The Simplii Cash Back Visa is a user-friendly credit card designed to help Canadians earn cash back on their everyday purchases. With no annual fee and a straightforward rewards structure, the Simplii Financial Cash Back Visa offers a simple and rewarding way to save money.

One of the standout features of the Simplii Cash Back Visa is its generous cash back rewards. Cardholders can earn up to 4% cash back on eligible restaurant, bar, and coffee shop purchases, making it a great option for those who frequently dine out. Additionally, the card offers 1.5% cash back on gas, groceries, and drugstore purchases, as well as 0.5% cash back on all other credit card purchases.

This blog post aims to guide you in maximizing your Simplii Cash Back Visa rewards. We’ll delve into the card’s features and benefits and provide tips on how to make the most of its cash back program. By understanding Simplii’s financial promos and using them strategically, you can unlock its full potential and enjoy the financial rewards it offers.

Understanding the Simplii Financial Cash Back Visa

The Simplii Cash Back Visa is a straightforward credit card that offers a simple and rewarding way to earn cash back on your everyday purchases. The card’s rewards system is designed to be easy to understand and use, making it a great option for those who prefer simplicity.

Simplii Financial Cash Back Visa rewards are based on your spending categories. You’ll earn a higher cash back rate on eligible restaurant, bar, and coffee shop purchases, while a lower rate applies to gas, groceries, drugstore purchases, and pre-authorized payments. All other credit card purchases earn a base cash back rate.

When considering the Simplii Financial Cash Back Visa, it’s important to factor in the following:

- Annual fee: The Simplii Cash Back Visa has no annual fee, making it an attractive option for those who want to avoid unnecessary costs.

- Interest rate: The card’s interest rate is competitive, but it’s important to pay your balance in full each month to avoid interest charges.

- Eligibility requirements: To be eligible for the Simplii Cash Back Visa, you’ll need to meet certain criteria, such as having a good credit score.

By understanding these factors, you can determine if the Simplii financial promo is the right choice for your needs and financial goals.

Key Features of the Simplii Financial Cash Back Visa

The Simplii Financial Cash Back Visa offers a comprehensive suite of features and benefits that make it a valuable credit card option for Canadian consumers. Here’s a closer look at some of its key features:

Welcome Offer: $100 Skip Digital Gift Card

As a new cardholder, you’ll receive a $100 Skip Digital Gift Card after spending $100 with your new Simplii Financial Cash Back Visa by November 30, 2024. This welcome offer provides an immediate boost to your rewards and makes it even more rewarding to use your card.

Elevated Cash Back: 10% Cash Back on Eligible Purchases

For the first four months of card ownership, you’ll enjoy an elevated cash back rate of 10% on eligible restaurant, food delivery, and bar purchases. This Simplii financial promo is a great opportunity to maximize your rewards and earn extra cash back on your dining expenses.

Cash Back Categories

The Simplii Financial Cash Back Visa offers three cash back categories:

- Restaurants, Bars, and Coffee Shops: Earn 4% cash back on eligible purchases up to $5,000 per year.

- Gas, Groceries, and Drugstores: Earn 1.5% cash back on eligible purchases up to $15,000 per year.

- All Other Purchases: Earn 0.5% cash back on all other credit card purchases with no limit.

These categories cover a wide range of everyday expenses, ensuring you can earn cash back on your regular spending.

Coverage: Purchase Security and Extended Protection Insurance

The Simplii Financial Cash Back Visa provides valuable coverage for your purchases. Purchase Security protects your eligible purchases against theft, loss, or damage within 90 days of purchase. Extended Protection Insurance doubles the manufacturer’s warranty for up to one additional year on eligible items.

Send Money Abroad: Cash Back on Global Money Transfers

When you send a Global Money Transfer using your Simplii Financial Cash Back Visa, you’ll receive cash back on the transaction. This is a convenient way to send money abroad while earning rewards.

Extra Card Fees: $0 for Up to 3 Additional Cards

The Simplii Financial Cash Back Visa allows you to add up to three additional cards at no extra charge. This is ideal for families or individuals who want to share their rewards with others.

Credit Score Requirement: 600+

To be eligible for the Simplii Financial Cash Back Visa, you’ll need to have a credit score of 600 or higher. This is a relatively low credit score requirement, making the card accessible to a wide range of consumers.

Interest Rates

The Simplii Financial Cash Back Visa has the following interest rates:

- Purchase Interest Rate: 20.99%

- Balance Transfer Interest Rate: 22.99%

- Cash Advance Interest Rate: 22.99%

It’s important to note that interest charges may apply if you carry a balance on your card. To avoid interest, it’s recommended to pay your balance in full each month.

By understanding these key features, you can make an informed decision about whether the Simplii Financial Cash Back Visa is the right choice for your needs. This card offers a combination of cash back rewards, valuable coverage, and convenience, making it a worthwhile option for Canadian consumers.

Maximizing Your Simplii Financial Cash Back Visa Rewards

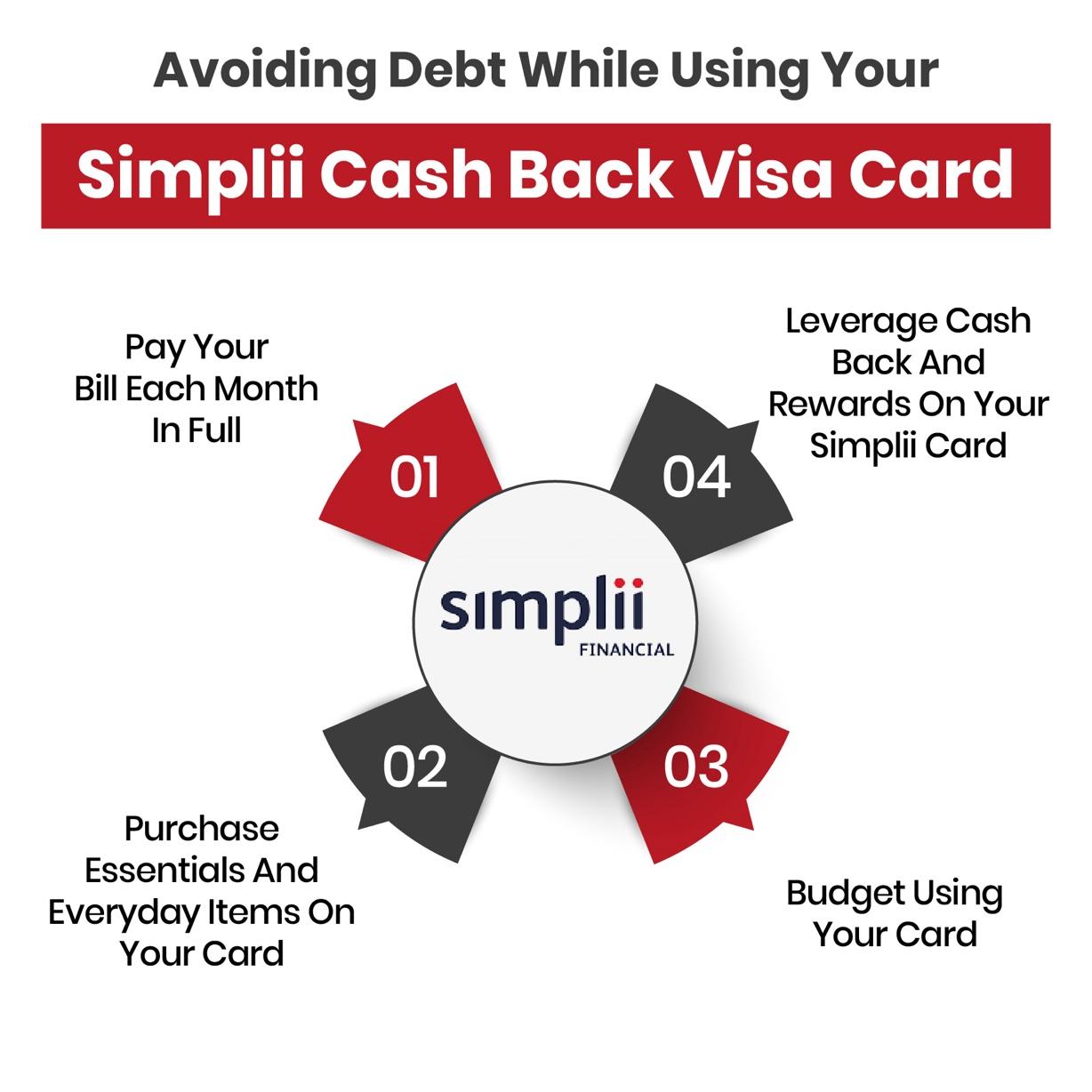

To get the most out of your Simplii Financial Cash Back Visa, it’s important to understand how to maximize your rewards. Here are some tips to help you make the most of your card:

Earning More Cash Back

- Take advantage of the welcome offer: The Simplii Financial Cash Back Visa offers a generous welcome offer that can provide a significant boost to your rewards. Make sure to take advantage of this opportunity to earn extra cash back.

- Focus on eligible spending categories: To maximize your cash back earnings, prioritize spending in the categories that offer the highest rewards. This includes restaurants, bars, coffee shops, gas, groceries, and drugstores.

- Use your card for everyday purchases: The Simplii Financial Cash Back Visa is a great option for earning cash back on your everyday expenses. Use your card for purchases like groceries, dining out, and utility bills to accumulate rewards.

- Consider using your card for online purchases: Many online retailers accept the Simplii Financial Cash Back Visa. By using your card for online purchases, you can earn cash back on a wide range of products and services.

Redeeming Cash Back for Maximum Value

- Redeem your cash back regularly: Don’t let your cash back rewards accumulate. Redeem your cash back regularly to avoid missing out on potential benefits.

- Consider cash back options: The Simplii financial promo offers various cash back options, such as cash deposits, statement credits, or gift cards. Choose the option that best suits your needs and preferences.

- Use cash back for everyday expenses: Redeeming your cash back for everyday expenses can help you save money on your regular purchases. Consider using cash back to pay for groceries, dining out, or utility bills.

- Take advantage of special offers: Keep an eye out for special offers and promotions that allow you to redeem your cash back for even greater value.

Using Your Simplii Financial Cash Back Visa Responsibly

- Pay your balance in full each month: One of the most important tips for using any credit card responsibly is to pay your balance in full each month. This will help you avoid interest charges and maximize the value of your rewards.

- Monitor your spending: Keep track of your spending to ensure you’re using your Simplii Financial Cash Back Visa responsibly. Avoid overspending and make sure you can comfortably afford your monthly payments.

- Take advantage of additional benefits: The Simplii Financial Cash Back Visa may offer additional benefits, such as purchase protection or extended warranty. Be sure to familiarise yourself with these benefits and take advantage of them when needed.

By following these tips, you can maximize the value of your Simplii Financial Cash Back Visa and enjoy the financial rewards it offers. Remember, responsible credit card usage is essential to ensure you’re getting the most out of your rewards.

Ready to take control of your finances? Great Canadian Rebates is your gateway to financial freedom. Our platform offers a curated selection of the best cash back credit cards in Canada, helping you maximize your savings and rewards.

By joining Great Canadian Rebates, you can compare top credit cards side-by-side, find the perfect card for your lifestyle, and earn cash back on your everyday spending. Start your journey to financial freedom today. Sign up now and discover the power of rewards.