If you’re a Canadian traveller looking to make the most of your TD First Class Travel Visa savings, this guide is your roadmap to maximizing points, securing flight upgrades, and enjoying exclusive travel experiences. The TD First Class Travel Visa Infiniteis one of Canada’s top travel cards, offering unparalleled earning potential and flexibility. By pairing this card with Great Canadian Rebates, you can stretch your travel rewards even further and unlock a whole new world of travel possibilities.

The TD First Class Travel Visa Infinite card stands out for frequent travellers because it allows you to accumulate points quickly and offers flexible redemption options. With this card, you can earn TD Rewards Points for everyday purchases and special categories, giving you more freedom to book flights, hotels, or vacation packages through Expedia for TD. This guide breaks down how to turn those points into tangible travel savings, providing the ultimate playbook for Canadians keen on maximizing their rewards.

How the TD First Class Travel Visa Infinite Earns You Points

The first step to maximizing your TD First Class Travel Visa savings is understanding the card’s earning structure. With TD Rewards Points, you’re rewarded for a variety of spending categories:

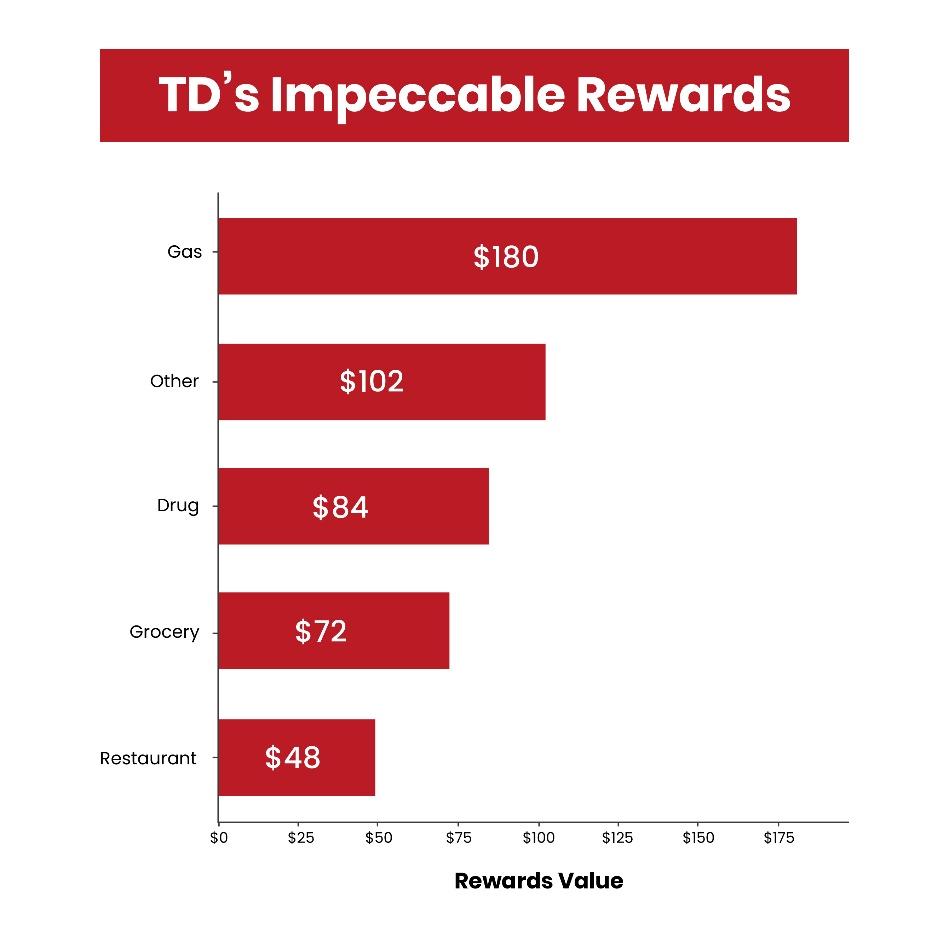

- 8 TD Rewards points for every $1 spent on travel bookings made through Expedia® For TD

- 6 TD Rewards Points for every $1 spent on groceries and restaurants

- 4 TD Rewards Points for every $1 spent on recurring bill payments

- 2 TD Reward Points per $1 on all other eligible purchases

- Plus, you can earn an annual birthday bonus of up to 10,000 TD reward points.

Using these categories wisely can help you quickly build up a substantial points balance. Here’s how:

- Book Flights and Hotels through Expedia for TD: With an accelerated rate of 8 points per dollar, booking through Expedia for TD gives you a head start on accumulating points. This can make a big difference, especially on major purchases like flights or hotel stays.

- Use Your Card for Everyday Expenses: Since groceries and dining earn double points, using your TD card for routine purchases helps you accumulate points faster than usual. Everyday spending adds up quickly, giving you the freedom to plan travel sooner.

- Recurring Bills for Steady Earning: Setting up recurring bills, such as phone or internet, allows you to passively earn points each month, effortlessly contributing to your travel fund.

Redeeming TD Rewards Points for Travel Savings

One of the greatest benefits of the TD First Class Travel Visa Infinite is its redemption flexibility. Unlike other cards that restrict how and when you can redeem points, TD allows you to redeem through Expedia TD, which provides direct booking access to flights, hotels, and vacation packages. Here’s how to unlock the card’s maximum potential:

- Use Points to Book Flights: When booking flights through Expedia for TD, every 200 TD Points is worth $1 in travel credit. With enough points, you can cover the entire cost of your ticket or use a mix of points and cash if you haven’t accumulated quite enough. This flexibility allows you to book your flight when it’s convenient rather than waiting for a full redemption.

- Access Travel Insurance:Travel prepared with the card’s added benefit of travel insurance..

- Book Vacation Packages: Expedia for TD offers vacation packages, which can be an ideal way to get a complete holiday experience with just a few clicks. Since packages usually include flights and accommodations, this one-stop booking option allows you to maximize your points for the whole trip.

Combining Your TD First Class Travel Visa with Great Canadian Rebates

Using Great Canadian Rebates alongside your TD First Class Travel Visa Infinite card can help you earn even more rewards. By accessing credit card rebates through Great Canadian Rebates, you can secure extra savings, which can be combined with the points you earn on your TD card. Here’s how:

- Apply through Great Canadian Rebates: When you apply for your TD First Class Travel Visa Infinite through Great Canadian Rebates, you may be eligible for a one-time rebate. This boosts your savings before you even begin spending.

- Earn Dual Cash Back and Points: By using Great Canadian Rebates to shop with partnered merchants, you’ll earn cash back through the rebate platform while also racking up points on your TD card. This means you can double-dip on rewards, enhancing your TD First Class Travel Visa savings even further.

- Check Regular Promotions: Great Canadian Rebates frequently offers special promotions, so check regularly to see if there’s an opportunity to save even more on travel-related expenses like flights or hotels.

Learn more about how it works to maximize your savings on travel bookings.

Insider Tips to Maximize TD First Class Travel Visa Infinite Savings

Here are some insider strategies for getting the most out of your TD First Class Travel Visa Infinite and maximizing TD First Class Travel Visa savings:

1. Time Your Purchases Around Bonus Point Offers

Occasionally, TD offers promotions where you can earn extra points for certain purchases. For example, they might provide extra points for shopping with specific retailers or during the holiday season. Take advantage of these promotions to earn points faster.

2. Book Flights in Advance to Take Advantage of Points Promotions

Booking in advance through Expedia for TD can save you both point redemption and total ticket costs. If you notice an upcoming promotion for points redemption or a price drop, book early to avoid missing out.

3. Use Points for Seat Selection and In-Flight Amenities

It’s not only about getting to your destination; comfort along the way matters, too. Points can be redeemed for extras like priority boarding, in-flight Wi-Fi, or preferred seats, making your travel experience more enjoyable.

4. Plan Around Expedia for TD’s Cancellation Policy

Expedia for TD offers a cancellation policy on many bookings, allowing you to redeem points confidently, knowing that if your plans change, you have some flexibility.

5. Transfer Points to Other Programs for Added Flexibility

While Expedia for TD is the primary redemption partner, TD Rewards Points are also transferrable to other rewards programs, providing additional flexibility if you want to explore travel options beyond Expedia.

Comparing TD First Class Travel Visa Infinite with Other Travel Cards

When it comes to top-rated cash back credit cards and travel cards, the TD First Class Travel Visa Infinite competes with other popular options in Canada. Here’s how it stacks up:

- Flexible Redemption: Unlike cards with restrictive travel portals, TD’s partnership with Expedia for TD means you can book virtually any airline.Superior Points Rate: The accelerated 8 points per dollar on Expedia for TD bookings is a high rate, especially when compared to other travel cards.

- Perks and Insurance: This card offers a suite of insurance benefits— a valuable feature for frequent travellers.

When combined with Great Canadian Rebates, the TD First Class Travel Visa Infinite becomes even more appealing. By using credit card rebates and accessing exclusive offers, you can enjoy further savings and add even more value to your travel experience.

Conclusion

The TD First Class Travel Visa Infinite offers Canadian travellers a powerful way to earn and redeem points for flights, upgrades, and other travel experiences. When paired with GreatCanadian Rebates, this card becomes even more valuable, allowing you to stack rewards and savings. By following these insider tips, timing your purchases, and making the most of the flexibility offered by the TD Rewards program, you can significantly increase your TD First Class Travel Visa savings and embark on your next adventure with confidence. Happy travels!

Apply For the Best Rewards Credit Card in Canada

If you’re looking for top cash back credit cards in Canada with amazing introductory APR offers, visit Great Canadian Rebates. The online platform allows you to compare various credit card offers in Canada and apply for the one that best suits your unique needs and preferences.

Visit the website today for more information.