When you see a credit card offer boasting 0% APR, it’s tempting to apply right away. These promotions often seem like a golden opportunity to make large purchases or transfer existing debt without the worry of accumulating interest for a set period of time. But have you ever wondered how credit card companies profit from these offers? After all, they’re in the business of making money, not giving away free credit.

This blog will uncover the various strategies credit card companies use to profit from 0% APR offers and how you can navigate these deals to your advantage. While these offers can be beneficial when used correctly, it’s important to understand the hidden costs and potential pitfalls. By the end of this post, you’ll have the insight you need to make informed decisions when using 0% APR credit cards.

What Is a 0% APR Offer?

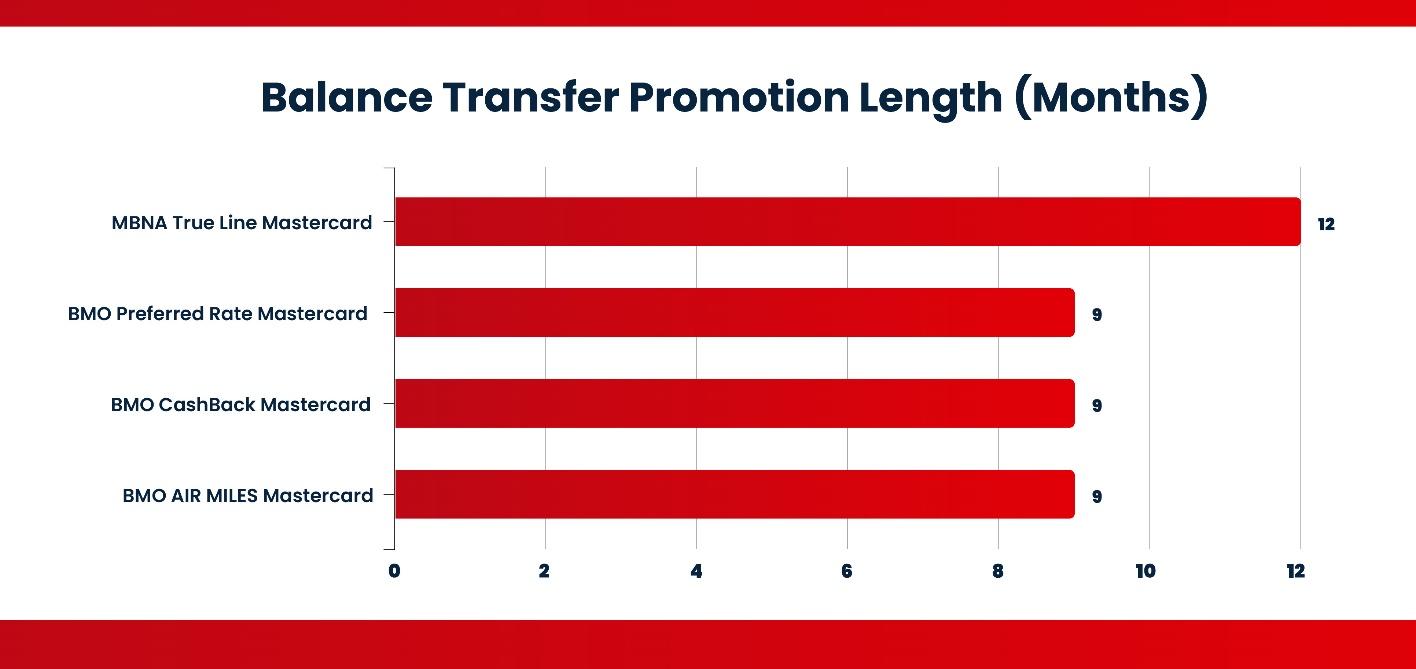

Before diving into how credit card companies profit, let’s clarify what a 0% APR offer is. APR, or Annual Percentage Rate, refers to the yearly interest rate charged on borrowed funds. When a credit card offers 0% APR, it means you won’t pay interest on purchases or balance transfers for a promotional period, typically ranging from 6 to 18 months.

These offers are designed to attract new customers, especially those looking to transfer high-interest debt or finance a large purchase. However, the 0% APR period is temporary, and once it expires, a higher interest rate applies.

How Do Credit Card Companies Profit from 0% APR Offers?

While 0% APR offers may appear to be a cost-free borrowing solution, they are far from it. Here’s how credit card companies make money even when they offer a promotional period with no interest:

Balance Transfer Fees

One of the most common ways credit card companies profit from 0% APR offers is through balance transfer fees. When you move debt from one card to another to take advantage of a 0% APR deal, most credit cards charge a fee, typically around 3% to 5% of the transferred balance. While this might seem like a small percentage, it can add up quickly.

For example, if you transfer $5,000 of debt to a new card with a 3% fee, you’ll immediately owe $150. That fee goes directly to the credit card company. Although you won’t be paying interest for the promotional period, you’ve already paid the company to move your debt.

Late Payment Fees

Missing a payment while on a 0% APR offer can cost you significantly. Not only do credit card companies impose hefty late payment fees (which can range from $35 to $40 per missed payment), but many also reserve the right to revoke the 0% APR offer if you fail to pay on time. Once revoked, you may be hit with a penalty APR—a much higher interest rate that can exceed 25%.

This is how credit card companies leverage human error. Many people sign up for 0% APR offers but forget or are unable to make a payment on time, leading to unexpected fees and increased interest.

Purchase Interest After the Introductory Period

One of the biggest misconceptions about 0% APR offers is that consumers believe they can pay off their debt at their own pace. In reality, once the promotional period ends, a much higher APR kicks in. If you haven’t paid off your balance by then, you’ll be paying interest on the remaining amount at the regular rate, which often ranges from 15% to 25%.

For example, if you have $3,000 left on a card after the 0% APR period ends and the APR jumps to 20%, you’ll now be accruing $50 per month in interest. Credit card companies count on this happening because many consumers underestimate how much they need to pay during the 0% period to clear their balance.

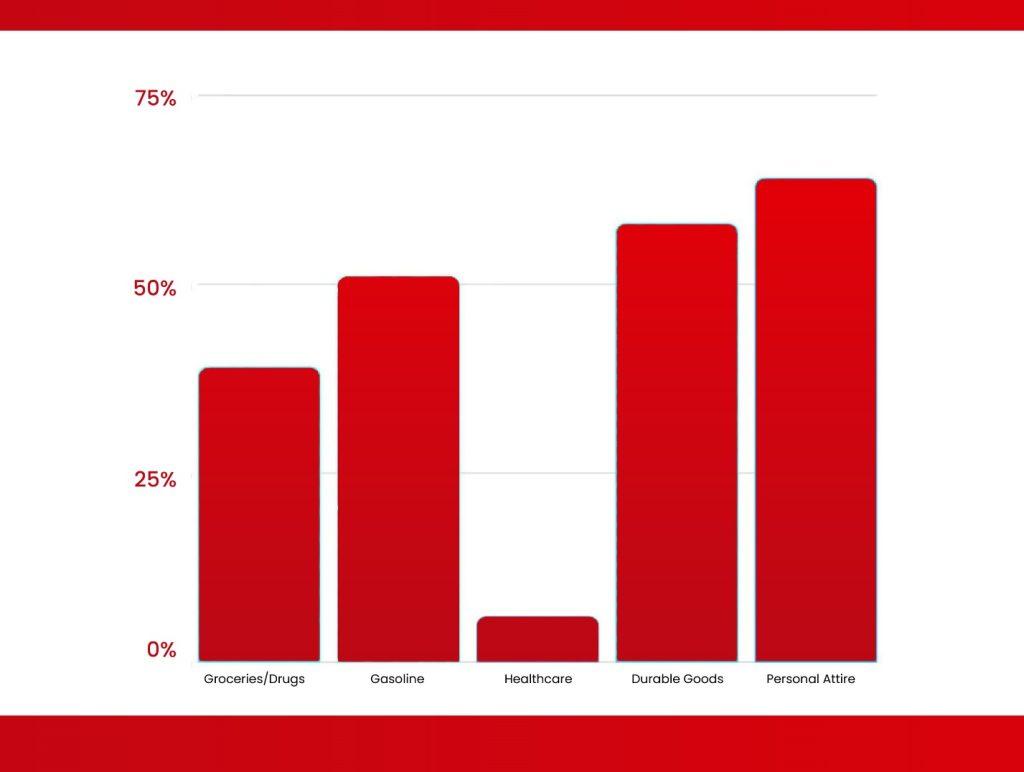

Increased Spending Temptation

A 0% APR offer can make it tempting to spend more than you normally would, especially since the thought of “interest-free” payments feels like you’re borrowing for free. Credit card companies capitalize on this by encouraging consumers to make larger purchases, knowing that not everyone will pay off their balance before the APR increases.

Additionally, the higher your balance, the more difficult it can be to pay off during the 0% APR period. This leads to extended debt and, ultimately, more interest payments after the promotional period ends.

Add-On Services and Offers

Many credit card companies use 0% APR offers as an opportunity to upsell additional services such as credit monitoring, identity theft protection, or insurance. These add-ons might come with extra monthly fees, padding the credit card company’s bottom line. While these services are optional, many consumers sign up without realizing how quickly the costs can add up.

Conclusion: Maximizing the Benefits of 0% APR Cards

While 0% APR offers can be a valuable tool for managing debt or making large purchases, they’re not without risks. Credit card companies profit from these offers through fees, increased spending, and post-introductory interest rates. However, if you use these offers wisely—by paying off your balance before the promotional period ends, avoiding new debt, and understanding the fine print—you can benefit from interest-free borrowing without falling into a financial trap.For Canadians looking to maximize their rewards while managing their credit, it’s also worth exploring cash back credit card options, credit card rebates, and travel credit cards.

Where Can You Apply For The Best Canadian Credit Cards?

Great Canadian Rebates is an online platform that lets Members compare credit card options available in Canada and apply for the one that best suits their financial and lifestyle requirements. It’s free to join, and Members can also choose from over 700 well-known merchants and take advantage of great rebates, deals, and discounts.

Visit the website today for more information.