Foreign transaction fees are a hidden cost that can significantly impact your travel budget. These fees, typically a percentage of the transaction amount, are charged by your credit card issuer when you make purchases in a foreign currency. While they may seem insignificant at first glance, these fees can quickly add up, turning a dream vacation into a financial burden.

Understanding the nuances of foreign transaction fees is crucial for savvy travelers. These fees are typically calculated as a percentage of the transaction amount, with an average range of 2% to 3%. However, it’s essential to note that this can vary significantly between credit card issuers. Some cards might have higher or lower fees, while others may offer no foreign transaction fees at all.

The impact of these fees can be substantial, especially for those who travel frequently or for extended periods. While a few dollars per transaction might seem negligible, the cumulative effect can be significant. For instance, on a $3,000 vacation, a 3% foreign transaction fee would equate to an extra $90. This additional expense can quickly erode your travel budget, leaving less money for experiences and souvenirs.

To illustrate the potential impact, consider a traveler who spends $2,000 on their trip. If they use a credit card with a 3% foreign transaction fee, they will incur an additional $60 in charges. Over the course of a year with multiple trips, these fees can add up to hundreds of dollars.

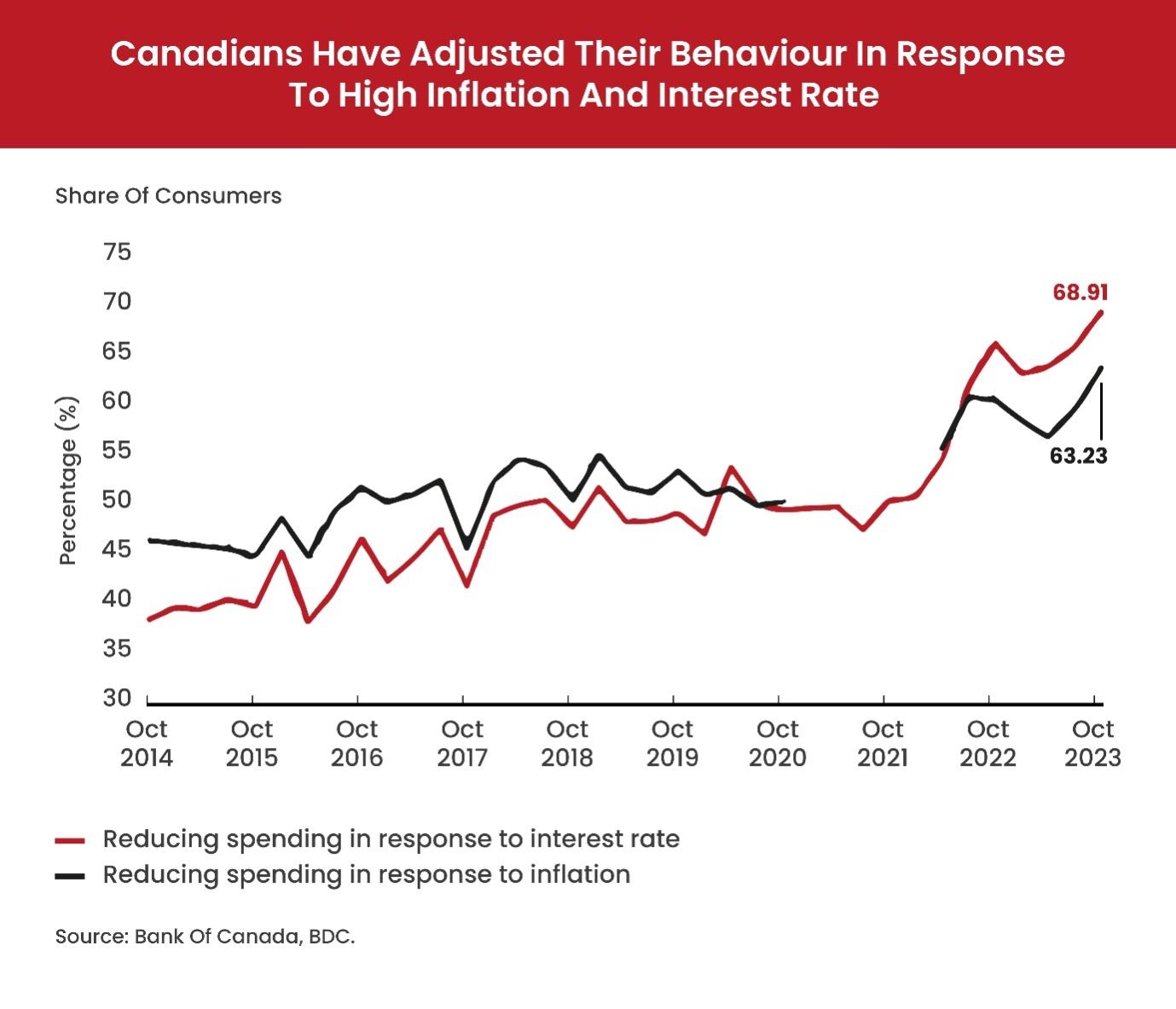

To put this into perspective, the average Canadian traveler spent approximately $950 on foreign transactionsin the third quarter of 2023 alone, according to Staistique Canada. This statistic highlights the importance of understanding and managing these fees to maximize travel savings.The good news is that Canadian consumers have been smart enough to adjust their spending according to interest and inflation rates.

While these figures may seem daunting, there is a way to avoid these transaction fees. No foreign transaction fee credit cards not only help you manage your finances, many options offer rewards and other benefits. Read on to learn more!

Choosing the Right Credit Card for International Travel

To mitigate the impact of foreign transaction fees, selecting the right credit card is crucial. Several Canadian credit card issuers offer cards specifically designed for international travel with no foreign transaction fees. These cards can be a game-changer for frequent travelers.

Key factors to consider when choosing a travel credit card:

- No foreign transaction fees: Prioritize cards that eliminate this cost altogether.

- Travel insurance coverage: Many travel credit cards include insurance benefits such as trip cancellation, medical emergencies, and lost baggage coverage.

- Rewards: Consider cards that offer travel rewards, cashback, or points on foreign transactions.

- Annual fees: Evaluate if the card’s benefits justify the annual fee.

Additional Tips for Managing Foreign Transaction Fees

While using a no-foreign-transaction-fee card is ideal, there are other strategies to help you minimize these charges:

Prepaid Travel Cards

Consider using a prepaid travel card loaded with Canadian dollars. While you might still incur currency conversion fees, you’ll eliminate foreign transaction fees. However, it’s important to note that some prepaid cards may have their own fees, such as loading fees or inactivity fees.

ATM Withdrawals

Be cautious when using ATMs abroad. Many banks impose foreign transaction fees and ATM fees. If you must use an ATM, choose one affiliated with your bank to potentially reduce fees. Additionally, be aware of daily withdrawal limits and potential ATM skimming devices.

Currency Exchange

Exchange a limited amount of cash before your trip to cover initial expenses. However, avoid exchanging large sums at airports or tourist areas, as exchange rates are often less favorable. Consider using currency exchange bureaus in your home city for potentially better rates.

Credit Card Protection

Ensure your credit card offers purchase protection and travel insurance to safeguard your investments.

Online Research

Before traveling, research exchange rates, ATM locations, and potential hidden fees to make informed decisions. Utilize online tools and resources to compare exchange rates and find the best deals.

Understanding Currency Exchange Rates

To maximize your spending power, it’s essential to understand currency exchange rates. Factors influencing exchange rates include economic conditions, interest rates, and geopolitical events. By monitoring exchange rates, you can potentially time your currency purchases to get the best deal.

Protecting Yourself from Fraud

When traveling, be vigilant about protecting your credit card information. Shield your PIN when using ATMs, avoid sharing your card details, and monitor your account for suspicious activity. Consider setting up travel notifications with your bank to alert you of any unusual activity.

The Importance of Responsible Credit Card Use

While credit cards offer convenience and rewards, it’s crucial to use them responsibly. Avoid carrying a balance, as interest charges can quickly offset any savings. Always pay your bill in full and on time to maintain a good credit score.

Building a Strong Financial Foundation

Beyond the immediate benefits of avoiding foreign transaction fees, using a credit card wisely can contribute to your overall financial well-being. By making on-time payments and maintaining a low credit utilization ratio, you can build a strong credit history. This can be advantageous when applying for loans, mortgages, or car financing in the future.

Navigating the Digital Age: Online Shopping and Foreign Transaction Fees

The rise of e-commerce has made it easier than ever to shop from international retailers. However, online purchases can also incur foreign transaction fees. To avoid these charges, look for retailers that offer pricing in Canadian dollars. If you must purchase from a foreign website, carefully review the payment options to ensure you’re not charged in a foreign currency.

The Role of Technology in Managing Travel Expenses

Several mobile apps and online tools can help you manage your travel expenses and minimize foreign transaction fees. These tools can provide real-time exchange rates, track your spending, and help you find the best deals.

Understanding Dynamic Currency Conversion (DCC)

Some merchants may offer to process your transaction in your home currency, a practice known as Dynamic Currency Conversion (DCC). While this might seem convenient, it often results in unfavorable exchange rates. It’s generally advisable to decline DCC and pay in the local currency.

The Impact of Economic Factors on Foreign Transaction Fees

Economic conditions can significantly impact foreign transaction fees. Factors such as inflation, interest rates, and currency fluctuations can influence the fees you pay. Staying informed about economic trends can help you make more informed decisions about your travel spending.

The Rise of Cryptocurrency and Its Impact on Travel

The emergence of cryptocurrencies has introduced new possibilities for international payments. While still in its early stages, cryptocurrency can offer certain advantages, such as lower transaction fees and faster processing times. However, it’s essential to be aware of the volatility of cryptocurrency markets and potential security risks.

The Future of Foreign Transaction Fees

As technology continues to evolve, the landscape of foreign transaction fees may change. Some experts predict a future where these fees become obsolete as more payment methods emerge. However, it’s essential to stay informed about industry trends and adapt your spending habits accordingly.

Maximize Travel Savings at Great Canadian Rebates

Understanding foreign transaction fees and implementing effective strategies can significantly enhance your travel experience. By carefully selecting your credit card, managing your spending, and staying informed about currency exchange rates, you can protect your finances and enjoy your travels to the fullest.

Great Canadian Rebates can help you navigate the complexities of foreign transaction fees and find top-rated cash back credit cards for your travel needs. With their expertise and access to a wide range of options, they can assist you in selecting a card that aligns with your budget and travel plans. From no-foreign-transaction-fee cards to travel rewards options, Great Canadian Rebates offers personalized guidance to help you make informed decisions.

Don’t let foreign transaction fees drain your travel budget. Visit Great Canadian Rebates today and take control of your finances.