Choosing the right credit card can be a game changer, especially if you’re someone who travels frequently. Two of the most popular types of cards for travellers are airline credit cards and general travel credit cards. Both options come with perks designed to enhance your travel experience, but deciding which one is right for you depends on your travel habits and priorities.

In this blog, we’ll compare the pros and cons of airline-specific credit cards and general travel credit cards, helping you determine which one will give you the best value. Whether you’re looking for flexible travel rewards, exclusive airline perks, or top-rated cash back credit cards, this guide will ensure you make an informed decision.

Understanding the Basics: Airline Credit Cards vs. General Travel Credit Cards

Before discussing each card’s advantages and disadvantages, it’s important to understand the core differences between airline credit cards and general travel credit cards.

- Airline Credit Cards: These cards are co-branded with specific airlines and offer rewards, perks, and discounts exclusive to that airline. They often provide benefits like free checked bags, priority boarding, and accelerated points earned when booking flights with that airline.

- General Travel Credit Cards: These cards allow you to earn rewards on a wide variety of travel-related purchases, including flights, hotels, rental cars, and more. The points or miles can typically be redeemed through a travel portal or transferred to various airlines and hotel loyalty programs.

Now that you know the basics, let’s weigh the pros and cons of each to help you decide which one best suits your travel style.

Pros and Cons of Airline Credit Cards

Pros:

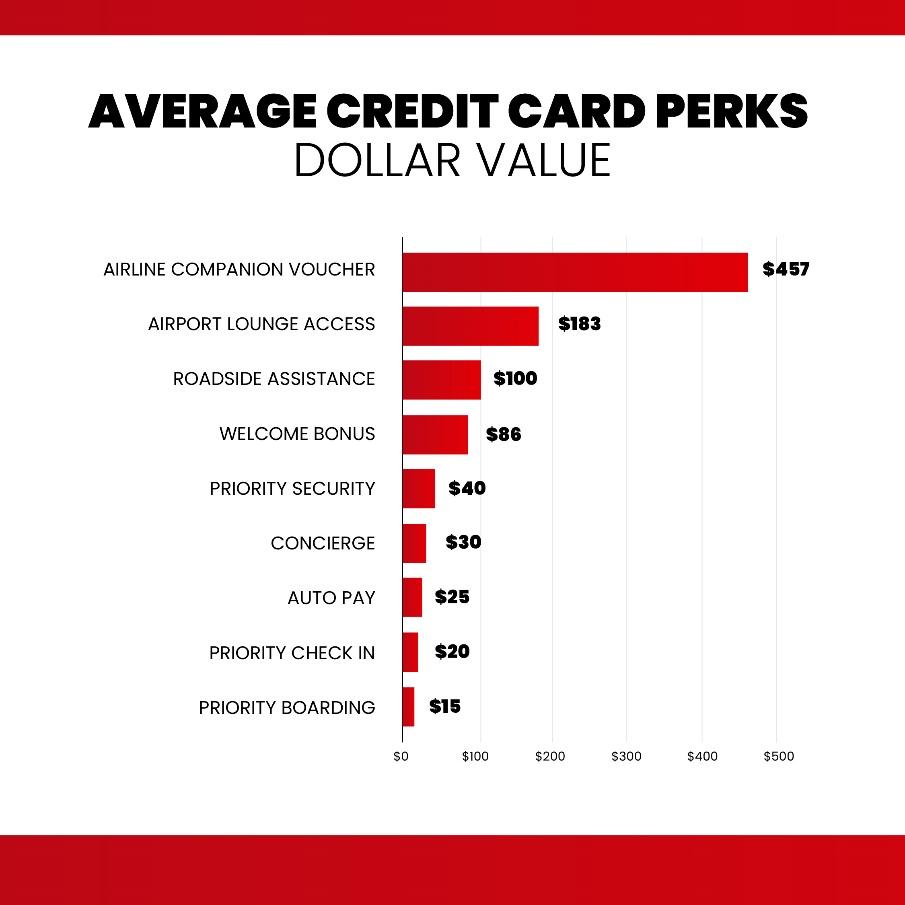

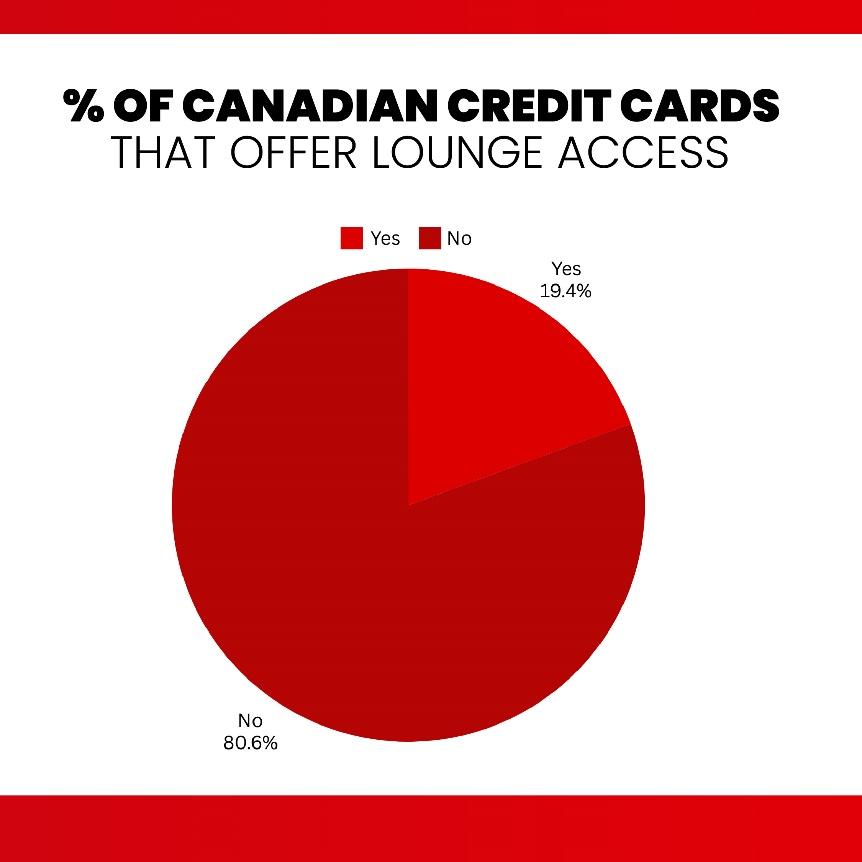

- Exclusive Airline Perks: One of the most significant advantages of airline credit cards is access to perks directly related to your preferred airline. These often include priority boarding, free checked bags, and, in some cases, access to airport lounges.

- Bonus Miles for Airline Purchases: If you frequently fly with one airline, you can earn a high number of miles for purchases made directly with that airline, typically 2x or 3x miles per dollar spent.

- Loyalty Rewards: Airline cards can be ideal for frequent flyers who are loyal to one specific airline. Many offer elite status benefits, such as complimentary upgrades and priority customer service.

- Companion Tickets: Some airline credit cards offer an annual companion ticket, which allows you to bring a friend or family member along on a flight for free or at a discounted rate.

Cons:

- Limited Redemption Options: The major downside of an airline credit card is the limited flexibility in redeeming rewards. You’re often locked into redeeming your points or miles with that specific airline, which can be restrictive if your travel plans change or if that airline doesn’t serve certain destinations.

- Fewer Non-Flight Rewards: While airline cards are excellent for racking up miles, they typically don’t offer much value outside of airfare-related purchases. If you spend a lot on other travel-related expenses, you might not earn as many rewards.

- High Annual Fees: Many airline credit cards come with hefty annual fees that can outweigh the value of the benefits if you don’t travel frequently enough to justify the cost.

Pros and Cons of General Travel Credit Cards

Pros:

- Flexibility in Redemption: One of the main benefits of general travel credit cards is flexibility. You can use your points or miles for a wide range of travel expenses, including flights, hotels, car rentals, and more. Many general travel cards also allow you to transfer points to multiple airline or hotel partners.

- Rewards on All Travel-Related Purchases: A general travel credit card typically earns rewards on flights and other travel expenses like hotels, car rentals, and even dining. This makes it ideal for travellers who spend in a variety of categories.

- No Loyalty Restrictions: Unlike airline credit cards, which lock you into a single airline, general travel cards allow you to shop around for the best deals. You’re not tied to one airline, giving you more freedom in how and when you travel.

- No Foreign Transaction Fees: Many general travel credit cards waive foreign transaction fees, making them a great option for international travellers. You can save up to 3% on every purchase made abroad.

Cons:

- Fewer Airline-Specific Perks: While general travel credit cards offer broad flexibility, they usually don’t come with the exclusive perks provided by airline credit cards, such as priority boarding or free checked baggage.

- Annual Fees: Like airline credit cards, many general travel credit cards also come with annual fees, though these are often offset by the value of the rewards and travel credits you can earn.

Which Should You Choose?

When deciding between an airline credit card and a general travel credit card, consider your travel habits.

Choose an Airline Credit Card if:

- You’re loyal to one airline and frequently fly with them.

- You value exclusive airline perks like free checked bags, priority boarding, and lounge access.

- You can earn enough airline miles to make up for the annual fee.

- You often fly within Canada or internationally with the same airline.

For example, if you frequently fly with Air Canada, having an Air Canada credit card would allow you to enjoy free checked bags and faster check-in, making your travel experience more enjoyable.

Choose a General Travel Credit Card if:

- You prefer flexibility and want the option to book flights, hotels, and other travel-related expenses through multiple vendors.

- You travel occasionally but not always with the same airline.

- You value earning rewards on all kinds of travel expenses, not just flights.

- You want to avoid foreign transaction fees when travelling abroad.

A general travel credit card might be the better choice if you’re someone who enjoys flexibility, whether you’re booking a hotel stay in Montreal or renting a car in Europe.

Final Thoughts

Deciding between an airline credit card and a general travel credit card ultimately comes down to how often you travel, how much flexibility you need, and whether you’re loyal to a specific airline. If you’re a frequent flyer with one airline, the perks and rewards of an airline card could be invaluable. But if you prefer flexibility and enjoy earning rewards across various travel expenses, a general travel credit card might be the better option.

Where To Apply For The Best Canadian Credit Cards?

Great Canadian Rebates is an online platform that lets Members compare credit card options available in Canada and apply for the one that best suits their financial and lifestyle requirements. It’s free to join, and Members can also choose from over 700 well-known merchants and take advantage of great rebates, deals, and discounts.

Visit the website today for more information.