Building or rebuilding credit in Canada is a crucial step towards financial independence. A strong credit score opens doors to better interest rates on loans, mortgages, and credit cards. While it takes time and responsible financial habits, utilizing the right credit card can significantly accelerate this process.

Credit cards are more than just payment tools; they can be powerful instruments for credit building when used wisely. A well-chosen credit card can help establish a positive credit history, increase your credit limit, and improve your credit score over time.

This blog is your guide to understanding credit scores and choosing the best credit cards for building creditand taking control of your financial future.

What is a credit score?

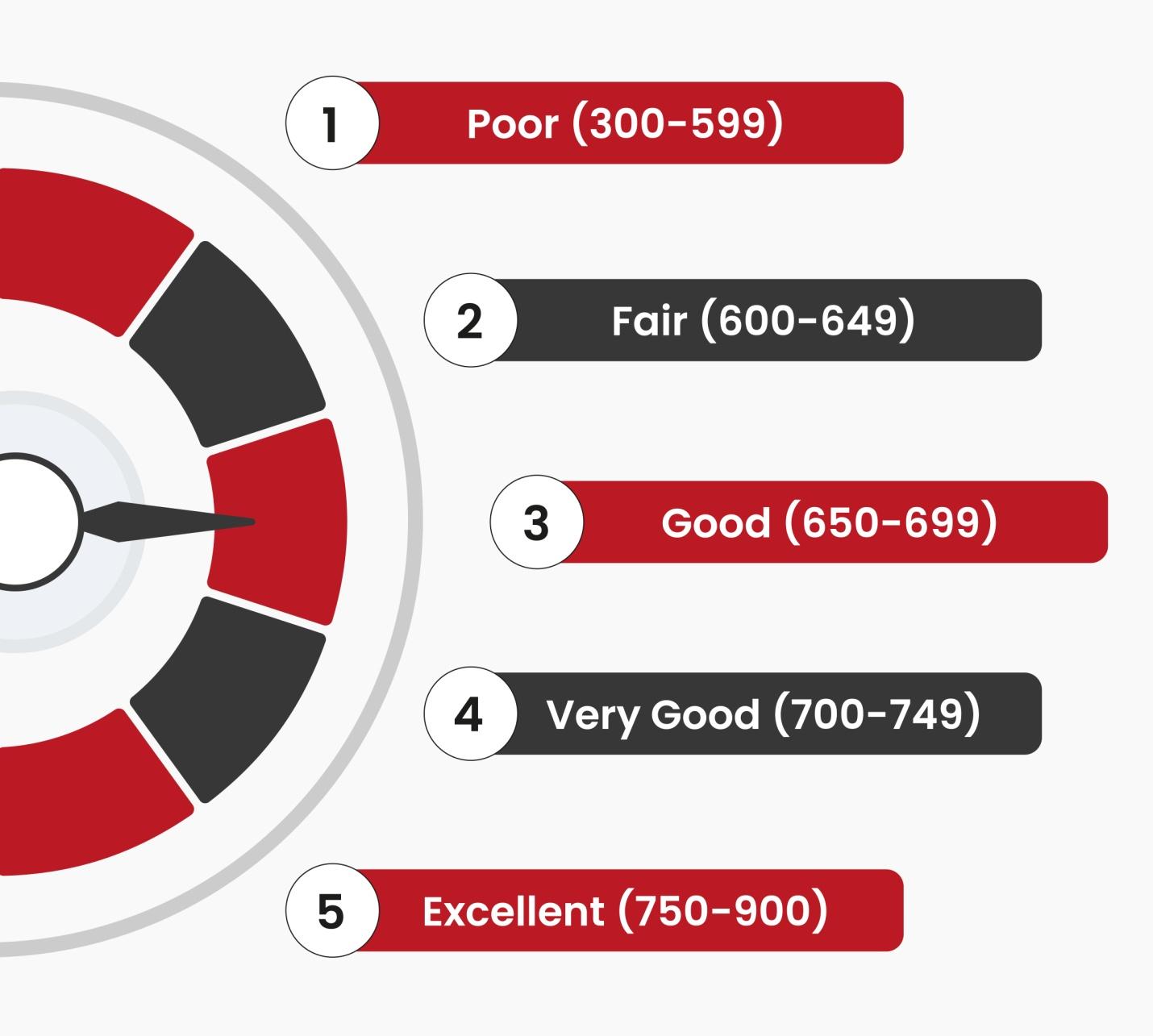

A credit score is a numerical representation of your creditworthiness, a reflection of your ability to manage debt responsibly. It ranges from 300 to 900, with higher scores indicating better creditworthiness. Lenders use credit scores to assess your risk as a borrower.

Several factors contribute to your credit score, including:

Payment history

Consistent on-time payments are paramount, accounting for 35% of your credit score. Late or missed payments can significantly damage your score.

Credit utilization

Credit utilization refers to the amount of credit you’re using compared to your total available credit. It’s expressed as a percentage. Maintaining a low credit utilization ratio is crucial for a healthy credit score. Ideally, you should aim to keep this ratio below 30%. A higher ratio can signal to lenders that you may be overextended financially.

Credit history length

The length of your credit history is another significant factor in determining your credit score. A longer credit history generally indicates financial stability and responsibility. Credit bureaus consider the age of your oldest account, the age of your newest account, and the average age of all your accounts.

Credit mix

A diverse range of credit accounts, such as credit cards, installment loans (car loans, personal loans), and mortgage loans, can positively impact your credit score. This demonstrates your ability to manage different types of credit responsibly.

New credit

While opening new credit accounts can be beneficial for building a credit mix, excessive applications can negatively impact your credit score. Each credit application results in a hard inquiry on your credit report, which can temporarily lower your score.

By effectively managing your credit card and other credit accounts, you can positively influence these factors and gradually improve your credit score.

This is how credit cards can help build credit:

Establishing a credit history

Responsible credit card use helps build a positive payment history, a crucial component of your credit score.

Demonstrating creditworthiness

Consistent on-time payments and low credit utilization showcase your ability to manage credit responsibly.

Increasing credit limit

As you demonstrate responsible credit management, you may qualify for credit limit increases, which can positively impact your credit score.

Accessing financial products

A good credit score opens doors to better interest rates on loans, mortgages, and other financial products.

The Importance of Secured Credit Cards

For individuals with limited or damaged credit, secured credit cards can be a valuable tool for credit building. These cards require a security deposit, which acts as collateral. By demonstrating responsible use of a secured credit card, you can gradually build your credit history and potentially graduate to an unsecured card.

Secured credit cards offer several advantages for credit building:

Guaranteed approval

Unlike unsecured cards, secured credit cards are typically easier to obtain, even with limited credit history.

Credit history building

Responsible use of a secured credit card helps establish a positive payment history, which is reported to credit bureaus.

Potential for increased credit limit

As you demonstrate responsible credit management, your credit limit may be increased without requiring an additional security deposit.

Graduation to unsecured card

Some issuers offer the option to convert your secured credit card to an unsecured card after a period of responsible use.

Key Features of Credit Cards for Building Credit

When selecting a credit card to build credit, consider the following features:

Low credit limit

Starting with a low credit limit can help you manage your spending and avoid accumulating debt.

No annual fee

Avoid unnecessary costs while building your credit.

Regular credit reporting

Ensure the card issuer reports your payment history to the credit bureaus.

Clear terms and conditions

Understand the card’s fees, interest rates, and other terms to avoid surprises.

Opportunities for rewards

While not the primary focus, some cards offer modest rewards, which can be an added benefit.

Best Credit Cards for Building Credit in Canada

While the credit card market is constantly evolving, here are some popular options to consider:

- Secured credit cards: Offered by banks and credit unions, these cards require a security deposit and are ideal for those with limited credit history.

- Student credit cards: Designed for students, these cards often have lower credit limits and may offer rewards or cashback.

- Starter credit cards: Some credit card issuers offer cards specifically for individuals looking to build credit. These cards typically have no annual fee and basic features.

Tips for Building Credit with a Credit Card

Consistent payments

Make all payments on time and in full to establish a positive payment history.

Low credit utilization

Keep your credit utilization ratio (the amount you owe compared to your credit limit) below 30% for optimal credit score impact.

Credit card age

The longer you have a credit card, the more positively it impacts your credit score.

Avoid closing old accounts

Closing old credit cards can negatively impact your credit score.

Monitor your credit report

Regularly review your credit report for errors and discrepancies.

The Role of Credit Bureaus in Credit Building

Credit bureaus, such as Equifax and TransUnion, collect and maintain credit information. Your credit score is calculated based on the data reported to these bureaus. By using your credit card responsibly, you can build a positive credit history that is reflected in your credit score.

Overcoming Credit Challenges

Building credit takes time and discipline. If you have a history of credit problems, it may take longer to rebuild your score. However, by using a secured credit card and following responsible financial practices, you can gradually improve your creditworthiness.

The Importance of Financial Literacy

Understanding credit and how it works is essential for building a strong financial foundation. Financial literacy empowers individuals to make informed decisions about their finances and avoid common pitfalls.

By educating yourself about credit scores, credit reports, and credit card management, you can take control of your financial future. There are numerous resources available online and through financial institutions to help you improve your financial literacy.

The Impact of Credit Card Debt on Credit Building

While credit cards can be a valuable tool for building credit, it’s essential to use them responsibly. Accumulating credit card debt can have a negative impact on your credit score. It’s crucial to balance the benefits of credit card usage with the risks of overspending.

To avoid credit card debt, create a budget, track your spending, and pay off your balance in full each month. If you find yourself struggling with credit card debt, consider seeking professional financial advice.

The Future of Credit Building

The credit card industry is constantly evolving, and new products and services are emerging to help consumers build credit. For example, some credit card issuers are offering credit-building programs that provide education and support to cardholders. Additionally, the increasing use of alternative data, such as rent and utility payments, may provide new opportunities for individuals with limited credit history to build credit.

Choose Among Top-Rated Cash Back Credit Cards in Canada

Building credit is a journey that requires patience and discipline. By understanding the factors that influence your credit score, choosing the right credit card, and practicing responsible financial habits, you can achieve your credit-building goals.

Great Canadian Rebates can help you find the perfect cash back credit card to build your credit. With their expertise and access to a wide range of options, they can assist you in selecting a card that suits your financial goals. Whether you need a cash back credit card for online shopping or one with travel rewards, this is one of the best Canadian cash back shopping sites to follow. Visit their website today to explore your options and start your credit-building journey.