When it comes to making the most out of daily spending, a reliable cash back credit card can be a game-changer. The TD Cash Back Visa is designed specifically to help Canadians save on everyday essentials, like groceries, gas, and other routine purchases. In this guide, we’ll explore how to get the best use of your TD Cash Back Visa card, focusing on maximizing cash back rewards for your essential purchases.

Why the TD Cash Back Visa is Perfect for Everyday Essentials

The TD Cash Back Visa is a no-annual-fee card with a generous cashback structure.It’s ideal for Canadians looking to earn rewards on essential spending without additional costs. The card is straightforward, with cashback earnings that accumulate on purchases Canadians make the most, including gas and groceries.

Here’s why this card is a top pick for cash back rewards on essentials:

- No Annual Fee: The TD Cash Back Visa has no annual fee, allowing cardholders to keep their full rewards without extra charges.

- Targeted Rewards on Essentials: The card focuses on cash back rewards for purchases like groceries and gas, making it perfect for frequent, everyday spending.

- Flexible Redemption: Cash back rewards are easy to redeem, and their structure allows you to use them when they best suit your financial goals.

The TD Cash Back Visa provides both practicality and rewards for Canadians who want to save straightforwardly on everyday needs.

Key Benefits of the TD Cash Back Visa for Essential Spending

The TD Cash Back Visa is designed with an emphasis on earning rewards for daily purchases. Here’s how it supports Canadian cardholders with significant cash back on everyday essentials like groceries, gas, and even recurring bills.

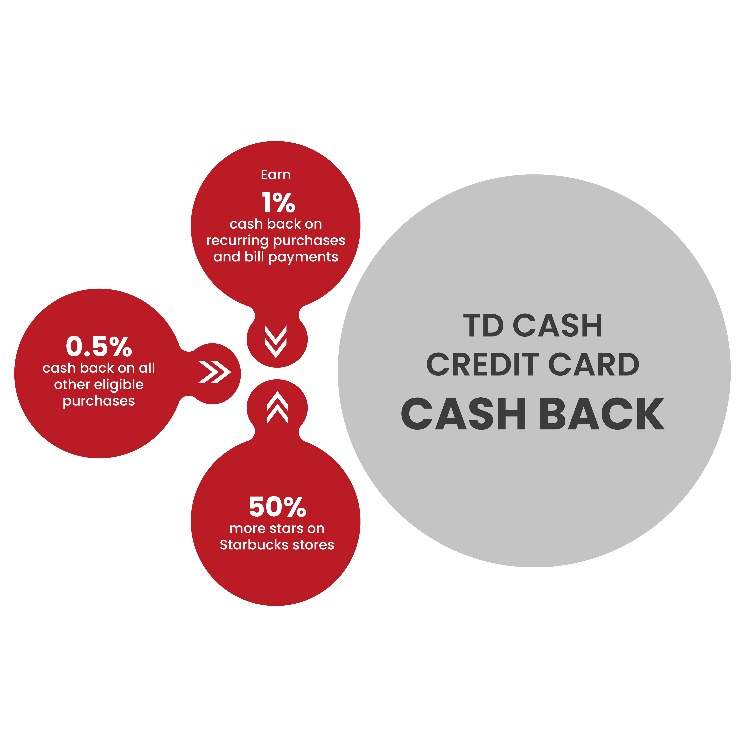

Earn 1% Cash Back on Gas, Grocery, and Recurring Bill Payments

When you use your TD Cash Back Visa to pay for gas, groceries, or recurring bill payments, you’ll earn 1% cash back. This rate applies automatically at the register, making it convenient and straightforward for cardholders to get rewards on every essential purchase.

- Gas Savings: With today’s fluctuating gas prices, earning 1% cash back on every fill-up can add up. This feature is especially beneficial for Canadians who commute or drive regularly.

- Grocery Savings: Groceries are one of the highest monthly expenses for most households, and earning 1% cash back on all grocery purchases offers substantial savings over time.

- Recurring Bills: By setting up recurring bill payments with your TD Cash Back Visa, you can earn 1% cash back on services like phone and internet. It’s an easy way to boost rewards with minimal effort.

0.5% Cash Back on All Other Purchases

For all other purchases, the TD Cash Back Visa offers a steady 0.5% cash back. This means that whether you’re dining out, shopping, or booking services, you’re still earning rewards. Although the focus is on essentials, this general rate ensures you’re getting value on every purchase, even outside primary categories like groceries and gas.

Easy Cash Back Redemption

The TD Cash Back Visa makes redeeming your rewards effortless, with the flexibility to apply them as statement credits whenever you choose. There are no restrictions or complex processes; just redeem when it’s most convenient.

Pro Tip: Save up your cash back and redeem it toward larger purchases or bills. This can significantly impact your monthly budget by reducing larger expenses with rewards you’ve accumulated from everyday spending.

No Annual Fee

One of the best things about the TD Cash Back Visa is that there’s no annual fee. You can earn unlimited cash back with no deductions or annual charges. For those looking to keep credit card costs low while enjoying benefits, this no-fee structure is ideal.

How to Maximize Your Rewards with the TD Cash Back Visa

While the TD Cash Back Visa provides excellent baseline rewards, you can maximize your cash back through strategic spending and planning. Here are some ways to ensure you’re getting the most from your card:

Use Your TD Cash Back Visa for All Gas, Grocery, and Recurring Bills

The 1% cash back rate on gas, groceries, and recurring bills adds up quickly if you make these purchases with your TD Cash Back Visa. Small everyday purchases can contribute significantly over time, allowing you to accumulate cash back without additional spending.

Stack Your Cash Back Earnings with Great Canadian Rebates

For even more rewards, consider applying for your TD Cash Back Visa through Great Canadian Rebates. This platform offers credit card rebates on applications and a variety of cashback offers for online shopping. When you use your TD Cash Back Visa for purchases through Great Canadian Rebates’ partner stores, you’ll earn cashback twice: once from the rebate platform and again from your card.

Explore more at Great Canadian Rebates to see current rebate offers and get additional value from your card.

Set Up Recurring Bills on Your Card

Phone, cable, and internet bills qualify for the 1% cash back rate when paid with your TD Cash Back Visa. Setting these payments to autopay ensures that you’re earning rewards regularly and effortlessly.

Tip: Use the card for subscriptions like streaming services and gym memberships to continue building your rewards.

Additional Features and Benefits of the TD Cash Back Visa

The TD Cash Back Visa provides cash back rewards and some useful perks that can add value beyond essential spending.

Purchase Security and Extended Warranty Protection

The TD Cash Back Visa offers purchase security, which protects most purchases made with the card against loss, theft, or damage for up to 90 days from the purchase date. Additionally, it provides an extended warranty benefit, which doubles the original manufacturer’s warranty for up to one additional year.

Visa Zero Liability

This card includes Visa Zero Liability, so you won’t be held responsible for unauthorized purchases made with your card. This feature provides peace of mind and ensures that you’re protected from potential fraud or unauthorized transactions.

Contactless Payment Convenience

The TD Cash Back Visa offers contactless payment, making it quick and easy to pay for everyday purchases. Simply tap your card or mobile device where contactless payments are accepted, and you’re good to go. This feature is ideal for grocery shopping or fueling up at the gas station.

Frequently Asked Questions

1. How much cash back can I earn with the TD Cash Back Visa?

With 1% on gas, grocery, and recurring bills, the amount you earn depends on your spending habits. Regular use for essential purchases can yield steady rewards, especially when used strategically.

2. How does cash back redemption work?

You can redeem cash back in increments of $25 as a statement credit through your TD online banking or app. This process is flexible, so you can choose when to apply rewards based on your financial goals.

3. Can I earn more by using Great Canadian Rebates with my TD Cash Back Visa?

Yes! You can earn additional rebates by shopping through Great Canadian Rebates. Apply for your card through their site for an initial rebate and earn cash back on partner purchases using your TD Cash Back Visa.

4. Does the TD Cash Back Visa offer any travel benefits?

While the primary focus is on cash back for essential spending, the TD Cash Back Visa’s flexibility in cash back redemption means you can use accumulated rewards toward travel expenses or other discretionary spending as desired.

Conclusion: Is the TD Cash Back Visa Right for You?

The TD Cash Back Visa is an excellent choice for Canadians looking to maximize cash back rewards on essential purchases like groceries, gas, and recurring bills. With a straightforward rewards structure and no annual fee, this card offers great value without added costs. Plus, by applying through Great Canadian Rebates, you can receive additional credit card rebates to enhance your savings further.

If you’re a Canadian cardholder who wants a no-fee card that provides steady rewards on everyday spending, the TD Cash Back Visa is worth considering. It’s easy to manage, provides straightforward cash back rewards, and offers a flexible redemption process that makes it simple to use your rewards when it’s convenient for you.