Navigating the complexities of running a small business often requires a strategic approach to financial management. One tool that can significantly impact a business’s financial health is the business credit card. These cards, designed specifically for business owners, offer a range of benefits that extend beyond simple payment processing.

Small businesses in Canada contribute substantially to the nation’s economy. According to a study about small business contributions to the economy, these enterprises play a pivotal role in job creation and economic growth. To thrive in today’s competitive landscape, small business owners must explore all available resources to optimize their financial operations. A well-chosen business credit card can be a powerful asset in achieving this goal.

By understanding the nuances of business credit cards, small business owners can make informed decisions about which card best aligns with their financial objectives. This guide will delve into the key features, benefits, and considerations when selecting a business credit card.

Understanding the Benefits of a Business Credit Card

A business credit card offers several advantages for small business owners:

Expense Management

Efficiently track business expenses, categorize them for tax purposes, and simplify reconciliation processes. Detailed transaction records can streamline your bookkeeping and save time.

Business Credit Building

Responsible use of a business credit card can help establish and improve your business’s credit score, opening doors for future financing opportunities such as loans or lines of credit. A strong business credit profile can enhance your company’s financial reputation and negotiating power.

Rewards and Cashback

Many business credit cards offer rewards programs, allowing you to earn points, miles, or cash back on business expenses. These rewards can be redeemed for travel, merchandise, or statement credits, providing additional value to your business operations.

Purchase Protection

Some cards provide purchase protection, safeguarding your business against losses due to damage or theft on eligible purchases. This added layer of security can offer peace of mind when making significant business purchases.

Fraud Protection

Robust fraud protection measures help safeguard your business from unauthorized transactions. Advanced fraud detection technologies and zero liability policies can protect your business from financial losses.

Unlock Your Business’s Potential with the Right Credit Card

A strategically selected business credit card can be a powerful tool to optimize your financial operations. To make the most of this financial instrument, consider the following key factors:

Cost-Benefit Analysis

A meticulous evaluation of annual fees in relation to the card’s rewards and perks is essential. A card with a higher annual fee might be justified if it offers substantial benefits that align with your business’s spending patterns and can generate a significant return on investment.

Reward Structure

Optimizing your rewards requires a card that precisely matches your business’s spending habits. Look for cards that offer bonus points or cashback on categories that constitute a substantial portion of your business expenses. This targeted approach ensures maximum returns on your spending.

Financial Flexibility

Understanding the interest rate structure is crucial for managing your cash flow effectively. While it’s ideal to maintain a zero balance, having a competitive interest rate can provide a safety net in case of unexpected expenses or economic downturns.

Efficient Management

Streamline your financial operations by selecting a card equipped with robust expense tracking and management tools. These features can significantly reduce administrative burdens, improve accuracy, and provide valuable insights into your business spending. By automating expense categorization and reconciliation, you can dedicate more time to strategic decision-making.

Top Business Credit Cards in Canada

While the best business credit card depends on your specific needs, here are some popular options to consider:

American Express Business Gold Card

Renowned for its extensive rewards program and travel benefits, this card is ideal for businesses with significant spending and frequent travel needs.

American Express® Business Edge™ Card

Designed for small to medium-sized businesses, the American Express® Business Edge™ Card offers a balance of rewards and benefits. With a focus on everyday business expenses, this card earns 3 points per dollar on eligible purchases in categories like office supplies, electronics, and dining. Cardholders can also enjoy benefits like purchase protection and extended warranties.

American Express® Aeroplan®* Business Reserve Card

For businesses with frequent travel needs, the American Express® Aeroplan®* Business Reserve Card is an excellent choice. This card offers a combination of Aeroplan points and Membership Rewards points, providing flexibility in redemption options. With access to Aeroplan’s extensive network of airline and hotel partners, cardholders can enjoy exclusive travel benefits and rewards.

Business Platinum Card® from American Express®

As a high-end option, the Business Platinum Card® from American Express® caters to businesses seeking premium benefits and exceptional rewards. This card offers exclusive access to airport lounges, travel credits, and concierge services, making it ideal for business owners who prioritize comfort and convenience. Additionally, cardholders earn valuable Membership Rewards points on eligible purchases.

Note: This list is not exhaustive, and the best card for your business may vary based on your specific needs and spending habits.

How to Choose the Right Business Credit Card

Selecting the right business credit card involves careful consideration of your business’s unique requirements. To make an informed decision, delve deep into your business’s financial landscape and spending habits.

Understanding Your Business’s Financial Profile

Before embarking on the quest for the perfect business credit card, it’s crucial to assess your business’s financial health and spending patterns.

Analyze Spending Habits

Create a detailed breakdown of your business expenses. Identify categories where spending is concentrated, such as travel, office supplies, or professional services. This analysis will help you pinpoint the most suitable rewards structure.

Evaluate Business Size and Industry

Consider the size and nature of your business. A small sole proprietorship might have different needs compared to a larger corporation with multiple employees. Some industries may have specific card preferences or requirements.

Assess Creditworthiness

Your business’s credit score will influence the type of cards available to you. Building and maintaining a strong business credit profile is essential for accessing favorable terms and conditions.

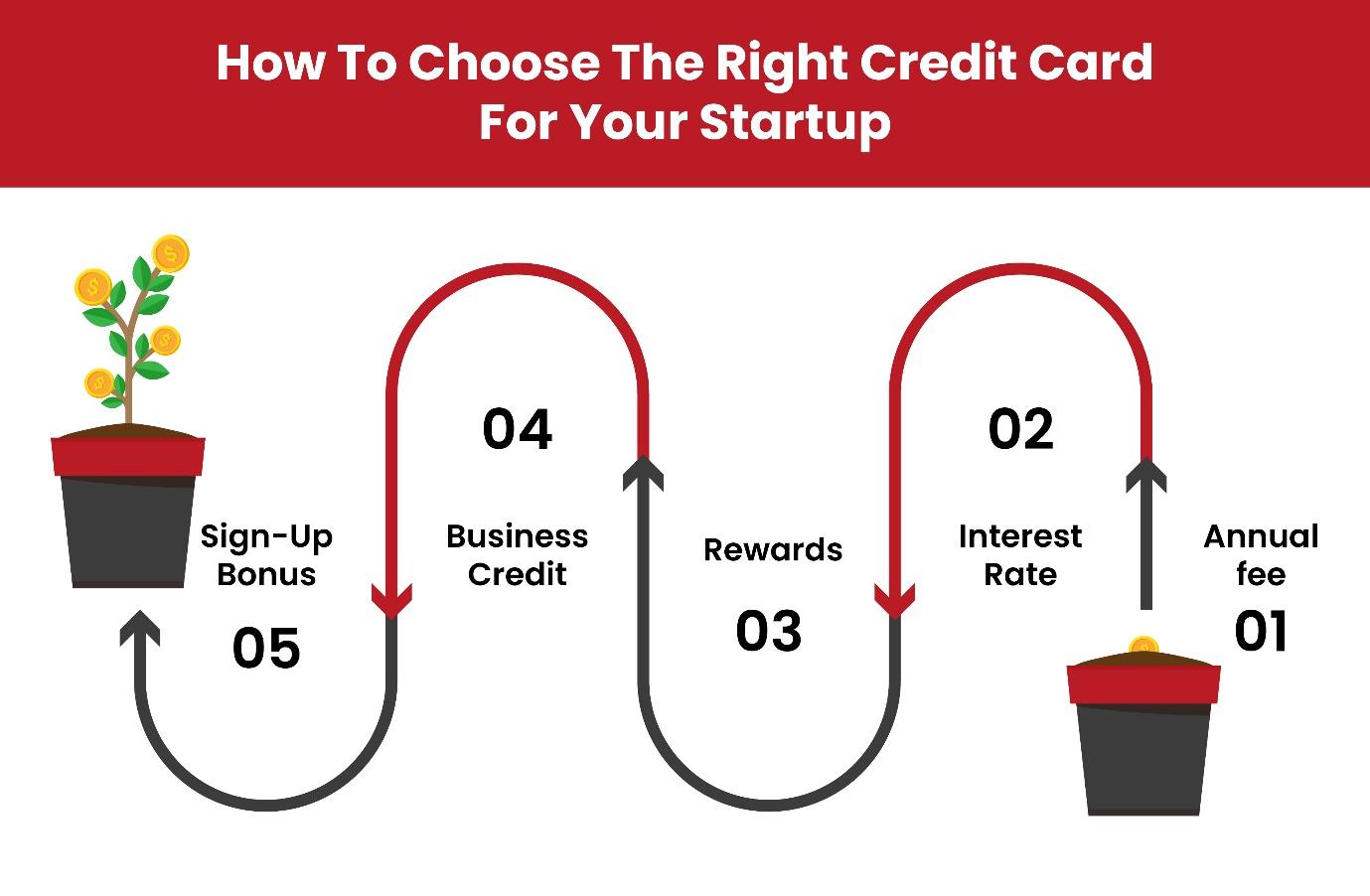

Key Factors to Consider When Choosing a Business Credit Card

Once you have a clear understanding of your business’s financial profile, consider the following factors when selecting a business credit card:

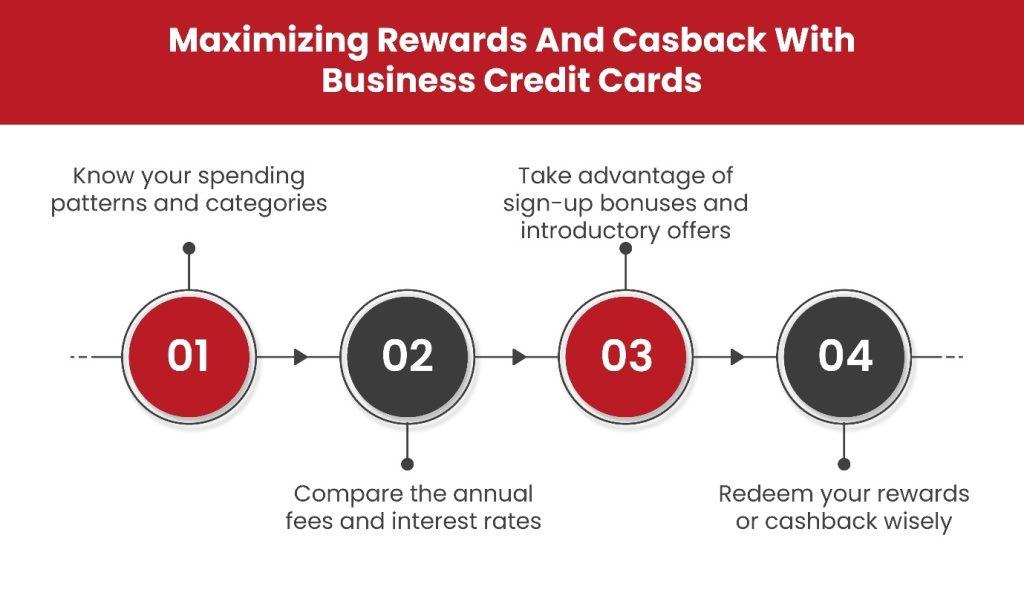

Annual Fee

Evaluate the annual fee against the card’s benefits and rewards. Some cards offer significant value beyond the annual fee, such as travel insurance, purchase protection, or concierge services. Weigh the potential return on investment against the cost.

Rewards Structure

Analyze the rewards program to determine if it aligns with your business spending habits. Look for cards that offer bonus rewards in categories where your business spends the most. Consider whether you prefer cash back, points, or travel miles.

Interest Rates

While ideally you should pay your balance in full each month, understanding the interest rate is crucial. Compare interest rates on purchases and cash advances to assess the potential cost of carrying a balance.

Fees

Beyond the annual fee, consider other potential fees such as balance transfer fees, foreign transaction fees, and late payment fees. Opt for a card with minimal or no additional fees.

Expense Management Tools

Look for cards that offer features like detailed transaction reports, expense categorization, and mobile app access. These tools can streamline your bookkeeping and save you time.

Additional Perks

Some cards may offer additional benefits such as purchase protection, extended warranties, travel insurance, or access to airport lounges. Evaluate these perks based on your business needs and travel habits.

Credit Limit

Ensure the credit limit offered by the card aligns with your business’s spending requirements. A higher credit limit provides greater flexibility, but it’s essential to use credit responsibly.

By carefully considering these factors, you can select a business credit card that optimizes your financial management and rewards potential.

Maximizing Your Business Credit Card Benefits

To fully leverage the benefits of your business credit card, consider the following tips:

Pay your balance in full and on time

Building a strong business credit history is crucial for future financing opportunities. Consistent on-time payments demonstrate financial responsibility and can help improve your business’s creditworthiness.

Utilize expense tracking features

Take advantage of your card’s expense management tools to streamline your bookkeeping and tax preparation. Detailed transaction records can save you time and effort during tax season.

Consider additional cards for employees

If applicable, provide employees with company-issued credit cards to centralize expense management and improve tracking. This can streamline expense reimbursement processes and enhance financial control.

Review your statement regularly

Monitor your spending and identify potential areas for cost savings. Regular statement reviews can help you identify unauthorized charges or errors and take corrective action promptly.

Take advantage of rewards

Redeem your earned rewards for business expenses, travel, or other valuable benefits. Maximize the value of your rewards by choosing redemption options that align with your business needs.

Protect your card information

Safeguard your business credit card information to prevent unauthorized use. Implement strong security measures, such as creating complex passwords and monitoring your account activity for suspicious transactions.

By following these tips and selecting the right business credit card, you can optimize your financial management and unlock the potential for growth and success for your business.

Finding the Best Business Credit Card with Great Canadian Rebates

Great Canadian Rebates offers a comprehensive platform to compare business credit cards and find the perfect fit for your business. With detailed information on features, rewards, and fees, you can make informed decisions and maximize your savings.

This platform goes beyond simply listing cards; it provides in-depth analysis, expert insights, and user reviews to help you navigate the complex world of business credit cards. By understanding your specific business needs, it can assist you in finding a card that aligns with your financial goals and empowers your business growth.

Don’t let complex financial decisions hinder your business growth. Visit Great Canadian Rebates today to explore a wide range of business credit card options, unlock the potential for your business, and take the first step towards financial optimization.