In today’s dynamic financial landscape, 0% APR credit cards are among the most attractive offers available to savvy consumers. These cards can provide much-needed breathing room by temporarily easing interest payments on purchases and balance transfers, helping users save significant amounts of money.

However, as enticing as these offers are, they come with a complex set of conditions that need to be thoroughly understood before applying. The allure of a 0% APR credit card can either work to your advantage or lead you into financial difficulties if you’re not cautious.

In this guide, we’ll break down the mechanics of 0% APR credit cards, explore their potential benefits, and identify the risks associated with them. You’ll leave with a comprehensive understanding of how these cards work, what to look for, and the essential factors to consider before applying.

What Is a 0% APR Credit Card?

At its core, a 0% APR credit card is a card that offers a promotional interest rate of 0% for a specific period. This promotion usually applies to either new purchases, balance transfers, or both, depending on the card issuer’s terms. The most common offer ranges between 6 to 18 months, during which you won’t incur interest on your balance.

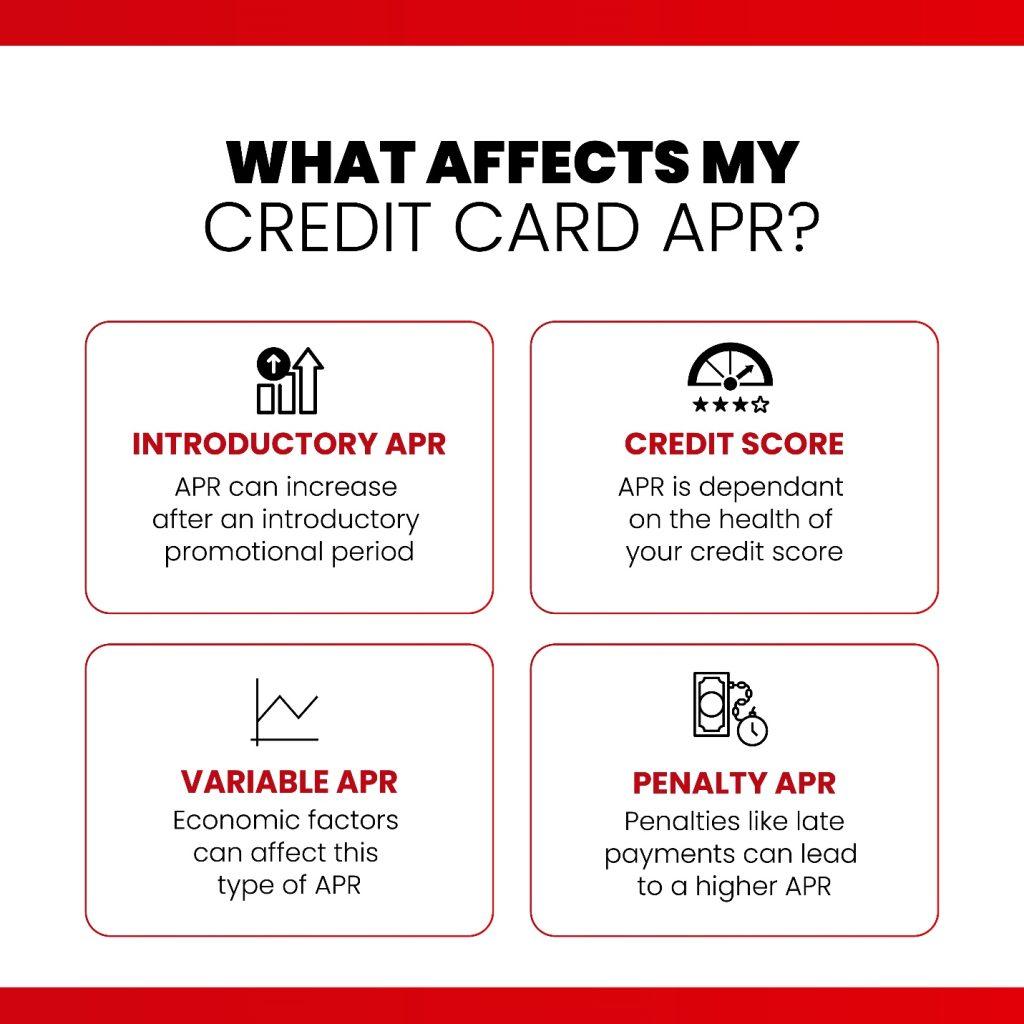

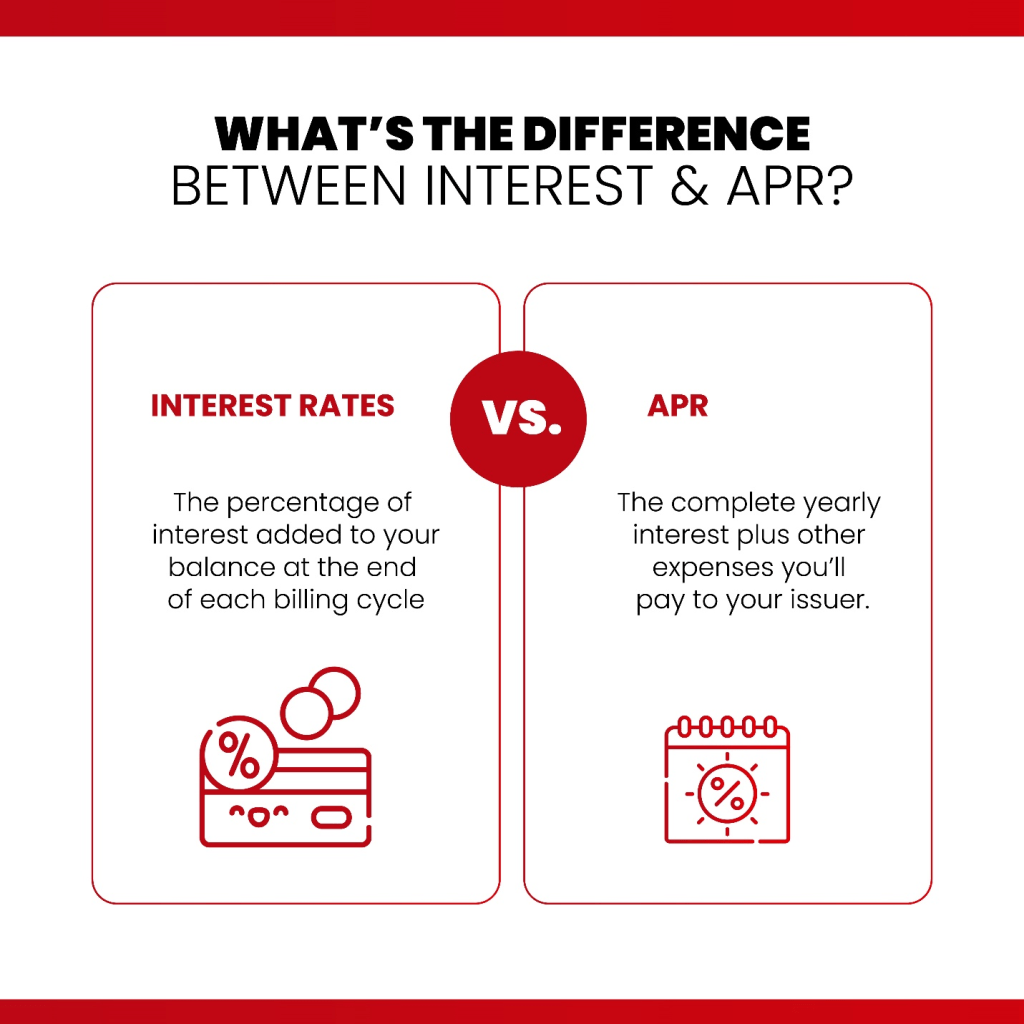

APR, or Annual Percentage Rate, is the amount of interest you’re charged yearly on balances that aren’t paid off in full. A 0% APR card eliminates that charge temporarily, giving you a window of time to pay off large purchases or transfer existing high-interest balances without accruing extra debt.

Understanding the Promotional Period

The most crucial aspect of any 0% APR credit card is the promotional period. This is the duration where no interest will be charged on balances, which could range from 6 to 21 months, depending on the issuer. During this period, you’re essentially getting an interest-free loan as long as you’re diligent about making payments.

However, once the promotional period ends, the APR kicks in—sometimes at a rate that’s higher than what you might find with other types of cards. Therefore, it’s essential to have a plan to pay off the balance in full before this period concludes.

The Benefits of 0% APR Credit Cards

0% APR credit cards offer several advantages, making them a highly attractive option for a wide variety of consumers. Whether you’re looking to finance a large purchase, consolidate debt, or manage your cash flow, a 0% APR card can be a valuable tool. Below are the key benefits:

Interest-Free Financing

One of the most appealing features of a 0% APR credit card is the opportunity to finance purchases without incurring interest charges during the promotional period. Typically ranging from 6 to 18 months, this interest-free period allows you to make significant purchases and pay them off gradually without the burden of accruing interest.

This feature is particularly helpful for individuals planning major expenses like home renovations, new appliances, or vacations. Instead of taking out a personal loan or paying high interest on another card, a 0% APR card lets you manage large purchases with zero added cost. It’s like getting an interest-free loan, as long as you make the required payments during the promotional window.

For example, if you’re planning to purchase new furniture for your home that costs $3,000, paying off this amount on a traditional card with an interest rate of 18% could add substantial interest to the total cost if not paid off right away. A 0% APR card allows you to spread out your payments over the promotional period without paying a penny in interest, provided that you pay off the balance before the promotional period ends.

Debt Consolidation

Another significant advantage of 0% APR cards is their potential for consolidating high-interest debt. If you’re currently carrying balances on multiple credit cards with high interest rates, transferring those balances to a 0% APR card can save you significant amounts of money.

With interest on some credit cards reaching upwards of 20%, consolidating that debt to a card with 0% APR means you can pay off the principal without accruing additional interest during the promotional period. Over time, this can save you hundreds or even thousands of dollars, depending on the size of your debt.

For instance, imagine you have a balance of $5,000 on a card with a 19% interest rate. If you only make the minimum payment each month, a significant portion of your payment goes toward interest rather than reducing the principal.

By transferring this balance to a 0% APR card, every payment you make during the interest-free period goes directly toward reducing the debt itself. This can help you pay off your balance faster and more efficiently without the stress of rising interest charges.

Cash Flow Management

0% APR credit cards also provide a valuable tool for managing cash flow. Whether you’re facing an unexpected expense or want to spread out payments for better budget management, a 0% APR card can offer flexibility. Without the pressure of accumulating interest, you can spread your payments over several months, making it easier to manage your monthly budget. This can be particularly useful for those who need to balance fluctuating income streams or handle irregular expenses.

For example, if you encounter a large, unexpected medical expense, a 0% APR card allows you to handle the payment upfront while giving you several months to pay it off. Instead of straining your monthly budget, you can focus on making manageable payments while avoiding interest charges.

Boosting Credit Score

Using a 0% APR credit card responsibly can also improve your credit score over time. By making on-time payments and paying off your balance before the promotional period ends, you demonstrate good credit habits, which can positively impact your credit score. Additionally, using a 0% APR card can help improve your credit utilization ratio, which is a significant factor in credit scoring. Keeping your balance low relative to your credit limit can boost your score even further.

Balance Transfers: A Strategic Use of 0% APR

One of the best uses of 0% APR credit cards is for balance transfers. A balance transfer involves moving your existing debt from one card with a high interest rate to a new card with a 0% APR promotional period. This is an excellent way to pay down debt faster, as your monthly payments go directly toward the principal balance rather than interest.

However, balance transfers typically come with fees. Most card issuers charge a fee of 3% to 5% of the amount being transferred. For example, if you transfer $5,000 and the fee is 3%, you’ll pay $150 upfront. While this might seem like a downside, the potential interest savings usually outweigh the transfer fee if you pay off the balance during the promotional period.

The Risks of 0% APR Credit Cards

As with any financial product, there are risks associated with 0% APR credit cards. If not managed carefully, they can lead to significant financial strain. Here are some of the primary risks to be aware of:

- Deferred interest: Some cards operate on a deferred interest model. If you don’t pay off the entire balance by the end of the promotional period, you may be charged retroactive interest on the full balance from the original purchase date.

- High post-promotional rates: Once the 0% APR period ends, the interest rate can shoot up dramatically. It’s not uncommon for rates to exceed 20% APR after the promotional period expires. If you’re carrying a balance at that point, the interest charges can accumulate quickly.

- Late payment penalties: Missing even one payment can trigger the loss of your 0% APR offer, resulting in high interest charges and potential penalties. Some cards may even apply a penalty APR, which is higher than the standard rate if you’re late on payments.

How to Qualify for a 0% APR Credit Card

Not everyone will qualify for a 0% APR credit card. These offers are generally reserved for individuals with good to excellent credit scores. A score of 670 or higher is typically considered “good,” but those with higher scores (750+) are more likely to secure the most favourable terms.

If your credit score is low, it’s worth taking steps to improve it before applying for a 0% APR credit card. Paying down existing debts, correcting any errors on your credit report, and keeping your credit utilization low can all help boost your score.

When Should You Consider a 0% APR Credit Card?

A 0% APR credit card can be a fantastic tool in specific financial situations. Here are some instances when it might be the right choice for you:

- Large purchases: If you’re planning a big purchase that you can pay off within the promotional period, a 0% APR credit card gives you the flexibility to do so without the burden of interest charges.

- Debt consolidation: If you have multiple credit card balances with high interest rates, transferring them to a card with 0% APR can help simplify your payments and reduce the amount of interest you pay.

- Short-term borrowing: If you need to borrow money for a short period and can repay the balance before the promotional period ends, these cards can offer an interest-free solution.

However, if you’re unable to pay off the balance within the promotional period or tend to carry debt, these cards could become costly once the regular APR kicks in.

Key Terms to Look Out For Before Applying

Before applying for a 0% APR credit card, it’s crucial to review the terms and conditions carefully. Here are a few key factors to consider:

- Length of the promotional period: Make sure the 0% APR period is long enough to pay off the balance. The longer the period, the better, but it’s important to align it with your financial goals.

- Balance transfer fees: If you’re using the card for a balance transfer, check the fees and calculate if the transfer will save you money in the long run.

- Regular APR: Understand what the interest rate will be once the promotional period ends, and ensure you have a strategy to avoid paying high interest rates.

- Late payment penalties: Be aware of what happens if you miss a payment. Many cards will cancel the 0% offer if you miss a payment, so staying on top of your due dates is crucial.

Maximizing the Benefits of 0% APR Credit Cards

To truly benefit from a 0% APR credit card, you need to have a clear strategy. Here are a few tips to ensure you maximize the potential of your card:

- Create a repayment plan: Before making a large purchase or transferring a balance, map out a plan to pay off the debt within the promotional period.

- Set payment reminders: Missing a payment can lead to losing your 0% APR offer, so set up automatic payments or reminders to ensure you stay on track.

- Avoid new debt: It can be tempting to make additional purchases once you have a 0% APR, but avoid racking up new debt unless you’re confident you can pay it off.

Conclusion: Is a 0% APR Credit Card Right for You?

0% APR credit cards can offer significant benefits, including interest-free financing and debt consolidation. However, they also come with risks if you fail to pay off the balance during the promotional period. Before applying, assess your financial situation, understand the card’s terms, and create a solid repayment plan.

Apply For the Best Rewards Credit Card in Canada

If you’re looking for top cash back credit cards in Canada with amazing introductory APR offers, visit Great Canadian Rebates. The online platform allows you to compare various credit card offers in Canada and apply for the one that best suits your unique needs and preferences.

Visit the website today for more information.