In an increasingly cashless economy, financial wellness is not merely about saving but also about spending smarter. The role of cash back programs has become pivotal in this regard, as they encourage better financial habits while offering tangible rewards for everyday transactions. Particularly, online cash back platforms lead the way, proving how cash back can significantly impact financial wellness.

Let’s explore how cash back and financial wellness play an instrumental role in promoting smarter spending and creating opportunities for sustainable savings.

What Are Cash Back Programs?

Cash back programs reward consumers for their spending by returning a percentage of the amount spent. These programs operate through partnerships between merchants, financial institutions, and cash back platforms. The consumer’s participation—whether by using specific credit cards, shopping through cash back portals, or signing up for membership—results in financial returns that incentivize smarter spending decisions.

By understanding how these programs function, consumers can make informed decisions to maximize their financial benefits. For instance, Great Canadian Rebates allow users to shop through its portal to earn cash back rebates from various retailers, combining convenience with savings.

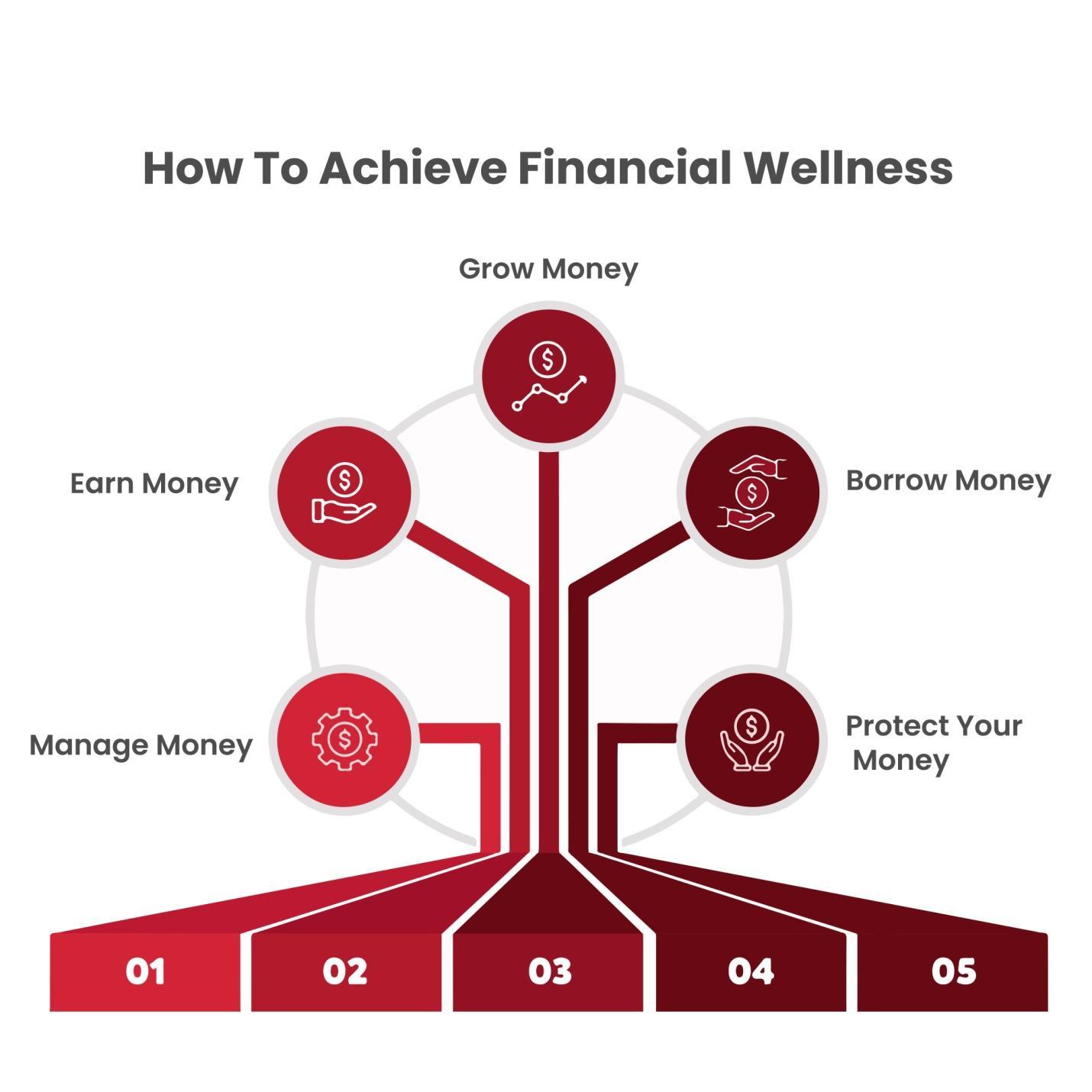

Financial Wellness: A Holistic View

Financial wellness extends beyond having a budget; it’s about achieving stability, minimizing financial stress, and making informed decisions. A cash back program’s integration into this equation can:

1. Promote Smarter Spending

Cash back encourages buyers to think critically about where and how they spend their money.

2. Enhance Savings

Receiving money back adds an additional layer of savings, which can be directed toward financial goals like investments, emergencies, or debt repayment.

3. Boost Mental Well-being

Knowing that every purchase brings a financial benefit promoting a sense of satisfaction and control.

Great Canadian Rebates: Revolutionizing Cash Back

When it comes to cash back, Great Canadian Rebates (GCR) stands out as Canada’s leading portal, offering substantial savings across a wide range of categories. Here’s how GCR contributes to financial wellness:

- Extensive Merchant Network: With hundreds of partnered retailers—from travel to electronics—GCR makes earning cash back rebates seamless for diverse shopping needs.

- User-Friendly Interface: GCR’s portal simplifies the process, allowing users to find offers, click, and shop without hassle.

- Transparent Payouts: The platform provides clarity on how much cash back users will earn, removing any guesswork.

By consistently updating its offerings and enhancing user experience, GCR empowers Canadians to save more while enjoying their shopping experience.

Cash Back Credit Cards: The Perfect Companion

GCR’s partnerships with leading financial institutions bring added benefits through top-rated cash back credit cards in Canada. Some top options include:

1. American Express SimplyCash™ Preferred Card

- Earn 4% cash back on gas and groceries.

- Earn 2% on all other purchases.

2. Tangerine Money-Back Credit Card

- Choose from 2 categories to earn up to 2% cash back, offering flexibility for your unique spending habits.

- Earn 0.5% on all other purchases.

3. Neo World Elite® Mastercard

- Earn5% cash back on groceries.

- Earn 4% cashback on recurring bills.

- Earn 3% cashback on gas.

- Earn 1% on all other purchases.

4. Simplii Financial™ Cash Back Visa* Card

- Earn 4% cash back on restaurant, bar and coffee shop purchases, up to $5,000 per year.

- Earn 1.5% cash back on gas, groceries, drugstore purchases and pre-authorized payments,

up to $15,000 per year. - Earn 0.5% cash back on all other purchases with no limit.

These cash back credit cards amplify financial wellness by aligning rewards with routine expenditures, ensuring every dollar works harder for you.

Benefits of Cash Back for Financial Wellness

Cash back for financial wellness has several benefits. These include:

1. Encourages Budget-Friendly Shopping

Cash back programs inherently reward frugality. By providing a return on purchases, they shift the focus to value-driven decisions. For instance, if you know you’ll receive a 10% rebate on electronics, you’re more likely to prioritize high-quality, necessary purchases over impulsive ones.

Additionally, these programs can influence consumers to seek out retailers offering higher cash back rebates, promoting mindful spending habits that align with their financial goals.

2. Builds a Passive Savings Habit

The small amounts earned through cash back accumulate over time, creating an effortless savings pool. With a reputable cash back platform, these savings can be transferred directly to your bank account, PayPal, or even reinvested in future purchases. Over months or years, these seemingly minor earnings can contribute significantly to larger financial objectives, such as a down payment on a home or an emergency fund.

3. Simplifies Financial Planning

With consistent returns from cash back, planning for short-term goals becomes easier. For example, families can allocate these funds towards holiday shopping, school supplies, or leisure activities, reducing reliance on credit. Additionally, cash back earnings can be integrated into monthly budgets, providing a predictable source of supplementary income.

4. Reduces Financial Stress

Cash back programs mitigate the sting of spending. Knowing that a portion of your money returns helps manage guilt and stress associated with significant purchases. Platforms like GCR further ease this process by offering user-friendly tools to track and redeemcash back rewards. This added transparency builds confidence in spending, turning purchases into opportunities for savings.

Case Studies: Real-Life Applications

Case Study 1: Grocery Savings

Scenario: A family spends $500 monthly on groceries.

- Solution: By shopping through GCR with a 2% cash back rate, they save $10 monthly, amounting to $120 annually.

Case Study 2: Student Budgeting

Scenario: A student spends $1,000 annually on textbooks and supplies.

- Solution: Using GCR to shop at retailers like Staples Canada, they earn 1.25% cash back, saving $12.50 annually.

Case Study 3: Small Business Essentials

Scenario: A small business owner spends $5,000 annually on office supplies, technology, and shipping services.

- Solution: By shopping through GCR’s partnered retailers like Staples Canada (1.25% cash back on office supplies) and Dell Canada (up to 3% cash back on accessories), they earn $62.50 annually on office supplies and $75 on accessories, totaling $137.50 in cash back savings.

These examples highlight how even modest savings can accumulate over time, contributing to better financial health.

How to Maximize Cash Back and Financial Wellness

1. Combine Platforms

Use GCR alongside top cash back credit cards in Canada to maximize earnings. For instance, purchasing through the GCR portal with a card like the American Express SimplyCash Preferred doubles your rewards. This synergy ensures that you’re leveraging every available opportunity to save.

2. Stay Informed

Regularly check GCR’s website for exclusive promotions, limited-time offers, and increased cash back rates. Staying proactive ensures you never miss out on added benefits. Subscribing to newsletters or alerts can further streamline this process.

3. Align with Needs

Choose cash back categories or merchants that align with your lifestyle. For instance, frequent travelers can leverage GCR’s partnerships with airlines and hotels to save on bookings by using an Amex Aeroplan Card. Similarly, families can focus on groceries and household essentials to maximize returns in areas of high expenditure.

4. Redeem Strategically

Reinvest your cash back earnings into areas that further financial wellness, such as paying off debt, building an emergency fund, or contributing to retirement accounts. Alternatively, you can use these earnings to fund indulgences guilt-free, knowing they were effectively “earned” through smarter spending.

Partner With Great Canadian Rebates for Financial Wellness

If you’re looking to embark on the path to cash back and financial wellness, trust Great Canadian Rebates. Our online platform provides information on a wide range of top credit cards in Canada and gives generous cash back rebates upon approval of credit cards applied for through our website. Visit the website today for more information.