Canadians looking for a credit card that offers top-rated cash back rewards, travel perks, and flexibility in everyday spending categories might find their perfect fit in the Tangerine World Mastercard. This card is designed for those who want more from their credit card without the hefty annual fees or complex rewards structures often associated with premium cards.

In this guide, we’ll explain the Tangerine World Mastercard benefits, highlighting its rewards, unique features, and potential for added savings. By the end, you’ll know whether this card aligns with your lifestyle and spending habits and how to get the most out of it through Great Canadian Rebates.

Key Benefits of the Tangerine World Mastercard

The Tangerine World Mastercard offers a range of advantages for Canadians who want cash back credit card rewards with straightforward terms. From customizable cash back categories to insurance for travellers and valuable mobile device protection, this card delivers excellent value.

Generous Cash Back on Everyday Spending

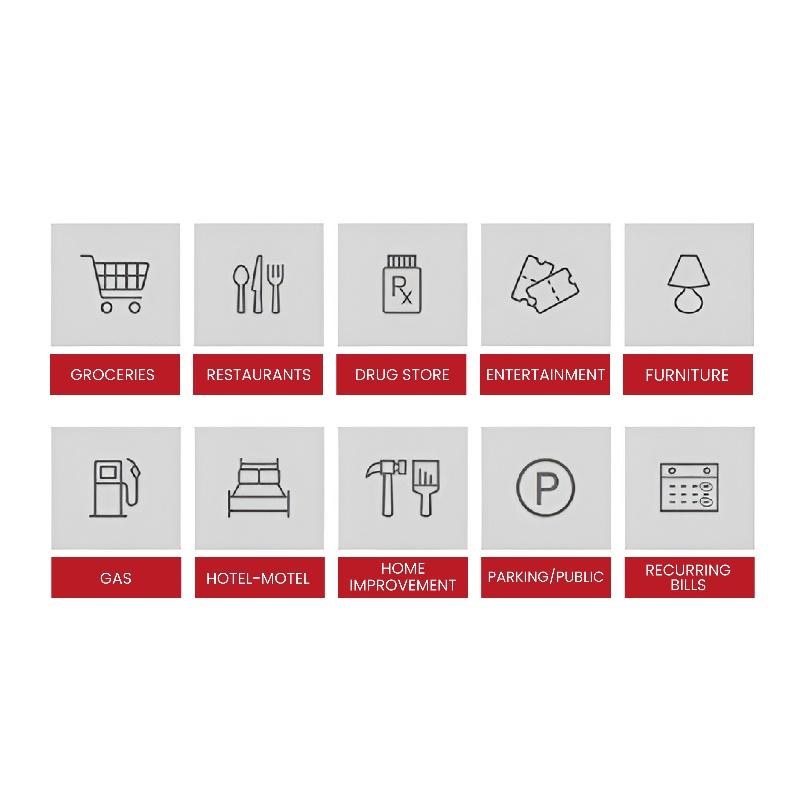

One of the Tangerine World Mastercard’s standout features is its flexible cash back structure, which allows you to earn on categories that matter most to you.

- Up to 2% Cash Back: You can earn 2% cash back in up to three categories of your choice. Eligible categories include groceries, gas, dining, furniture, hotel-motel, and recurring bill payments. This flexibility means you can tailor the card to suit your spending habits.

- 0.5% Cash Back on Other Purchases: For any purchases that don’t fall under your chosen categories, you’ll still earn 0.5% cash back, so every dollar you spend can help you save.

- Automatic Rewards: Cash back is automatically redeemed monthly as a statement credit, so you don’t need to keep track of points or wait for annual redemption dates.

Best For:

The Tangerine World Mastercard’s cash back flexibility is ideal for Canadians who want to maximize rewards on frequently used categories without being locked into a single spending type.

No Annual Fee

Unlike many premium cash back cards, the Tangerine World Mastercard comes with no annual fee. This makes it a smart choice for budget-conscious Canadians who want rewards and premium benefits without an upfront cost.

- Zero Annual Fee: Enjoy all the benefits of a top-rated cash back credit card without having to factor in an annual cost.

- High Earning Potential: With up to 2% cash back, this card offers strong earning potential relative to other no-fee options, making it a value-packed choice.

Additional Tangerine World Mastercard Benefits

In addition to its attractive cash back program, the Tangerine World Mastercard includes a range of other benefits designed to enhance your travel experience, protect your mobile devices, and provide added convenience.

Comprehensive Travel Insurance Coverage

For frequent travellers, the Tangerine World Mastercard provides peace of mind through a suite of travel insurance options that cover joint issues.

- Rental Car Collision/Loss Damage Waiver Insurance: If you rent a car, you’re automatically covered for damage or theft of the vehicle, a helpful perk that can save you money on car rental insurance.

- Travel Medical Insurance: This card includes medical insurance for short trips, typically covering expenses incurred from unexpected medical issues while travelling outside your province or territory. However, be sure to confirm details on coverage limits and eligibility, especially if you travel frequently or internationally.

Best For:

Canadians who travel often, whether domestically or internationally, can benefit from Tangerine World Mastercard’s travel insurance, which reduces the need to purchase standalone policies.

Mobile Device Insurance

One unique perk of the Tangerine World Mastercard is its mobile device insurance, which protects your smartphone or tablet against accidental damage, theft, or loss.

- Coverage for New Devices: This insurance can cover repair or replacement costs for mobile devices purchased with your Tangerine World Mastercard. It protects up to $1,000 and is valid for devices less than two years old.

- Simple Claims Process: This added insurance means you won’t need to take out additional coverage on a new phone, and you can file claims easily if an issue arises.

Best For:

If you’ve recently purchased a new smartphone or tablet, the mobile device protection offered by this card adds value and peace of mind, helping to safeguard your technology investments.

Access to Mastercard’s Premium Benefits

As a World Mastercard holder, you gain access to exclusive Mastercard benefits that enhance your shopping, dining, and travel experiences.

- Mastercard Airport Experiences Provided by LoungeKey: Cardholders can access exclusive airport lounges around the world, making travel more enjoyable and comfortable.

- Priceless Cities: The World Mastercard program also includes access to the Priceless Cities program, which provides unique offers and experiences in major cities across the globe, including discounts and VIP access to events, restaurants, and attractions.

Best For:

This benefit is perfect for Canadians who value travel comfort and exclusive experiences. It gives you access to a variety of perks without any additional cost.

How to Maximize Tangerine World Mastercard Benefits with Great Canadian Rebates

Using Great Canadian Rebates to apply for the Tangerine World Mastercard or make online purchases allows you to compound your savings through additional credit card rebates. Here’s how to make the most of it:

1. Sign Up and Apply for the Tangerine World Mastercard on Great Canadian Rebates

Applying for the Tangerine World Mastercard through Great Canadian Rebates may qualify you for a one-time rebate, boosting your savings immediately.

2. Use Great Canadian Rebates for Online Shopping

Once your card is active, shop through Great Canadian Rebates at participating retailers to earn extra cash back on your purchases, maximizing your savings on top of your Tangerine card rewards.

3. Combine with Cashback Offers

With the Tangerine World Mastercard, you’ll earn up to 2% on selected categories, while Great Canadian Rebates offers additional cash back on purchases made through their platform. By stacking these rewards, you can significantly increase your savings on essentials, travel, and everyday expenses.

FAQs About the Tangerine World Mastercard

1. Does the Tangerine World Mastercard charge foreign transaction fees?

Yes, like most Canadian credit cards, the Tangerine World Mastercard does charge a foreign transaction fee, which is typically around 2.5%.

2. Can I switch my selected cash back categories?

Yes, Tangerine allows cardholders to change their cash back categories. However, these changes may take effect in the following billing cycle, so be sure to plan accordingly.

3. How do I redeem my cash back rewards?

Cash back rewards are automatically applied as a credit to your account each month, making redemption easy and effortless.

4. Is there a minimum income requirement to qualify for the Tangerine World Mastercard?

Yes, a minimum personal income of $60,000 or household income of $100,000 is generally required to qualify. However, these requirements may vary based on your credit score and other factors.

Final Thoughts: Is the Tangerine World Mastercard Right for You?

The Tangerine World Mastercard is an excellent choice for Canadians who want a cash back credit card that offers flexibility, value, and premium perks without an annual fee. With its customizable cash back categories, travel insurance, and mobile device protection, this card stands out among the top-rated cash back credit cards in Canada.

For those looking to maximize their rewards even further, using Great Canadian Rebates provides an added layer of savings. The platform’s credit card rebates and partner discounts make it easy to get more out of each purchase, giving you extra cash back on your everyday spending.

Whether you’re a frequent traveller, a regular online shopper, or someone who wants comprehensive rewards in specific spending categories, the Tangerine World Mastercard benefits can help you make the most of every dollar spent.

Search For the Best Cashback Card for Online Shopping

If you’re looking for cards that offer fantastic cash back or credit card rebates, you’ve come to the right place! Great Canadian Rebates is an online platform that lets Members compare credit card options available in Canada and apply for the one that best suits their financial and lifestyle requirements. Great Canadian Rebate’s credit card comparison tool is one of the best in the business.

It’s free to join, and Members can also choose from over 700 well-known merchants and enjoy great rebates, deals, and discounts. Visit the website today for more information.