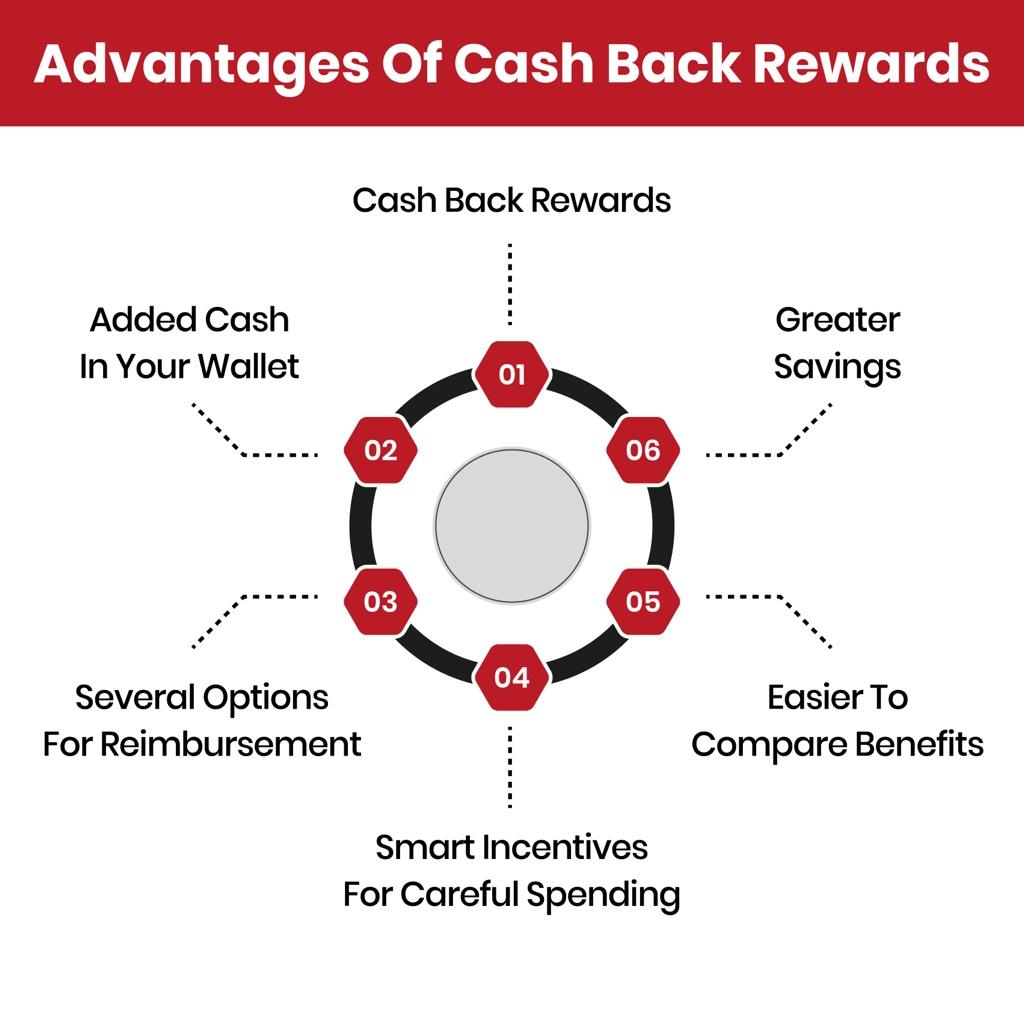

Cash back credit cards work by rewarding cardholders with a percentage of their spending. This cash back can be earned on various purchases, including groceries, gas, travel, and everyday expenses. There are different types of cash back rewards:

- Flat-rate cash back: This offers a consistent percentage of cash back on all purchases.

- Tiered cash back: Rewards increase as you spend more, often with higher percentages for specific spending categories.

- Rotating category cash back: Offers increased cash back on different categories each quarter or month.

When choosing a top rated cash back credit card in 2024, consider the following factors:

- Annual fee: Some cards have annual fees, while others do not.

- Interest rate: If you carry a balance, a lower interest rate can save you money.

- Eligibility requirements: Ensure you meet the eligibility criteria to obtain the card.

- Cash back redemption options: Consider how you prefer to redeem your rewards (cash, gift cards, statement credits).

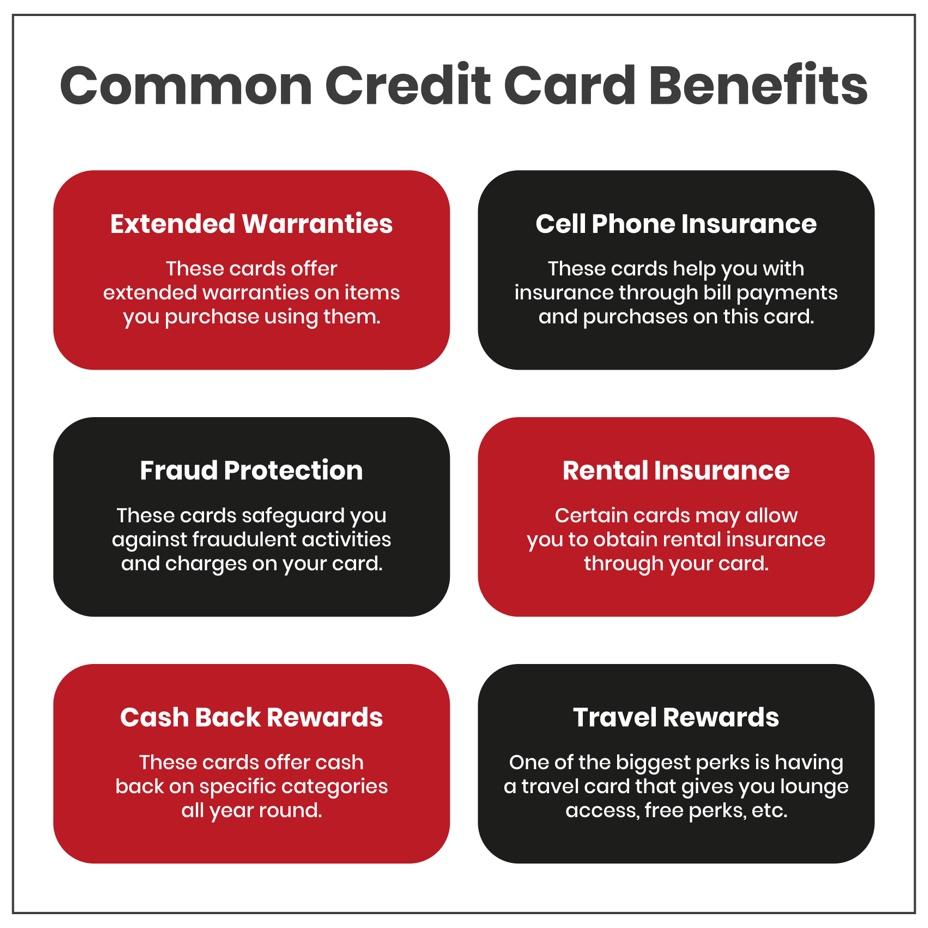

- Additional benefits: Some cards may offer travel perks, insurance, or other benefits.

Top Cash Back Credit Cards in Canada for 2024

Let’s break it down and look at the top cash back credit cards in Canada that will enable you to save more, spend less, and enjoy all kinds of perks:

American Express Gold Rewards Card: A Top-Tier Cash Back Option

The AMEX gold credit card is one of the top rated cash back credit cards in Canada for 2024. This card offers a generous cash back program that rewards cardholders for their everyday spending.

One of the standout features of the AMEX gold credit card is its elevated cash back rates on groceries, travel, and everyday purchases. Cardholders enjoy a higher percentage of cash back on these categories, making it a great choice for those who frequently shop at grocery stores or travel.

In addition to its cash back rewards, the AMEX gold credit card also offers several unique perks and advantages. These may include travel insurance, hotel benefits, and access to exclusive experiences. These added features can enhance the overall value of the card and provide additional benefits for cardholders.

American Express Cobalt Card: A Premier Cash Back Option

The American Express Cobalt Card is another top rated cash back credit card that offers exceptional rewards for dining and travel. This card’s unique cash back structure makes it a popular choice for those who frequently dine out or take vacations.

One of the AMEX cobalt cash back card’s most attractive features is its elevated rewards for dining. Cardholders earn a generous percentage of cash back on all dining purchases, making it a great option for foodies who enjoy exploring restaurants. Additionally, the AMEX cobalt cash back card offers competitive rewards for travel expenses, including flights, hotels, and car rentals.

While the American Express Cobalt Card offers many benefits, it’s important to consider potential drawbacks or limitations. One potential downside is that the card may have a higher annual fee compared to some other cash back options. Additionally, the card’s cash back rewards may be limited to specific categories, so it’s essential to understand the terms and conditions to maximize your earnings.

TD First Class Travel Visa Infinite Card: A Travel Enthusiast’s Dream

The TD First Class Travel Visa Infinite Card is a top rated cash back credit card designed specifically for frequent travellers. This card offers a comprehensive suite of travel-focused rewards and benefits that can significantly enhance your travel experiences.

One of the standout features of the TD First Class Travel Visa Infinite Card is its extensive travel insurance coverage. This includes trip cancellation insurance, medical emergency insurance, and lost or stolen baggage insurance. These benefits can provide peace of mind and financial protection when traveling.

In addition to its travel-focused rewards, the TD First Class Travel Visa Infinite Card also offers cash back options for everyday spending. Cardholders can earn cash back on eligible purchases, which can be redeemed for travel expenses or other rewards. This flexibility allows you to maximize your rewards, whether you’re travelling frequently or not.

When comparing the TD First Class Travel card to other travel credit cards, it’s important to consider factors such as annual fees, interest rates, and the specific travel benefits offered. While some cards may offer similar travel insurance coverage, the TTD First Class Travel Visa Infinite Card’s combination of travel rewards and cash back options makes it a compelling choice for those who value both travel benefits and everyday rewards.

RBC ION+ Visa: A Customizable Cash Back Card

The RBC ION+ Visa is a top rated cash back credit card that offers a unique and customizable rewards program. This card allows cardholders to personalize their cash back categories, making it a great option for those who have specific spending habits.

One of the standout features that makes the RBC ION+ Visa a top rated cash back credit card is its flexibility in choosing cash back categories. Cardholders can select up to five categories where they want to earn elevated cash back rewards. This customization allows you to tailor the card to your specific spending patterns, maximizing your rewards.

When comparing the RBC ION+ Visa to other cash back cards with similar features, it’s important to consider the number of customizable categories offered and the overall cash back rates. While some cards may offer a fixed number of categories, the RBC ION+ Visa provides more flexibility in choosing your preferred categories.

Additionally, the RBC ION+ Visa may offer other benefits or features that differentiate it from competing cards. These may include travel perks, insurance coverage, or access to exclusive offers.

Using Cash Back Credit Cards Responsibly

While cash back credit cards can be a valuable tool for earning rewards, it’s essential to use them responsibly to avoid falling into debt. Here are some additional tips for using cash back credit cards wisely:

1. Pay Your Balance in Full Each Month: One of the most crucial aspects of responsible credit card usage is paying off your balance in full each month. Carrying a balance can lead to accumulating interest charges, which can significantly reduce the value of your cash back rewards. By paying your balance in full, you’ll avoid interest charges and maximise your savings.

2. Track Your Spending: To ensure you’re using your top cash back credit cards responsibly, it’s important to track your spending. Keep a record of your purchases and monitor your spending habits. This will help you stay within your budget and avoid overspending.

3. Avoid Using Your Credit Card as a Cash Advance: Cash advances are typically associated with higher interest rates and fees. Avoid using your credit card to withdraw cash, as this can quickly lead to debt. If you need cash, consider using a debit card or withdrawing money from your savings account instead.

4. Set a Budget and Stick to It: Before using your cash back credit card, set a budget for your monthly expenses. This will help you determine how much you can afford to spend on your credit card each month. By sticking to your budget, you can avoid overspending and reduce the risk of falling into debt.

5. Consider a Balance Transfer: If you’re already carrying a balance on another credit card with a high interest rate, you may want to consider a balance transfer. This involves transferring your balance to a new card with a lower interest rate. However, be aware that some cards may charge a balance transfer fee.

6. Be Mindful of Annual Fees: Some cash back credit cards have annual fees. Before applying for a card, carefully consider whether the benefits outweigh the cost of the annual fee. If you’re not using the card frequently or not earning enough rewards to offset the fee, it may be more beneficial to choose a card with no annual fee.

Ready to maximize your cash back rewards? Join Great Canadian Rebates today and start earning more money on your everyday purchases.

Our platform connects you with the top rated cash back credit cards in Canada, making it easy to find the perfect card for your needs.

Don’t miss out on this opportunity to earn extra cash. Sign up now and start earning cash back on your groceries, travel, and everyday spending.