The Rogers Red Mastercard stands out as an excellent credit card option for Canadian shoppers. It offers multiple ways to maximize cash back rewards, whether you’re purchasing everyday essentials or paying your mobile phone bill. This no-annual-fee card provides excellent value.

If you’re a Rogers, Fido, or Shaw customer, the card’s enhanced rewards make it even more appealing. In this article, we will explore the key features, benefits, and ways to take full advantage of the Rogers Red Mastercard for maximum savings.

Key Features of the Rogers Red Mastercard

One of the most attractive aspects of the Rogers Red Mastercard is its ability to earn cash back on all purchases without limits. Let’s take a closer look at the card’s standout features:

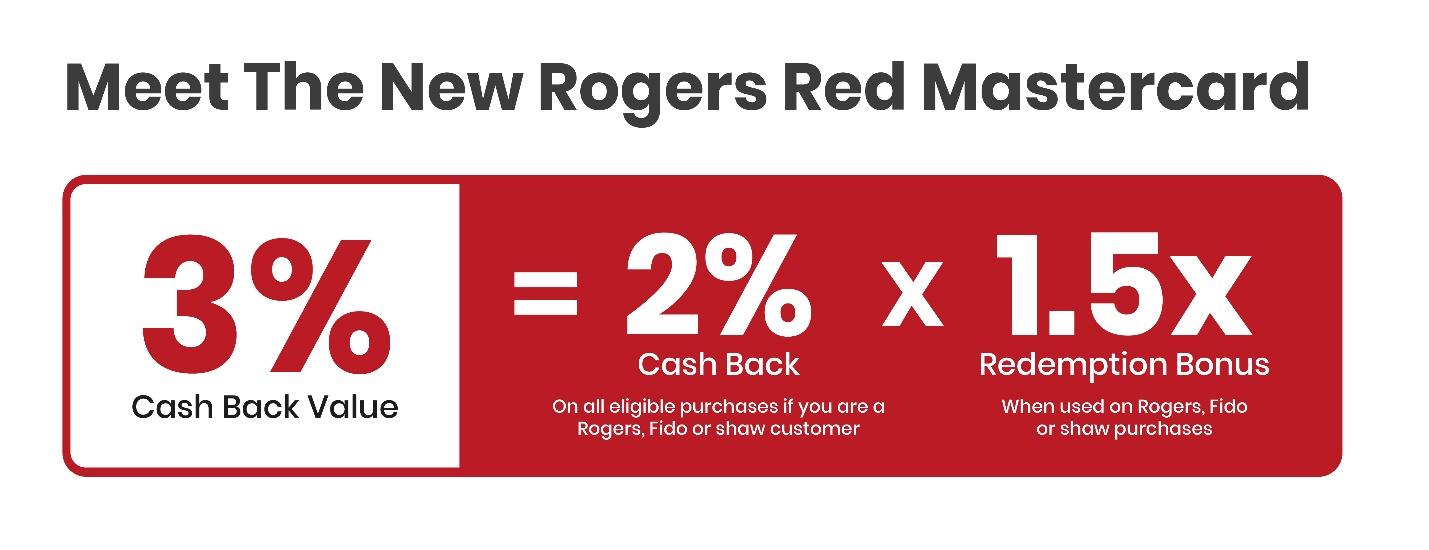

- 2% Cash Back for Rogers, Fido, and Shaw Customers: The Rogers Red Mastercard offers an outstanding 2% cash back on all eligible purchases for Rogers, Fido, or Shaw postpaid customers. This makes it a perfect fit for individuals already using services from these companies, as you can enjoy cash back rewards simply for your everyday spending.

- 1.5x Redemption Bonus:On top of the 2% cash back, Rogers, Fido, and Shaw customers also benefit from a 1.5x redemption bonus when using their rewards to pay for Rogers, Fido, or Shaw purchases. This means you can effectively earn 3% cash back when redeeming your rewards for these services. The combination of high earning potential and the bonus redemption rate makes the Rogers Red Mastercard one of the best cash back cards for users of these services.

- 2% Cash Back on U.S. Dollar Purchases For frequent cross-border shoppers or those making online purchases in U.S. dollars, the Rogers Red Mastercard offers 2% unlimited cash back on eligible U.S. dollar purchases. This is a great way to offset foreign transaction fees and enjoy extra savings when shopping abroad or from U.S.-based retailers.

- 1% Cash Back on All Other Purchases For any purchases not made through Rogers, Fido, Shaw, or in U.S. dollars, cardholders still earn 1% cash back. This rate applies to all other eligible purchases, meaning you’ll still accumulate rewards on everything from groceries to gas.

- No Annual Fee One of the card’s biggest perks is that it comes with no annual fee. This means you won’t need to worry about additional costs eating into your savings, allowing you to focus on maximizing your rewards. Many cards with similar benefits charge annual fees, making the Rogers Red Mastercard an exceptional value.

- 10% Welcome Bonus for New Cardholders New cardholders can also take advantage of a generous 10% cash back welcome bonus. This offer applies to new cardholders who make a mobile wallet purchase within the first 90 days and set up six automatic payments for their Rogers, Fido, or Shaw postpaid services within the first eight months. This bonus can add up to significant savings right from the start.

- Roam Like Home Days Another fantastic benefit for Rogers mobile customers is the inclusion of 5 Roam Like Home days at no cost with an eligible Rogers mobile plan. This perk is worth up to $75, making it an attractive option for those who frequently travel abroad and want to stay connected without incurring hefty roaming charges.

How to Maximize Your Savings with the Rogers Red Mastercard

To fully take advantage of the Rogers Red Mastercard, it’s important to incorporate some strategic spending and redemption habits. Here’s how you can make the most out of this cash back card:

- Make Rogers, Fido, or Shaw Purchases a Priority. Since the card offers a 3% cash back rate when redeeming points for Rogers, Fido, or Shaw purchases, it’s wise to prioritize these services for your reward redemptions. This can include everything from your monthly phone bill to purchasing new devices. With every redemption, you’re essentially maximizing the value of your accumulated points.

- Use the Card for U.S. Dollar Purchases With 2% cash back on all U.S. dollar purchases, the Rogers Red Mastercard can help offset the cost of foreign exchange fees and give you better value when shopping from U.S.-based retailers. If you frequently travel to the U.S. or buy items online from American websites, make sure to use this card for every transaction.

- Pay Your Mobile Bills with the Card Another great way to optimize your cash back rewards is to use the card to pay your Rogers, Fido, or Shaw bills. You’ll not only earn 2% cash back on these transactions, but you’ll also get the added bonus of using your earned points to pay down future bills at a 1.5x redemption rate.

- Take Advantage of the Welcome Bonus The 10% welcome bonus is a fantastic way to rack up rewards quickly when you first receive your Rogers Red Mastercard. By ensuring you make a mobile wallet purchase and set up six automatic payments within the first eight months, you can unlock extra savings while establishing a consistent cash back strategy.

- Track Your Cash Back Rewards Regularly check your account to monitor your accumulated cash back rewards. Staying on top of your rewards balance will help ensure you’re redeeming at optimal times, especially for Rogers, Fido, and Shaw purchases where the 1.5x redemption bonus applies.

- Consider the Roam Like Home Feature. If you have an eligible Rogers mobile plan, the Roam Like Home feature gives you five days of free international roaming per year, worth up to $75. This is an excellent added benefit for those who travel frequently and want to avoid paying extra for mobile usage abroad.

The Security Features of Rogers Red Mastercard

In addition to its generous rewards, the Rogers Red Mastercard also includes robust security features to protect your account and transactions. These include:

- Transaction Monitoring & Alerts: The card’s transaction monitoring system helps detect any suspicious activity on your account. You’ll receive alerts whenever unusual transactions occur, giving you peace of mind and prompt information to act quickly in case of fraud.

- Zero Liability Protection: If your card is lost or stolen, Zero Liability protection ensures you’re not held responsible for any unauthorized transactions. This coverage provides additional reassurance when using the card for both online and in-person purchases.

- Mastercard Identity Check The card includes Mastercard Identity Check, an extra layer of authentication for online purchases. This feature helps prevent fraud by requiring identity verification before completing transactions, ensuring that only authorized users can make purchases with your card.

Redeem Cash Back Without Restrictions

One of the most convenient aspects of the Rogers Red Mastercard is its flexible cash back redemption options. Cardholders can redeem their cash back rewards for any purchase made at merchants that accept Mastercard.

This means you can use your cash back rewards for everyday purchases like gas, groceries, or even larger ticket items such as home electronics. There’s no minimum redemption requirement, making it easy to apply your rewards to your account balance whenever you like.

Additionally, cash back rewards can be applied directly to your Rogers, Fido, or Shaw bills, allowing for seamless integration between your credit card and mobile or internet service payments.

Why Choose the Rogers Red Mastercard?

For Canadian shoppers, particularly those who are already Rogers, Fido, or Shaw customers, the Rogers Red Mastercard offers unmatched flexibility and value. With its high cash back rates, no annual fee, and a variety of security features, the card provides excellent perks without any hidden costs. Moreover, the ability to redeem cash back for Rogers purchases with a 1.5x bonus makes it an unbeatable option for those who want to maximize their rewards.

The Rogers Red Mastercard is a well-rounded card that appeals to both everyday shoppers and frequent travellers, thanks to its Roam Like Home feature and 2% U.S. dollar cash back rate. Its flexibility, security, and high rewards structure make it one of the best cash back cards in Canada for consumers looking to save on their daily expenses and mobile bills.

Where To Apply For The Best Canadian Credit Cards?

Great Canadian Rebates is an online platform that lets Members compare credit card options available in Canada and apply for the one that best suits their financial and lifestyle requirements. It’s free to join, and Members can also choose from over 700 well-known merchants and take advantage of great rebates, deals, and discounts.

Visit the website today for more information.