Credit card sign-up bonuses can be a great way to maximize your financial benefits. These bonuses often provide substantial rewards, including cash back, travel points, and other perks just for signing up and meeting specific spending requirements.

In Canada, numerous credit cards offer lucrative sign-up bonuses that can significantly enhance your financial situation. This article will guide you on how to make the most of these sign-up bonuses, highlight the top cards offering the best deals, and explain how to meet the spending requirements.

Understanding Credit Card Sign-Up Bonuses

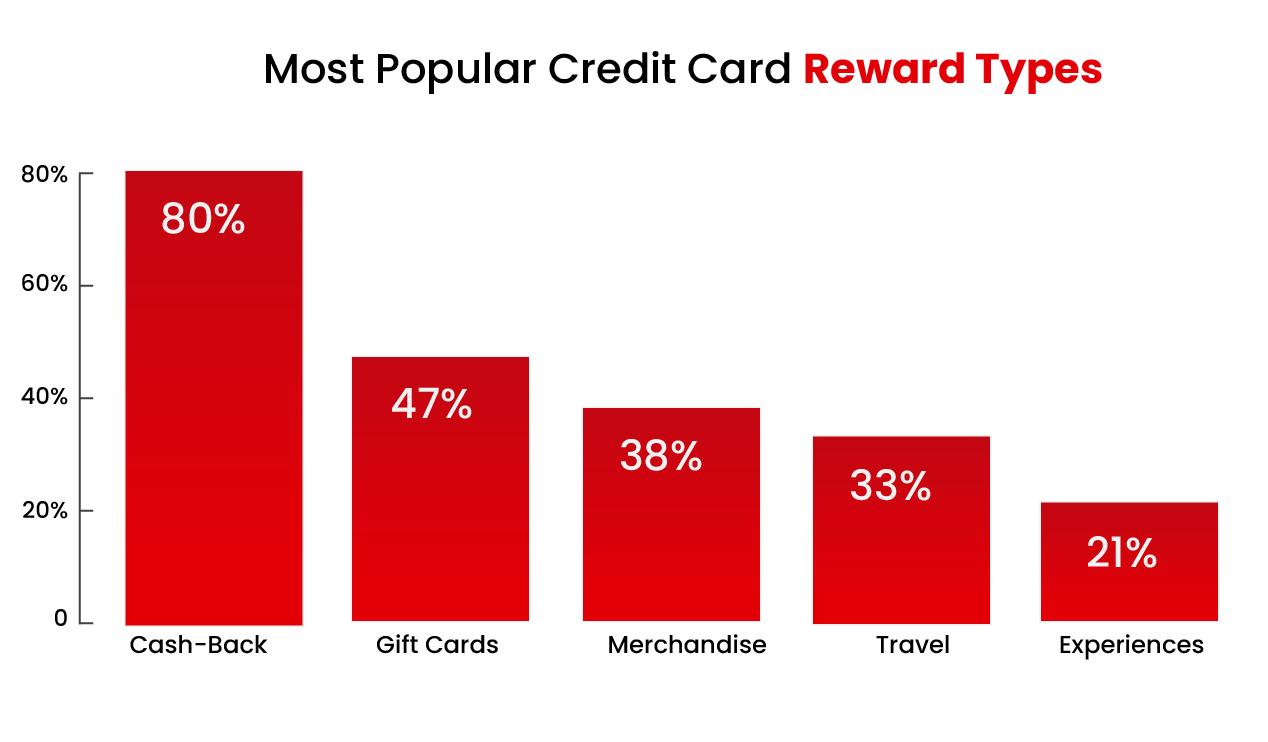

Credit card sign-up bonuses are incentives that card issuers offer to attract new customers. These bonuses can come in various forms, such as:

- Cash Back: A percentage of your spending returned to you as cash.

- Travel Points or Miles: Points that can be redeemed for travel-related expenses, such as flights and hotel stays.

- Statement Credits: Credits applied to your credit card bill, reducing your outstanding balance.

- Gift Cards and Merchandise: Rewards that can be redeemed for gift cards or products.

Secured and Unsecured Credit Cards in Canada

Before diving into sign-up bonuses, it’s essential to understand the types of credit cards available: secured and unsecured.

- Secured Credit Cards: These require a security deposit, which serves as collateral and determines your credit limit. They are ideal for individuals looking to build or rebuild their credit.

- Unsecured Credit Cards: These do not require a security deposit and are the most common type of credit card. They offer higher credit limits and more rewards.

The Appeal of Credit Card Sign-Up Bonuses

Sign-up bonuses are particularly attractive because they provide immediate value. By choosing a credit card with a substantial sign-up bonus, you can quickly accumulate rewards that might otherwise take months or even years to earn through regular spending. These bonuses can be used to offset significant expenses, such as travel or large purchases, making them a powerful tool for managing your finances.

How to Make the Most of Credit Card Sign-Up Bonuses

The first step to maximizing credit card sign-up bonuses is to research and compare the available offers. Look for cards that align with your spending habits and financial goals. Great Canadian Rebates is an excellent resource for finding the best credit card deals in Canada.

Top Credit Cards Offering the Best Sign-Up Deals

Here are some of the top credit cards in Canada offering impressive sign-up bonuses:

- American Express Cobalt Card

- Sign-Up Bonus: Earn up to 30,000 Membership Rewards points in your first year.

- Spending Requirement: Earn 2,500 points for each month you spend $500, for up to 12 months.

- Benefits: 5x points on eligible eats and drinks, 2x points on travel and transit, and 1x points on everything else.

- Scotiabank Gold American Express Card

- Sign-Up Bonus: Earn up to 40,000 Scotia Rewards points.

- Spending Requirement: Earn 20,000 points by spending $1,000 in the first 3 months and an additional 20,000 points after spending $7,500 in the first year.

- Benefits: 5x points on groceries, dining, and entertainment, 3x points on gas, transit, and streaming, and 1x points on all other purchases.

- TD Aeroplan Visa Infinite Card

- Sign-Up Bonus: Earn up to 25,000 Aeroplan points.

- Spending Requirement: Earn 15,000 points after the first purchase and an additional 10,000 points after spending $1,000 within the first 3 months.

- Benefits: Earn 1.5 points per dollar spent on gas, groceries, and Air Canada purchases, and 1 point per dollar on everything else.

- RBC Avion Visa Infinite Card

- Sign-Up Bonus: Earn up to 35,000 Avion points.

- Spending Requirement: Earn 15,000 points upon approval and 20,000 points by spending $1,000 within the first 3 months.

- Benefits: Earn 1 point per dollar spent on all purchases, with no category restrictions.

- CIBC Aventura Visa Infinite Card

- Sign-Up Bonus: Earn up to 20,000 Aventura points.

- Spending Requirement: Earn 15,000 points after the first purchase and an additional 5,000 points after spending $1,000 within the first 4 months.

- Benefits: Earn 2 points per dollar on travel purchased through the CIBC Rewards Centre, 1.5 points on gas, groceries, and drugstore purchases, and 1 point on everything else.

Meeting the Spending Requirements

To earn the sign-up bonus, you typically need to meet a minimum spending requirement within a specific timeframe, usually the first 3 months. Here are some strategies to help you meet these requirements without overspending:

- Plan Your Expenses: Use your credit card for everyday purchases, such as groceries, gas, and dining out. Also, consider using it for larger, planned expenses, like home improvements or travel bookings.

- Pay Bills with Your Card: Many utility companies, insurance providers, and other service providers allow you to pay your bills with a credit card. This can help you reach the spending threshold quickly.

- Buy Gift Cards: If you have future purchases planned, buy gift cards from retailers you frequently shop at. This way, you can meet the spending requirement without changing your spending habits.

- Split Expenses with Friends and Family: If you’re dining out or making a large purchase with friends or family, offer to pay with your credit card and have them reimburse you. This can help you rack up the necessary spending.

- Prepay for Services: Some services, like gym memberships or streaming subscriptions, allow you to prepay for a year. This can be a great way to meet the spending requirement while covering future expenses.

Utilizing Sign-Up Bonuses Effectively

Once you’ve earned your sign-up bonus, it’s essential to use it wisely to maximize its value. Here are some tips on how to utilize your sign-up bonuses effectively:

- Redeem for Travel: If you’ve earned travel points or miles, use them to book flights, hotels, or vacation packages. Travel rewards often provide the highest value per point.

- Statement Credits: Use your rewards as statement credits to offset your credit card bill. This can help reduce your outstanding balance and save on interest charges.

- Gift Cards and Merchandise: If your credit card issuer offers gift cards or merchandise as redemption options, choose items that you need or can use as gifts for others.

- Combine Rewards: Some credit card issuers allow you to combine points or miles from multiple cards within the same loyalty program. This can help you accumulate enough rewards for larger redemptions.

- Monitor Expiration Dates: Some rewards have expiration dates. Keep track of when your points or miles expire and use them before they become worthless.

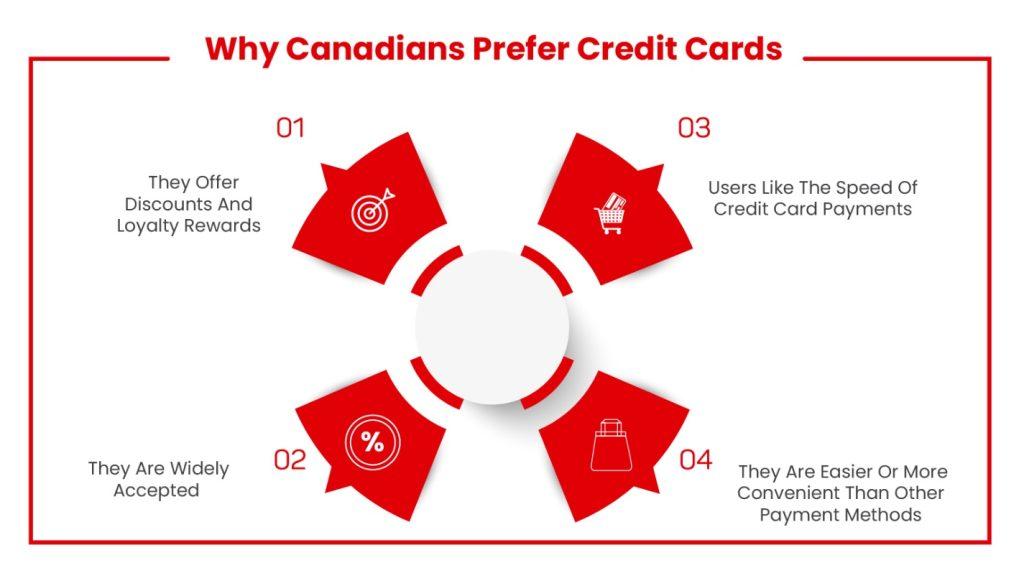

Other Perks of Having a Credit Card in Canada

In addition to sign-up bonuses, credit cards in Canada offer a variety of perks that can enhance your financial well-being and lifestyle.

Rewards Programs

Credit card rewards programs allow you to earn points, miles, or cash back on your purchases. These rewards can be redeemed for travel, merchandise, statement credits, or even cash. Here are some popular rewards programs in Canada:

- Aeroplan: Earn points on everyday purchases and redeem them for flights, hotel stays, car rentals, and more.

- AIR MILES: Collect miles on your purchases and redeem them for travel, merchandise, and gift cards.

- Scotia Rewards: Earn points on eligible purchases and redeem them for travel, merchandise, and more.

- American Express Membership Rewards: Earn points on your purchases and redeem them for travel, gift cards, and statement credits.

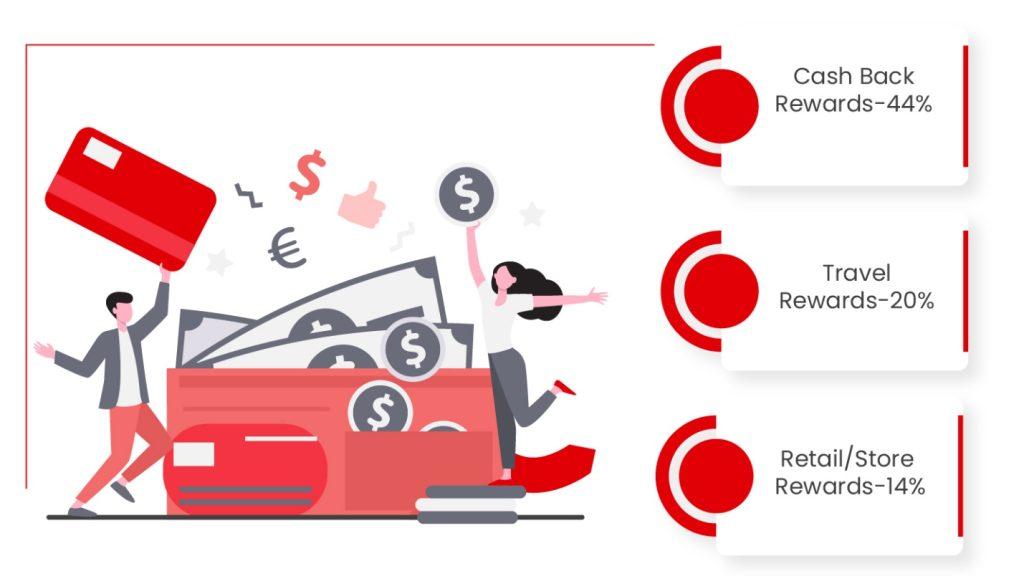

Cash Back Programs

Cash back credit cards offer a percentage of your spending back as cash rewards. This is an excellent way to earn money on everyday purchases. Some of the best Canadian cash back credit cards include:

- Tangerine Money-Back Credit Card: Earn 2% cash back on purchases in two categories of your choice and 0.5% on everything else.

- Scotiabank Momentum Visa Infinite Card: Earn 4% cash back on groceries and recurring bill payments, 2% on gas and transit, and 1% on all other purchases.

- American Express SimplyCash Preferred Card: Earn 2% cash back on all purchases with no limit on how much you can earn.

Travel Benefits

Travel credit cards offer various perks that can enhance your travel experience and save you money. Some of the best travel rewards credit cards in Canada include:

- RBC Avion Visa Infinite Card: This card offers travel insurance, access to airport lounges, and the ability to transfer points to airline partners.

- TD Aeroplan Visa Infinite Card: Earn Aeroplan points, enjoy comprehensive travel insurance, and get preferred pricing on Air Canada flights.

- CIBC Aventura Visa Infinite Card: Access travel insurance, airport lounges, and flexible redemption options for flights and travel-related expenses.

Purchase Protection and Extended Warranty

Many credit cards offer purchase protection and extended warranty benefits, which can save you money and provide peace of mind. Purchase protection covers eligible items against theft or damage within a specified period after purchase, while extended warranty extends the manufacturer’s warranty on eligible items.

Insurance Coverage

Credit cards often come with various insurance coverages, including:

- Travel Insurance: Covers trip cancellation, interruption, medical emergencies, and lost luggage.

- Rental Car Insurance: Provides coverage for damage or theft of rental cars.

- Purchase Protection: Covers eligible items against theft or damage.

- Extended Warranty: Extends the manufacturer’s warranty on eligible items.

Building Credit History

Using a credit card responsibly can help you build and maintain a good credit history. This is important for securing loans, mortgages, and other credit products in the future. To maintain a healthy credit score, make sure to pay your bills on time, keep your credit utilization low, and avoid carrying a balance.

Tips for Choosing the Right Credit Card

When selecting a credit card, consider the following factors to ensure you choose the one that best suits your needs:

- Spending Habits: Choose a card that offers rewards or benefits that align with your spending habits. For example, if you spend a lot on groceries and dining, look for a card that offers higher rewards in those categories.

- Annual Fees: Consider whether the card’s annual fee is worth the rewards and benefits it offers. Some cards with higher fees provide more substantial rewards and perks.

- Interest Rates: If you plan to carry a balance, look for a card with a lower interest rate to save on interest charges.

- Sign-Up Bonus: Evaluate the sign-up bonus and spending requirement to ensure you can meet the threshold without overspending.

- Additional Benefits: To maximize the card’s value, consider its additional benefits, such as travel insurance, purchase protection, and extended warranty.

Avoiding Common Pitfalls

While credit card sign-up bonuses can be highly beneficial, it’s essential to avoid common pitfalls to ensure you maximize their value without falling into financial traps.

- Overspending: Don’t spend more than you can afford just to meet the spending requirement. Stick to your budget and use the card for planned purchases.

- Carrying a Balance: Avoid carrying a balance on your credit card, as high interest rates can negate the value of your rewards. Aim to pay off your balance in full each month.

- Ignoring Fees: Be aware of annual fees, foreign transaction fees, and other charges associated with the card. Make sure the benefits outweigh the costs.

- Missing Payments: Late payments can result in fees, interest charges, and damage to your credit score. Set up automatic payments or reminders to ensure you pay on time.

- Not Maximizing Rewards: Use your rewards strategically to get the most value. For example, redeem travel points for high-value redemptions like flights or hotel stays.

Credit card sign-up bonuses in Canada offer a fantastic opportunity to earn substantial rewards quickly. By researching and comparing offers, meeting spending requirements responsibly, and using your rewards wisely, you can maximize the benefits of credit card sign-up bonuses.

Additionally, consider the overall perks of having a credit card, such as rewards programs, cash back, travel benefits, and insurance coverage. With the right strategies and careful planning, you can make the most of credit card sign-up bonuses and enhance your financial well-being.

Apply For the Best Rewards Credit Card in Canada

If you’re looking for top cash back credit cards in Canada with amazing introductory APR offers, visit Great Canadian Rebates. The online platform allows you to compare various credit card offers in Canada and apply for the one that best suits your unique needs and preferences.

Visit the website today for more information.