When it comes to choosing a travel credit card, it can feel like stepping into a world of endless perks and rewards. With airlines, hotels, and credit card companies vying for your loyalty, many cards offer impressive-sounding benefits, but are they worth the hype? While perks like free checked bags and priority boarding may catch your eye, some travel credit card benefits aren’t as valuable as they seem.

In this guide, we’ll take a closer look at overrated travel credit card perks and explore alternatives that can help you get the most out of your card. From unnecessary travel insurance to overhyped concierge services, we’ll help you avoid perks that don’t live up to the marketing and steer you toward features that truly benefit your wallet and your travel experience.

Airport Lounge Access

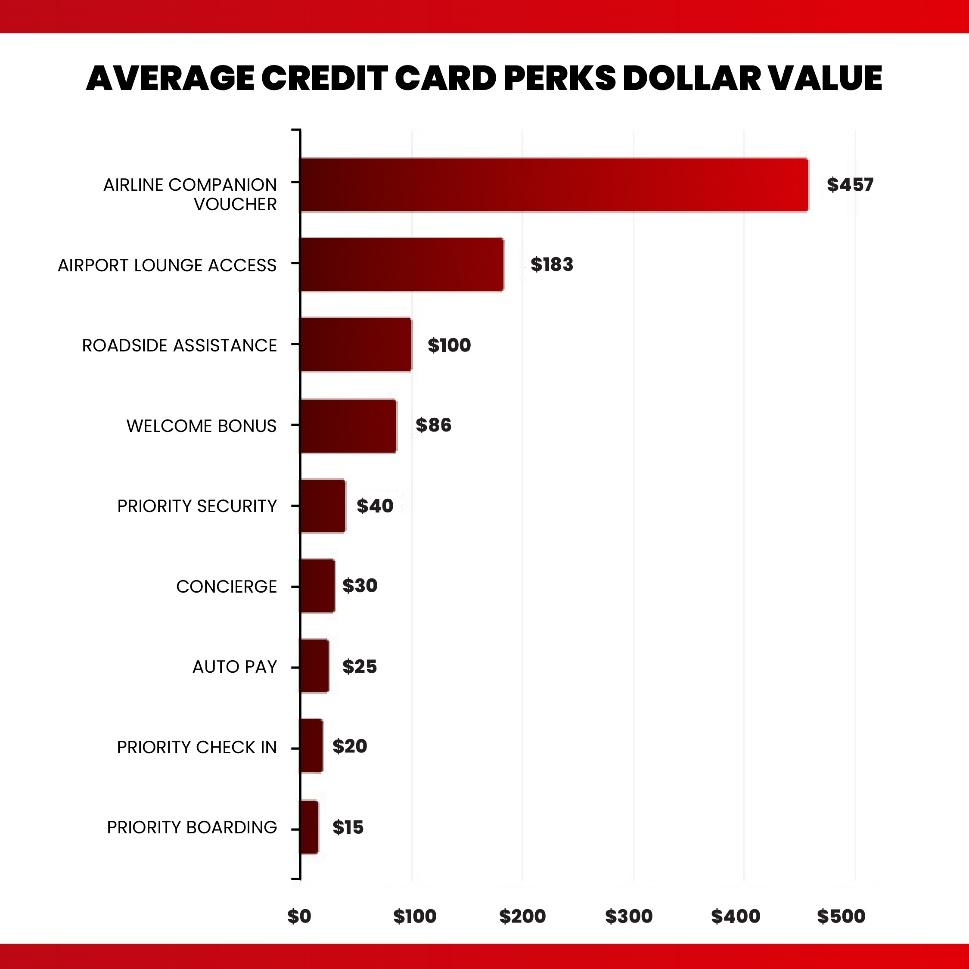

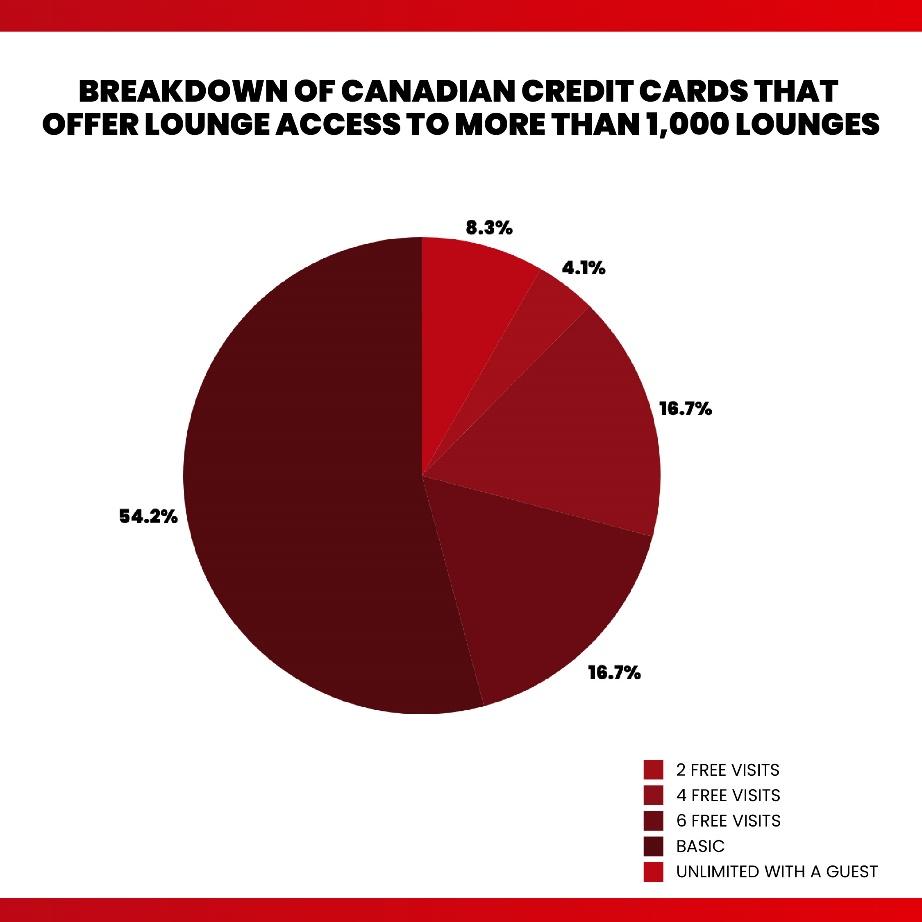

At first glance, airport lounge access can seem like the ultimate travel perk. You’re promised a quiet space away from the bustling terminal, free drinks, snacks, and even shower facilities in some locations. While the idea of lounging in style before your flight sounds luxurious, the reality is that this perk is often overrated for the average traveller.

Firstly, not all travel credit cards offer access to high-quality lounges. Many only provide access to domestic or smaller international lounges that might not live up to the expectations of comfort or luxury. If you’re not flying frequently or tend to travel budget airlines that don’t partner with major lounge networks, this perk might end up gathering dust in your cardholder benefits. Additionally, even with lounge access, you may find overcrowded spaces and limited services, making the experience far less enjoyable than anticipated.

Alternatives to Consider: Instead of paying extra for lounge access on your credit card, consider top-rated cash back credit cards that offer direct financial rewards for everyday spending. With these cards, you can save money to spend on things that matter more to you, like upgrading your hotel room or purchasing an in-flight meal.

Travel Concierge Services

Many premium travel credit cards tout concierge services as a feature that will make your life easier. From booking restaurant reservations to securing event tickets, concierge services claim to handle the tedious tasks for you. But how valuable is this service in practice?

For most people, the need for a dedicated concierge is limited, and the value of this service is questionable in the digital age. Thanks to apps and websites, booking a table at a restaurant or purchasing tickets can be done in seconds.

In fact, many cardholders never use this perk and those who do often report mixed results. Sometimes, the concierge team is unable to secure special bookings or provide meaningful upgrades, making this perk seem like more of a sales gimmick than an essential service.

Alternatives to Consider: Instead of focusing on concierge services, look for cash back credit cards that reward your spending with tangible cash or rebates. You can apply these savings toward travel upgrades and unique experiences, or you can even splurge on the event tickets you want.

Car Rental Insurance

Many travel credit cards offer complimentary car rental insurance as a perk, providing peace of mind when driving abroad or within Canada. However, this perk can be overrated for several reasons.

Firstly, not all credit card car rental insurance policies are comprehensive. Many exclude certain types of vehicles, like luxury or exotic cars, and might not cover all possible damages or losses. Some policies only provide secondary coverage, meaning you’ll need to file a claim with your primary insurance provider first, potentially causing delays and complications.

Additionally, if you rarely rent cars, this perk is unlikely to provide much value. It may seem attractive on paper, but if you don’t use it frequently, it might not justify the card’s annual fee.

Alternatives to Consider: If car rental insurance doesn’t fit your lifestyle, focus on cards that offer broader everyday benefits. Credit card rebates or top-rated cash back credit cards can provide year-round rewards for purchases you actually make, helping you save money more consistently.

Extended Warranty and Purchase Protection

Extended warranty and purchase protection may seem like excellent safeguards when making large purchases with your credit card. Still, in practice, they’re often difficult to claim and don’t offer significant value.

While these perks promise to repair or replace damaged items, the reality can be more complicated. Many claims are denied due to exclusions or fine print, and the process of filing a claim can be time-consuming.

Extended warranties provided by credit cards often overlap with manufacturer warranties, meaning you might already be covered without needing the extra protection from your card. Additionally, many items don’t break within the extended warranty period, rendering the perk irrelevant.

Alternatives to Consider: Instead of relying on these perks, choose a cash back credit card that provides direct financial rewards. Cash-back offers can be used to offset the cost of new purchases or replacements, giving you more control over your spending.

No Foreign Transaction Fees

One of the most heavily advertised perks on travel credit cards is the elimination of foreign transaction fees. While this can be a valuable feature for frequent international travellers, it’s an overrated perk for many casual travellers or those who don’t spend much abroad.

Firstly, many credit cards with no foreign transaction fees come with high annual fees. If you’re not travelling internationally often enough, the savings on fees may not outweigh the cost of maintaining the card. Additionally, many cards charge higher interest rates or offer fewer rewards in exchange for waiving foreign fees, so the trade-off may not be worth it unless you’re consistently spending money overseas.

Alternatives to Consider: For those who rarely travel abroad, top-rated cash back credit cards or credit card rebates can offer more meaningful savings. By earning cash back on everyday purchases, you can maximize rewards without worrying about travel-specific fees.

Where to Apply?

If you plan to apply for a cash back rewards credit card, head to Great Canadian Rebates. Their online platform will allow you to compare the best cashback credit cards and others, which will help you choose the one that fits the bill. You can earn a solid credit card rebate when you sign up for the credit card through our platform.

Visit their website for more information.