The Canadian financial landscape is brimming with credit card options, but few are as tailored to the modern, budget-conscious consumer as the Tangerine World Mastercard. This card offers flexible cash back categories, excellent travel perks, and—the best part—no annual fee. It’s designed with everyday Canadians in mind, making it one of the best options for people who want a balance of rewards, flexibility, and smart spending.

Tangerine Bank: A Leading Innovator in Canada

Tangerine Bank, formerly known as ING Direct, is widely regarded as one of the most innovative financial institutions in Canada. Focusing on digital banking, Tangerine offers services that are accessible, easy to use, and free from many of the fees that traditional banks impose.

Tangerine’s no-nonsense approach to banking has made it a favourite among Canadians, and it continues to gain popularity due to its customer-friendly policies and products. With Tangerine, everything from opening accounts to applying for a cash back credit card is a seamless online experience.

One of the key reasons Tangerine stands out as one of the best banks in Canada is its commitment to providing value to its customers. Unlike traditional brick-and-mortar banks, Tangerine operates entirely online, allowing them to offer competitive interest rates, fewer fees, and higher-quality digital tools. Whether it’s through their savings accounts, investment services, or their credit card lineup, Tangerine makes it easy for Canadians to take control of their finances.

In recent years, Tangerine has become synonymous with smart financial products tailored to the needs of Canadians who prefer transparency, ease of use, and value for money. One of their most innovative offerings is the Tangerine World Mastercard, which is a perfect fit for savvy consumers looking to maximize rewards while keeping costs low.

Tangerine’s Credit Card Lineup

Tangerine has made a name for itself with its simple yet rewarding credit card options. Their credit card lineup includes the Tangerine Money-Back Credit Card and the Tangerine World Mastercard, both of which offer cash back options that can be tailored to suit your spending habits. These cards appeal to a wide range of Canadians due to their no-fee structure and ability to deliver real savings on everyday purchases.

What sets Tangerine’s credit card options apart is their innovative cash back structure, which allows cardholders to select categories where they want to earn the most rewards. This flexibility is a major selling point, as it enables users to maximize returns on the things they spend the most money on. Whether you’re looking for a basic card for day-to-day spending or one with more premium perks, Tangerine has an option for you.

Introducing the Tangerine World Mastercard

The Tangerine World Mastercard is designed for Canadians who want a bit more from their credit card without having to pay an annual fee. It’s an ideal card for individuals who enjoy cash back rewards but also want access to additional benefits like travel perks and mobile device insurance.

No Annual Fee

One of the most attractive features of the Tangerine World Mastercard is that it offers these premium benefits without charging an annual fee. Many credit cards that provide comparable perks come with hefty annual fees, but Tangerine has managed to make these rewards accessible to the average Canadian at no extra cost.

Flexible Cash Back Categories

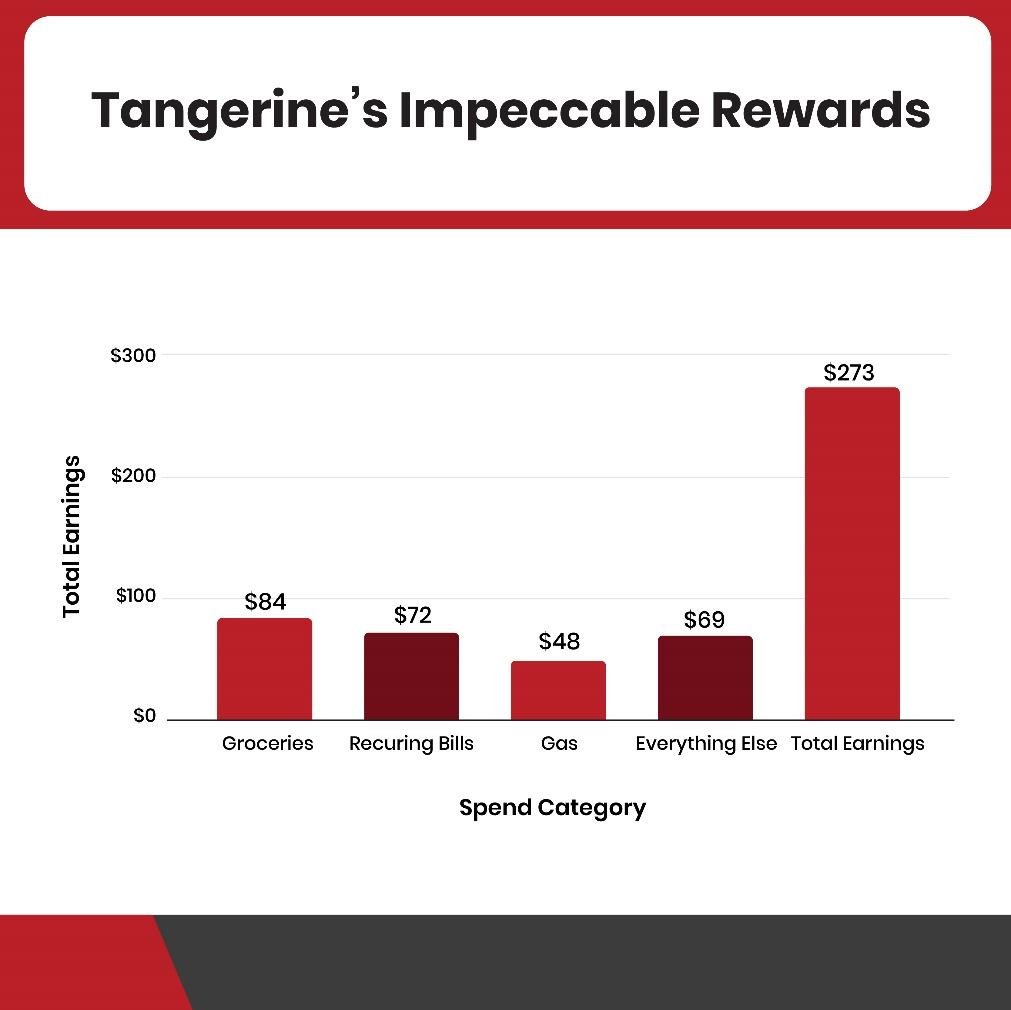

What truly sets the Tangerine World Mastercard apart is its unique cash back structure. Cardholders can choose up to three spending categories where they’ll earn 2% cash back. This flexibility allows users to tailor their rewards to match their spending habits. The available categories include:

- Groceries

- Gas

- Restaurants

- Furniture

- Hotels/Motels

- Recurring Bill Payments

- Entertainment

- Public Transportation and Parking

- Home Improvement

If you set up your cash back to be deposited into a Tangerine Savings Account, you unlock the ability to choose an additional category, bringing the total to three categories with 2% cash back. All other purchases earn 0.5% cash back, ensuring you’re always earning something on every transaction.

This flexibility is a huge advantage for Canadians who have diverse spending needs. You can adjust your cash back categories as your priorities change, which means that the card grows with you and continues to offer value over time.

Travel Perks

In addition to the cash back rewards, the Tangerine World Mastercard includes some excellent travel perks that make it ideal for frequent travellers. These include:

- No Foreign Transaction Fees: Unlike many other credit cards, the Tangerine World Mastercard does not charge foreign transaction fees on purchases made outside of Canada. This is a major benefit for travellers who frequently shop online or abroad. Typically, credit card providers charge a 2.5% fee on foreign transactions, so having a card without this charge can result in significant savings.

- Rental Car Collision/Loss Damage Insurance: When you rent a car with your Tangerine World Mastercard, you’re covered for collision and loss damage insurance, giving you peace of mind during your travels.

- Mastercard Travel Rewards: As a World Mastercard holder, you gain access to the Mastercard Travel Rewards program, which allows you to save on hotels, flights, car rentals, and more. These rewards can be a great way to stretch your travel budget further.

Mobile Device Insurance

The Tangerine World Mastercard also comes with mobile device insurance, which is a relatively rare perk for a no-fee credit card. This coverage protects your smartphone or tablet from damage or theft, provided you purchased the device with your card. Given the high cost of mobile devices, this insurance adds a lot of value to the card, especially for those who tend to drop their phones or frequently upgrade to the latest models.

Purchase Protection and Extended Warranty

In addition to travel and mobile device perks, the Tangerine World Mastercard also provides purchase protection and extended warranty coverage. This means that any item you buy with the card is covered for damage, theft, or loss for a set period after purchase, and the card will also extend the manufacturer’s warranty by up to an additional year. For those making significant purchases, this added layer of protection can be invaluable.

No Annual Fee with Premium Perks

One of the biggest reasons the Tangerine World Mastercard is considered one of the best credit cards in Canada is its no-annual-fee structure combined with premium benefits. Many cards that offer similar perks—such as no foreign transaction fees, mobile device insurance, and cash back rewards—often charge annual fees of $100 or more. With Tangerine, cardholders can enjoy these benefits without worrying about an extra cost.

High Canadian Acceptability

The Tangerine World Mastercard is widely accepted across Canada and internationally, wherever Mastercard is accepted. This means that whether you’re shopping locally, buying online, or travelling, you’ll have no trouble using this card. Furthermore, the no foreign transaction fee benefit makes it one of the most attractive cards for international spending, as you won’t have to worry about hidden costs when making purchases abroad.

Why the Tangerine World Mastercard is Among Canada’s Best

The Tangerine World Mastercard offers a perfect blend of flexibility, rewards, and convenience, making it one of the best credit cards in Canada. It’s particularly suited to Canadians who want to maximize cash back on everyday purchases without paying an annual fee. The flexibility to choose your own cash back categories means that the card adapts to your spending habits, giving you control over how you earn rewards.

For frequent travellers, the card’s no foreign transaction fees and travel-related perks make it an ideal companion. It allows you to save on international purchases while enjoying travel benefits like rental car insurance. Add to that the mobile device insurance and purchase protection, and you have a card that offers premium perks without the premium price tag.

Tangerine Bank’s commitment to providing transparent, user-friendly financial products has made it a top choice for Canadians who value flexibility, innovation, and real value. The

Tangerine World Mastercard reflects this commitment by offering a card that delivers excellent rewards and benefits at no cost to the cardholder.

Conclusion

If you’re looking for a credit card that offers flexibility, travel perks, and robust rewards with no annual fee, the Tangerine World Mastercard is hard to beat. With customizable cash back categories, no foreign transaction fees, and premium travel benefits, this card stands out as a versatile tool for both everyday spending and travel. Canadians who want a card that adapts to their financial needs and offers exceptional value will find that the Tangerine World Mastercard is a smart choice for their wallet.

Where To Apply For The Best Canadian Credit Cards?

Great Canadian Rebates is an online platform that lets Members compare credit card options available in Canada and apply for the one that best suits their financial and lifestyle requirements. It’s free to join, and Members can also choose from over 700 well-known merchants and take advantage of great rebates, deals, and discounts.

Visit the website today for more information.