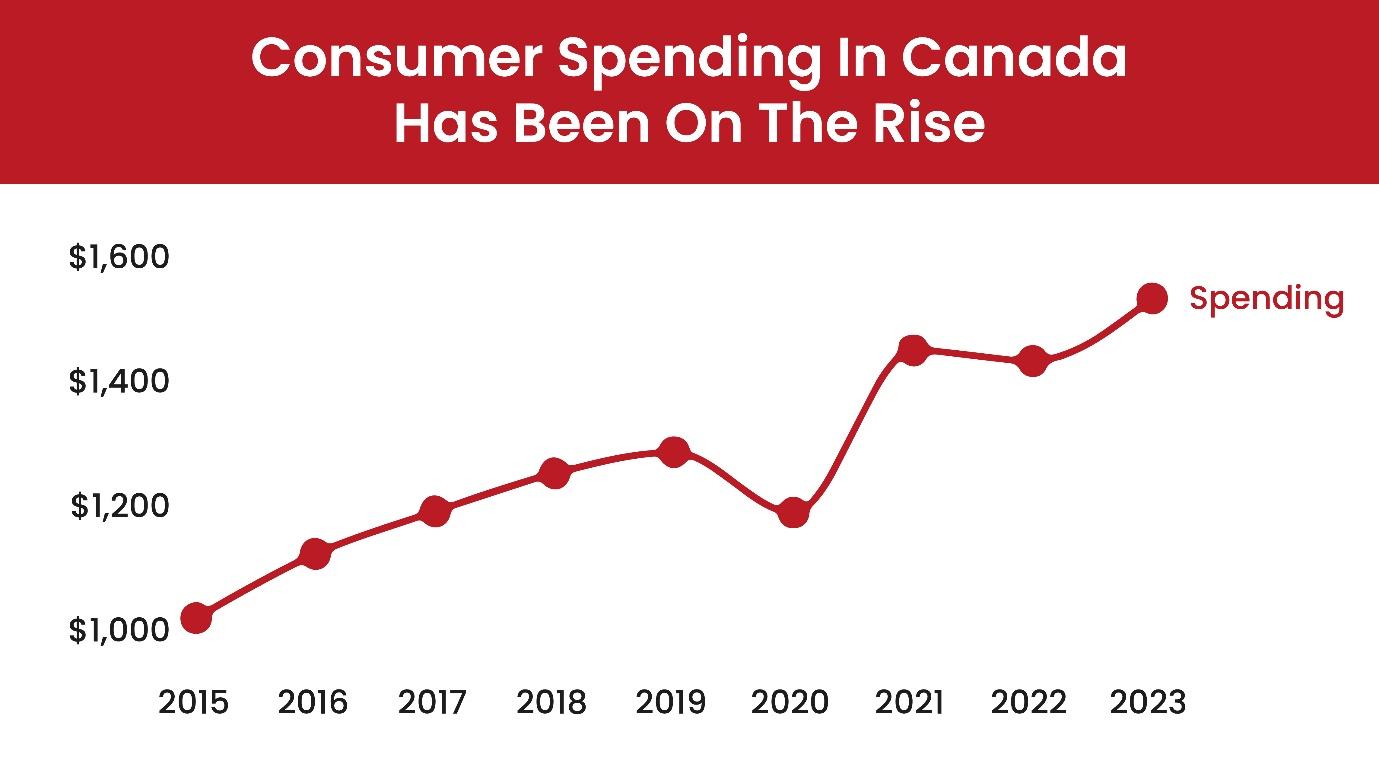

Every year, Canadians indulge in generous spending during the holidays.Consumer spending in Canada has only moved onwards and upwards over the years, and 2024 will be no different. While this festive period brings joy, it can also strain budgets. However, with strategic planning and the right financial tools, you can navigate the holiday shopping season with greater control and potential rewards.

Credit cards, often perceived as financial burdens, can be transformed into powerful allies during this time of heightened expenditure. By understanding and leveraging credit card offers, such as cash back and special discounts, you can not only manage your spending more effectively but also potentially turn your holiday shopping into a financially rewarding experience.

It’s essential to use credit cards for holiday shopping with a strategic mindset. By carefully selecting the right card, maximizing rewards, and practicing responsible spending habits, you can harness the potential of credit cards to enhance your holiday shopping experience and potentially offset some of the associated costs.

Understanding the Power of Credit Card Rewards

Credit cards are more than just payment tools; they can be powerful rewards vehicles when used strategically. Cash back credit cards offer a percentage of your spending back as cash, while travel rewards credit cards accumulate points redeemable for flights, hotels, and other travel expenses.

The holiday season is a prime opportunity to capitalize on these rewards. With increased spending on gifts, decorations, and entertaining, you can rack up points or cash back at an accelerated pace.

Choosing the Right Credit Card for Holiday Shopping

Selecting the right credit card is crucial to maximizing your savings. Consider these factors:

Cash back vs. Travel Rewards

Decide if you prefer cash back or travel rewards based on your spending habits and goals. For those focused on immediate savings, cash back cards are ideal. If you’re planning a post-holiday getaway, travel rewards cards can be more beneficial.

Bonus Categories

Look for cards that offer higher cash back or rewards on specific categories like groceries, gas, or online shopping, which are common holiday expenses. For instance, a card with elevated rewards on online shopping can significantly boost your savings during the holiday shopping season.

Welcome Bonuses

Many credit cards offer sign-up bonuses, such as bonus points or cash back, after meeting certain spending requirements. These bonuses can provide a substantial initial boost to your rewards balance.

Annual Fees

Weigh the benefits of a card against its annual fee. Some cards with high annual fees may offer exceptional rewards, but they might not be suitable for everyone. If you’re a frequent traveler or high spender, a premium card with an annual fee might be justified, but for casual shoppers, a no-annual-fee card might be more appropriate.

Top Canadian Credit Cards for Holiday Shopping

Canada boasts a plethora of credit card options, each with unique features and rewards. Here are some popular choices:

Cash back Credit Cards:

Scotia Momentum Visa Infinite

Known for its generous cash back rates and flexible rewards, the Scotia Momentum Visa Infinite is a solid choice for those seeking to maximize cash back on everyday purchases.

American Express SimplyCash Preferred Card

Offering a straightforward cash back structure with no annual fee, the American Express SimplyCash Preferred Card is a popular option for those who prefer simplicity.

Tangerine Cash Back Credit Card

Known for its user-friendly online platform and competitive cash back rates, the Tangerine Cash Back Credit Card is a good choice for those who value convenience.

Travel Rewards Credit Cards:

American Express Cobalt Card

Ideal for dining and entertainment spending, the American Express Cobalt Card offers significant rewards on these categories, making it a strong contender for holiday shopping.

Scotiabank Passport Visa Infinite

Providing a balance of travel and everyday rewards, the Scotiabank Passport Visa Infinite is a versatile option for those who value flexibility.

TD Aeroplan Visa Infinite

A strong choice for Air Canada loyalists, the TD Aeroplan Visa Infinite offers valuable travel perks and the ability to earn Aeroplan points on everyday spending.

Maximizing Your Credit Card Rewards

The holiday season makes all of us frugal, but you don’t want to end up with post-holiday debt! To make the most of your credit card rewards during the holidays, consider these strategies:

Consolidate Spending

Use a single credit card for most of your holiday purchases to maximize rewards or cash back. This will help you earn rewards faster and simplify your tracking.

Take Advantage of Bonus Categories

If your card offers bonus rewards on specific categories, prioritize spending in those areas. For example, if your card offers increased rewards on online shopping, consider purchasing gifts online to maximize your earnings.

Pay Your Balance in Full

Avoid carrying a balance to prevent accruing interest charges, which can quickly erode your savings. Responsible credit card use is essential for long-term financial health.

Monitor Your Spending

Keep track of your spending to ensure you’re staying within your budget and maximizing rewards. Several credit card companies offer online tools and mobile apps to help you monitor your spending and track your rewards progress.

Understanding Credit Card Fees and Interest Rates

While focusing on rewards is essential, it’s equally important to be aware of potential costs associated with credit cards.

Annual Fees

As mentioned earlier, some cards have annual fees. Carefully evaluate the benefits against the cost to determine if the card is worth it.

Balance Transfer Fees

If you’re considering a balance transfer to consolidate debt, be aware of potential transfer fees.

Cash Advance Fees

Avoid cash advances as they typically come with high fees and interest rates.

Interest Charges

Always aim to pay your balance in full each month to avoid interest charges, which can significantly impact your overall savings.

Additional Tips for Holiday Shopping

Beyond credit card rewards, there are other ways to save during the holiday season:

Create a Detailed Budget

Determine a specific amount you can allocate for holiday spending and stick to it. This will help you avoid overspending and financial stress.

Shop Early and Take Advantage of Sales

Avoid the last-minute rush and take advantage of early bird discounts and promotions. Many retailers offer discounts on Black Friday and Cyber Monday.

Compare Prices

Research prices online and in-store to find the best deals. Price comparison websites and apps can be helpful for this.

Consider Gift Cards

Gift cards can be a convenient and appreciated gift, especially if you can purchase them at a discount.

Explore Alternative Payment Options

Consider using debit cards or cash for smaller purchases to avoid accumulating credit card debt.

Take Advantage of Store Loyalty Programs

Many retailers offer loyalty programs that provide discounts, points, or other perks.

DIY Gifts

Consider making homemade gifts to save money and add a personal touch.

Shop Secondhand

Explore thrift stores or online marketplaces for unique and affordable gift options.

The Importance of Responsible Credit Card Use

While credit cards can be a powerful tool for saving money and earning rewards, it’s crucial to use them responsibly. Avoid carrying a balance, as interest charges can quickly offset any savings. Always pay your bill in full and on time to maintain a good credit score.

Building a Strong Financial Foundation

Beyond the holiday season, consider using your credit card to build a strong financial foundation. This includes:

Establishing a Good Credit History

Consistent on-time payments can help you build a positive credit history, which can be beneficial for future financial endeavors like mortgages and car loans.

Utilizing Credit Monitoring Tools

Many credit card companies offer credit monitoring services to help you stay informed about your credit score and identify potential fraud.

Setting Financial Goals

Determine your long-term financial objectives and use your credit card to help you achieve them, whether it’s saving for a down payment on a home or building an emergency fund.

By following these tips and making informed decisions, you can harness the power of credit card rewards to enhance your holiday shopping experience and improve your overall financial well-being.

Great Canadian Rebatesis one of the best Canadian cash back shopping sites to follow this holiday season. With their expertise and access to a wide range of options, they can help you find the perfect cash back credit cardfor holiday shopping. Whether you’re seeking maximum cash back, valuable travel rewards, or a balance transfer to consolidate debt, Great Canadian Rebates can provide personalized recommendations and support.

Visit their website today to explore their comprehensive suite of services and discover how they can help you achieve your financial objectives.s