Online shopping continues to gain popularity, especially for Canadians seeking convenience, variety, and often competitive prices. With so much buying happening online, it’s important to have a credit card that not only rewards spending but also aligns with digital shoppers’ needs. The Rogers Red World Elite Mastercard stands out as an excellent choice for those looking to maximize their online shopping benefits.

With competitive cash back, no foreign transaction fees, and exclusive card perks, it’s one of Canada’s top-rated cash back credit cards designed for the digital age.Here’s why the Rogers Red World Elite Mastercard might be the perfect addition to your wallet if you’re a frequent online shopper.

Why Choose the Rogers Red World Elite Mastercard for Online Shopping?

When shopping online, having the right credit card can mean saving on international purchases, earning significant cash back, and enjoying perks like additional rewards for purchases in foreign currencies. Here are the main reasons why the Rogers Red World Elite Mastercard is an excellent fit for online shoppers.

Foreign Transaction Fees Offset with Cash Back – A Unique Perk for International Shopping

The Rogers Red World Elite Mastercard offers a compelling advantage for international shoppers by offsetting foreign transaction fees with generous cash back rewards. Like most Canadian credit cards, this card applies a standard foreign transaction fee—typically around 2.5%—on purchases made in a foreign currency. However, what sets it apart is its 3% cash back on USD purchases, which more than compensates for the surcharge.

This means that while the fee still applies, you effectively come out ahead by earning more cash back than the fee itself. For example, a $100 USD purchase would incur a $2.50 fee, but you’d receive $3.00 in cash back, resulting in a net gain.

For frequent travellers or online shoppers who often make purchases from U.S.-based retailers, this feature is a major benefit. It allows you to enjoy the convenience of global shopping and earn rewards, making it easier to take advantage of the best international deals without worrying about additional costs eating into your savings

Competitive Cash Back on Every Purchase

The Rogers Red World Elite Mastercard offers an impressive cash back credit card structure that rewards you for all eligible purchases. Cardholders enjoy:

· 3% cash back on U.S. dollar purchases, making it an excellent choice for Canadians who shop frequently on U.S.-based websites.

· 1.5% cash back on all other purchases, providing consistent rewards on online shopping, Canadian retailers, and everyday expenses like groceries and streaming subscriptions.

For those who are Rogers, Fido, or Shaw customers, the value of cash back becomes even more compelling. When you redeem your rewards through Rogers, your cash back is worth 1.5x its value, effectively turning your rewards into 3% cash back. This unique feature significantly boosts your earning potential, making the card an even more attractive option for loyal Rogers customers.

Access to Credit Card Rebates Through Great Canadian Rebates

You can amplify your rewards with Great Canadian Rebates, Canada’s leading cash back platform. By applying for the Rogers Red World Elite Mastercard through Great Canadian Rebates, you’re eligible for a one-time rebate, putting money back in your pocket right from the start.

Great Canadian Rebates works with hundreds of popular online retailers, enabling members to earn additional cashback on top of what their card provides. Once you’re a Rogers Red World Elite Mastercard cardholder, you can use the card to pay for purchases through the Great Canadian Rebates site and double your savings, collecting both platform rebates and your card’s cash back.

If you’re new to Great Canadian Rebates and want to know more, check out How It Works to learn how easy it is to start earning cash back with your online shopping.

Flexible Cash Back Redemption Options

Flexibility is a significant advantage when it comes to rewards, and the Rogers Red World Elite Mastercard allows you to redeem cash back on your terms. You can apply cash back towards any outstanding balance on the card or use it to offset specific purchases.

While some credit cards only allow annual cash back redemptions, the Rogers Red World Elite Mastercard makes it convenient to redeem cash back throughout the year. This feature gives you control over when and how you use your rewards, a convenient benefit for frequent online shoppers who want instant savings.

Travel Benefits for the Modern Shopper

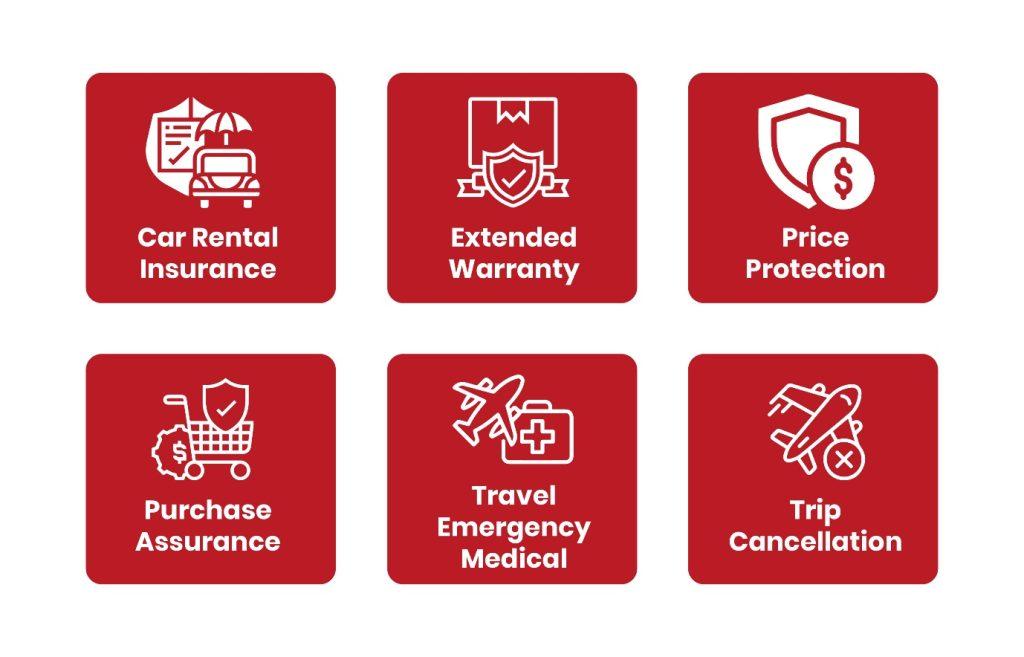

While primarily a cash back credit card, the Rogers Red World Elite Mastercard also provides a range of travel benefits, including:

- Travel Insurance Coverage: With coverage for emergency medical, trip cancellation, and interruption insurance, you’re protected when you travel. These benefits make it an all-around card suitable not just for online purchases but also for trips abroad.

- Access to Mastercard Airport Experiences: The card grants access to Mastercard Airport Experiences provided by LoungeKey, with additional perks and discounts at airports worldwide.

For Canadian online shoppers who also enjoy travel, these benefits make the Rogers Red World Elite Mastercard even more attractive. You can shop online knowing you’ll save on every purchase and have travel perks waiting for you on your next trip.

How to Apply for the Rogers Red World Elite Mastercard Through Great Canadian Rebates

To apply for the Rogers Red World Elite Mastercard and benefit from exclusive rebates, visit the Great Canadian Rebates credit card summary page. Applying through this portal not only gives you access to a top-rated cash back card but also provides you with the added bonus of a one-time rebate, starting you off with immediate savings.

Here’s how to apply in a few easy steps:

- Visit the Great Canadian Rebates website.

- Head to the Rogers Red World Elite Mastercard page.

- Follow the prompts to apply, and be sure to complete the application for your rebate.

With the Rogers Red World Elite Mastercard, you can start earning cash back on every purchase and combine your savings with Great Canadian Rebates to make the most of every online transaction.

Tips to Maximize Your Cash Back with the Rogers Red World Elite Mastercard

To get the most out of your cash back credit card, here are some strategies to boost your rewards:

- Use Great Canadian Rebates for Shopping: Shop through Great Canadian Rebates’ partner stores to earn extra cash back. With retailers across multiple categories, you can maximize cash back earnings every time you shop online.

- Plan U.S.-Dollar Purchases: Earn 3% cash back on all U.S. dollar transactions, from international retail sites to streaming subscriptions billed in U.S. dollars.

- Consolidate Expenses on One Card: Using the Rogers Red World Elite Mastercard as your primary card helps you accumulate more rewards faster.

- Redeem Cash Back Regularly: This card’s flexibility allows you to apply cash back to your balance whenever you like, so take advantage of this option to offset your spending.

Frequently Asked Questions

1. Does the Rogers Red World Elite Mastercard have an annual fee?

No, this card has no annual fee, which is uncommon for a card with such competitive cash back rates and benefits.

2. How does the cash back on U.S. dollar purchases work?

For purchases made in U.S. dollars, you’ll receive 3% cash back. This feature also applies to U.S.-based online shopping, making it an excellent choice for international online shoppers.

3. What’s the best way to maximize rewards with this card?

Shopping through Great Canadian Rebates and making U.S.-dollar purchases are two excellent ways to maximize cash back rewards. Using the card for all types of purchases helps you earn more cash back over time.

4. Is the cash back redeemable at any time?

Yes, you can redeem your cash back at any time, either to cover your card’s outstanding balance or to offset specific purchases.

Final Thoughts: Why the Rogers Red World Elite Mastercard is Ideal for Online Shoppers

For Canadian online shoppers, the Rogers Red World Elite Mastercard is a top contender. The competitive cash back rates on both U.S.-dollar and domestic purchases, and additional perks such as Great Canadian Rebates make it a winning choice. When you combine this with Great Canadian Rebates to earn even more cash back, you’re setting yourself up for continuous savings on every online purchase.

Apply For the Best Rewards Credit Card in Canada

If you’re looking for top cash back credit cards in Canada with amazing introductory APR offers, visit Great Canadian Rebates. The online platform allows you to compare various credit card offers in Canada and apply for the one that best suits your unique needs and preferences.

Visit the website today for more information.