When it comes to choosing the right credit card, Canadians want options that provide value and flexibility in their daily lives. The TD Cash Back Visa stands out as a powerful tool for those looking to maximize their everyday purchases, offering competitive cash back rates on groceries, gas, and recurring bill payments. In this comprehensive guide, we will explore how TD Bank’s innovative credit card lineup—specifically the TD Cash Back Visa—can help Canadians get the most out of their spending.

Introducing TD Bank: A Leader in Canadian Banking

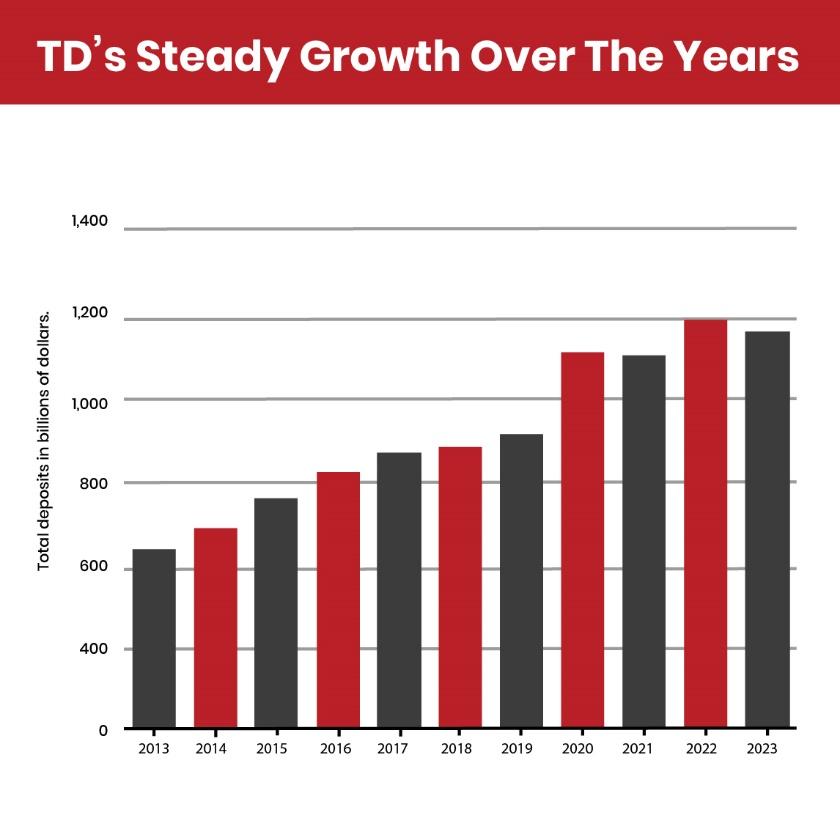

Toronto-Dominion Bank, more commonly known as TD Bank, is one of Canada’s largest and most reputable financial institutions. With over 22 million clients worldwide, TD has built a legacy of trust, reliability, and innovation. TD’s comprehensive range of financial services—from personal and commercial banking to wealth management and insurance—caters to the diverse needs of Canadians. Their reputation for excellent customer service and innovative banking solutions sets them apart in the competitive Canadian banking landscape.

TD Bank consistently ranks among the top Canadian banks for several reasons. They prioritize customer experience, making banking accessible with user-friendly digital platforms, 24/7 customer support, and a widespread network of branches and ATMs across the country. TD is also committed to innovation, integrating technology to provide seamless banking experiences, from mobile apps to contactless payments.

As a leader in the credit card industry, TD offers a range of products designed to suit various spending habits and lifestyles. Whether you’re looking for travel rewards, cash back credit cards, or low-interest options, TD has a credit card to match your financial goals.

TD’s Innovative Credit Card Lineup

TD Bank offers a variety of credit cards, each tailored to different spending needs. From top-rated cash back credit cards to premium travel cards, TD provides options for every type of consumer.

The TD Aeroplan Visa Infinite, for example, caters to frequent flyers with a robust points system for travel rewards. At the same time, the TD First Class Travel Visa Infinite allows cardholders to earn rewards that can be redeemed for flights, hotels, and vacation packages. TD also offers low-interest options like the TD Emerald Flex Rate Visa, which appeals to Canadians looking to manage their credit more efficiently.

Among these excellent options, the TD Cash Back Visa emerges as an outstanding choice for everyday purchases. It’s a card that transforms regular spending—groceries, gas, and bill payments—into tangible rewards, helping Canadians stretch their dollars further while managing their finances effectively.

The TD Cash Back Visa: A Closer Look

The TD Cash Back Visa is designed for individuals who want to earn cash back on everyday purchases without paying annual fees. It offers simplicity, convenience, and tangible rewards for responsible spending. Whether you’re shopping for groceries, filling up your car with gas, or paying your monthly utility bills, the TD Cash Back Visa provides a straightforward way to earn money back on your purchases.

Competitive Cash Back Rates

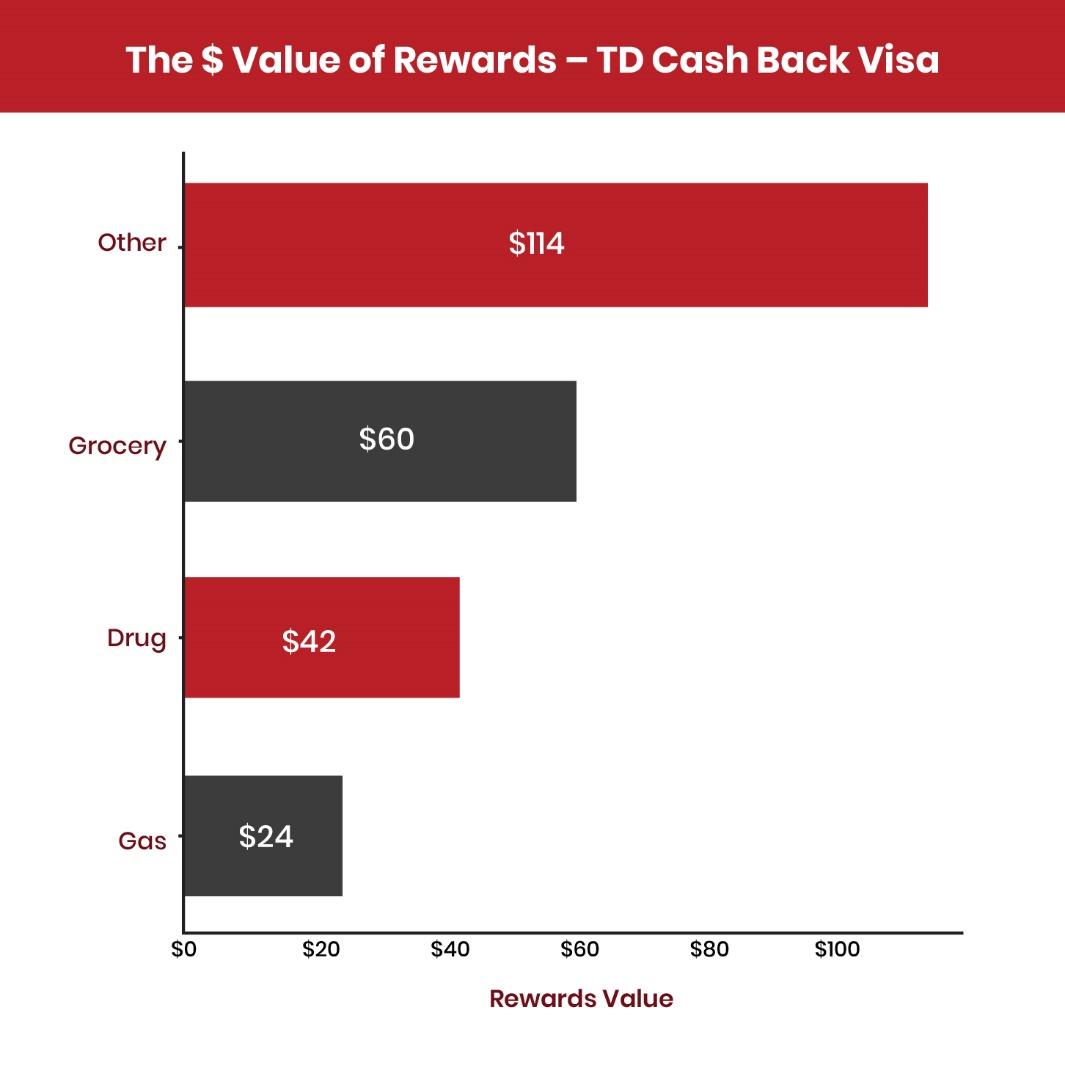

One of the main reasons the TD Cash Back Visa is so appealing is its competitive cash back rates on essential spending categories. Here’s how you can maximize your cash back earnings:

- Groceries: The card offers 1% cash back on grocery purchases, making it an excellent option for weekly supermarket runs. This feature is particularly valuable for families or individuals who spend a significant portion of their budget on groceries.

- Gas: Canadians can earn 1% cash back at gas stations. With fluctuating fuel prices, this can help offset the costs of commuting or road trips.

- Recurring Bill Payments: You also earn 1% cash back on recurring bill payments, including utilities, phone bills, and subscriptions like Netflix or Spotify. This makes it easy to accumulate cash back on necessary monthly expenses passively.

On all other purchases, the TD Cash Back Visa offers 0.5% cash back, ensuring that every transaction contributes to your rewards, no matter where you’re spending.

Perks and Benefits of the TD Cash Back Visa

While the cash back structure is a significant draw, the TD Cash Back Visa benefits go beyond simple rewards. Here are some of the additional perks that make this card an exceptional choice for Canadians:

- No Annual Fee: The TD Cash Back Visa does not charge an annual fee, making it a cost-effective option for Canadians who want to earn rewards without paying for the privilege. Many premium cards charge hefty fees, but the TD Cash Back Visa offers valuable rewards at no cost.

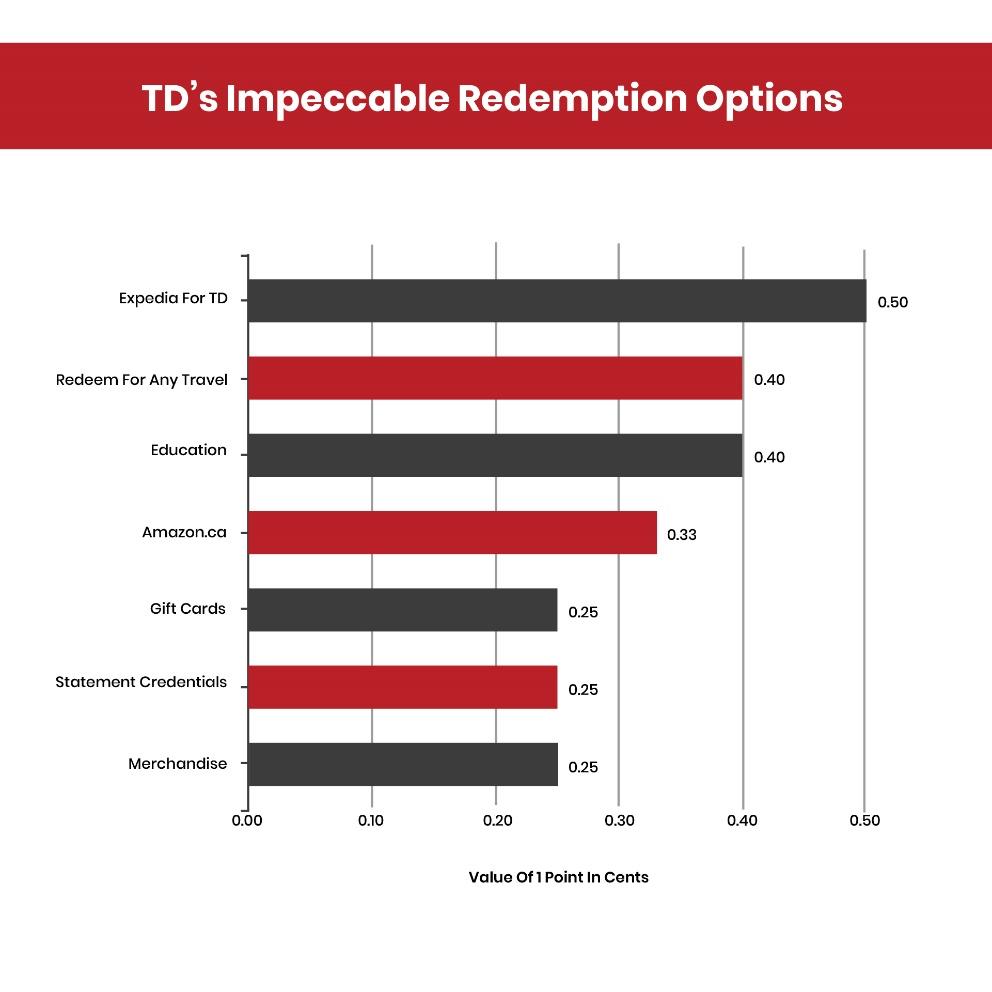

- Instant Cash Back Redemption: Cardholders can redeem their cash back at any time once they’ve accumulated $25, providing flexibility and immediate access to your rewards. You’re not locked into waiting for annual redemption periods, which is common with some other cards.

- Purchase Security and Extended Warranty Protection: The TD Cash Back Visa includes Purchase Security and Extended Warranty Protection. This means that eligible purchases made with your card are protected from theft, loss, or damage for 90 days, and you’ll receive an extended warranty on items for up to one additional year beyond the manufacturer’s warranty.

- Visa Zero Liability: With Visa Zero Liability, cardholders aren’t held responsible for unauthorized purchases made on their TD Cash Back Visa, offering peace of mind in the event of fraud.

- Emergency Cash Advances: The card provides access to cash advances at over 1 million ATMs worldwide, making it a reliable option when you need cash on hand during unexpected situations.

- Auto Rental Collision/Loss Damage Insurance: Cardholders also benefit from Auto Rental Collision/Loss Damage Insurance, covering damage or loss when renting a vehicle using their TD Cash Back Visa.

Maximizing Your Cash Back Earnings

To fully take advantage of the TD Cash Back Visa benefits, Canadians should consider using the card strategically. Here are some tips for maximizing your rewards:

- Focus Spending on Cash Back Categories: Since the card offers 1% cash back on groceries, gas, and recurring bills, try to funnel as many purchases as possible into these categories. For example, if your grocery store offers gift cards for other retailers, consider purchasing those with your TD Cash Back Visa to extend your cash back to additional spending areas.

- Set Up Automatic Payments: Enrolling in recurring bill payments on your TD Cash Back Visa ensures that you earn cash back automatically each month without extra effort.

- Combine with Other Reward Programs: Many grocery stores and gas stations have their loyalty programs. Using your TD Cash Back Visa in conjunction with these programs can lead to double-dipping on rewards. For example, if your grocery store offers loyalty points, you’ll earn both points and cash back on a single transaction.

Why TD Cash Back Visa Stands Out in Canada

The TD Cash Back Visa stands out in Canada not only for its generous rewards structure but also for its widespread acceptability. As a Visa card, it’s accepted at millions of locations worldwide, ensuring that you can earn cash back on both domestic and international purchases. Whether you’re shopping online or paying bills, the TD Cash Back Visa provides seamless integration into your daily financial routine.

Additionally, TD’s commitment to customer service enhances the overall experience for cardholders. TD is known for its robust support network, including online banking, mobile apps, and 24/7 customer service, making it easy to manage your account and stay on top of your cash back earnings.

The TD Cash Back Visa in Comparison

When compared to other cash back credit cards, the TD Cash Back Visa offers an appealing combination of competitive rates, no annual fee, and valuable perks. While some other cards may offer higher cash back percentages in specific categories, they often come with annual fees or more complex redemption rules. The TD Cash Back Visa provides a straightforward and user-friendly experience, making it a great choice for those who want to earn rewards without the hassle.

Other Credit Cards Offered by TD

TD Bank offers a variety of credit cards tailored to meet the diverse needs of Canadians, from cash back credit cards to premium travel options. Here’s a look at some of the top cards in their lineup:

- TD Aeroplan Visa Infinite

The TD Aeroplan Visa Infinite is designed for frequent travellers, offering an excellent way to earn Aeroplan Miles on every purchase. Cardholders earn accelerated points on Air Canada purchases, and travel benefits like priority boarding, a free first checked bag, and access to exclusive Aeroplan offers make this card perfect for jet-setters. It’s a top choice for those looking to leverage travel rewards. - TD First Class Travel Visa Infinite

This travel credit card allows you to earn TD Rewards Points on all purchases, with bonus points on travel-related purchases through Expedia for TD. The flexibility to redeem points on flights, hotels, and vacation packages makes it one of TD’s best options for those who prioritize travel rewards without being tied to a specific airline. - TD Platinum Travel Visa

For the occasional traveller, the TD Platinum Travel Visa offers similar travel rewards without the high annual fee of premium travel cards. Cardholders earn points on everyday purchases and enjoy travel perks like travel medical insurance, delayed and lost baggage insurance, and car rental insurance.

With a diverse range of credit card rebates, rewards, and perks, TD Bank provides Canadians with options that suit various financial goals and lifestyles. Whether you’re seeking travel rewards or cash back, TD has the right card for you.

Why TD Bank is One of the Best in Canada

Beyond the benefits of individual credit cards, TD Bank’s reputation as one of the best banks in Canada further strengthens the appeal of the TD Cash Back Visa. TD is consistently recognized for its excellent customer service, innovative digital banking tools, and commitment to helping Canadians achieve their financial goals.

TD also offers a comprehensive suite of financial products, from mortgages to investment accounts, making it a one-stop shop for all your banking needs. For customers who prefer to manage their finances with one institution, TD provides convenience, accessibility, and reliability, backed by a long-standing reputation for trustworthiness.

Conclusion: Is the TD Cash Back Visa Right for You?

The TD Cash Back Visa is an excellent choice for Canadians looking to maximize their everyday spending while enjoying perks like purchase protection, no annual fee, and easy cash back redemption. With competitive rates on groceries, gas, and recurring bills, it’s a versatile card that fits seamlessly into the average Canadian’s financial life.

Whether you’re looking to cut costs on essentials or earn rewards on regular purchases, the TD Cash Back Visa benefits are designed to help you get more from every dollar you spend. With TD Bank’s strong reputation backing the card, you can rest assured that you’re in good hands as you work toward your financial goals.

Where Can You Apply?

If you plan to apply for a cash back rewards credit card, head to Great Canadian Rebates. Our online platform will allow you to compare the best cashback credit cards and others, which will help you choose the one that fits the bill. You can earn a solid credit card rebate when you sign up for the credit card through our platform.

Visit our website for more information.