- Use cash back credit cards to book flights and hotels.

- Book through Expedia Canada for cash back opportunities.

- Look for marriottbonvoy credit cards Canada to earn hotel rewards while getting cash back.

- Use Rogers World Elite Mastercard for no foreign transaction fees + cash back on travel purchases.

Extra Hack: Many credit cards offer free travel insurance, so check your benefits before paying extra for coverage!

Conclusion

Saving money on everyday purchases doesn’t have to be a chore. With the right combination of cash back credit cards, rebate platforms, store loyalty programs, and strategic shopping, you can make the most of your spending and enjoy substantial savings. Happy shopping, and may the cash back be ever in your favor!

Start Saving with Great Canadian Rebates

Want to earn cash back rebates while shopping online? Great Canadian Rebates makes it easy to save money on everyday purchases with top deals and online coupons. With hundreds of merchants to choose from, shopping and saving has never been more rewarding.