Travelling is one of the best ways to create lifelong memories, relax, and explore the world. However, vacations can also come with hefty price tags, and many people turn to credit cards to fund their trips. But is it really smart to pay for a vacation with a credit card? While using a credit card for your trip offers certain benefits, such as rewards, protection, and convenience, it also comes with risks, including accumulating debt and potential interest charges.

In this blog, we’ll explore the advantages and disadvantages of paying for a vacation with a credit card, helping you make an informed decision before you swipe your card for that dream getaway.

Advantages of Using a Credit Card for Your Vacation

Earning Rewards Points and Cash Back

One of the most significant advantages of paying for a vacation with a credit card is the opportunity to earn rewards points or cash back. Many top-rated cash back credit cards offer lucrative rewards for every dollar you spend, especially on travel-related purchases such as flights, hotels, and rental cars. These rewards can help offset the cost of your trip or even be saved for future vacations.

For example, certain travel credit cards allow you to accumulate points that can be redeemed for airfare, hotel stays, or travel-related perks. By using your cash back credit card, you’re essentially getting a percentage of your purchase back, which is like receiving a discount on your vacation expenses. Some cards offer higher reward rates for travel purchases, allowing you to maximize your savings.

Additionally, credit cards listed on Great Canadian Rebates provide cardholders with the chance to earn rebates and take advantage of exclusive deals. Through platforms like Great Canadian Rebates, you can further enhance the value of your travel purchases by earning cash back rebates from participating merchants, adding to your overall savings.

Travel Protection and Insurance

Another significant benefit of paying for a vacation with a credit card is the travel protection that often comes with it. Many premium travel credit cards include valuable insurance benefits such as trip cancellation, trip interruption, and baggage protection. This coverage can offer peace of mind if your plans are disrupted by unexpected events like illness, bad weather, or lost luggage.

For instance, if you book a flight or hotel using your credit card and an emergency forces you to cancel, your credit card’s trip cancellation insurance may reimburse you for the non-refundable portion of your trip. Similarly, if your bags are lost or delayed, your card’s baggage protection may cover the cost of replacing your items.

Additionally, some credit cards include rental car insurance, which can save you money on additional coverage offered by rental companies. This added protection can be precious when you’re travelling, as it helps reduce the need for separate travel insurance and can save you from unexpected costs during your trip.

Fraud Protection and Security

Using a credit card to pay for your vacation provides an extra layer of security compared to other forms of payment. Most credit cards come with built-in fraud protection, meaning you won’t be held responsible for unauthorized purchases if your card is lost or stolen while you’re travelling. This can be incredibly reassuring when you’re exploring unfamiliar destinations where the risk of theft may be higher.

Credit cards also offer purchase protection, which can cover you in cases where travel services, like a hotel or airline, fail to deliver on their promises. For instance, if an airline goes out of business or your hotel cancels your booking at the last minute, your credit card may provide options to dispute the charge and recover your money.

Convenient Foreign Transactions

When travelling internationally, using a credit card can save you from the hassle of exchanging currency and carrying large amounts of cash. Many travel credit cards come with no foreign transaction fees, meaning you can make purchases abroad without incurring extra charges.

This can save you significant amounts, especially on larger purchases during your trip.

Furthermore, credit cards often offer competitive exchange rates, which may be better than those available at currency exchange booths. With the right card, you can enjoy seamless transactions no matter where you are in the world.

Disadvantages of Using a Credit Card for Your Vacation

Risk of Accumulating Debt

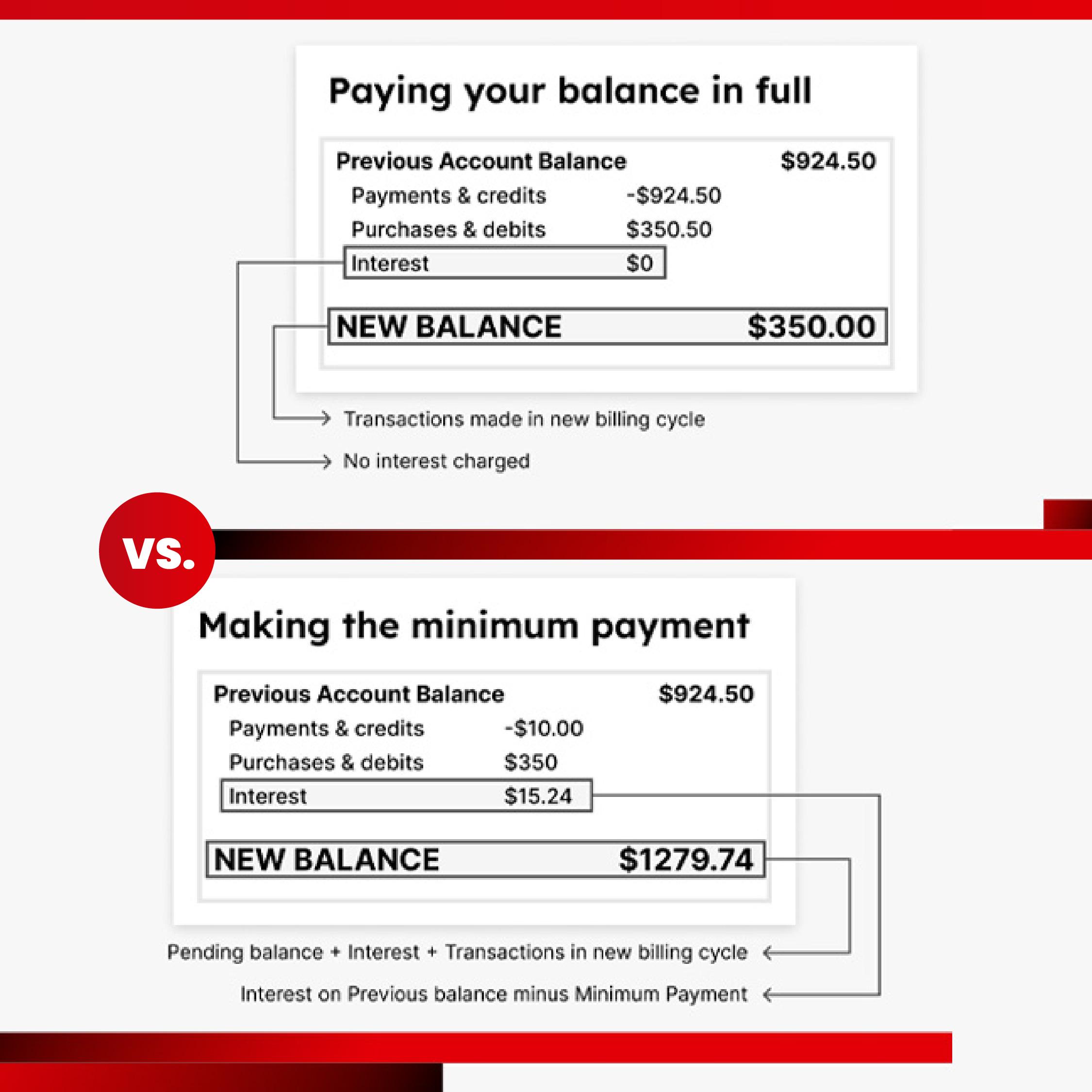

While the rewards and protections offered by credit cards are appealing, they come with a significant downside: the potential to accumulate debt. Vacations can be expensive, and it’s easy to overspend when you’re swiping a credit card. If you’re unable to pay off the full balance when your bill is due, you’ll begin accruing interest—sometimes at very high rates.

For example, many travel credit cards have Annual Percentage Rates (APRs) in the 19-25% range. If you finance a $5,000 vacation and only make the minimum monthly payments, you could end up paying hundreds or even thousands of dollars in interest over time. This can quickly turn your relaxing getaway into a financial burden.

It’s crucial to have a repayment plan in place before charging your vacation to a credit card. If you’re confident you can pay off the balance in full by the due date, then using a credit card for your trip can be a smart move. However, if you’re not sure how you’ll cover the cost, it may be wiser to explore other payment options.

Temptation to Overspend

Credit cards can make it easier to spend more than you originally planned on your vacation. Since you’re not immediately parting with cash, you might be tempted to upgrade to a luxury hotel, dine at expensive restaurants, or book additional excursions that weren’t part of your initial budget.

This temptation to overspend can lead to financial stress once the vacation is over. It’s important to establish a clear budget before your trip and stick to it, regardless of the convenience of using a credit card. Responsible spending is critical to avoiding post-vacation regret when the bill arrives.

In summary, paying for a vacation with a credit card can be a smart move if you’re able to take advantage of the rewards, travel protection, and fraud security that come with it. For frequent travellers, using a travel credit card or top-rated cash back credit card can offer substantial benefits, such as earning points for future trips or receiving cash back on your travel expenses. However, it’s essential to be mindful of the potential downsides, including the risk of accruing debt, overspending, and paying high fees or interest.

Where To Apply For The Best Canadian Credit Cards?

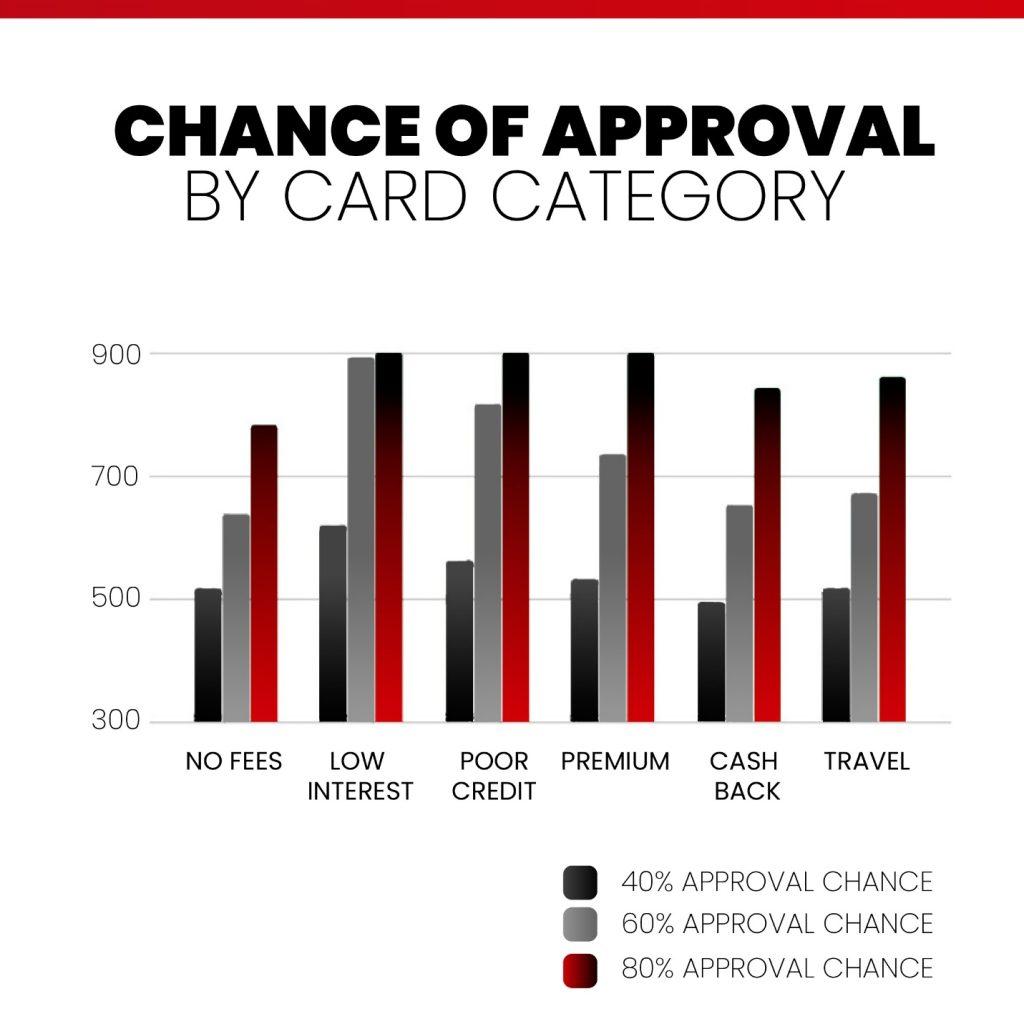

Great Canadian Rebates is an online platform that lets Members compare credit card options available in Canada and apply for the one that best suits their financial and lifestyle requirements. It’s free to join, and Members can also choose from over 700 well-known merchants and take advantage of great rebates, deals, and discounts.

Visit the website today for more information.