In today’s world of travel credit cards, points vs miles travel credit cards are a frequent debate among frequent flyers and globetrotters alike. Both points and miles offer valuable rewards, but which option is better for you? That answer depends on your travel habits, redemption preferences, and the types of rewards you prioritize.

This blog will explain the key differences between earning points and miles, compare their benefits, and help you decide which type of travel credit card best suits your personal travel goals.

Understanding Points and Miles

Before diving into the pros and cons, let’s clarify the basics. Both points and miles are rewards currencies that travel credit cards offer as part of their incentive programs. However, they differ in terms of earning and redeeming, with points being more flexible and miles typically tied to airline loyalty programs.

- Points are rewards that you earn from a variety of spending categories, such as grocery stores, restaurants, gas stations, and travel expenses. Points can often be redeemed for different options, including hotel stays, gift cards, or statement credits.

- Miles, on the other hand, are usually associated with airline-specific or general travel credit cards and can be redeemed primarily for flights, upgrades, or travel-related expenses. Miles often have specific values tied to certain airlines, making them somewhat restrictive compared to points.

Earning: Flexibility vs Specificity

When comparing points and miles, it’s essential to consider how easy it is to earn rewards.

- Points: Most top-rated cash back credit cards that offer points are versatile, allowing you to earn across various categories. For instance, cards that offer bonus points for dining, entertainment, and grocery purchases are ideal for those who want flexibility in earning rewards. You’ll earn points for everyday spending as well as travel-related purchases, which is perfect for people who are not strictly focused on flying.

- Miles: For those dedicated to air travel, miles may be more advantageous. Miles-based travel credit cards often offer higher earning rates on flight purchases and can include valuable perks like free checked baggage, priority boarding, and access to airport lounges. Some credit card rebates offer up to 5x miles for airline purchases, providing significant benefits to frequent flyers.

Redeeming: Versatility vs Exclusivity

Next, let’s explore the key difference in redemption options:

- Points: The biggest advantage of points is their flexibility. You can redeem them for flights, hotels, vacation packages, or even statement credits. Some cards allow you to transfer points to airline or hotel partners, giving you even more versatility. Programs like American Express Membership Rewards or Chase Ultimate Rewards offer a variety of redemption options, which makes points a better option for those who want the freedom to choose.

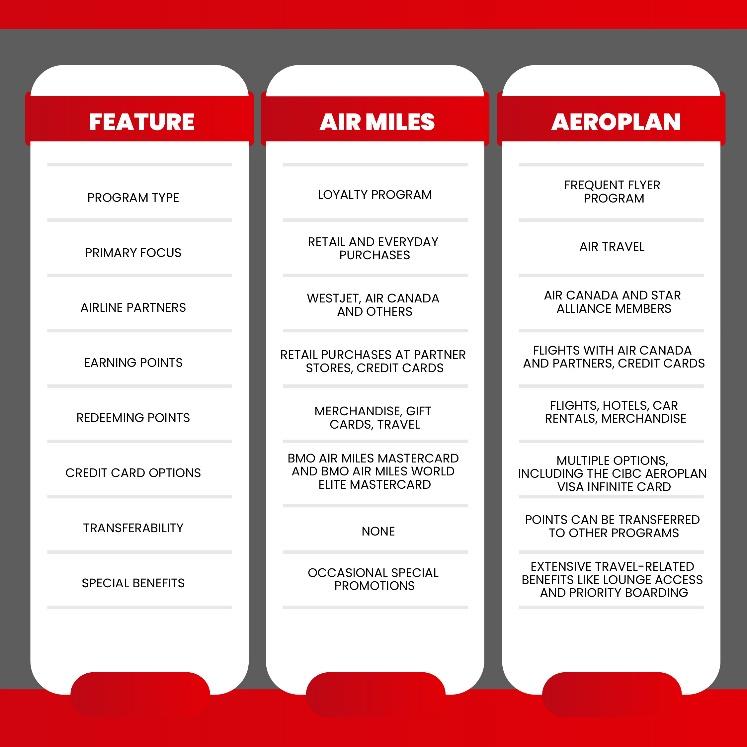

- Miles: If your goal is specifically to book flights, miles can be extremely valuable. Miles typically offer better value when redeemed for flights on the airline’s own rewards platform. For example, frequent flyers on Aeroplan or WestJet may find that miles give them excellent redemption options for flights within the airline’s network or partners. However, miles usually lack the flexibility to be redeemed for non-travel-related expenses.

Which Option Offers Better Value?

When assessing points vs miles travel credit cards, it’s important to think about the value each currency brings:

- Points: Points often offer a variable value depending on how they are redeemed. For example, using points for a statement credit might give you less value compared to redeeming them for a first-class hotel stay. Depending on the program, the value of a point can range from 0.5 to 2 cents per point. However, cards that allow you to transfer points to airlines or hotel partners can increase the value of each point significantly.

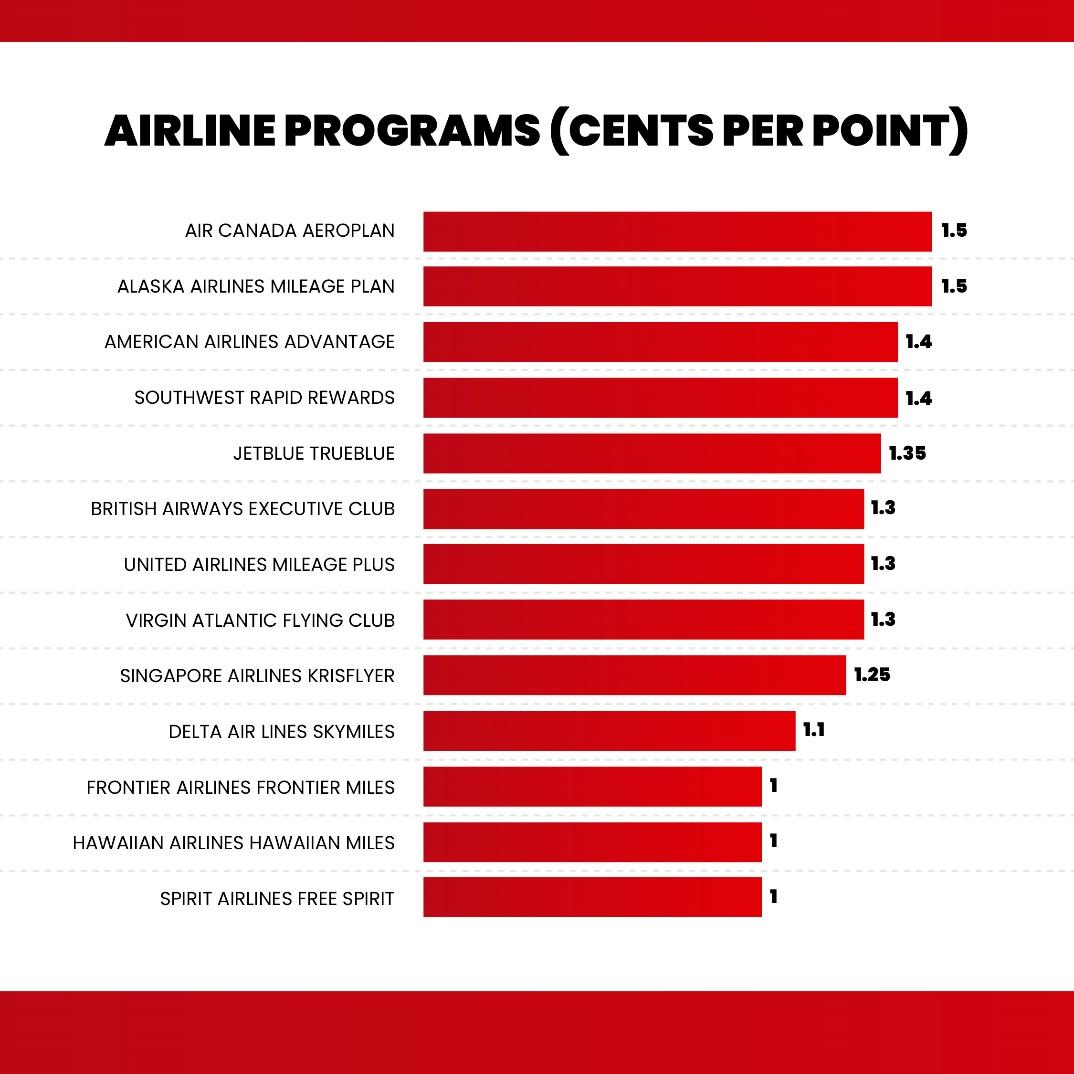

- Miles: While miles can sometimes feel more restrictive due to their airline-specific nature, they usually offer a set value when redeemed for flights. The typical value of miles ranges between 1 and 2 cents per mile, making it easier to calculate the reward potential of each purchase. Moreover, some airlines offer enhanced redemption rates for business or first-class seats, maximizing the value of your miles. However, availability for reward seats can be limited, making it essential to book early.

Consider Your Travel Goals

So, which is suitable for you: points or miles? It ultimately depends on your travel goals.

- If you’re a frequent flyer loyal to a specific airline or travel within certain alliances, a miles card might be the best option. You’ll benefit most from booking flights, enjoying travel perks, and maximizing your miles for exclusive airline benefits.

- If you prefer flexibility or want to earn rewards across various spending categories beyond flights, then points-based travel credit cards are likely a better choice. The ability to redeem points for hotels, travel packages, or even statement credits makes points a versatile option for the average traveller.

Conclusion: Points vs Miles Travel Credit Card—Which One Wins?

Ultimately, the choice between points vs miles travel credit cards depends on how you travel and how you prefer to redeem your rewards. Frequent flyers who enjoy loyalty benefits and airline-specific perks will likely get more value from miles. At the same time, those seeking flexibility in both earning and redeeming may find that points offer broader opportunities for value. Understanding your travel habits, preferences, and goals is the key to making the right choice when selecting a travel credit card.

Whichever option you choose, remember that maximizing your rewards is about more than just earning points or miles—it’s about making informed decisions and understanding how to use those rewards to get the best value. For Canadians, websites like Great Canadian Rebates provide detailed insights on the top-rated cash back credit cards, helping you find the perfect card that aligns with your travel and financial goals.

Where to Apply?

If you plan to apply for a cash back rewards credit card, head to Great Canadian Rebates. Our online platform will allow you to compare the best cashback credit cards and others, which will help you choose the one that fits the bill. You can earn a solid credit card rebate when you sign up for the credit card through our platform.

Visit our website for more information.