The Amex Platinum Card in Canada stands as a symbol of prestige, offering unparalleled rewards and benefits to travellers and everyday spenders alike. Whether you’re jetting off to exotic locations, indulging in fine dining, or managing your daily purchases, this premium credit card enhances every aspect of your spending experience. By understanding its features and learning how to make the most of them, you can unlock the full potential of one of the top-rated cash back credit cards available.

A Brief History of American Express and the Platinum Card Legacy

American Express (Amex) has a rich history dating back to 1850. It started as an express mail business in New York. Over the decades, it evolved into a global leader in financial services, known for its focus on customer-centric products and unmatched service.

Among its many offerings, the Platinum Card emerged as the pinnacle of luxury. Introduced in 1984, it was one of the first premium credit cards designed specifically for high-net-worth individuals.

In Canada, the Amex Platinum Card has become synonymous with exclusive travel perks, superior customer service, and luxurious experiences. It remains a favourite among travellers seeking a card that combines rewards, convenience, and status.

What Makes the Amex Platinum Card a Standout in Canada?

The Amex Platinum Card in Canada is not just about earning points; it’s about accessing a lifestyle of unparalleled benefits. Here’s what sets it apart:

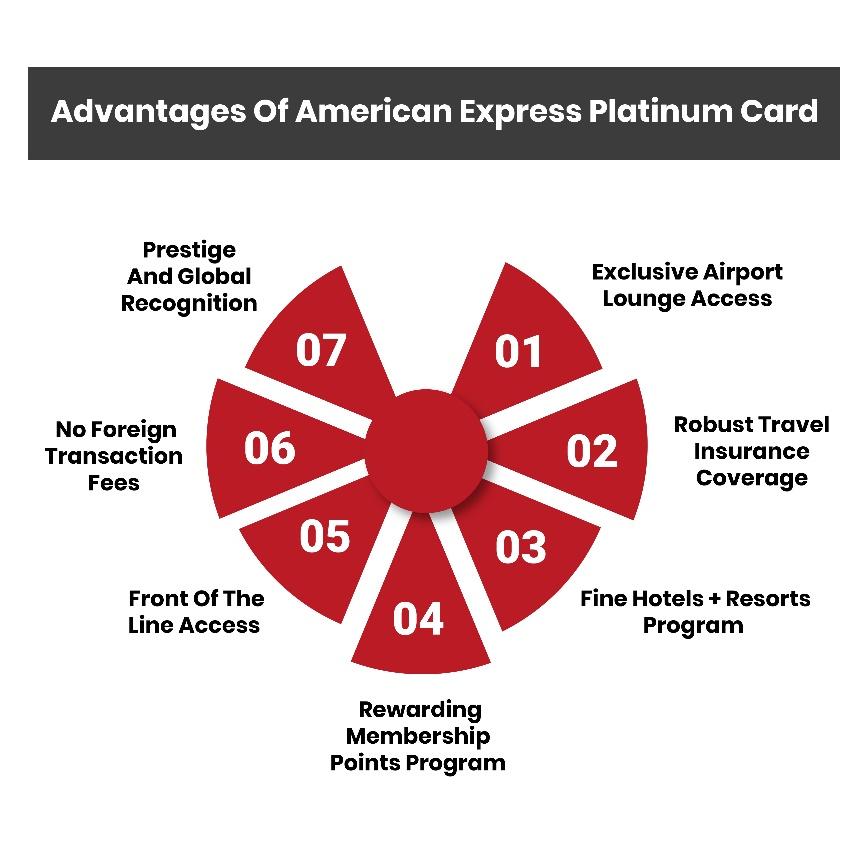

1. Airport Lounge Access

Frequent travellers will appreciate complimentary access to over 1,400 airport lounges worldwide, including Priority Pass lounges and the exclusive Amex Centurion Lounges. Whether you’re flying out of Toronto Pearson or Vancouver International, the Amex Platinum ensures you travel in style.

2. Generous Rewards Program

The Platinum Card is part of the Membership Rewards program, offering flexibility in how you redeem points. Earn 5x points on eligible travel bookings and 3x points on dining, with no expiry on points.

3. Comprehensive Travel Insurance

Travelling with peace of mind is easy with the extensive insurance coverage offered by this card. Benefits include travel medical, trip cancellation/interruption, car rental insurance, and lost luggage protection.

4. Annual Travel Credit

Receive an annual $200 travel credit that can be used toward eligible travel bookings through the American Express Travel portal.

5. Exclusive Perks

From hotel upgrades and late check-outs with Fine Hotels + Resorts to early access to events with Front Of The Line, the Platinum Card elevates your lifestyle.

Tips to Maximize Rewards with the Amex Platinum Card in Canada

Focus Spending on High-Earning Categories

To make the most of your card, direct your spending to categories with the highest rewards:

- Travel: Earn 5x points on eligible flights and hotels booked through Amex Travel.

- Dining: Get 3x points on restaurants and food delivery services, making it perfect for food enthusiasts.

- Everyday Purchases: While non-category purchases earn 1x points, they add up over time.

Utilize the Membership Rewards Program

Membership Rewards points are incredibly versatile. Here’s how you can redeem them:

- Travel: Transfer points to over ten airline and hotel loyalty programs, including Aeroplan and Marriott Bonvoy.

- Statement Credits: Use points to offset your credit card balance.

- Merchandise and Gift Cards: Redeem points for top-brand products or gift cards.

Tip: Transferring points to travel partners often provides the highest value per point.

Leverage Lounge Access

Whether travelling for business or leisure, use your complimentary lounge access to enjoy meals, refreshments, and Wi-Fi while escaping the hustle of the airport terminal.

Combine with Great Canadian Rebates

When you apply for the Amex Platinum through Great Canadian Rebates, you gain access to credit card rebates, boosting your initial savings. Additionally, shop through their platform to earn cash back on your everyday purchases.

Additional Benefits for Canadian Travellers

The Amex Platinum Card in Canada is much more than a tool for earning rewards—it is a gateway to exclusive experiences and peace of mind for Canadian travellers. From premium accommodations to comprehensive travel insurance and unique entertainment perks, the card is designed to enhance every aspect of your journey. Let’s dive deeper into the benefits that make the Platinum Card a must-have for discerning travellers.

Fine Hotels + Resorts Program

When you book accommodations through the Fine Hotels + Resorts program, you unlock a suite of exclusive benefits at over 1,300 luxury properties worldwide. These perks not only elevate your travel experience but also provide excellent value.

Benefits include:

- Room upgrades upon arrival: When available, enjoy an elevated stay with enhanced room features, such as better views, larger layouts, or premium amenities.

- Complimentary breakfast for two: Start your day with a delicious meal for you and your travel companion without any extra cost, making your mornings stress-free and indulgent.

- Early check-in and late check-out: Avoid the inconvenience of waiting for your room or rushing to leave. With early check-in and late check-out, you can settle in or extend your stay at your own pace.

- Resort or dining credits: Receive credits to spend on spa treatments, dining, or other on-property services, adding even more luxury to your getaway.

These benefits can easily amount to hundreds of dollars in value per stay, making the Fine Hotels + Resorts program a favourite among frequent travellers. For Canadian cardholders exploring cities like New York, Paris, or Tokyo, the program ensures that their accommodations match the grandeur of their destination.

Comprehensive Travel Insurance

Travelling often brings uncertainties, but the Amex Platinum Card provides some of the best travel insurance available in Canada. Whether you’re dealing with unexpected delays or major emergencies, this card has you covered.

Highlights include:

- Emergency medical coverage: Travel outside of Canada and get up to $5,000,000 in emergency medical coverage. This benefit ensures that any unforeseen health issues during your trip won’t turn into financial burdens.

- Trip cancellation/interruption insurance: Protect your investment in case your plans change due to unforeseen circumstances like illness or emergencies. With this coverage, you can recover non-refundable expenses like flights or hotel bookings.

- Flight and baggage delay insurance: If your flight is delayed, the Platinum Card reimburses expenses for necessities like meals or overnight stays. Similarly, if your luggage is delayed, you’re covered for essential purchases.

- Car rental theft and damage insurance: Skip the costly insurance fees at car rental counters. The Platinum Card includes coverage for theft or damage to rental vehicles, giving you peace of mind during road trips.

Whether you’re jetting off to Europe for a summer vacation or embarking on a business trip across the border, this comprehensive suite of travel insurance protects you and your loved ones every step of the way.

Front Of The Line Access

The Amex Platinum Card in Canada isn’t just about travel—it also opens doors to unforgettable entertainment experiences. With Front Of The Line access, you’ll never miss out on tickets to the hottest concerts, shows, and special events across the country.

What you get:

- Early access: Beat the crowd by purchasing tickets before they go on sale to the general public. This benefit is invaluable for securing seats for high-demand performances or sporting events.

- Reserved seating: Enjoy some of the best seats in the house with access to premium seating options at select venues.

- Exclusive offers: Take advantage of pre-sale opportunities and cardmember-only events, which often include additional perks like meet-and-greets or VIP packages.

For music lovers, theatre enthusiasts, or sports fans, Front Of The Line is a game-changer. Imagine snagging prime tickets to a sold-out concert or reserving seats to a Broadway show in Toronto before others even have the chance to buy.

Why These Benefits Matter

The added perks of the Amex Platinum Card in Canada go beyond monetary value—they contribute to a seamless, stress-free travel and lifestyle experience. When combined with the card’s robust earning potential and redemption flexibility, these benefits solidify its reputation as the ultimate travel companion.

For instance, the Fine Hotels + Resorts program ensures that every trip is a luxurious escape, while the comprehensive travel insurance provides peace of mind that you’re protected against the unexpected. Meanwhile, Front Of The Line access allows you to curate your lifestyle with exclusive entertainment opportunities that are often out of reach for others.

In addition, pairing these benefits with the card’s earning power—such as 5x points on travel bookings and 3x points on dining—means you can accumulate Membership Rewards points quickly, further enhancing your travel and entertainment experiences.

By strategically using these benefits, Canadian travellers can make the most of every trip, whether it’s for business, leisure, or a blend of both. And remember, applying through Great Canadian Rebates not only grants access to these perks but also adds a layer of savings through credit card rebates, amplifying the overall value of the card.

With these unparalleled benefits, the Amex Platinum Card goes beyond being a payment method—it’s a key to unlocking a world of opportunities tailored to your lifestyle.

Why Apply Through Great Canadian Rebates?

Using Great Canadian Rebates to apply for the Amex Platinum Card in Canada allows you to benefit from additional savings and perks. Here’s how it works:

- Visit the credit card summary page.

- Choose the Amex Platinum Card and complete the application.

- Earn an exclusive rebate upon approval, adding extra value to your card membership.

By shopping through Great Canadian Rebates, you can also earn cash back on online purchases, effectively stacking rewards on top of your Platinum benefits.

Is the Amex Platinum Card Right for You?

The Amex Platinum Card is ideal for:

- Frequent Flyers: Maximize lounge access, travel credits, and high reward rates on travel bookings.

- Luxury Seekers: Enjoy premium experiences with Fine Hotels + Resorts and exclusive event access.

- Point Enthusiasts: Take advantage of versatile redemption options, including high-value transfers to airline and hotel programs.

Comparing the Amex Platinum to Other Cards

While the Amex Platinum Card in Canada offers unmatched benefits for travellers, it’s worth comparing it to other premium options to ensure it meets your needs. For instance:

- SimplyCash Preferred Card: Offers a straightforward 2% cash back rate, suitable for those who prefer simpler rewards without an annual travel focus.

- Gold Rewards Card: Combines travel and cash back perks at a lower annual fee than the Platinum Card.

- Cobalt Card: Provides high points on dining and travel but lacks some of the Platinum’s luxury perks.

Find detailed comparisons of these cards on the Great Canadian Rebates credit card page.

Common Questions About the Amex Platinum Card in Canada

1. What is the annual fee for the Amex Platinum Card?

The annual fee is $699, but it is offset by perks like the $200 travel credit, extensive lounge access, and premium travel insurance.

2. Can I earn cash back with the Platinum Card?

While the focus is on Membership Rewards points, these can be redeemed as statement credits, effectively acting as cash back.

3. How do I apply for the Amex Platinum Card through Great Canadian Rebates?

Simply visit the Amex Platinum Card page on Great Canadian Rebates and complete the application process.

Final Thoughts: The Platinum Experience Awaits

The Amex Platinum Card in Canada is more than just a credit card—it’s a gateway to premium travel experiences, luxury benefits, and versatile rewards. By strategically using its features, such as maximizing high-earning categories, leveraging lounge access, and taking advantage of travel credits, you can make every dollar work harder for you.

Apply through Great Canadian Rebates to enhance your benefits further with credit card rebates and exclusive deals. Whether you’re a frequent flyer or someone who values exceptional perks, the Amex Platinum Card sets the gold standard for Canadian travellers. Start your journey today and enjoy a lifestyle of luxury and rewards.

Where To Apply For The Best Canadian Credit Cards?

Great Canadian Rebates is an online platform that lets Members compare credit card options available in Canada and apply for the one that best suits their financial and lifestyle requirements. It’s free to join, and Members can also choose from over 700 well-known merchants and take advantage of great rebates, deals, and discounts.

Visit the website today for more information.