In Canada, cash back shopping has become a go-to strategy for saving money. Whether you’re buying groceries, electronics, or booking travel, platforms offering cash back rewards have transformed the shopping experience. However, not all cash back platforms are created equal.

Let’s dive deep into the comparison of cash back rates in Canada across major platforms and look at why Great Canadian Rebates (GCR) is a standout choice for savvy shoppers.

Understanding Cash Back Platforms

Cash back platforms are online services that reward users with a percentage of their purchase amount when they shop through affiliate links. These platforms partner with retailers to provide incentives to customers while earning a commission for directing traffic to the stores. The concept is simple: you shop, and a portion of your spending is returned as cash back.

In Canada, leading cash back platforms include Great Canadian Rebates, Rakuten, and Koho, among others. While they all offer rewards, their rates, retailer partnerships, and additional features differ significantly.

Why Compare Cash Back Rates?

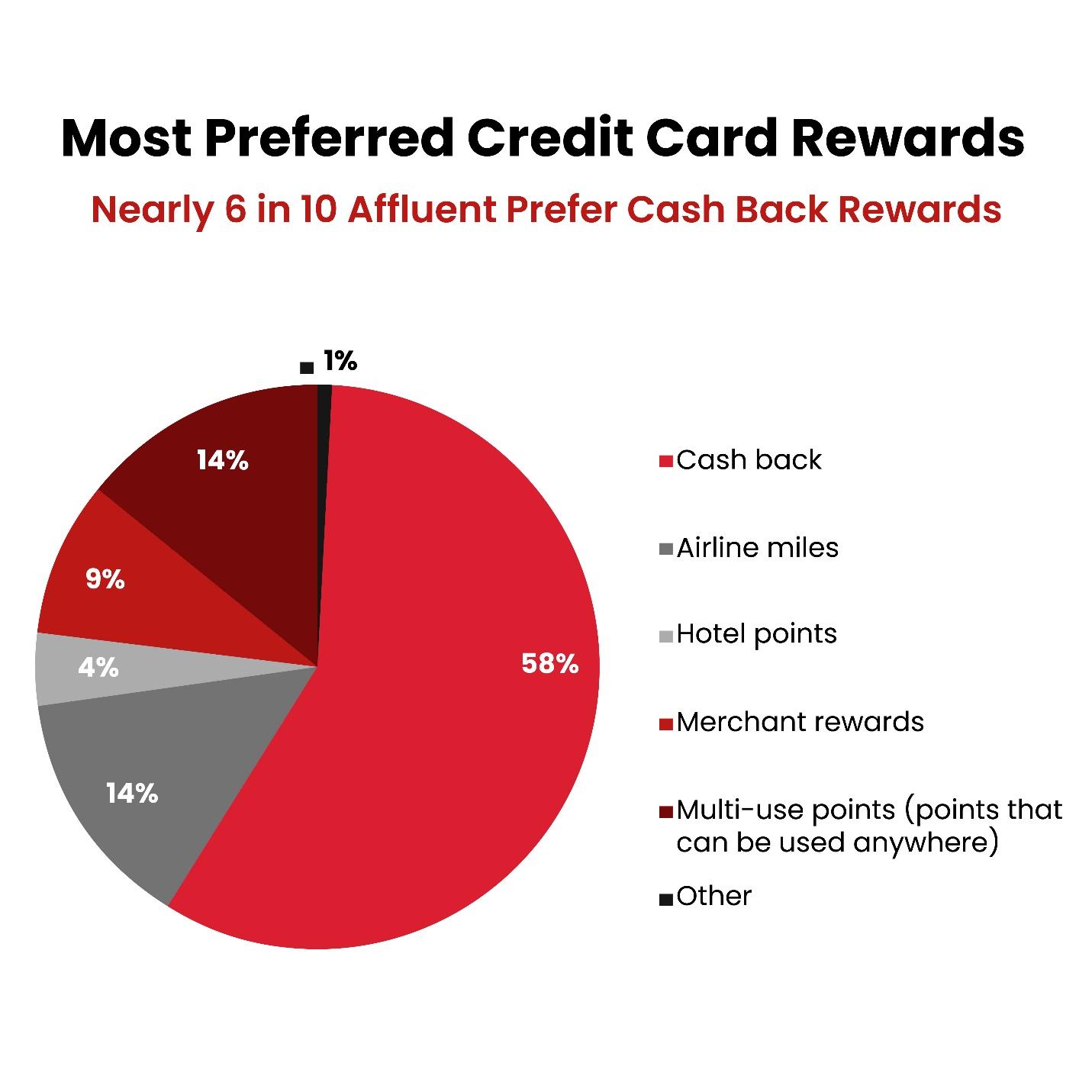

When choosing a cash back platform, the rate of return should be a primary consideration. Even a small difference in rates can lead to significant savings over time, especially for frequent shoppers or those making big-ticket purchases.

For example, if you’re buying a $1,000 laptop:

- Platform A offers 1% cash back, giving you $10.

- Platform B offers 3% cash back, giving you $30.

Over the course of a year, these differences can add up to hundreds of dollars. Comparing cash back rates in Canada ensures you’re getting the most value for your purchases.

Comparing Cash Back Rates

Let’s examine the offerings of cash back platforms using case studies and compare their features and rates with those of Great Canadian Rebates.

1. Platform A (Example)

Platform A is one of the most recognized cash back platforms globally. It offers competitive rates on popular retailers, making it a favourite among many shoppers.

- Cash Back Rates: Typically ranges from 1% to 5%, with occasional promotions offering higher percentages.

- Retailers: Partners with over 750 stores in Canada, including big names like Amazon and Old Navy.

- Key Features: Frequent double cash back events and a user-friendly app.

- Limitations: The cash back rates may not be as high as those offered by GCR for certain retailers.

2. Platform B (Example)

Platform B is a financial app that combines a prepaid Visa card with cash back rewards. It’s an excellent tool for budgeting and earning on everyday expenses.

- Cash Back Rates: Offers a maximum cash back rate of 7.15%.

- Retailers: Cash back applies to specific stores.

- Key Features: Integration with budgeting tools and real-time spending insights.

- Limitations: Lower cash back rates compared to GCR and lack of retailer-specific promotions.

3. Great Canadian Rebates

Great Canadian Rebates stands out as a top-tier cash back platform in Canada. Here’s why:

- Cash Back Rates: Offers rates as high as 20% for certain retailers, significantly higher than competitors.

- Retailers: Partners with over 700 stores, including Walmart, Best Buy, Dell Canada, and Expedia Canada.

- Key Features: Exclusive credit card promotions, referral bonuses, and enhanced cash back during sales events.

- Limitations: Requires users to shop through GCR’s links to earn cash back.

Detailed Comparison: Why GCR Excels

These are the major reasons why GCR is a better option than other cash back platforms:

Higher Cash Back Rates

One of GCR’s most compelling advantages is its competitive cash back rates. For instance:

- AliExpress Canada: Shop through GCR and earn 4% for clothing and accessories, mobile phone accessories, interior accessories, and garden supplies, 3% on other categories, and 1.25% on consumer electronics.

- Dell Canada: GCR offers 3% cash back on accessories and PowerEdge, 2.5% cash back on displays, 1% cash back on desktops, and 0.5% cash back on notebooks and laptops, whereas other platforms may cap at 1% or 2%.

- Staples Canada: Earn 1.5% cash back on qualifying items, a rate that outpaces some competitors.

Extensive Retailer Partnerships

GCR collaborates with an impressive range of top retailers in Canada across various categories, from electronics to travel. Notable partnerships include:

- Walmart Canada

- Shein Canada

- HP Canada

- Expedia Canada

This variety ensures that no matter what you’re shopping for, GCR provides opportunities to earn cash back.

Top Credit Card Offers

GCR goes beyond standard cash back by offering exclusive credit card deals. For example:

- Tangerine Money-Back Credit Card: Earn 2% cash back in chosen categories and 0.5% cash back on other purchases when you apply through GCR.

- Simplii Financial™ Cash Back Visa Card: Enjoy up to 4% cash back on restaurant, coffee, and bar (up to $5,000 per year), 1.5% cash back on gas, groceries, drugstore (up to $15,000 per year, and 0.5% cash back on all other purchases.

- American Express® Gold Rewards Card: Get 2 points for every $1 spent on travel, gas, grocery, and drugstore purchases, and 1 point for every $1 spent on all other purchases.

These offers allow users to stack rewards, maximizing their savings.

Tips for Maximizing Cash Back Earnings

To make the most of your cash back experience, follow these strategies:

1. Combine Platforms and Cards

Use GCR alongside a cash back credit card to double your rewards. For example, pairing GCR with the TD Cash Back Visa Infinite Card can earn you 3% on groceries, gas, and recurring bills, and 1% cash back on all other purchases.

2. Leverage Seasonal Sales

Shopping during events like Black Friday, Boxing Day, or back-to-school sales can amplify your cash back rates. GCR frequently offers enhanced rates during these periods, making it the ideal time to make significant purchases.

3. Monitor Promotions

Stay updated on GCR’s latest deals by following their social media pages. Exclusive offers and limited-time promotions can lead to substantial savings.

4. Refer Friends

GCR’s referral program rewards you for introducing others to the platform. Share your referral link to earn additional bonuses, further increasing your cash back earnings.

The Financial Impact of Comparing Cash Back Rates in Canada

By comparing rates and strategically choosing where to shop, you can significantly boost your savings. Let’s consider an example:

- Annual Spending: $12,000 (average of $1,000 per month)

- Average GCR Rate: 3%

- Total Annual Cash Back: $360

If you use a cash back credit card alongside GCR, you could earn an additional $240 (assuming 2% on all purchases). That’s a combined total of $600 saved annually — a substantial amount that can be reinvested or used for other financial goals.

Common Mistakes to Avoid

Some common pitfalls that you should avoid to maximize cash back include:

1. Not Using Affiliate Links Correctly

Always access retailer websites through GCR’s links to ensure your purchases are tracked. Missing this step may result in forfeited cash back.

2. Ignoring Credit Card Fees

When pairing GCR with a credit card, choose one with low or no annual fees, or ensure the rewards outweigh the costs. Not considering fees can diminish your overall savings.

3. Forgetting to Redeem Cash Back

Redeem your cash back regularly to avoid account inactivity or potential expiration of rewards – forgetting to do so might lead to lost earnings over time.

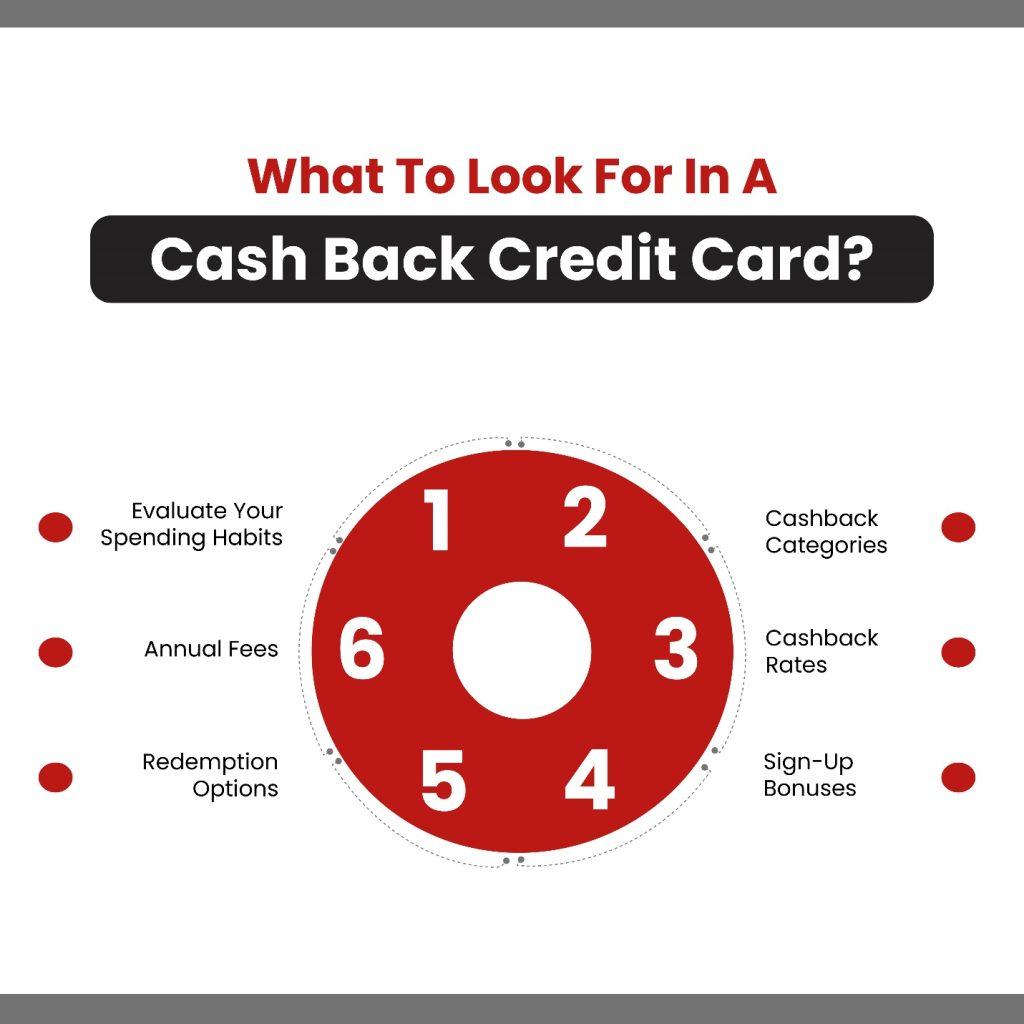

Why Great Canadian Rebates is the Top Choice?

When you compare cash back rates in Canada, Great Canadian Rebates emerges as a clear winner. Our competitive rates, extensive retailer network, and additional perks like credit card promotions makes us the ideal platform for maximizing savings. By shopping strategically and leveraging GCR’s features, you can turn everyday purchases into a reliable source of financial rewards.

Our online platform lets Members compare top credit card options available in Canada and apply for the one that best suits their financial and lifestyle requirements. It’s free to join, and Members can also choose from over 700 well-known merchants and take advantage of great rebates, deals, and discounts. Visit the website today for more information.