In the realm of premium credit cards, the American Express Platinum Card and the Neo World Elite Mastercard stand out, each catering to distinct consumer preferences. The former is synonymous with luxury, offering a suite of high-end benefits tailored for the affluent traveler. In contrast, the latter emphasizes practicality, delivering substantial cashback rewards and essential perks. This comprehensive analysis delves into the luxurious offerings of the American Express Platinum Card and juxtaposes them with the pragmatic advantages of the Neo World Elite Mastercard, aiding readers in aligning their choice with their financial aspirations.

American Express Platinum Card: A Paradigm of Luxury

The American Express Platinum Card is designed for those who seek an elevated lifestyle, particularly in travel and exclusive experiences.

1. Travel Benefits

- Global Lounge Access: Cardholders enjoy complimentary entry to over 1,400 airport lounges worldwide through the American Express Global Lounge Collection, including Centurion Lounges and Priority Pass Select lounges.

- $200 Airline Fee Credit: Annually, cardholders receive up to $200 in statement credits for incidental fees charged by a selected airline, such as checked baggage or in-flight refreshments.

- $200 Hotel Credit: A $200 statement credit is available each year for prepaid bookings at Fine Hotels + Resorts or The Hotel Collection properties through American Express Travel.

- $200 Uber Cash: Cardholders receive up to $15 in Uber Cash monthly, with an additional $20 in December, applicable to Uber rides or Uber Eats orders within the U.S.

- $100 Global Entry or TSA PreCheck Credit: The card covers the application fee for Global Entry or TSA PreCheck, expediting security processes at airports.

2. Rewards Program

- Earning Rates: The card offers 5 Membership Rewards points per dollar on flights booked directly with airlines or through American Express Travel (up to $500,000 per calendar year) and on prepaid hotels booked through American Express Travel. All other purchases earn 1 point per dollar.

- Redemption Options: Points can be redeemed for travel, gift cards, merchandise, or transferred to various airline and hotel loyalty programs, providing flexibility in maximizing value.

3. Additional Perks

- Elite Status with Hotel Chains: Enrollment grants complimentary elite status with Hilton Honors and Marriott Bonvoy, offering benefits like room upgrades and late check-out.

- Comprehensive Travel Insurance: The card includes trip cancellation and interruption insurance, baggage insurance, and car rental loss and damage insurance, ensuring peace of mind during travels.

- Concierge Service: Access to a 24/7 concierge service assists with dining reservations, event tickets, and personalized recommendations, enhancing the cardholder’s lifestyle.

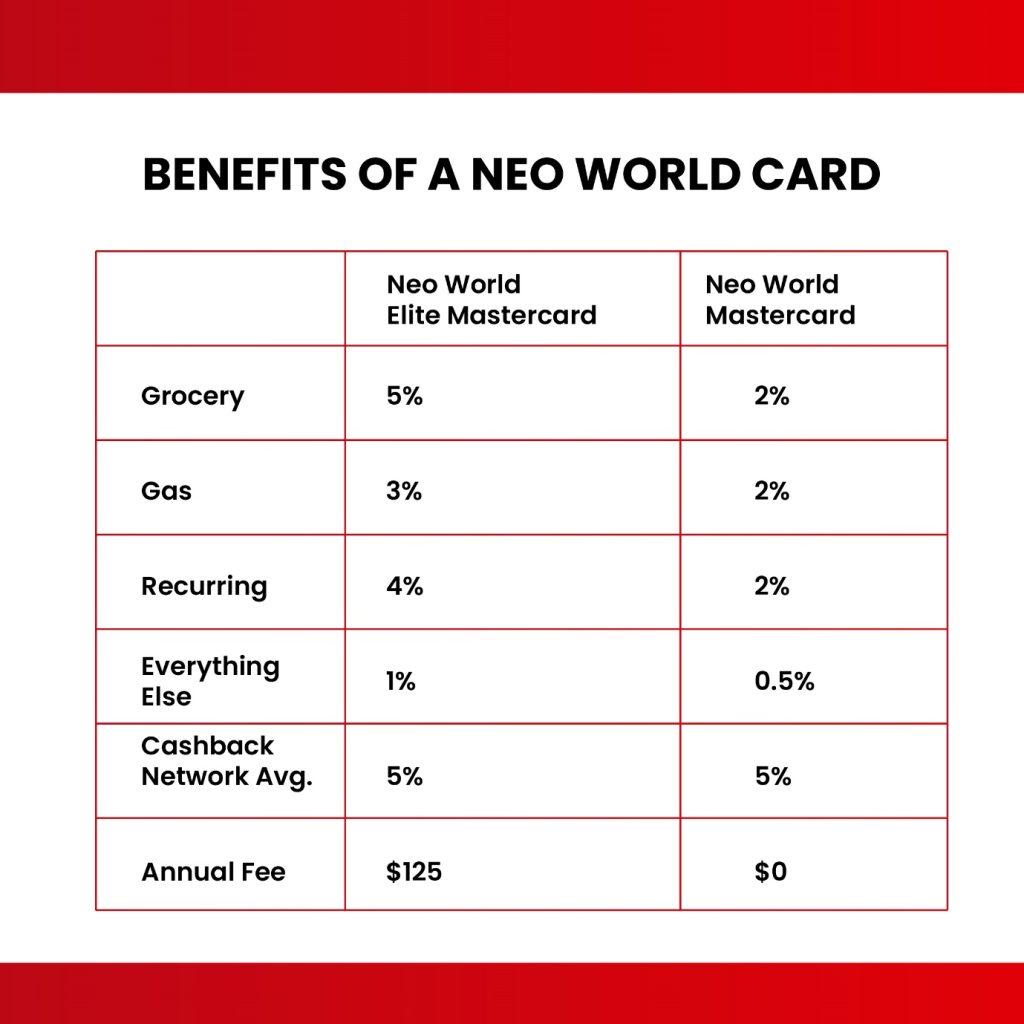

Neo World Elite Mastercard: Emphasis on Practicality

The Neo World Elite Mastercard caters to individuals seeking substantial cashback rewards and essential benefits without a hefty annual fees.

1. Cashback Rewards

- Earning Rates: Cardholders earn 5% cashback on grocery purchases, 4% on recurring bills, and 3% on gas purchases, each up to a monthly cap. All other purchases earn 1% cashback.

- Neo Partner Network: Shopping within Neo’s partner network can yield an average of 5% additional cashback, enhancing overall savings.

2. Fees and Accessibility

- Annual Fee: The card carries an annual fee of $125, which is competitive among premium cashback credit cards.

- Income Requirements: Eligibility requires a minimum annual personal income of $80,000 or a household income of $150,000, aligning with standard criteria for premium cards.

3. Additional Benefits

- Insurance Coverage: The card offers extended warranty, purchase protection, auto rental collision loss damage waiver, and comprehensive travel insurance, including emergency medical coverage up to $1,000,000 for trips up to 14 days.

- Mastercard World Elite Perks: Cardholders have access to World Elite Concierge Service and exclusive offers with participating partners, enhancing the card’s value proposition.

Comparative Analysis: Luxury vs. Practicality

When it comes to choosing between the American Express Platinum Card and the Neo World Elite Mastercard, the debate goes far beyond annual fees and rewards. These cards cater to distinct user profiles, each tailored to different financial goals, lifestyles, and spending habits. In this extended analysis, we delve deeper into specific use cases, nuanced benefits, and overlooked aspects that can help potential cardholders make informed decisions.

Annual Fee Justification and Value Extraction

While the American Express Platinum Card comes with a hefty $695 annual fee, its value lies in how cardholders utilize the card’s extensive benefits. For instance, frequent travelers who regularly access airport lounges, use the $200 annual airline credit, and redeem points for first-class flights can easily extract far more value than the fee. Similarly, elite status at hotel chains like Hilton and Marriott can lead to significant savings on premium hotel stays, not to mention enhanced experiences.

In contrast, the Neo World Elite Mastercard offers a more manageable $125 fee, which is easier to justify for those who prefer straightforward cashback rewards. Its appeal lies in the simplicity of earning and redeeming cashback, making it more accessible for everyday spenders. For example, the card’s integration with the Neo Partner Network amplifies cashback earnings for specific purchases, which could be significant for those who frequent these partnered merchants.

Earning Potential Beyond the Obvious

The American Express Platinum Card excels in rewarding travel and luxury spending, but its earning structure can be limiting for those whose expenses don’t align with its high-point categories. Flights booked directly through airlines or American Express Travel and prepaid hotel bookings earn 5x Membership Rewards points. However, general spending earns only 1x points, which may not appeal to cardholders seeking to maximize rewards across varied spending categories.

Conversely, the Neo World Elite Mastercard takes a more inclusive approach by offering high cashback rates on common expenses, such as 5% on groceries, 4% on recurring bills, and 3% on gas. This structure benefits families and individuals with predictable monthly expenses, allowing for consistent and impactful savings. Additionally, its integration with local and online businesses through the Neo Partner Network further boosts earning potential, making it a strong contender for those seeking tangible rewards.

Flexibility in Rewards Redemption

The American Express Platinum Card offers unparalleled flexibility when it comes to redeeming Membership Rewards points. These points can be transferred to airline and hotel loyalty programs, often at favorable rates. Savvy travelers who strategize their point transfers can unlock significant value, such as premium cabin flights or luxury hotel stays at a fraction of the cash price. This flexibility, however, requires planning and a deep understanding of transfer partners to maximize benefits.

On the other hand, the Neo World Elite Mastercard keeps things simple with cashback rewards. There’s no need to navigate complicated loyalty programs or redemption systems. Cashback is credited directly to the cardholder’s account, making it instantly usable for any financial need. This simplicity appeals to users who prefer immediate and tangible rewards without the hassle of point valuations or redemption strategies.

Travel Insurance and Protections

One area where both cards excel is travel insurance, but they do so in different ways. The American Express Platinum Card offers comprehensive coverage that includes trip cancellation and interruption insurance, baggage insurance, and rental car damage waiver. These benefits are tailored for frequent travelers who need extensive coverage for high-value trips and luxury travel experiences.

The Neo World Elite Mastercard, while not as expansive in its coverage, provides practical protections, including emergency medical insurance up to $1,000,000 for trips up to 14 days, extended warranty, and purchase protection. These benefits are particularly valuable for occasional travelers or families looking for affordable yet reliable coverage.

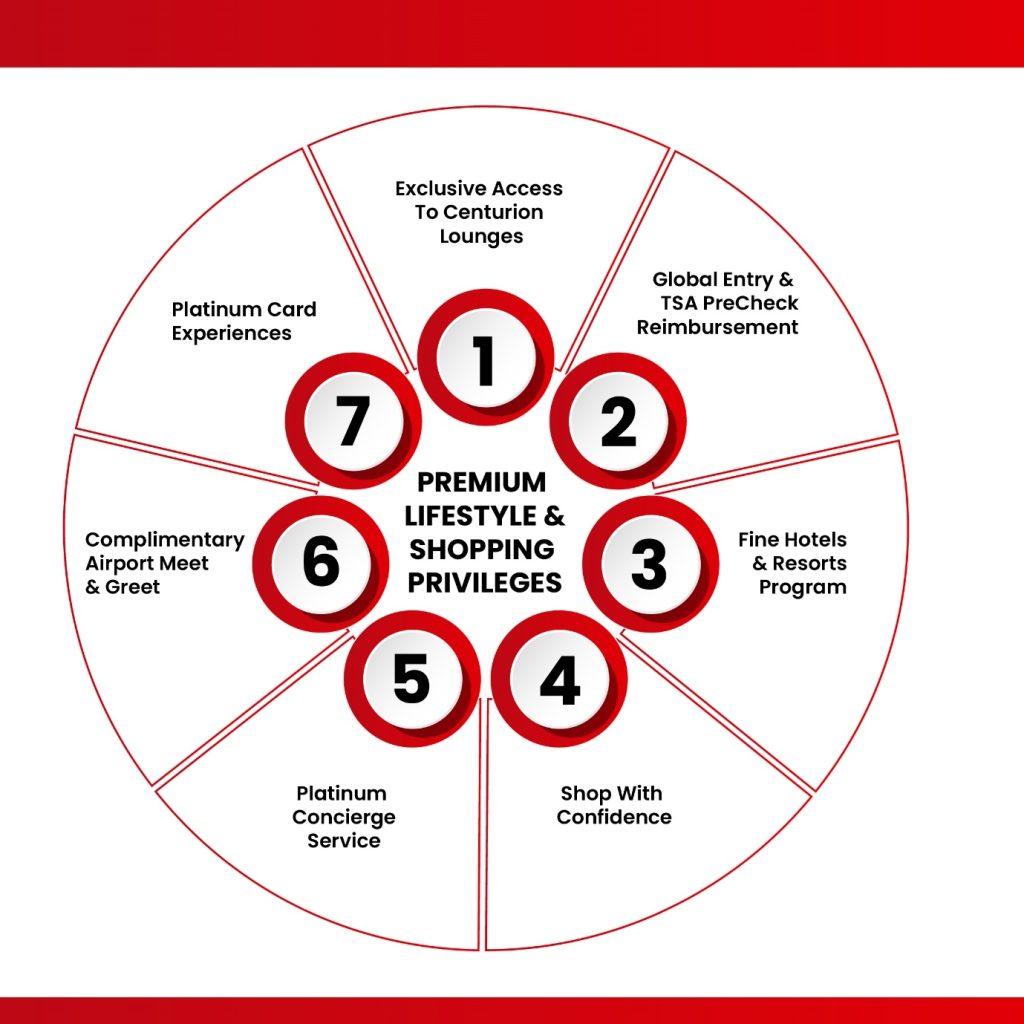

Lifestyle Benefits and Enhancements

The American Express Platinum Card elevates everyday experiences into exclusive events. For instance, its concierge service acts as a personal assistant, handling everything from dinner reservations at Michelin-starred restaurants to securing tickets for sold-out events. Additionally, cardholders gain access to curated experiences, such as private tours and invite-only events, that enhance their lifestyle.

The Neo World Elite Mastercard, while lacking these luxurious offerings, provides lifestyle benefits that are more grounded in practicality. The Mastercard World Elite Concierge Service can assist with everyday needs, such as travel bookings and gift recommendations, without the high-touch exclusivity of the Platinum Card. Moreover, its partnerships with retailers allow cardholders to enjoy exclusive discounts, adding value to daily shopping habits.

Integration with Digital Platforms and Tools

In today’s digital-first world, how a credit card integrates with technology can significantly influence the user experience. The American Express Platinum Card is well-suited for tech-savvy users who value seamless online account management, detailed spending reports, and an intuitive mobile app. It also integrates with travel booking platforms and allows for easy point transfers through the app, making it ideal for frequent travelers on the go.

The Neo World Elite Mastercard focuses on a different aspect of digital integration. Its connection to the Neo Financial app offers a user-friendly interface where cardholders can track cashback earnings, view spending patterns, and explore partner deals in real time. This focus on transparency and practicality aligns with the card’s mission to simplify rewards for everyday users.

Target Audience and User Profiles

The American Express Platinum Card is tailored for high-income earners who prioritize travel, luxury, and exclusivity. It caters to individuals who are willing to pay a premium for superior service, access, and rewards. This card is less about practicality and more about the experience it offers, making it a status symbol for many.

In contrast, the Neo World Elite Mastercard appeals to a broader audience, including young professionals, families, and budget-conscious individuals. Its emphasis on cashback rewards, practical benefits, and affordability makes it an attractive option for those looking to optimize their spending without breaking the bank.

Hidden Costs and Considerations

Beyond the annual fees, both cards have hidden costs that potential users should consider. For the American Express Platinum Card, foreign transaction fees and high APRs can add up if not managed carefully. Additionally, maximizing the card’s benefits requires a significant upfront financial commitment, as many perks are only valuable if actively utilized.

The Neo World Elite Mastercard, while more affordable, has limitations in its cashback caps for certain categories, which can restrict earning potential for high spenders. Moreover, its benefits are tied closely to the Neo Partner Network, which may not align with every cardholder’s shopping preferences.

Longevity and Scalability of Benefits

For individuals planning their long-term credit card strategy, scalability is an essential factor. The American Express Platinum Card offers benefits that grow with the cardholder’s lifestyle. As travel and spending habits evolve, the card’s rewards and perks remain relevant, particularly for those who aim to explore luxury experiences.

The Neo World Elite Mastercard provides consistent value over time but may become less appealing as cardholders’ financial goals shift toward premium rewards and exclusive experiences. Its practical benefits are excellent for early stages of financial planning but may lack the aspirational qualities of cards like the Platinum Card.

Start Saving Today with Great Canadian Rebates

Maximize your rewards with top-rated cashback credit cards and exclusive discounts on online shopping. Join Great Canadian Rebates to earn cashback and access coupons for hundreds of merchants. From the American Express Platinum Card to Neo World Elite Mastercard, shop smart and save big.