Getting denied a student credit card can be frustrating, but it’s not the end of the road. This situation can serve as an opportunity to improve your financial standing and explore alternative ways to build credit. Here’s a step-by-step guide on what to do if your student credit card application is denied in Canada, along with some tips on increasing your chances of approval next time.

1. Review the Rejection Notice

When a credit card application is denied, the issuer must provide a reason in a rejection notice, also known as an adverse action letter. This document outlines why your application was turned down, such as insufficient income, lack of credit history, or too many recent inquiries. By carefully reading this notice, you can gain insight into the specific factors that need to be addressed before reapplying. For example, if your income is too low, you might need to find part-time work or secure a co-signer to improve your chances.

2. Check Your Credit Report for Errors

Credit card issuers look closely at your credit history, and even minor mistakes on your report can affect your application. You’re entitled to a free credit report from each of Canada’s two major credit bureaus—Equifax and TransUnion—once a year. Check these reports for any inaccuracies, such as incorrect payment histories or accounts that don’t belong to you. If you spot any errors, dispute them immediately with the credit bureau to have them corrected.

3. Consider a Secured Credit Card

If your student credit card application is denied, a secured credit card might be a good alternative. With a secured card, you make a cash deposit that acts as your credit limit. While it requires an upfront payment, it can be easier to get approved since the issuer has less risk. A secured card is an excellent way to build or rebuild your credit, and as you demonstrate responsible use, you could eventually qualify for a traditional credit card.

4. Become an Authorized User

Another way to build credit without applying for your own card is to become an authorized user on a family member’s credit card account. This allows you to piggyback on their credit history. As long as the primary cardholder makes timely payments and maintains a low balance, your credit score can benefit. Just be sure to confirm that the credit card issuer reports authorized users to the credit bureaus, as not all do.

5. Improve Your Debt-to-Income Ratio

Your debt-to-income ratio, which compares your monthly debt payments to your monthly income, is a crucial factor in credit card approvals. If your ratio is too high, you’re seen as a risk to lenders. To improve this, focus on reducing your existing debts, such as paying off any student loans or car loans. Alternatively, increasing your income through part-time work can also help boost this ratio and improve your chances of approval in the future.

6. Avoid Too Many Credit Applications

Each time you apply for a credit card, the lender performs a “hard inquiry” on your credit report, which can temporarily lower your credit score. Applying for multiple credit cards within a short period of time raises red flags for lenders and may hurt your chances of approval. It’s a good idea to wait at least six months between applications and only apply for cards for which you’re more likely to qualify. Some issuers offer pre-approval checks, which allow you to see if you might qualify without affecting your credit score.

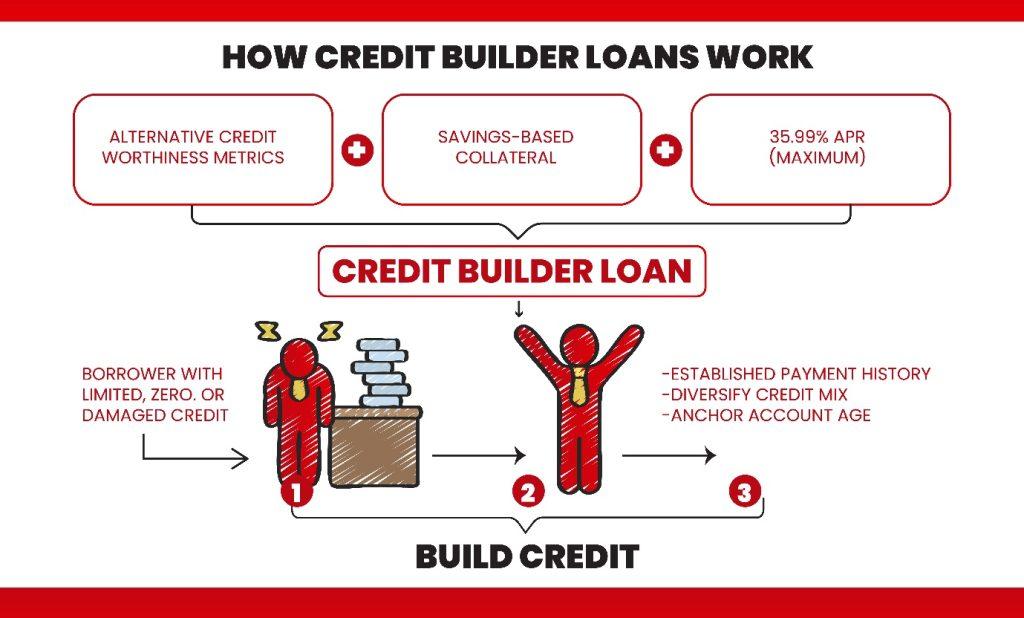

7. Build Credit with a Credit-Builder Loan

In addition to secured cards, another option for building credit is a credit-builder loan. These loans are designed specifically to help you establish credit. Instead of receiving the loan amount upfront, the funds are placed in a savings account. You make monthly payments, and once the loan is repaid, you receive the money. Meanwhile, your on-time payments are reported to the credit bureaus, helping to improve your credit score.

8. Reapply When You’re Ready

Patience is key when applying for credit. After addressing the reasons for your initial rejection, take time to improve your financial situation before reapplying. Whether it’s building your credit history, correcting credit report errors, or improving your debt-to-income ratio, these steps can significantly improve your chances of approval the next time around.

9. Explore Other Ways to Build Credit

If you’re unable to get a student credit card, you can still build credit in other ways. For instance, paying your utility and phone bills on time can help establish a positive payment history. Additionally, services like RentTrack allow you to report your rent payments to the credit bureaus, which can also boost your credit score.

Having your application for a student credit card doesn’t mean you’re out of options. By understanding the reasons for your rejection and taking steps to improve your financial situation, you can build a strong credit profile over time. Consider secured credit cards, become an authorized user, or explore credit-builder loans as alternatives while you work on improving your creditworthiness. With patience and persistence, you’ll be better positioned for credit approval in the future.

Start Saving with Great Canadian Rebates

Earn cash back rebates and use online coupons with Great Canadian Rebates. Sign up and enjoy savings from hundreds of merchants. Featuring top cash back credit cards like the American Express Cobalt and Tangerine World Mastercard.