When it comes to finding a credit card that offers unbeatable value, the American Express Cobalt Card stands out as one of the best options for Canadians. With its focus on rewards tailored to everyday spending, including dining, groceries, and travel, the Cobalt Card provides a unique system that enables you to accumulate points quickly and redeem them for maximum value. Whether you’re a frequent traveller or simply looking to get the most out of your daily purchases, this card offers something for everyone.

In this comprehensive guide, we will explore how to maximize your rewards with the American Express Cobalt Card, its benefits, and why American Express is a top choice for Canadian consumers. We’ll also cover travel credit cards, top-rated cash back credit cards, and credit card rebate options that make this card a strong contender in the Canadian credit card market.

Why the American Express Cobalt Card is a Game-Changer

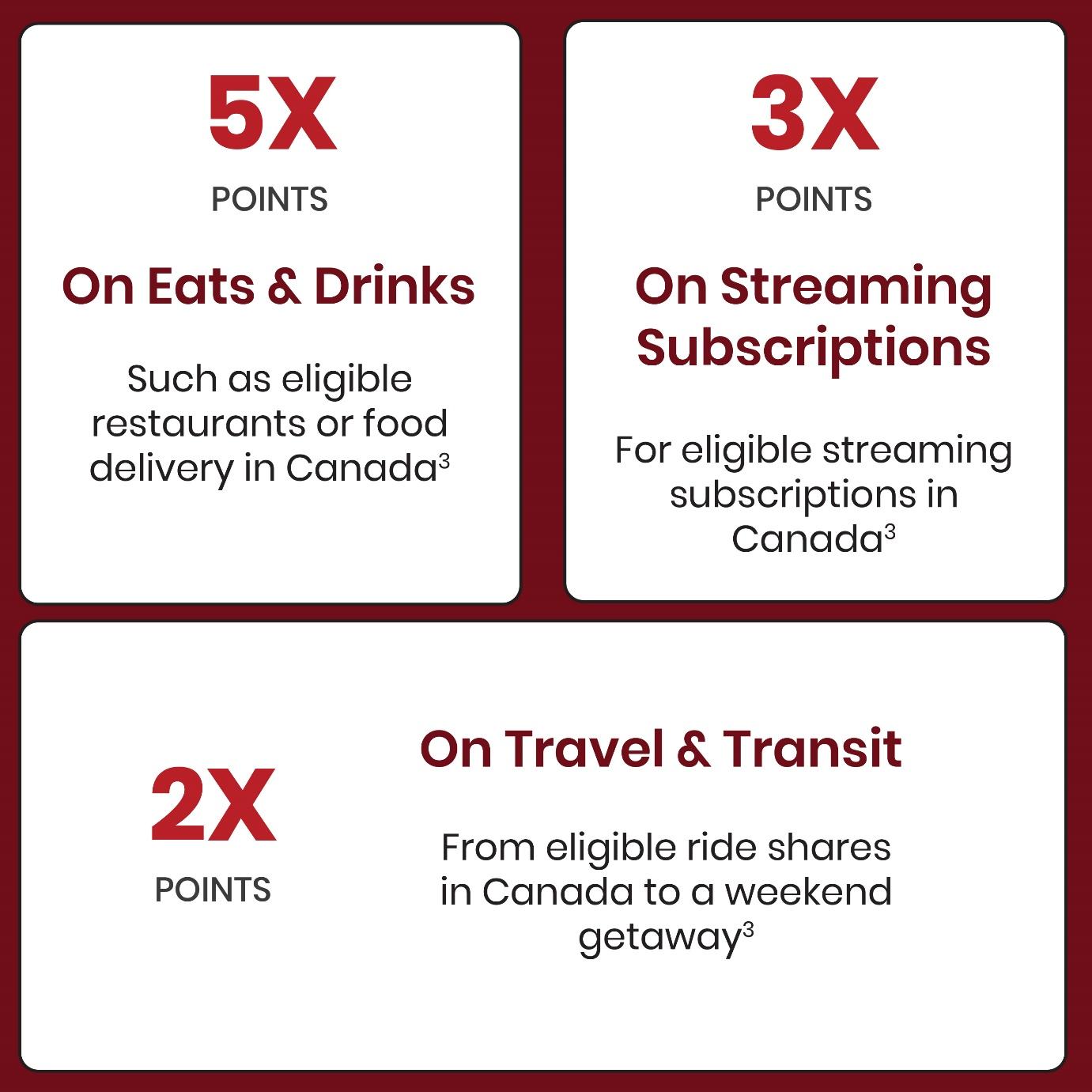

The American Express Cobalt Card has redefined what a rewards card can do. Its appeal lies in its ability to reward cardholders generously on common categories such as dining, groceries, and travel purchases. With the Cobalt Card, you can earn 5x Membership Rewards points on every dollar spent on groceries, restaurants, and food delivery services in Canada. Additionally, the card offers 2x points on travel purchases, including flights, hotels, and public transportation, and 1x points on all other purchases.

This combination of rewards categories makes it one of the most versatile and valuable credit cards for everyday spending, particularly for those who enjoy dining out or travelling frequently. The Cobalt Card is also different from many other credit cards because it doesn’t require a significant initial spend to unlock rewards. Instead, the cardholder earns points steadily throughout the year, making it easier to accumulate rewards without the pressure of meeting high spending thresholds within a short time frame.

Key Features of the American Express Cobalt Card

The American Express Cobalt Card shines with its generous rewards structure, but it also comes with several other benefits that make it a top choice for Canadians:

- 5x Points on Dining and Groceries: Earn 5 points per dollar spent on restaurants, cafes, bars, grocery stores, and food delivery services in Canada. This is one of the highest rates available for any credit card in these categories.

- 2x Points on Travel and Transit: Cardholders can also earn 2 points per dollar on travel-related purchases, including flights, hotels, taxis, and even public transit.

- 1x Points on Everything Else: For all other purchases, you earn 1 point per dollar spent, ensuring that you continue to accumulate rewards no matter what you buy.

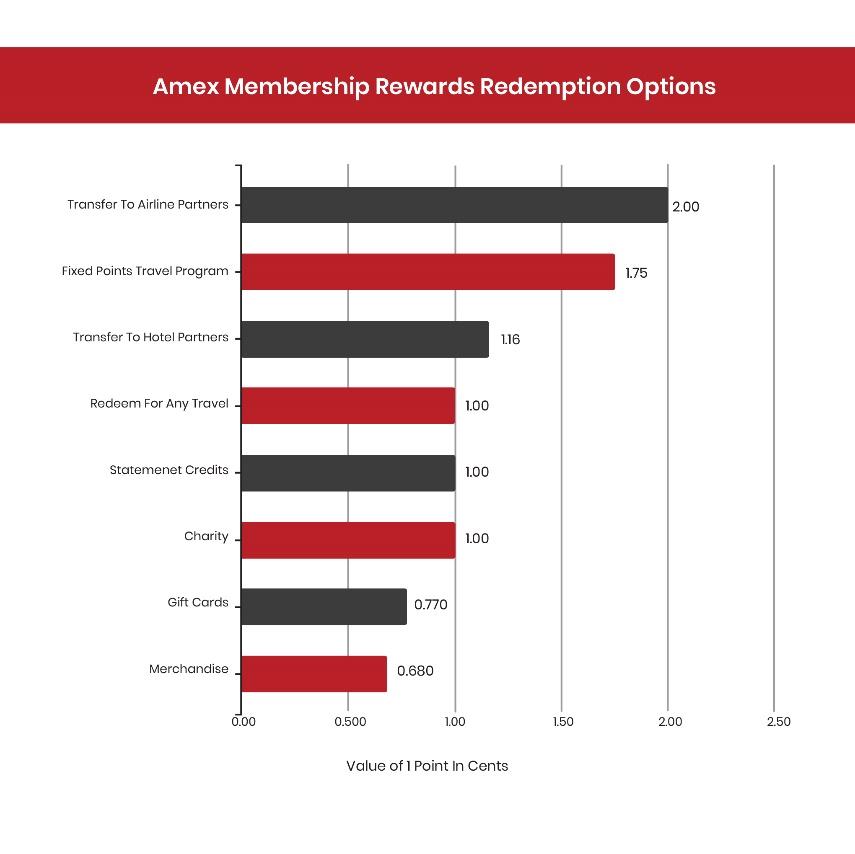

- Flexible Points Redemption: The American Express Cobalt Card gives you multiple ways to redeem your points. Whether you’re booking a vacation, paying off recent purchases, or transferring your points to one of Amex’s airline or hotel partners, the flexibility is unmatched.

- Comprehensive Travel Insurance: The card comes with robust travel insurance coverage, including emergency medical, flight delay, lost baggage, and rental car insurance, making it an excellent companion for travellers.

- Mobile Device Insurance: A unique feature is mobile device insurance, which covers up to $1,000 if your phone or tablet is lost, stolen, or damaged.

- Entertainment Access: As an Amex cardholder, you gain access to exclusive events, including pre-sale concert tickets, VIP experiences, and more.

- Low Monthly Fee: The American Express Cobalt Card charges a modest $12.99 per month, making it affordable for most Canadians, especially considering the rich rewards and benefits.

- No Foreign Transaction Fees: One of the standout features is that this card doesn’t charge foreign transaction fees, making it ideal for international travellers.

Maximizing Your Rewards with the American Express Cobalt Card

Now that you’re familiar with the American Express Cobalt Card’s key features let’s explore how you can maximize its rewards. From everyday spending to strategic redemptions, here are the top tips for getting the most value out of your card.

1. Focus on High-Earning Categories

The most obvious way to maximize your rewards is by concentrating your spending on categories that offer the highest return. Since the Cobalt Card offers 5x points on dining and groceries, you’ll want to use your card for these purchases as often as possible. This includes eating out at restaurants, ordering food delivery, or buying your weekly groceries. By strategically using your card for these transactions, you can accumulate a significant amount of points in a short time.

2. Use the Card for Travel Purchases

If you’re someone who travels frequently, the 2x points on travel purchases will quickly add up. Book your flights and hotel stays, and even use the card for public transportation and taxis while you’re on the go. Given the card’s generous insurance protections and no foreign transaction fees, it’s a perfect companion for your international trips as well.

3. Take Advantage of Transfer Partners

One of the most powerful ways to use your points is by transferring them to Amex’s airline and hotel partners. Through Membership Rewards, you can transfer your points to various loyalty programs, including Aeroplan (Air Canada’s loyalty program) and Marriott Bonvoy. This can significantly increase the value of your points, mainly when booking premium travel experiences such as business or first-class flights.

4. Use Points for Statement Credits

If you don’t travel frequently or want to reduce your credit card bill, you can redeem your points as statement credits. This option allows you to apply your points directly toward paying off recent purchases, giving you flexibility in how you use your rewards.

5. Maximize Welcome Bonuses

When signing up for the American Express Cobalt Card, you’ll often be eligible for a generous welcome bonus. Typically, you can earn extra points by spending a certain amount within the first few months of getting the card. This is an excellent way to kick-start your rewards accumulation, so be sure to take full advantage of any welcome offers available when you apply.

Other Choices

While the American Express Cobalt Card is an excellent option for maximizing rewards on dining, groceries, and travel, there are several other American Express cards that cater to different financial needs and lifestyles. Whether you’re looking for travel perks, premium benefits, or cash back opportunities, American Express offers a range of cards that suit various spending habits. Here are some additional American Express credit cards to consider:

American Express Platinum Card

Best for: Premium travel and luxury perks

The American Express Platinum Card is a premium travel card that offers unparalleled luxury perks for frequent travellers. With this card, you can unlock access to exclusive airport lounges worldwide, including Centurion Lounges, Priority Pass Lounges, and more.

Key Benefits:

- 60,000 welcome bonus points after meeting the minimum spending requirement.

- Earn 3x points on dining and 2x points on travel purchases.

- Complimentary airport lounge access through Amex’s Global Lounge Collection.

- Comprehensive travel insurance, including trip cancellation, medical, and baggage insurance.

- Annual $200 travel credit for eligible flights and accommodations.

- Elite hotel status with brands like Marriott Bonvoy and Hilton Honors.

- Fine Hotels & Resorts program: Get exclusive benefits like room upgrades, complimentary breakfast, and late check-out at luxury hotels.

While the Platinum Card comes with a higher annual fee, its extensive benefits make it an excellent choice for those who value luxury travel and premium experiences.

American Express Gold Rewards Card

Best for: Flexible travel rewards and everyday spending

The American Express Gold Rewards Card is another versatile option, particularly suited for those who want to earn rewards on a broader range of purchases. It offers flexible points redemption and is ideal for frequent travellers who want flexibility when booking flights, hotels, and other travel services.

Key Benefits:

- 25,000 welcome bonus points after meeting the minimum spending requirement.

- Earn 2x points on gas, groceries, drugstore purchases, and travel.

- Transfer points to airline frequent flyer programs like Aeroplan and Avios.

- Travel insurance, including emergency medical coverage, trip cancellation, and baggage loss.

- No foreign transaction fees, making it a solid card for international travel.

The Gold Rewards Card also offers flexible point redemption through Membership Rewards, allowing you to pay for flights with virtually any airline or transfer points to partner loyalty programs.

Why American Express Stands Out from the Competition

American Express is known for its premium services, and the American Express Cobalt Card is no exception. While many credit cards focus solely on cash back or travel points, Amex delivers a more holistic experience with its vast array of cardholder benefits. Here are a few reasons why American Express is different from other providers and why it’s a favourite among Canadians:

- Exclusive Experiences: American Express cardholders gain access to special events, exclusive concerts, restaurant openings, and even early access to tickets for popular shows.

- World-Class Customer Service: American Express is well-regarded for its customer service, often ranking higher than its competitors in customer satisfaction. Whether you need help with your card, a question about your points, or assistance during travel, Amex representatives are known for being helpful and responsive.

- Global Acceptance: While some people believe that American Express is less widely accepted than other cards, the company has made significant strides in expanding its acceptance globally. The American Express Cobalt Card can now be used by a growing number of merchants in Canada and around the world, making it a competitive option among travel credit cards for international travellers.

- Enhanced Security: American Express is known for its commitment to security. It offers cardholders zero liability for unauthorized purchases, fraud detection tools, and the ability to freeze a card if it’s lost or stolen instantly.

- Flexible Rewards System: The American Express Membership Rewards program is incredibly flexible, allowing you to redeem points in a variety of ways. Whether you prefer to use your points for travel, merchandise, gift cards, or even transferring them to other loyalty programs, Amex gives you the freedom to choose.

Is the American Express Cobalt Card Right for You?

The American Express Cobalt Card is an excellent choice for those who spend heavily on dining, groceries, and travel. It’s also ideal for Canadians who want a flexible rewards program that offers both cash back and travel redemption options. If you value experiences such as dining out, travelling, and exclusive events, this card is perfect for enhancing those aspects of your lifestyle.

However, it’s important to note that not all merchants accept American Express, especially in smaller shops or rural areas. If you live in a location where Amex isn’t widely accepted, you might need a backup card, such as a top-rated cash back credit card or another travel credit card.

Other Benefits of Using the American Express Cobalt Card

Apart from the rewards system, the American Express Cobalt Card offers a host of other valuable benefits:

- Purchase Protection: Enjoy purchase protection on eligible items bought with your card, covering you against theft or damage for up to 90 days.

- Extended Warranty: The card automatically extends the manufacturer’s warranty by up to one additional year on eligible purchases.

- Access to American Express Offers: Cardholders receive tailored offers and discounts at a wide range of participating retailers, restaurants, and travel brands.

- No Pre-Set Spending Limit: Unlike traditional credit cards, the Cobalt Card doesn’t have a strict pre-set spending limit, giving you more flexibility in making larger purchases, provided you can repay the balance.

The American Express Cobalt Card is undeniably one of the best choices for Canadians looking to maximize their rewards on everyday spending, particularly in the areas of dining, groceries, and travel. Its flexible rewards system, coupled with exclusive benefits and strong customer support, makes it stand out from other travel credit cards and cash back credit cards on the market.

Whether you’re a foodie, a frequent traveller, or just looking for a card that offers excellent value, the Cobalt Card delivers on all fronts. If you’re ready to maximize your rewards and enjoy the unique benefits of being an American Express cardholder, the American Express Cobalt Card might be the perfect fit for your wallet.

How to Apply for the American Express Cobalt Card

Applying for the American Express Cobalt Card is simple and can be done directly through American Express or via Great Canadian Rebates to earn additional cash back on your application. If you want to maximize your rewards from the start, using a rebate website like Great Canadian Rebates can provide you with a bonus when you apply for the card. Not only will you get a great credit card, but you’ll also earn cash back on the application process itself.

For more information on how Great Canadian Rebates works and how you can take advantage of cash back offers when applying for the American Express Cobalt Card, visit our website to explore all the ways to save and earn on your purchases.