Credit cards have transcended their role as simple payment instruments, evolving into sophisticated financial tools offering a plethora of benefits beyond the traditional rewards programs. While cashback, travel points, and merchandise incentives undeniably entice consumers, the full spectrum of perks often remains untapped.

A recent study by Innovation, Science and Economic Development Canada revealed that most Canadian consumers are unaware of credit card benefits. This statistic underscores the need for greater consumer awareness regarding the comprehensive package that credit cards offer. By delving deeper into the terms and conditions, Canadians can unlock a world of opportunities to protect their purchases, save money, and enhance their overall financial well-being.

This guide aims to demystify the often-overlooked benefits embedded within credit card agreements, empowering you to make the most of your plastic. From purchase protection and extended warranties to travel insurance and concierge services, we will explore the hidden credit card benefits in Canada that can elevate your financial journey.

Understanding the Comprehensive Credit Card Benefits Package

Credit cards offer a multifaceted suite of benefits that extend far beyond rewards programs. These perks are designed to enhance your overall financial well-being and provide protection against unexpected challenges.

Purchase Protection

This coverage safeguards your purchases against theft, loss, or damage for a specified period. If your newly acquired item is stolen or damaged, your credit card issuer may reimburse you for the cost, subject to certain terms and conditions.

Extended Warranties

Many credit cards automatically extend the manufacturer’s warranty on eligible purchases. This benefit can provide significant savings by protecting your investment in high-ticket items such as electronics, appliances, and home goods.

Price Protection

This valuable perk reimburses you for the price difference if you purchase an item and the price drops within a specified timeframe.

Travel Insurance

For frequent travelers, credit card travel insurance can be a lifesaver. Many cards offer complimentary coverage for trip cancellation, interruption, medical emergencies, baggage loss, and rental car collision damage waiver (CDW).

Rental Car Insurance

Some credit cards offer rental car insurance as a complimentary benefit. However, it’s essential to understand that your personal auto insurance policy may also provide rental car insurance coverage.

Roadside Assistance

In case of unexpected car troubles, roadside assistance can be a lifesaver. Some credit cards offer this benefit as a complimentary service.

Concierge Services

Premium credit cards often include concierge services, providing personalized assistance for various needs.

Identity Theft Protection

This benefit helps protect your personal information and offers support in case of identity theft.

Purchase Security

Some credit card issuers offer purchase security, which provides protection against unauthorized charges for online and in-store purchases.

Mobile Device Insurance

Certain credit cards extend coverage to protect your mobile devices against theft, loss, or accidental damage.

Event Ticket Protection

This benefit reimburses you for the cost of tickets if an event is canceled or rescheduled.

Legal Assistance

Some credit cards offer access to legal advice and assistance for various legal matters.

Pet Insurance

A growing number of credit cards include pet insurance as a benefit, providing coverage for veterinary care and other pet-related expenses.

Home Emergency Assistance

This benefit provides financial assistance in case of home emergencies such as burst pipes, electrical failures, or lockouts.

Discount Programs

Some credit cards offer discounts on various products and services, including travel, dining, and entertainment.

The Importance of Responsible Credit Card Use

While credit card benefits can enhance your financial well-being, it’s crucial to use your credit card responsibly. Overspending and carrying a balance can negate the value of any rewards or benefits. Prioritize paying your balance in full and on time to avoid interest charges and maintain a good credit score.

Unlocking Your Credit Card’s Full Potential

By understanding your spending habits, selecting the right credit card, and implementing effective strategies, you can significantly boost your rewards earnings and enhance your overall financial well-being. To truly unlock the full potential of your credit card, consider these additional tips:

Leverage credit card partnerships

Many credit card issuers collaborate with retailers, airlines, and other businesses to offer exclusive rewards and benefits. By utilizing these partnerships, you can maximize the value of your spending.

Stay informed about industry trends

The credit card landscape is constantly evolving. Stay updated on the latest rewards programs, benefits, and technologies to make the most of your card.

Consider a rewards credit card for everyday spending

Using a rewards card for regular purchases can help you accumulate points or miles quickly.

Protect your credit card information

Safeguard your personal information to prevent fraud and unauthorized charges.

Review your credit card agreement regularly

Stay informed about any changes to terms and conditions, fees, or benefits.

By taking a proactive approach to managing your credit card and leveraging the full range of benefits available, you can transform your financial outlook.

The Importance of Responsible Credit Card Use

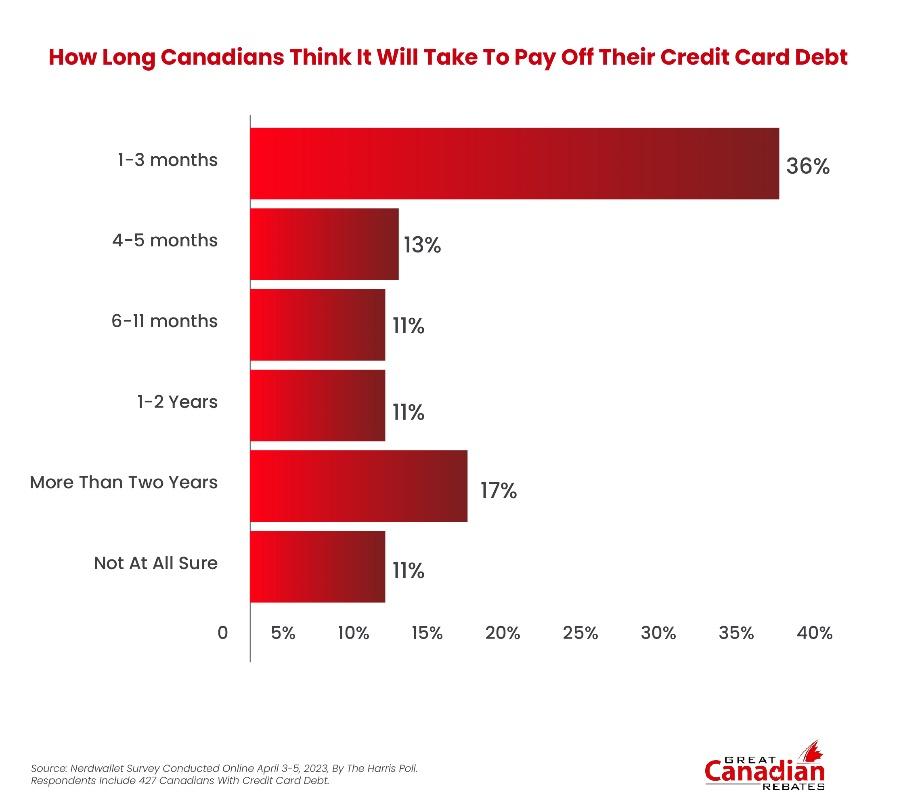

While credit card benefits undoubtedly enhance financial well-being, responsible usage is paramount. Overspending and carrying a balance can quickly erode the value of rewards and lead to a cycle of debt. Many Canadian credit card holders rely too heavily on credit cards and fall into this debt trap. To maximize the benefits of your credit card while safeguarding your financial health, adhere to these principles:

Prioritize Timely Payments

Consistent and timely payments are foundational to responsible credit card use. By making your monthly payments in full and on time, you avoid accruing interest charges, preserving your financial resources. Moreover, a history of on-time payments positively impacts your credit score, opening doors to more favorable financial opportunities in the future.

Manage Credit Utilization Wisely

Credit utilization, the ratio of your outstanding balance to your credit limit, significantly influences your credit score. Aim to keep your credit utilization below 30% to demonstrate responsible credit management. By avoiding maxing out your credit cards, you enhance your creditworthiness and improve your chances of securing loans or other forms of credit with favorable terms.

Create a Budget and Track Spending

Developing a comprehensive budget is essential for responsible credit card use. By tracking your income and expenses, you can identify areas where you can cut back and allocate funds towards debt repayment. A budget empowers you to make informed financial decisions and avoid impulsive spending.

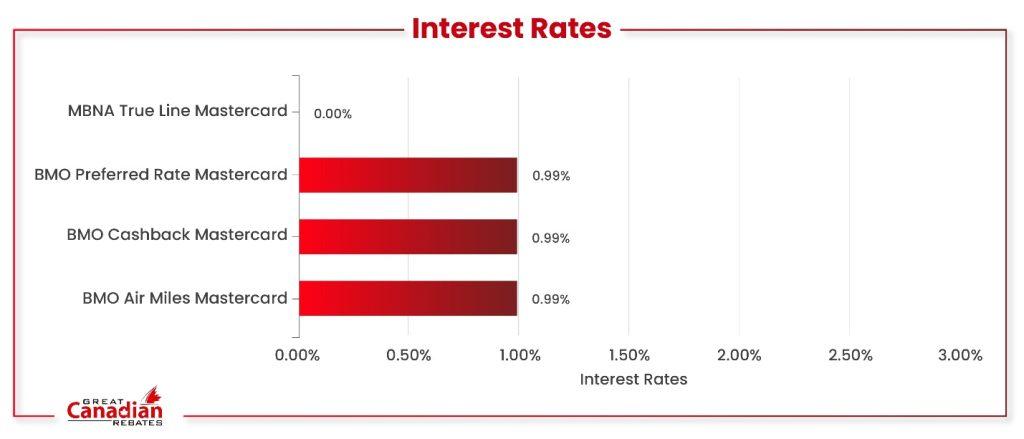

Understand Interest Rates and Fees

Credit cards often come with interest rates and fees that can quickly erode the value of your rewards. Familiarize yourself with the terms and conditions of your credit card agreement to understand the costs associated with carrying a balance, making late payments, or using your card for cash advances. By comprehending these financial implications, you can make informed decisions and avoid unexpected charges.

Avoid Cash Advances

Cash advances typically come with higher interest rates, fees, and limited or no grace period. Using your credit card for cash withdrawals should be avoided whenever possible. If you need cash, consider using a debit card or withdrawing money from your bank account to minimize costs.

Protect Your Credit Card Information

Safeguarding your credit card information is crucial to preventing fraudulent activities. Avoid sharing your card details with unauthorized individuals, and be cautious of phishing scams. Regularly monitor your credit card statements for any suspicious activity and report any discrepancies to your credit card issuer promptly.

Build an Emergency Fund

While credit cards can be a convenient source of funds in emergencies, relying on them for unexpected expenses can lead to debt. Building an emergency fund can provide a financial safety net, reducing the need to rely on credit cards during challenging times.

Seek Professional Financial Advice

If you’re struggling with credit card debt or unsure about managing your finances effectively, consider seeking professional financial advice. A financial advisor can provide personalized guidance and develop a tailored plan to help you achieve your financial goals.

By adopting these responsible credit card practices, you can harness the benefits of credit cards while safeguarding your financial future. Remember, credit cards are tools that can be used to your advantage when managed wisely.

Navigating the Credit Card Landscape

The credit card market is a dynamic ecosystem characterized by fierce competition and continuous innovation. To make informed decisions and maximize the benefits of your credit card, it’s essential to stay informed about the latest trends and developments.

Understanding the Credit Card Application Process

Securing a credit card involves a careful evaluation by the issuer. Creditworthiness, income, and spending habits are key factors considered in the application process. Understanding the factors influencing approval can increase your chances of obtaining a desired credit card.

Credit Score

A strong credit score is a significant advantage when applying for a credit card. It demonstrates responsible financial behavior and increases your likelihood of approval.

Income and Employment

Credit card issuers assess your income and employment stability to evaluate your ability to repay the credit line.

Credit History

A longer credit history with a record of on-time payments positively impacts your creditworthiness.

Credit Utilization

Maintaining a low credit utilization ratio (the amount you owe compared to your available credit) can improve your chances of approval.

Application Timing

Applying for multiple credit cards within a short period can negatively impact your credit score due to multiple hard inquiries.

The Importance of Regular Reviews

Credit card terms and conditions can change over time, so it’s crucial to review your agreement periodically. Pay attention to changes in interest rates, fees, rewards programs, and other terms that may impact your financial obligations.

By staying informed about the latest developments, you can identify opportunities to optimize your credit card usage and avoid potential pitfalls.

Leveraging Technology for Credit Card Management

Technology has transformed the way we manage our finances, including credit card usage. Credit card companies offer mobile apps and online platforms that provide convenient access to account information, rewards balances, and transaction history.

These platforms often include features such as spending analytics, fraud alerts, and contactless payment options. By utilizing technology, you can streamline your credit card management and enhance your overall financial experience.

Protecting Yourself from Fraud

Credit card fraud remains a prevalent issue, emphasizing the importance of safeguarding your personal information. Follow these best practices to protect yourself:

Monitor your account regularly

Review your credit card statements for any unauthorized charges.

Strong passwords

Create complex and unique passwords for your online accounts.

Beware of phishing scams

Be cautious of emails or messages requesting personal information.

Contact your issuer immediately

Report any suspicious activity to your credit card issuer promptly.

Enable fraud alerts

Sign up for fraud alerts to receive notifications about unusual activity on your account.

Building a Strong Financial Foundation

While credit cards offer numerous benefits, responsible credit card use is essential for long-term financial well-being. Consider these strategies:

Create a budget

Establish a monthly budget to track your income and expenses and identify areas where you can cut back.

Set financial goals

Define your short-term and long-term financial objectives to guide your spending and saving decisions.

Emergency fund

Build an emergency fund to cover unexpected expenses and avoid relying on credit card debt.

Diversify your financial portfolio

Consider investing in stocks, bonds, or other assets to build wealth over time.

Seek professional financial advice

If you need assistance managing your finances, consult with a financial advisor.

By understanding the intricacies of credit card agreements, utilizing available benefits, and practicing responsible financial behavior, you can harness the power of credit cards to achieve your financial goals.

Great Canadian Rebates can help you navigate the complex world of cash back credit cards and uncover hidden benefits. Are you seeking a cash back credit card for online shopping, travel rewards, or simply to sort your finances. With their expertise and access to a wide range of options, they can assist you in selecting the credit card that perfectly aligns with your financial aspirations. Visit their website today to unlock the full potential of your credit card and embark on a journey towards financial empowerment.