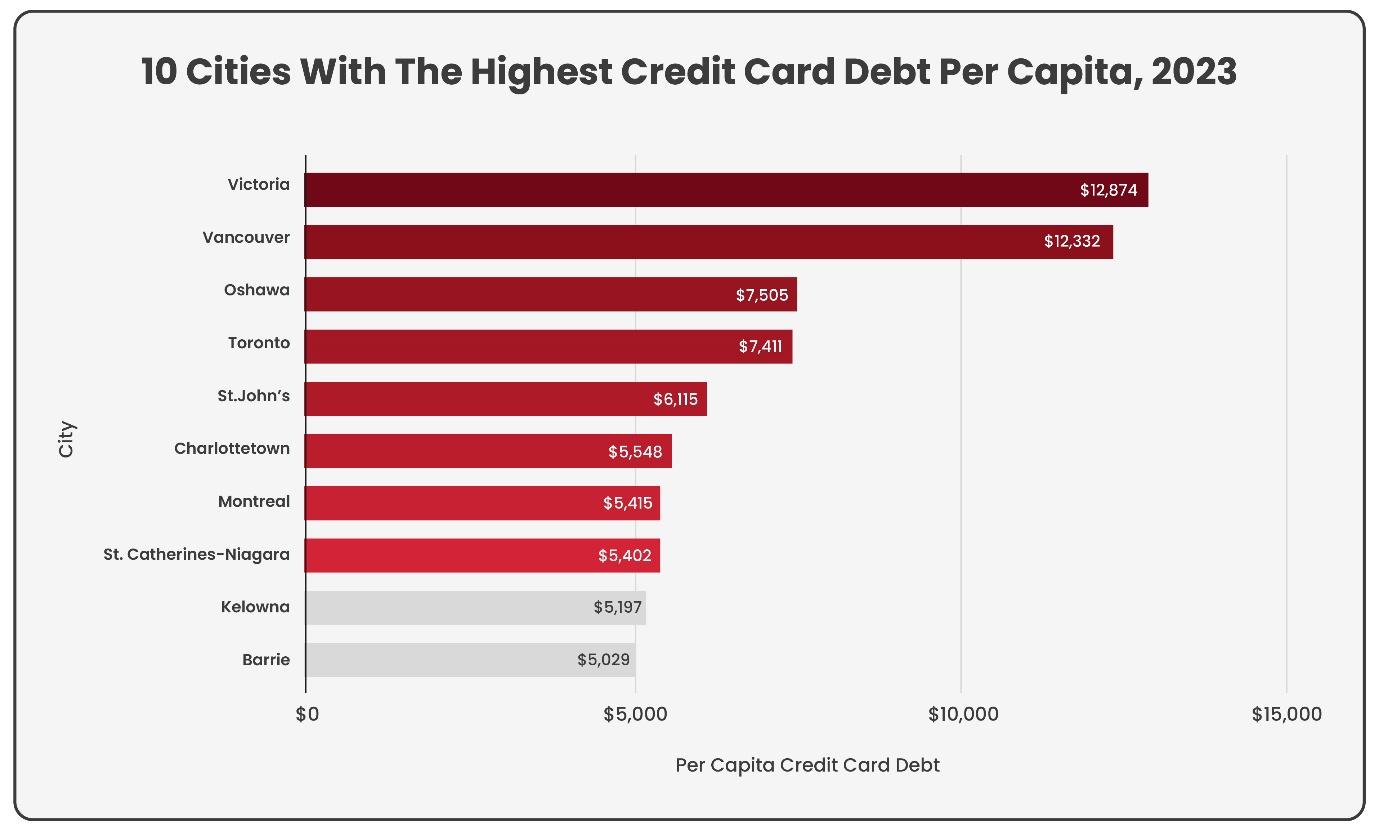

The weight of credit card debt can be a crushing burden for many Canadians. TransUnion recently reported that the average Canadian carries a credit card balance of over $4,200, and this figure has been steadily increasing over the past decade. The high-interest rates associated with credit cards can trap individuals in a cycle of debt, making it increasingly difficult to break free.

One potential solution to this problem is credit card debt consolidation. By combining multiple debts into a single, more manageable payment, individuals can potentially reduce their monthly financial burden and accelerate their path to debt freedom. However, it’s essential to approach debt consolidation with caution and a clear understanding of its potential benefits and drawbacks.

Understanding the Debt Consolidation Landscape

Debt consolidation is a financial strategy that involves combining multiple debts into a single, more manageable payment. In the realm of credit card debt, this often involves securing a personal loan or balance transfer credit card to settle outstanding balances.The appeal of debt consolidation is clear: simplified financial management. Instead of juggling multiple minimum payments, you’re dealing with just one. Additionally, if you can secure a lower interest rate on your consolidation loan or balance transfer, you could potentially save money on interest charges over time.

However, it’s essential to approach debt consolidation with a critical eye. Not everyone benefits from this strategy. Let’s delve deeper into the pros and cons to help you make an informed decision.

Advantages of Debt Consolidation:

Reduced Monthly Payments

By consolidating multiple debts into a single payment, you can often lower your overall monthly financial obligation. This can provide much-needed financial relief and improve your cash flow.

Simplified Budgeting

Managing a single monthly payment can streamline your financial planning and budgeting process. You’ll have a clearer picture of your financial commitments and can allocate funds more effectively.

Potential Interest Rate Savings

If you can secure a lower interest rate on your consolidation loan or balance transfer, you could significantly reduce the amount of interest you pay over time. This can lead to substantial savings.

Improved Credit Score

Successfully managing a consolidation loan, with consistent on-time payments, can positively impact your credit score. A higher credit score opens doors to better financial opportunities in the future.

Disadvantages of Debt Consolidation

Increased Total Interest Paid

While your monthly payments may decrease, the total amount of interest paid over the life of the loan could potentially be higher compared to paying off your credit cards individually.

Potential Fees

Some consolidation options, such as balance transfers, come with fees that can offset your savings. It’s essential to factor in these costs when evaluating the overall benefits.

Temporary Solution

Debt consolidation is a short-term strategy. It can provide relief and help you get back on track, but it doesn’t address the underlying causes of your debt. To achieve long-term financial stability, you need to develop sustainable budgeting habits and avoid accumulating new debt.

Negative Impact on Credit Score

Applying for a consolidation loan can temporarily lower your credit score due to a hard credit inquiry. However, if you manage the loan responsibly, your credit score should recover over time.

When Should You Consider Debt Consolidation?

Debt consolidation might be a suitable option if you meet the following criteria:

High-Interest Debt

If you have multiple credit cards with high interest rates, consolidating your debt into a lower-interest loan can be a strategic move to save money.

Overwhelmed by Payments

If you’re struggling to manage multiple minimum payments, debt consolidation can simplify your financial life and reduce stress.

Good Credit Score

A strong credit score increases your chances of qualifying for a low-interest consolidation loan, which is crucial for maximizing savings.

Debt Consolidation Options

There are several effective strategies for consolidating credit card debt:

1. Balance Transfer Credit Card

This involves transferring outstanding balances from multiple high-interest credit cards to a single card with a lower interest rate. This can provide significant savings, especially if you take advantage of introductory 0% APR offers. However, balance transfer fees and the potential for interest rate increases after the promotional period should be carefully considered.

2. Debt Consolidation Loan

A personal loan can be used to pay off multiple credit cards, often resulting in a single monthly payment and potentially a lower interest rate. Factors such as loan term, fees, and your creditworthiness influence the overall cost.

3. Home Equity Loan or Line of Credit (HELOC)

If you have substantial equity in your home, a home equity loan or HELOC can be used to consolidate credit card debt. While these options often offer lower interest rates, they put your home at risk if you’re unable to repay the loan.

4. Debt Management Plan (DMP)

A DMP is a structured program offered by credit counseling agencies. It involves negotiating with creditors to reduce interest rates and set up a single monthly payment plan. While it can provide relief, it typically takes several years to complete, and your credit score may be negatively impacted.

5. Debt Settlement

This involves negotiating with creditors to settle your debts for less than the full amount owed. While it can significantly reduce your debt, it can also damage your credit score and may have tax implications.

Choosing the Right Consolidation Option

Selecting the best debt consolidation option requires meticulous evaluation:

Interest Rates

Scrutinize interest rates on various loans and balance transfer offers to pinpoint the most favorable rate. A lower interest rate translates to substantial savings over time.

Fees

Assess all associated fees with the consolidation option, including balance transfer fees and origination fees. These costs can significantly impact the overall cost-effectiveness of the consolidation.

Loan Terms

Carefully consider the repayment term of the loan or balance transfer. A longer repayment term might result in lower monthly payments, but it could also lead to paying more interest overall.

Credit Score

A robust credit score enhances your chances of qualifying for a lower interest rate. Building and maintaining good credit is fundamental for accessing favorable financial options. Additionally, consider the impact of the consolidation option on your overall credit profile. Some options, such as balance transfers, might involve multiple credit inquiries, which could temporarily lower your credit score.

Flexibility and Repayment Options

Assess the repayment flexibility offered by different consolidation options. Some loans may allow for extra payments or lump sum payments, enabling you to accelerate debt repayment and potentially save on interest.

Customer Service and Reputation

Research the lender or credit card issuer’s reputation for customer service and responsiveness. A reliable lender can provide support and assistance throughout the debt consolidation process.

Hidden Costs

Be vigilant for any hidden fees or charges associated with the consolidation option. Some lenders might impose penalties for early repayment or late payments.

Financial Goals

Consider your long-term financial goals and how the consolidation option aligns with them. If you’re aiming to improve your credit score, a consolidation loan with consistent on-time payments might be beneficial. However, if your primary goal is to reduce monthly payments, a balance transfer with a low introductory rate could be a better fit.

By conducting thorough research and comparing different options, you can select the debt consolidation strategy that best suits your financial situation and objectives. Remember to prioritize transparency and avoid any hidden surprises that could negatively impact your financial well-being.

Tips for Successful Debt Consolidation

Create a Realistic Budget

Develop a detailed budget to track your income and expenses. Identify areas where you can cut back spending to allocate more funds towards debt repayment.

Avoid New Debt

Once you’ve consolidated your debt, it’s crucial to resist the temptation to accumulate new credit card balances. Focus on paying off the consolidated debt and building an emergency fund.

Build an Emergency Fund

Having an emergency fund can prevent you from relying on credit cards in case of unexpected expenses, helping you stay on track with your debt repayment plan.

Seek Professional Help

If you’re struggling to manage your debt, consider consulting with a credit counsellor or financial advisor. They can provide guidance, support, and develop a personalized debt management plan.

Your Next Steps: Weighing Your Options

Credit card debt consolidation can be a valuable tool for managing your finances, but it’s essential to approach it with caution and realistic expectations. By carefully considering your options, understanding the potential benefits and drawbacks, and implementing a solid repayment plan, you can increase your chances of success.

Great Canadian Rebates, one of the best Canadian cash back sites, can provide expert guidance and tailored solutions to help you navigate the complexities of debt consolidation. They offer a range of financial products and services designed to support your financial well-being.

Remember, while debt consolidation can offer temporary relief, long-term financial stability requires addressing the underlying causes of your debt. Building healthy spending habits, creating a budget, and exploring additional income streams are essential components of your financial recovery.