If you’re looking to make the most of your spending, understanding cash-back rates on Canadian credit cards is essential. With a wide range of options available, each offering different rewards structures, knowing the average cash-back rate and how to compare cards can help you find the best fit for your financial habits. In this guide, we’ll explore the standard cash-back rates offered by Canadian credit cards and provide tips on how to choose the best card for your needs.

Understanding Cash-Back Rates

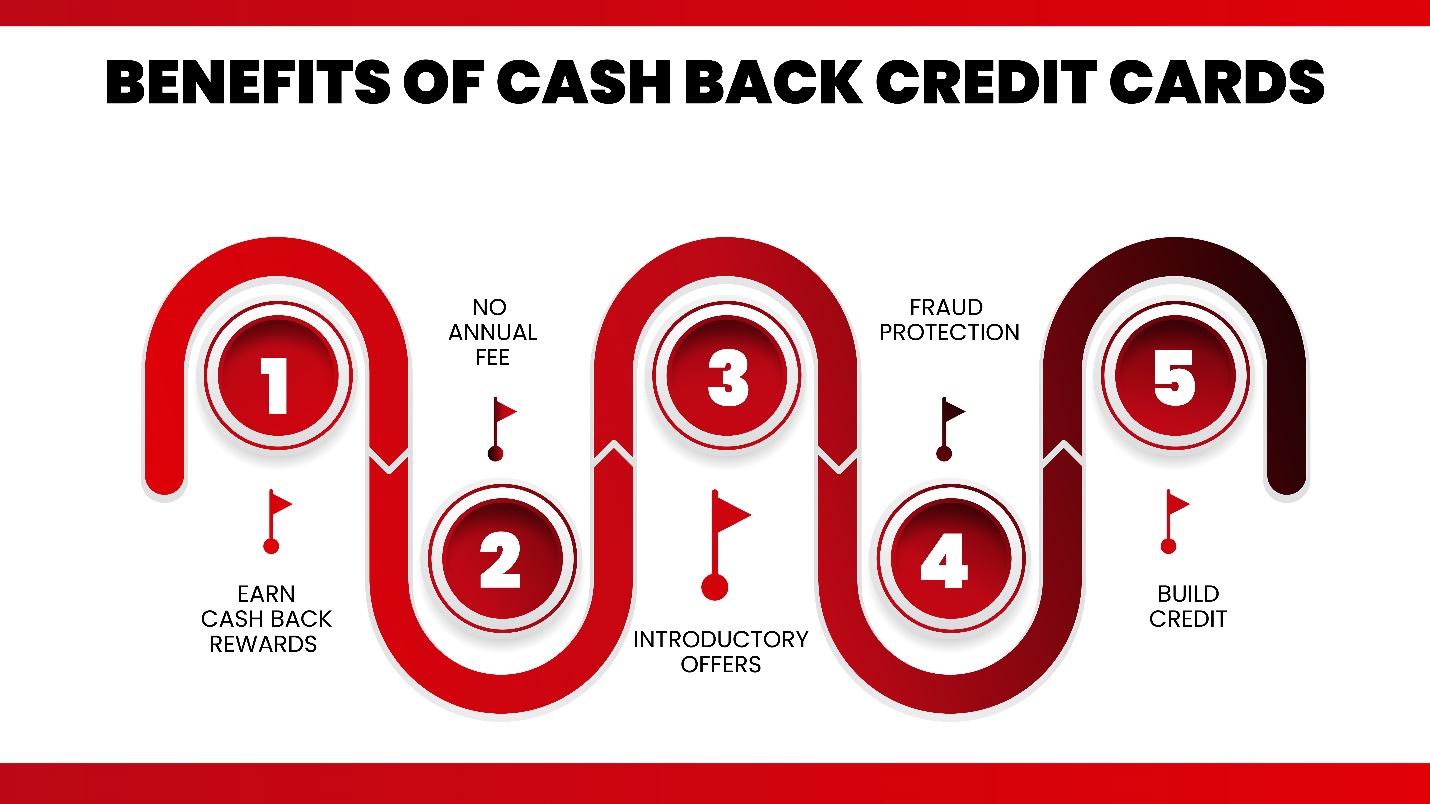

Cash-back credit cards offer a percentage of your purchases back as a cash reward. This can be a valuable way to earn money on your everyday spending. Here’s a look at typical cash-back rates and what you can expect from different types of cards.

1. Standard Cash-Back Rates

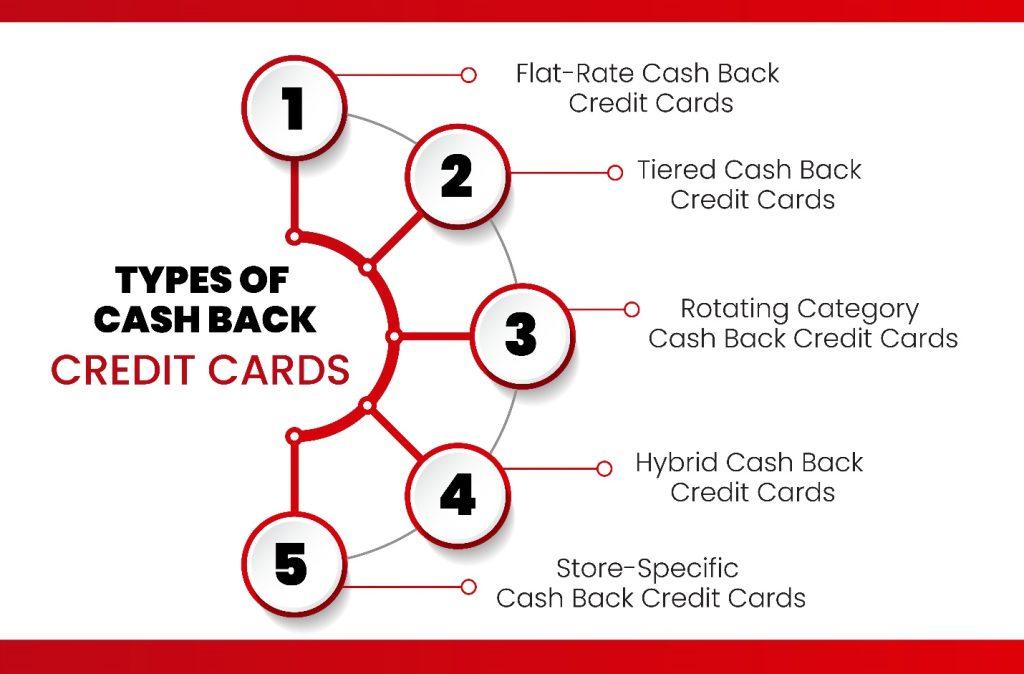

Most Canadian cash-back credit cards offer cash-back rates ranging from 0.5% to 2% on most purchases. The rate can vary based on the card and the type of purchase. For example, some cards offer higher cash-back rates on specific categories like groceries, gas, or dining.

- Basic Cash-Back Cards: These cards typically offer around 0.5% to 1% cash back on all purchases.

- Tiered Cash-Back Cards: These cards offer different cash-back rates depending on the spending category. For instance, the Tangerine Cash Back Credit Card offers 2% cash back in up to three spending categories of your choice and 0.5% on other purchases.

- Rotating Categories: Some cards offer higher cash-back rates on rotating categories that change quarterly.

2. Premium Cash-Back Cards

Premium cards often come with higher cash-back rates but may have higher annual fees. These cards are designed for those who spend more and want to maximize their rewards.

- American Express Cobalt Card: This card offers up to 5% cash back on dining and groceries, and 2% on travel and transit, making it a top choice for those who spend heavily in these categories.

3. High-Earning Cash-Back Cards

Cards with high cash-back rates are often among the top-rated cash back credit cards in Canada. These cards are designed to provide significant rewards for high spenders.

- Simplii Cash Back Visa: Known for its competitive rates, this card provides 1.5% cash back on all eligible purchases, with no annual fee.

Comparing Cash-Back Cards

When choosing a cash-back card, it’s essential to compare various factors beyond the cash-back rate to find the card that best suits your spending habits.

1. Annual Fees

While some cash-back cards have no annual fee, others may charge one. Cards with annual fees often offer higher cash-back rates or additional benefits. For example, the American Express Cobalt Card has an annual fee but offers high cash-back rates and other perks.

2. Cash-Back Caps

Some cards may have limits on how much cash back you can earn in specific categories or overall. For example, the Scotiabank Gold Passport card offers higher cash back rates but may cap rewards in certain categories.

3. Rewards Redemption

Consider how you can redeem your cash-back rewards. Some cards provide statement credits, while others may offer direct deposits or gift cards. For instance, the RBC Avion Rebate allows you to redeem rewards for travel or cash back.

4. Additional Benefits

Look for additional benefits such as travel insurance, purchase protection, or extended warranty coverage. Cards like the Rogers World Elite Mastercard offer travel benefits along with cash back, adding extra value.

Tips for Maximizing Cash Back

To make the most of your cash-back credit card, follow these strategies:

- Use Your Card for Everyday Purchases: Maximize your cash-back earnings by using your card for regular expenses like groceries, gas, and dining. For instance, if you have the Tangerine Cash Back Card, make sure to use it in your chosen categories to earn 2% cash back.

- Pay Off Your Balance in Full: Avoid interest charges by paying off your balance each month. Interest can quickly erode your cash-back rewards, so it’s important to manage your spending and payments effectively.

- Take Advantage of Bonus Categories: For cards with rotating or tiered categories, track and optimize your spending according to the bonus categories.

- Combine with Promotions: Use your cash-back card in conjunction with promotional offers or coupons to maximize savings. For example, pairing your card with a Staples coupon code in Canada can boost your overall rewards and savings.

Conclusion

The average cash-back rate for Canadian credit cards typically ranges from 0.5% to 2%, depending on the card and spending categories. By understanding the different cash-back structures and comparing various cards, you can find the best option for your spending habits and maximize your rewards. Whether you choose the high cash-back rates of the American Express Cobalt Card or some other option, careful selection and strategic use of your card can help you make the most of your spending and earn valuable cash back.

Maximize Your Cash-Back Rewards Today!

Find the perfect cash-back credit card for your spending habits with Great Canadian Rebates and start earning more on every purchase. Whether you choose the American Express Cobalt Card or any other, make the most of your rewards. Explore top-rated options and combine your card with online deals for even greater savings!