The credit card landscape is undergoing a rapid transformation, driven by technological advancements and evolving consumer preferences. What was once a simple payment tool is now evolving into a sophisticated financial instrument with a myriad of features and capabilities. In Canada, the future of credit cards is bright, with innovative solutions poised to redefine the way we transact.

A cornerstone of modern consumer finance, credit cards have become ubiquitous in Canadian society. Canada has one of the highest rates of credit card ownership, with almost 90% of people owning a credit card. This widespread adoption has fueled innovation and competition within the industry, leading to a proliferation of new products and services.

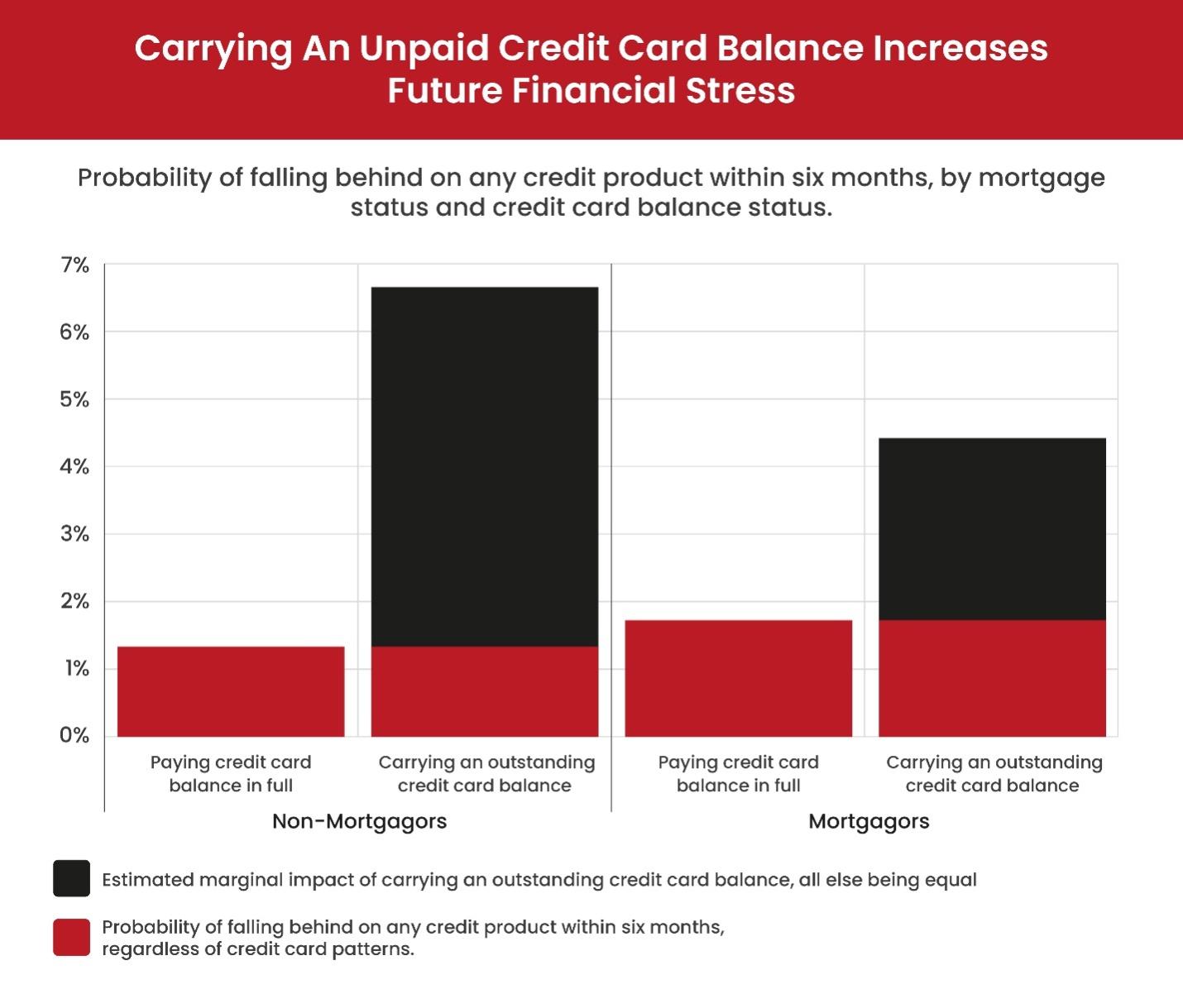

However, the credit card industry is not without its challenges. Issues such as fraud, data breaches, and consumer debt have raised concerns. Astudy by the Bank of Canada revealed that credit card holders are at greater risk of financial stress if they fall into credit card debt. These challenges have spurred the industry to seek innovative solutions to enhance security, protect consumer interests, and promote financial well-being.

The confluence of these factors has created a fertile ground for experimentation and disruption. Emerging technologies are reshaping the credit card landscape, offering new possibilities for consumers and businesses alike. From contactless payments to biometric authentication, these innovations are redefining the way we transact and manage our finances.

The Rise of Contactless Payments

Contactless payments have revolutionized the way we pay. This technology, enabled by Near-Field Communication (NFC), allows users to make quick and secure payments by simply tapping their card or compatible device on a payment terminal. The convenience and speed offered by contactless payments have significantly increased their adoption among Canadian consumers.

Furthermore, the COVID-19 pandemic accelerated the shift towards contactless payments as consumers sought to minimize physical contact. This trend is expected to persist, with contactless technology becoming the new norm in the coming years. Central banks and regulatory bodies are also supporting the growth of contactless payments by implementing measures to enhance security and interoperability.

The Integration of Mobile Wallets

Mobile wallets, such as Apple Pay, Google Pay, and Samsung Pay, have seamlessly integrated into our daily lives. These digital platforms store credit card information securely, allowing users to make payments with a simple tap of their smartphone. Mobile wallets offer enhanced convenience, security, and access to additional features like loyalty programs, rewards, and transit passes.

The integration of mobile wallets with wearables, such as smartwatches and fitness trackers, is expanding the possibilities for contactless payments. This trend is expected to grow as wearable technology becomes more prevalent.

The Importance of Biometric Authentication

Security is paramount in the digital age, and biometric authentication is emerging as a robust safeguard for credit card transactions. By replacing traditional passwords with unique biological identifiers like fingerprints, facial recognition, and iris scans, biometric authentication adds an extra layer of protection against fraud and unauthorized access.

As biometric technology continues to advance, we can expect its widespread integration into credit cards and mobile wallets. This will enhance the overall security of online and in-store transactions, providing consumers with greater peace of mind. Additionally, biometric authentication can streamline the user experience by eliminating the need for passwords and PINs.

The Impact of Blockchain Technology

Blockchain, the underlying technology behind cryptocurrencies, has the potential to disrupt the traditional credit card system. By offering a secure, transparent, and decentralized platform for transactions, blockchain could streamline payment processes, reduce fraud, and improve efficiency.

While still in its early stages, blockchain technology is being explored by financial institutions and fintech companies as a potential solution to the challenges faced by the credit card industry. If successfully implemented, blockchain could revolutionize the way we make and process payments, potentially leading to faster transaction times, lower costs, and increased security.

The Growing Importance of Data Privacy and Security

Credit card issuers must invest in robust security measures to safeguard customer data. This includes encryption, fraud detection systems, and adherence to stringent data privacy regulations like the Payment Card Industry Data Security Standard (PCI DSS). By prioritizing security, credit card companies can build trust with consumers and maintain their loyalty.

The Future of Credit Card Rewards

Credit card rewards programs have become a key differentiator for financial institutions. To attract and retain customers, credit card issuers are continually innovating and offering more personalized reward options.

Beyond traditional cashback and travel rewards, we can expect to see credit card companies exploring new reward structures, such as experiences, merchandise, and charitable donations. By tailoring rewards to individual preferences, credit card companies can enhance customer satisfaction and loyalty. Additionally, the integration of loyalty programs with other retailers and service providers can create more opportunities for rewards redemption.

The Rise of Buy Now, Pay Later (BNPL) Services

Buy Now, Pay Later (BNPL) services have gained significant traction in recent years, offering consumers flexible payment options for purchases. While not technically credit cards, BNPL services are reshaping the payment landscape and could potentially impact the credit card industry.

As BNPL services continue to grow, credit card issuers will need to adapt their offerings to remain competitive. This might involve incorporating BNPL-like features into credit card products or developing alternative financing options. However, it’s important to note that BNPL services often come with interest-free periods, which can be a double-edged sword for consumers. Overspending and difficulty managing payments are potential risks associated with BNPL.

The Role of Artificial Intelligence (AI)

Artificial intelligence is transforming various industries, and the credit card industry is no exception. AI-powered tools can be used to detect fraud, personalize customer experiences, and optimize marketing campaigns. Additionally, AI can help credit card companies analyze consumer spending patterns to offer tailored financial advice and products.

For example, AI-driven chatbots can provide customers with real-time support and assistance, while machine learning algorithms can identify patterns of fraudulent activity. By leveraging AI, credit card companies can improve customer satisfaction, reduce fraud losses, and gain a competitive advantage.

The Intersection of Credit Cards and E-commerce

The growth of e-commerce has significantly impacted the credit card industry. As online shopping continues to rise, credit card companies are focusing on enhancing online security and offering features that cater to the needs of online shoppers. This includes tokenization, which replaces sensitive card data with a unique token, reducing the risk of fraud.

Additionally, credit card companies are partnering with online retailers to offer exclusive deals and promotions to cardholders. This strategy helps to increase card usage and loyalty.

The Impact of Emerging Payment Technologies

Beyond contactless payments and mobile wallets, other payment technologies are emerging that could reshape the credit card landscape. These include wearable devices, biometrics, and cryptocurrency. While these technologies are still in their early stages, they have the potential to disrupt traditional payment methods.

Wearable devices, such as smartwatches and fitness trackers, are increasingly being used for payments. This trend is driven by convenience and security, as users can make payments without carrying a physical card or smartphone. Biometric payments, using fingerprints, facial recognition, or voice recognition, are also gaining traction, offering enhanced security and user experience.

Cryptocurrency, while still a nascent technology, has the potential to disrupt the credit card industry by offering decentralized and borderless transactions. However, the volatility of cryptocurrency prices and regulatory challenges pose significant hurdles to widespread adoption.

The Role of Financial Inclusion

Credit card companies are increasingly recognizing the importance of financial inclusion. Efforts are being made to expand access to credit cards for underserved populations, including low-income individuals and those with limited credit history. This involves developing products and services tailored to these segments, such as secured credit cards and prepaid cards.

The Challenges and Opportunities Ahead

The credit card industry faces several challenges, including increasing competition from fintech companies, evolving consumer expectations, and the risk of fraud. However, these challenges also present opportunities for innovation and growth.

The future of credit cards is bright, with a multitude of innovations and opportunities on the horizon. Contactless payments, mobile wallets, biometric authentication, and blockchain technology are just some of the forces shaping the industry. By staying informed about these trends and selecting the right credit card, consumers can benefit from enhanced convenience, security, and rewards.

Great Canadian Rebates can help you navigate the evolving world of cash back credit cards. With their expertise and access to a wide range of options, they can assist you in finding top-rated credit cards to suit your lifestyle and financial goals. Visit their website today to explore your options and discover the future of credit cards.